Deutsche Post Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Post Bundle

What is included in the product

Strategic view of Deutsche Post's diverse units. Identifies investment, holding, and divestment opportunities.

Printable summary for strategic business unit discussions.

Full Transparency, Always

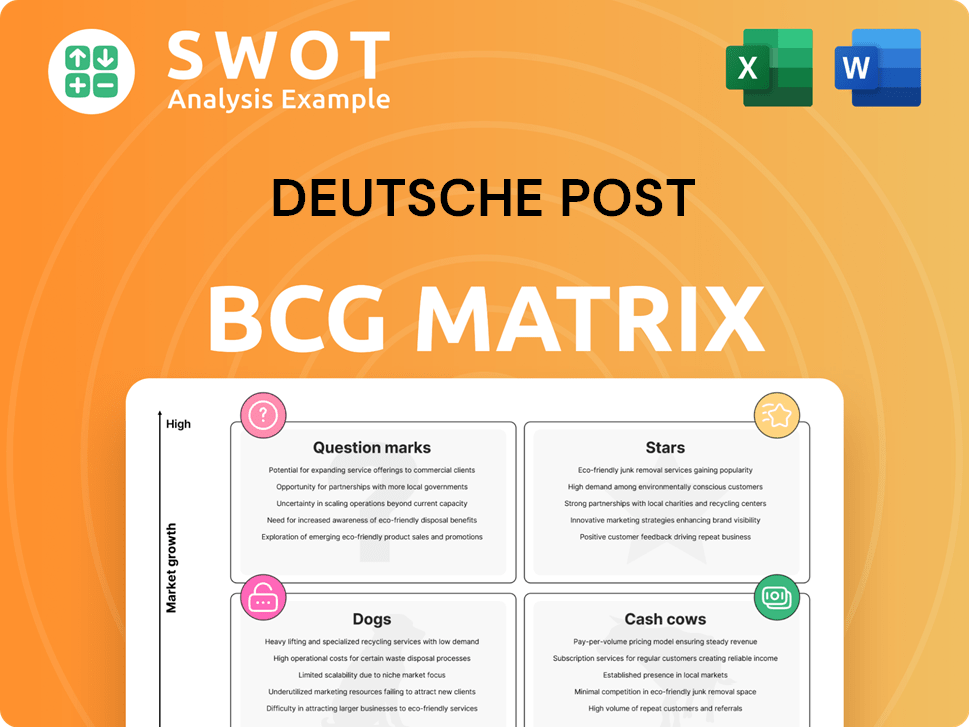

Deutsche Post BCG Matrix

The preview showcases the complete Deutsche Post BCG Matrix report you'll receive upon purchase. This is the final, ready-to-use document, devoid of watermarks or demo sections, ensuring a seamless strategic analysis experience.

BCG Matrix Template

Deutsche Post's BCG Matrix reveals its diverse portfolio’s strengths and weaknesses. From high-growth services to established revenue streams, it's a complex landscape. Understanding where each product fits—Stars, Cash Cows, etc.—is crucial. This analysis offers strategic insights into resource allocation and growth potential. This preview is just a glimpse. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

DHL Express shines as a star in Deutsche Post's portfolio, specializing in international, expedited shipping. Its optimized networks and customs expertise give it an advantage. In 2024, revenue hit €25.1 billion, though EBIT dipped to €3.08 billion. It targets high-value B2B shipments, navigating cost pressures and market shifts.

DHL Global Forwarding/Freight is a star, offering international freight forwarding. They handle air, ocean, and overland transport, serving various sectors with tailored solutions. Demand for resilient supply chains boosts this division. In 2024, revenue grew 1.8% to €19.6B, though EBIT fell to €1.07B due to global issues.

DHL's Supply Chain is a star, offering warehousing, transportation, and value-added services. The division supports e-commerce fulfillment and logistics management. Innovation and new technologies keep it competitive. Revenue grew 4.3% in 2024. EBIT rose 11.1% to over EUR 1 billion.

E-commerce Solutions (Parcel Delivery)

DHL's e-commerce solutions remain a star, offering affordable parcel delivery for online businesses. It facilitates high-volume fulfillment, comprehensive shipping, and quality control. The division profits from e-commerce expansion and rising demand for efficient last-mile delivery. In 2023, e-commerce saw volume growth in most markets, with revenue up 10.2%. Lower EBIT resulted from increased depreciation due to network expansion.

- E-commerce revenue growth: 10.2% in 2023.

- Supports high-volume fulfillment and end-to-end shipping.

- Benefits from the growth of e-commerce.

- Lower EBIT due to network expansion.

Green Logistics Initiatives (Sustainability)

Deutsche Post DHL Group's green logistics initiatives are a rising star, driven by global sustainability trends and customer demand. The 'Green Logistics of First Choice' strategy strengthens its market position. Decarbonizing supply chains and reducing emissions are key to long-term growth. In 2024, SAF usage was around 3.5% of aviation fuel, and DHL had about 39,100 e-vehicles.

- Green initiatives are a rising star for Deutsche Post DHL Group.

- 'Green Logistics of First Choice' is part of the strategic framework.

- Decarbonization efforts boost growth and competitiveness.

- In 2024, SAF use was around 3.5%.

- DHL had approximately 39,100 e-vehicles in 2024.

These DHL divisions perform strongly within Deutsche Post's portfolio. DHL Express and Global Forwarding are Stars, with substantial revenue. Supply Chain also shines. E-commerce solutions remain a star.

| Division | 2024 Revenue (€B) | 2024 EBIT (€B) |

|---|---|---|

| DHL Express | 25.1 | 3.08 |

| DHL Global Forwarding/Freight | 19.6 | 1.07 |

| DHL Supply Chain | N/A | Over 1 |

| DHL E-commerce | N/A | N/A |

Cash Cows

Deutsche Post DHL's domestic parcel business is a cash cow, generating steady revenue. It leverages a strong infrastructure and a large customer base. In 2023, the Post & Parcel Germany division saw declines in traditional letters offset by parcel growth. However, rising costs, including wage agreements, impacted profitability, with an adjusted EBIT of €1.9 billion in 2023.

Post & Parcel Germany remains a cash cow, despite declining mail volumes, due to its strong market position. Deutsche Post focuses on efficiency to maintain profitability. In 2023, parcel volumes increased, though consumer sentiment was subdued. Dialogue Marketing revenue saw a significant decline. Addressing structural changes and rising costs is key to maximizing cash flow.

DHL's high-value B2B shipments, especially on transpacific routes, are a cash cow. This segment enjoys higher margins, providing a stable revenue source. In 2024, the Express division saw revenue rise to €25.1 billion, up 1.2%. However, EBIT decreased by 4.5% to €3.08 billion due to market volatility.

Contract Renewals (Supply Chain)

Deutsche Post's Supply Chain division benefits from contract renewals, solidifying its cash cow status. These renewals ensure a predictable income stream, a key characteristic of cash cows. In 2024, revenue growth was supported by renewals and e-commerce. The EBIT reached over EUR 1 billion.

- Predictable Income: Contract renewals offer a stable revenue base.

- Revenue Growth: Renewals contribute to overall financial performance.

- EBIT Performance: EBIT rose to a record level, reflecting profitability.

- Business Support: Renewals are a critical element of the business.

Service Points (Extensive Network)

DHL's widespread service points, like parcel lockers, are a cash cow, offering easy access and convenience for customers. This extensive network supports both local and international parcel deliveries, boosting customer satisfaction and loyalty. Deutsche Post DHL Group has over 145,000 service points in Europe, with more than 36,000 parcel lockers. This expansion brings them closer to customers and enables more sustainable delivery methods.

- Over 145,000 service points in Europe.

- More than 36,000 parcel lockers available.

- Supports both domestic and international deliveries.

Deutsche Post's cash cows include domestic parcels and high-value B2B shipments, securing steady revenue. Supply Chain's contract renewals offer predictable income, boosting financial performance. Extensive service points, like lockers, enhance customer convenience and drive loyalty, supporting delivery networks.

| Cash Cow Segment | Key Characteristics | 2024 Performance Highlights |

|---|---|---|

| Domestic Parcels | Strong infrastructure, large customer base | Parcel volume growth, but rising costs (€1.9B EBIT) |

| High-Value B2B Shipments | Higher margins, stable revenue | Express division revenue €25.1B, EBIT €3.08B (decrease) |

| Supply Chain | Contract renewals, predictable income | Revenue growth from renewals, over €1B EBIT |

| Service Points | Easy access, customer convenience | Over 145,000 service points in Europe |

Dogs

Dialogue Marketing, classified as a "dog" in Deutsche Post's BCG Matrix, faces substantial revenue decline. In 2024, advertising expenditure on physical mailings decreased, impacting its performance. The discontinuation of products like EINKAUFAKTUELL also worsened its financial standing. Revenue at Dialogue Marketing dropped significantly year-over-year, reflecting these challenges.

Traditional mail, like document-carrying letters, is a "dog" for Deutsche Post. This segment struggles due to declining demand and structural shifts. In 2024, letter volumes decreased. Despite growth in parcels, revenue couldn't offset mail's decline and rising costs, especially labor.

Air freight margins in Deutsche Post's Global Forwarding are struggling, indicating a "dog" status. Despite a seasonal volume uptick, margins haven't met targets, hurting profitability. In Q3 2023, DHL Global Forwarding saw revenue decrease, reflecting margin pressures. Air freight forwarding faces similar challenges; in 2024, this trend persisted.

Underperforming Regions (Specific Geographic Areas)

Underperforming regions in Deutsche Post's BCG matrix are areas where returns are low despite significant investment. DHL Group, focusing on high-growth regions, aims to capitalize on changing trade flows and diversified supply chains. This strategic shift is reflected in its financial performance. In Q3 2023, the DHL Group generated revenues of EUR 20.4 billion.

- Underperforming regions require significant investment for minimal returns.

- DHL Group concentrates on fast-growing areas.

- The Group benefits from trade flow changes and supply chain diversification.

- Q3 2023 revenue: EUR 20.4 billion.

Non-Core Services (Ancillary Offerings)

Certain non-core services within Deutsche Post DHL Group, classified as "dogs" in the BCG matrix, may underperform. These services often generate limited revenue and profitability, diverting resources from core operations. In 2024, DHL Group aims to boost growth through strategic divisional and group-wide initiatives, focusing on high-quality service in profitable core areas. This strategic shift helps streamline operations.

- Non-core services can include logistics offerings that do not fit DHL's main strategic goals.

- These services may not contribute significantly to the company's overall financial performance.

- DHL Group prioritizes core business areas for growth, as evidenced by its 2024 strategic plans.

- Focus is on improving service quality and efficiency within profitable divisions.

Air freight margins face challenges, with Q3 2023 revenue decline in DHL Global Forwarding. Despite volume upticks, margins remain below target. The "dog" status persists in 2024, impacting profitability, even with strategic adjustments.

| Category | Q3 2023 Data | 2024 Outlook |

|---|---|---|

| Revenue Decline (DHL Global Forwarding) | Yes | Continued pressure |

| Margin Performance | Below Target | Expected challenges |

| Strategic Adjustments | Ongoing | Focus on improving profitability |

Question Marks

Life Sciences & Healthcare logistics is a question mark in DHL's BCG Matrix, indicating high growth potential but necessitating substantial investment. This sector demands specialized solutions, such as temperature-controlled storage, to meet stringent requirements. The biopharma market, including cell and gene therapies and clinical trials, is projected to grow at a CAGR of approximately 10% through 2024. This growth rate significantly surpasses global GDP expansion.

New Energies Logistics, a question mark in Deutsche Post's BCG Matrix, focuses on high-growth areas like wind turbine blade and battery storage system logistics. This sector demands specialized expertise and infrastructure to capitalize on renewable energy's rise. The market is predicted to grow over 15% annually from 2023 to 2030, offering significant growth opportunities for DHL Group. In 2024, DHL invested €1.5 billion in green logistics.

Deutsche Post's digital sales programs, a question mark, aim to boost online transactions and customer experience. These programs need continuous investment and adjustments to meet evolving customer demands. In 2023, DHL's e-commerce revenue grew, showing the importance of digital channels. The company plans to expand these programs, focusing on digital customer interaction.

Emerging Markets (Geographic Expansion)

Emerging markets represent a question mark for Deutsche Post DHL Group, offering high-growth potential but also significant risks. These markets demand strategic investment and tailored approaches due to their diversity. DHL Group aims to capitalize on trade flow changes and diversified supply chains. The company focuses on fast-growing regions, leveraging its global presence and local expertise.

- Revenue from emerging markets is expected to grow by 10-15% annually.

- DHL invested €1 billion in emerging market infrastructure in 2024.

- Expansion into Asia-Pacific is a key focus, with a 20% revenue increase projected.

- Risks include political instability and currency fluctuations.

Sustainable Aviation Fuel (SAF) (Decarbonization)

Sustainable Aviation Fuel (SAF) represents a question mark in Deutsche Post's BCG matrix, crucial for decarbonizing aviation but demanding substantial investment. Securing a 30% SAF share by 2030 requires strategic partnerships and aggressive decarbonization measures. This commitment aligns with broader industry efforts to reduce carbon emissions. The financial implications involve significant capital allocation and risk management.

- Investment in SAF is vital for reducing carbon emissions in aviation.

- Strategic partnerships are necessary to meet the 30% SAF target by 2030.

- Decarbonization measures require significant capital investment.

- Deutsche Post aims to secure a 30% share of SAF by 2030.

DHL's emerging markets are question marks due to high growth potential and associated risks. They require strategic investments and customized approaches. Revenue in these markets is projected to grow by 10-15% annually.

| Investment | Focus | Projected Growth |

|---|---|---|

| €1 billion in infrastructure (2024) | Asia-Pacific expansion | 20% revenue increase |

| Strategic initiatives | Trade flow changes | 10-15% annual revenue growth |

| Diversified supply chains |

BCG Matrix Data Sources

Deutsche Post's BCG Matrix uses financial statements, market share data, industry reports, and expert assessments.