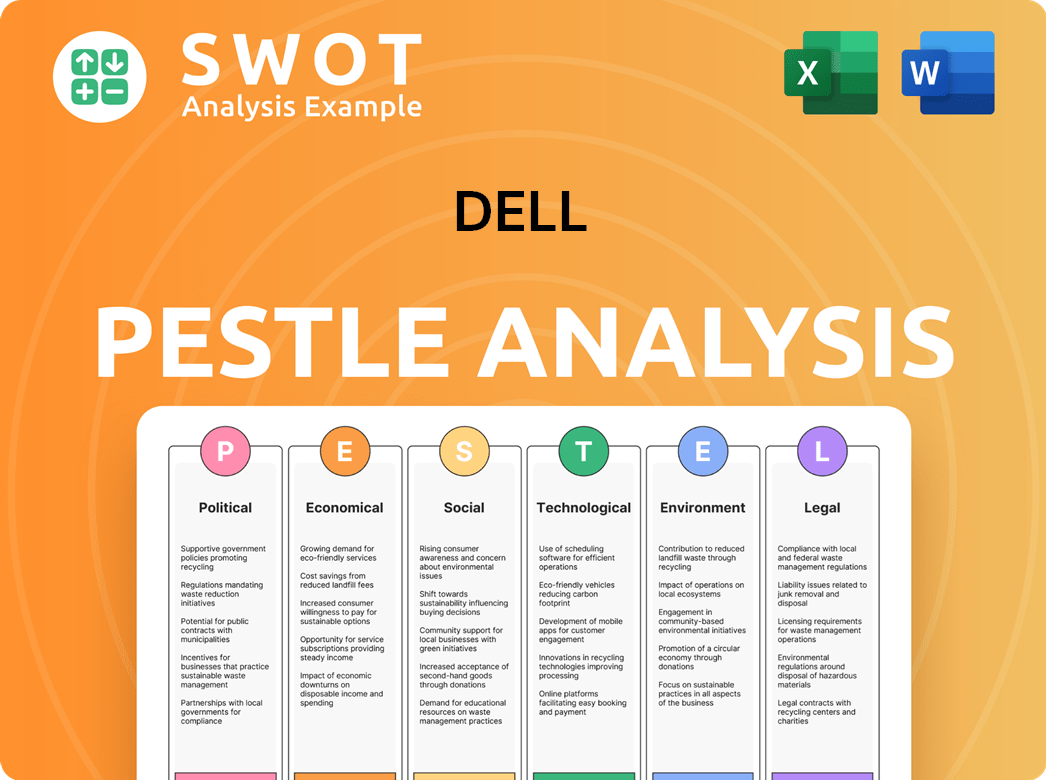

Dell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dell Bundle

What is included in the product

Evaluates Dell's external macro-environment via Political, Economic, Social, Tech, Environmental & Legal dimensions.

Provides key highlights, enabling faster identification of crucial areas in strategic assessments.

Full Version Awaits

Dell PESTLE Analysis

See the Dell PESTLE Analysis preview? It's the real deal! The structure and details are the same.

After purchase, download the fully-formatted document, no changes. It’s ready to go!

This complete analysis you're viewing is the one you will receive.

No guesswork, what you see here is what you get after buying.

Everything in the preview is the exact content you'll download!

PESTLE Analysis Template

Delve into Dell's operating environment with our expertly crafted PESTLE Analysis. We explore political shifts, economic climates, social trends, technological advancements, legal frameworks, and environmental concerns shaping the company. This analysis reveals key opportunities and threats affecting Dell’s strategy and performance. Understand how external factors will affect Dell's future. Access a detailed breakdown—essential for investors and strategists. Get the complete PESTLE Analysis now!

Political factors

Geopolitical tensions, especially between the US and China, affect Dell's supply chain and market access. For example, US-China trade disputes led to increased tariffs, impacting Dell's costs. Dell has diversified its supply chain to mitigate these risks. In 2024, Dell's revenue from the Americas was $25.3 billion.

Governments globally are significant Dell customers. Public sector revenue is sensitive to shifting government spending. Procurement processes and favoring domestic suppliers affect Dell's sales. Dell must maintain strong government relationships. In 2024, Dell secured over $5 billion in government contracts.

Data localization mandates are growing globally, impacting Dell's operations. These regulations, requiring data storage within specific countries, increase operational complexity. For example, in 2024, India's data localization rules significantly affected tech companies. Cybersecurity standards are also evolving, necessitating Dell to adapt its security protocols. These changes lead to higher compliance costs and potential infrastructure adjustments, which could impact Dell's profit margins by 2-3% in some regions.

Political Stability in Key Markets

Political stability significantly impacts Dell's global operations. Instability, civil unrest, or government changes can disrupt supply chains and market demand. Dell closely monitors political risks in regions like EMEA, where geopolitical tensions exist. These risks can lead to operational challenges and impact profitability. Effective risk mitigation strategies are crucial for business continuity.

- Political instability in key markets can disrupt operations.

- Changes in government can affect market demand.

- Monitoring and mitigating political risks are essential.

- Geopolitical tensions in EMEA region pose risks.

Industry-Specific Regulations and Lobbying

Dell faces industry-specific regulations, especially concerning data privacy and cybersecurity, impacting its operations. The company actively lobbies, spending $2.6 million in 2023 to influence policy. These efforts aim to shape legislation and maintain a competitive edge within the tech sector. Dell's lobbying focuses on issues like digital trade and supply chain security.

- 2.6 million USD - Dell's lobbying spending in 2023

- Data privacy and cybersecurity - Key regulatory areas for Dell

- Digital trade and supply chain security - Major lobbying topics

Political factors significantly influence Dell's global strategy and operations, primarily through geopolitical tensions, especially the US-China relationship, which affects supply chains and trade. Governmental regulations, data localization mandates, and evolving cybersecurity standards globally demand constant adaptation and increased compliance costs, with impacts like potential profit margin dips. Political instability and shifts in government policies can further disrupt operations and market demand; thus, monitoring and mitigating political risks are essential for Dell's business continuity and financial performance.

| Aspect | Impact | Financial Data |

|---|---|---|

| Geopolitical Risks | Supply Chain Disruptions | Revenue from Americas $25.3B in 2024 |

| Government Influence | Shifting market dynamics | Government contracts exceed $5B |

| Regulations | Compliance Costs | Lobbying spent $2.6M in 2023 |

Economic factors

Global economic growth significantly influences technology spending. In 2024, the World Bank projected global growth at 2.6%, impacting demand for Dell's products. Recession risks, like those seen in late 2022 and early 2023, can curb IT investments. Growth boosts sales, while downturns reduce demand, affecting Dell's revenue.

Rising inflation significantly impacts Dell's operational costs. The Consumer Price Index (CPI) rose 3.5% in March 2024, indicating ongoing inflationary pressures. This affects raw materials, labor, and logistics, potentially squeezing profit margins. Dell must optimize its supply chain and pricing strategies to navigate these challenges effectively. The company's ability to adapt will be crucial in 2024/2025.

Dell, operating globally, faces currency exchange rate risks. Fluctuations impact reported international sales and costs. For instance, a stronger dollar reduces the value of overseas earnings. Companies use hedging to mitigate these risks. In 2024, major currency shifts, like the USD/EUR, could significantly affect Dell's financial results.

Consumer and Business Spending Power

Consumer and business spending power significantly impacts Dell's sales. Disposable income and capital expenditure budgets directly influence the demand for Dell's products. For instance, in Q4 2024, U.S. consumer spending rose by 3.1%, showing solid purchasing power. High interest rates can curb spending.

- Q1 2024 saw a 3.0% increase in business investment in equipment.

- Employment levels and access to credit also play crucial roles.

- Dell's Client Solutions and Infrastructure Solutions segments are sensitive to these economic shifts.

- In 2024, the Federal Reserve maintained its benchmark interest rate.

Availability and Cost of Credit

Dell's financial health is closely tied to credit conditions, especially given its financing options for customers and substantial enterprise transactions. Increased interest rates or stricter lending criteria can elevate the cost of financing for customers, potentially delaying purchasing decisions and affecting sales. In 2024, the Federal Reserve maintained a high-interest-rate environment, impacting borrowing costs. This environment has a direct impact on Dell's financing arm and large-scale deals.

- In Q1 2024, the average interest rate on new commercial loans was around 6%.

- Dell's financial services revenue was approximately $1.5 billion in fiscal year 2024.

- Changes in credit availability can shift customer behavior, potentially affecting Dell's sales volumes.

Economic factors are crucial for Dell's performance. Global growth, projected at 2.6% in 2024, drives tech spending. Inflation, with a 3.5% CPI rise in March 2024, increases costs. Currency fluctuations, like the USD/EUR, affect revenue. Consumer spending (3.1% Q4 2024 rise) and credit conditions are vital. Q1 2024 saw business investment in equipment increase by 3.0%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Global Growth | Tech spending influence | 2.6% growth projected |

| Inflation | Operational costs rise | 3.5% CPI (March) |

| Currency Rates | Revenue fluctuations | USD/EUR shifts |

Sociological factors

The rise of remote work and hybrid models, accelerated by the COVID-19 pandemic, continues to shape device demand. In 2024, approximately 30% of the US workforce worked remotely or in a hybrid model, influencing the need for laptops, collaboration tools, and robust IT infrastructure. Online education's growth further fuels this, with a 15% increase in online course enrollments projected for 2024-2025, thereby increasing demand for accessible and reliable technology. Dell must adapt its product offerings to these shifting dynamics, prioritizing portability, connectivity, and user-friendly collaboration features.

Societal disparities in technology access, digital literacy, and income significantly impact Dell's market reach. In 2024, the global digital divide persists, with approximately 37% of the world's population lacking internet access. This affects Dell's ability to penetrate markets, especially in developing regions. Offering affordable technology and digital literacy programs presents a strategic growth opportunity for Dell to expand its customer base.

Consumer preferences significantly impact Dell's market position. Device features, design, and sustainability are key. Brand reputation and trust are also critical. In 2024, sustainable tech demand rose 15%. Dell's positive brand image is essential for sales growth.

Demographic Shifts and Aging Populations

Demographic shifts significantly impact technology demand, especially for Dell. An aging global population, with a median age of 30.9 years in 2024, influences product preferences. Older users often seek simpler, more accessible tech solutions, potentially boosting demand for Dell's user-friendly devices. Conversely, younger demographics drive demand for cutting-edge mobile and gaming technologies.

- Global median age: 30.9 years (2024)

- Increased demand for accessible tech

- Growth in mobile and gaming tech

Societal Expectations for Corporate Responsibility

Societal expectations significantly influence Dell. Consumers, employees, and investors increasingly demand corporate social responsibility, ethical sourcing, and community contributions. Dell's initiatives in diversity, inclusion, education, and community impact are crucial for its societal standing. These efforts shape brand perception and stakeholder relationships.

- Dell's FY24 ESG report highlights its social impact initiatives.

- In 2024, Dell invested $100 million in digital inclusion initiatives.

- Employee surveys show a rising demand for ethical and sustainable practices.

The global median age was 30.9 years in 2024, influencing tech preferences. Demand for accessible technology increased due to aging populations. Younger demographics continue to drive growth in mobile and gaming tech. Societal demands for CSR increased; Dell invested $100 million in digital inclusion.

| Factor | Impact | Data (2024) |

|---|---|---|

| Ageing Population | Demand for accessible tech | Median age: 30.9 years |

| Consumer Expectations | CSR importance | $100M digital inclusion |

| Younger Demographics | Mobile/gaming demand | Rising demand |

Technological factors

The rise of AI and Machine Learning is reshaping computing. Dell must adapt its hardware to handle AI demands. In 2024, the AI hardware market is valued at over $30 billion, expected to reach $60 billion by 2025. This drives Dell to innovate and integrate AI for operational and product improvements.

The cloud computing landscape continues to evolve, with a growing preference for hybrid and multi-cloud strategies. This shift impacts Dell's traditional infrastructure business. In Q4 2024, the global cloud computing market was valued at $670.4 billion, a 20% increase from the prior year. Dell needs to adapt by offering cloud solutions to capitalize on this growth.

Dell benefits from constant hardware innovation. Ongoing advancements in processors, SSDs, memory, and displays boost device performance. In Q4 2024, Dell reported strong server and storage sales, driven by tech upgrades. Staying ahead in hardware is crucial for Dell's competitive advantage. The company's R&D spending in 2024 was approximately $1.8 billion.

Cybersecurity Threats and Solutions

Cybersecurity threats are a growing concern for Dell. The company faces risks from increasingly sophisticated cyberattacks targeting its products, services, and customers. Dell's response includes continuous investment in cybersecurity research and the integration of robust security features. In 2024, global cybercrime costs are projected to reach $9.5 trillion.

- Dell's cybersecurity revenue grew by 15% in fiscal year 2024.

- The company allocated $500 million to cybersecurity R&D in 2024.

- Dell offers security solutions like endpoint detection and response.

Research and Development Investment and Innovation Pace

The rapid pace of technological advancement necessitates substantial and consistent investment in Research and Development (R&D). Dell's capacity to innovate and introduce new products and services swiftly is crucial for maintaining a competitive edge and adapting to changing customer needs. In fiscal year 2024, Dell invested approximately $2.5 billion in R&D, reflecting its commitment to innovation. This investment supports the development of cutting-edge technologies.

- R&D Spending: $2.5 billion in FY2024.

- Focus areas: AI, cloud computing, and cybersecurity.

- Innovation Cycle: Rapid product iterations.

- Competitive Advantage: Speed to market.

Dell's tech environment sees AI/ML's growth. Hardware demand for AI drives innovation; the AI hardware market is projected at $60B by 2025. Continuous R&D investment, reaching $2.5B in 2024, boosts innovation and adapts to change.

| Technology Area | 2024 Key Data | 2025 Forecasts |

|---|---|---|

| AI Hardware Market | $30B Market Value | $60B Market Value |

| Cloud Computing Market | $670.4B in Q4 2024 (20% YoY growth) | Continued Growth Expected |

| R&D Investment | $2.5 Billion | Ongoing Strategic Investment |

Legal factors

Dell faces rigorous global data privacy laws. The GDPR in Europe and CCPA in California set data handling standards. Compliance is crucial for Dell's operations worldwide. Non-compliance can lead to hefty fines, potentially millions of dollars. In 2024, Dell's focus remains on adapting to evolving regulations.

Dell's legal standing significantly hinges on intellectual property. Protecting its patents and trademarks is crucial in the tech industry. Legal battles over tech patents can be expensive; in 2024, the average cost of patent litigation was $3.5 million. Dell must strategize to avoid infringing on others' IP.

Dell faces intense competition, governed by antitrust laws to prevent monopolies. Regulatory bodies scrutinize Dell's market share and acquisitions. In 2024, the global PC market saw significant shifts. Dell's strategies must align with these legal frameworks to ensure fair competition and avoid penalties.

Product Safety and Compliance Standards

Dell must adhere to stringent product safety and compliance standards globally. These include regulations on hazardous substances, energy efficiency, and waste disposal. Compliance with these standards is a significant legal and operational challenge. Dell's commitment to environmental sustainability is reflected in its product design and manufacturing processes.

- In 2024, Dell reported a 10% increase in spending on environmental compliance.

- Dell aims for 100% of its packaging to be made from sustainable materials by 2030.

- Dell's products must meet standards like RoHS and REACH.

Labor Laws and Employment Regulations

Dell faces complex labor law compliance across its global operations. This includes adhering to wage standards, working hour regulations, and employee benefit mandates in various countries. Compliance is crucial for avoiding legal issues and maintaining operational efficiency. Dell's HR departments must stay updated on changing regulations. For example, in 2024, the U.S. Department of Labor reported a 10% increase in wage and hour violation investigations.

- Compliance with global labor laws is critical for Dell's operational stability.

- HR must navigate diverse regulations to manage its workforce effectively.

- Failure to comply can result in significant financial penalties and reputational damage.

- Dell's focus on ethical labor practices is increasingly important.

Dell navigates stringent global data privacy laws like GDPR and CCPA, facing potential fines for non-compliance. Intellectual property protection through patents and trademarks is critical to avoid expensive legal battles, with the average patent litigation costing around $3.5 million in 2024.

Antitrust laws require Dell to maintain fair competition in the evolving global PC market, where strategic acquisitions and market share are under constant scrutiny.

Product safety, compliance with regulations on hazardous substances, energy efficiency, and waste disposal are critical, as Dell increased spending on environmental compliance by 10% in 2024.

| Legal Area | 2024 Focus | Impact |

|---|---|---|

| Data Privacy | Adapting to evolving regulations | Potential for multi-million dollar fines |

| Intellectual Property | Protecting Patents and Trademarks | Avoidance of expensive legal battles |

| Antitrust | Ensuring Fair Competition | Adhering to legal frameworks |

Environmental factors

E-waste is a major environmental issue, driving regulations on product end-of-life. Dell needs robust take-back programs and designs for recyclability. Globally, e-waste generation reached 62 million metric tons in 2022. The EU's WEEE directive and similar regulations globally require Dell's compliance.

Dell faces growing demands from regulators, investors, and consumers to cut carbon emissions across its entire value chain. The company actively measures and aims to decrease its carbon footprint from operations, logistics, and product use. For instance, Dell has committed to achieving net-zero emissions across its value chain by 2050. This commitment is a response to the increasing pressure to address climate change.

Dell recognizes the rising consumer preference for eco-friendly products. The company is committed to incorporating recycled materials in its products and packaging. In 2024, Dell aimed for 50% recycled or renewable content in all new products. Dell also focuses on responsibly sourcing minerals, addressing environmental and ethical issues.

Energy Efficiency of Products and Operations

Energy efficiency is a key environmental factor. Regulations and consumer demand push for greener tech. Dell focuses on energy-saving hardware and operational efficiency. This reduces environmental impact and cuts customer costs. Dell's 2023 sustainability report highlights these efforts.

- Dell aims to achieve net-zero greenhouse gas emissions across its value chain by 2050.

- In 2023, Dell increased the use of renewable electricity to 85% across its global operations.

- Dell's servers and storage products are designed to be more energy-efficient, with some models using up to 30% less energy than previous generations.

Environmental Reporting and Transparency

Dell faces growing pressure to disclose its environmental footprint. This includes detailed reports on emissions, waste, and resource use. Transparency is crucial for meeting regulatory demands and satisfying stakeholders. For instance, the CDP (formerly Carbon Disclosure Project) report in 2024 showed that Dell achieved a B rating for climate change.

- Dell's 2024 sustainability report highlighted a 20% reduction in greenhouse gas emissions from its operations since 2019.

- The company aims for net-zero emissions by 2050, demonstrating a long-term commitment.

- Dell's environmental disclosures are vital for maintaining investor confidence and attracting socially responsible investments.

Environmental factors significantly influence Dell's operations. E-waste regulations and the circular economy are key considerations, with global e-waste hitting 62 million metric tons in 2022. Dell prioritizes reducing its carbon footprint through renewable energy and sustainable materials. Transparency in environmental reporting is increasingly vital.

| Area | Initiative | Data |

|---|---|---|

| Carbon Emissions | Net-zero target | By 2050, across the value chain |

| Renewable Energy | Use of renewables | 85% in global operations (2023) |

| Recycled Materials | Target | 50% in new products (2024 goal) |

PESTLE Analysis Data Sources

Our Dell PESTLE Analysis relies on diverse sources, including financial reports, tech forecasts, and government publications for accuracy.