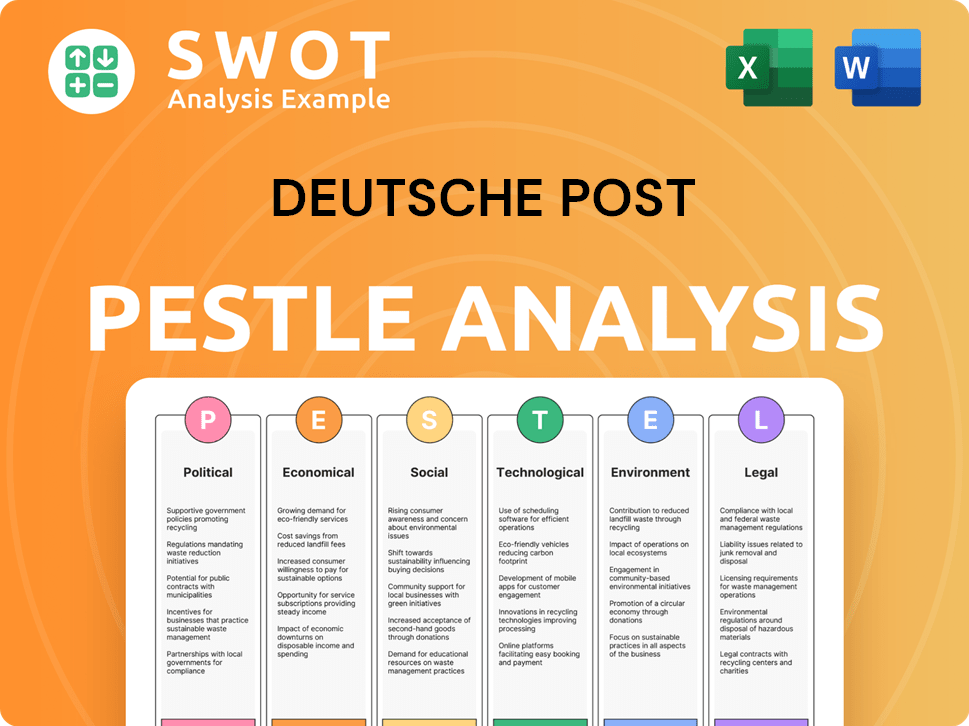

Deutsche Post PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Post Bundle

What is included in the product

Examines Deutsche Post's operations through Political, Economic, Social, Tech, Environmental, and Legal factors. Each part is explained with related examples.

A summarized and easy-to-understand analysis for fast strategic planning across various departments.

Preview Before You Purchase

Deutsche Post PESTLE Analysis

This is the actual Deutsche Post PESTLE Analysis document you're previewing. Everything here, including formatting and content, is what you’ll get after purchasing. No changes, just instant access. Download this real and ready-to-use file immediately.

PESTLE Analysis Template

Navigate the complex world impacting Deutsche Post with our PESTLE Analysis. We examine the political landscape, exploring regulatory impacts on operations. Analyze economic factors, understanding market influences and global trade. Identify technological advancements affecting logistics and automation. Uncover social trends shaping consumer behavior. Assess environmental concerns and sustainability strategies. Get the complete picture of Deutsche Post's external environment—download now for strategic advantage.

Political factors

Deutsche Post DHL Group faces challenges from changing international trade regulations. Tariffs and customs procedures directly affect cross-border operations, potentially increasing costs. Geopolitical tensions and trade wars may disrupt established routes. For instance, in 2024, the company reported increased operational complexity due to global trade shifts. The company must adept to these political landscapes.

Deutsche Post DHL Group faces risks from political instability across its global operations. Conflicts like those in Ukraine and Palestine, along with events in the Red Sea, disrupt services. These issues can damage assets and force operational changes. In 2024, the company reported potential service delays due to these challenges.

Government infrastructure spending significantly influences Deutsche Post's operations. Investments in roads, ports, and airports directly affect logistics efficiency. For example, Germany's 2024 infrastructure budget is about €45.5 billion. Improved infrastructure reduces transit times and operational costs. Conversely, underinvestment hinders service delivery and increases expenses.

Government support for e-commerce

Government backing significantly influences e-commerce, vital for Deutsche Post DHL. Initiatives like digital infrastructure investments and online business incentives boost parcel delivery demand. For instance, in 2024, EU funding for digital projects hit €2.5 billion, aiding e-commerce. Such policies create favorable conditions for logistics expansion.

- Digital infrastructure investments, like the EU's €2.5B in 2024.

- Incentives for online businesses, boosting parcel demand.

- Favorable conditions for logistics and Deutsche Post.

Regulation of the gig economy

Deutsche Post DHL faces evolving regulations on gig economy workers. These regulations impact labor costs within last-mile delivery. Worker classification changes can alter operational models. The company must comply with labor laws to avoid penalties. This ensures fair treatment and legal adherence.

- In 2024, the EU introduced the Platform Work Directive, aiming to improve gig workers' rights.

- The US Department of Labor has increased scrutiny on worker classification.

- Deutsche Post DHL's labor costs have increased by 5% in markets with stricter gig economy rules.

Changing trade rules pose challenges to Deutsche Post DHL's operations, impacting costs and requiring adaptation. Geopolitical instability, including conflicts and trade disruptions, can lead to service delays and asset damage.

Government spending on infrastructure significantly affects logistics. E-commerce policies like digital infrastructure funding, such as the EU's €2.5 billion in 2024, boost parcel delivery.

Evolving regulations on gig economy workers, impacting labor costs. Worker classification changes impact operational models and compliance requirements. Labor costs increased by 5% in markets with stricter gig economy rules.

| Factor | Impact | Examples/Data |

|---|---|---|

| Trade Regulations | Cost increases; disruption | Global trade shifts increased operational complexity in 2024. |

| Political Instability | Service delays; damage | Conflicts in Ukraine, Palestine, and Red Sea impacted services in 2024. |

| Infrastructure Spending | Efficiency gains; cost reduction | Germany’s 2024 infra budget ~€45.5B, reduced transit times. |

| E-commerce Policies | Increased demand | EU digital projects (€2.5B, 2024) aid e-commerce, boost parcel delivery. |

| Gig Economy Rules | Increased labor costs | Deutsche Post DHL's labor costs increased by 5% with strict rules. |

Economic factors

Global economic growth strongly impacts logistics demand. Increased trade and shipping volumes often follow economic expansion. Conversely, a recession can decrease consumer spending and business activity, which negatively affects shipping volumes. For example, in 2023, global trade volume grew by about 0.2%, and forecasts for 2024 anticipate moderate growth of 2-3%.

Inflation significantly impacts Deutsche Post DHL Group's operating costs, especially fuel, labor, and transport. In 2023, the company faced higher costs, affecting profitability. Deutsche Post's operating expenses rose, reflecting inflation's pressure. The firm aims to manage these costs through efficiency and pricing strategies.

Deutsche Post DHL Group faces exchange rate risks due to its global operations. Currency fluctuations affect its reported revenue and expenses. In 2023, currency effects reduced revenue by €1.3 billion. The company uses hedging to manage these risks, aiming to stabilize financial results.

E-commerce growth trends

E-commerce is a major economic force for Deutsche Post DHL Group. It boosts demand for parcel delivery and fulfillment services, which the company is targeting. In 2024, global e-commerce sales reached approximately $6.3 trillion, with further growth expected. Deutsche Post DHL Group's strategic focus on e-commerce positions it well.

- E-commerce sales are projected to hit $8.1 trillion by 2026.

- The Asia-Pacific region leads e-commerce growth.

- Deutsche Post DHL is expanding its e-commerce logistics.

- The company has invested heavily in its e-commerce infrastructure.

Competition in the logistics market

The logistics market is fiercely competitive. Deutsche Post faces major rivals such as FedEx and UPS, which can affect pricing. Competition necessitates continuous improvement in efficiency and service to retain market share. For example, in 2024, FedEx reported a revenue of $87.5 billion, illustrating the scale of competition.

- FedEx Revenue (2024): $87.5 billion

- UPS Revenue (2024): $91 billion

Economic growth, trade, and shipping are intertwined, with Deutsche Post's performance influenced by global conditions; forecasts predict moderate growth in 2024-2025. Inflation significantly impacts costs, including fuel and labor, requiring effective management strategies for Deutsche Post. E-commerce expansion, expected to hit $8.1 trillion by 2026, is a key driver, boosting demand for parcel services.

| Factor | Impact | 2024 Data |

|---|---|---|

| Global Economic Growth | Influences trade volumes | Trade volume growth: 2-3% |

| Inflation | Raises operating costs | Fuel, labor, transport costs up |

| E-commerce | Drives parcel demand | Global sales: ~$6.3T |

Sociological factors

Consumer behavior shifts impact Deutsche Post. Demand for rapid delivery and convenient options, like parcel lockers, is rising. Transparency in shipping is also crucial. Deutsche Post must adapt, investing in tech to meet these evolving needs. In 2024, e-commerce sales reached $8 trillion globally, fueling these changes.

Social commerce is booming, with consumers increasingly buying directly via social media. This shift requires logistics providers like Deutsche Post to adapt. For example, in 2024, social commerce sales reached $1.2 trillion globally. This is a 20% increase over 2023. Deutsche Post must integrate services to meet this demand.

Deutsche Post faces workforce shifts. In Germany, the median age is 44.6 years. This impacts staffing and labor costs. The availability of younger workers for demanding roles is also a key concern. Logistics' labor-intensive nature requires careful workforce planning.

Urbanization and population shifts

Urbanization and population shifts significantly impact Deutsche Post DHL. Cities require denser delivery networks. Last-mile delivery solutions are crucial. In 2024, urban populations grew by 1.8%, impacting logistics. Efficient routes and technology are key.

- Urban population growth: 1.8% in 2024.

- Last-mile delivery solutions are increasingly vital.

- Route optimization and tech investment are essential.

Public perception and corporate social responsibility

Public perception significantly influences Deutsche Post DHL Group. Rising awareness of social issues, including labor practices and community impact, compels the company to enhance social responsibility. This includes ethical operations and sustainable practices. A 2024 survey showed that 75% of consumers favor companies with strong CSR. The company's commitment to sustainability is a key focus.

- Consumer preference for socially responsible companies is increasing.

- Deutsche Post DHL Group has invested €7 billion in sustainable fuels by 2030.

- Ethical sourcing and labor practices are under constant scrutiny.

Sociological factors significantly affect Deutsche Post. Rising e-commerce, fueled by social commerce, drives demand, with $1.2T in 2024 sales. Workforce demographics and urbanization also pose challenges. Enhanced social responsibility is key.

| Aspect | Impact | Data |

|---|---|---|

| Consumer Behavior | Demand for fast delivery and transparency. | E-commerce reached $8T in 2024. |

| Social Commerce | Increased direct-to-consumer sales via social media. | 20% growth in social commerce to $1.2T. |

| Workforce | Aging population & labor shifts. | Germany's median age: 44.6. |

Technological factors

Deutsche Post invests heavily in automation. This includes robotic sorting systems and automated guided vehicles (AGVs). In 2024, the company allocated €1.5 billion to digital transformation. Automation reduced labor costs by 15% in some facilities. These improvements enhance operational efficiency.

Deutsche Post is significantly impacted by the digitalization of logistics. Online booking systems and tracking platforms are becoming standard. In 2024, the global digital logistics market was valued at $35.8 billion, expected to reach $66.8 billion by 2029. This trend boosts efficiency and customer satisfaction.

Deutsche Post DHL leverages data analytics and AI to enhance operations. They use AI to optimize delivery routes, potentially reducing fuel consumption by 15% as of 2024. Furthermore, AI aids in demand forecasting, improving inventory management and cutting costs. This technology also personalizes customer interactions. This tech-driven approach boosts efficiency and service quality.

Development of electric and alternative fuel vehicles

Deutsche Post DHL Group is heavily impacted by the development of electric and alternative fuel vehicles. This shift requires significant investment to meet environmental targets. The company is actively electrifying its fleet, with over 30,000 e-vehicles globally. By 2030, DHL aims to have 60% of its last-mile delivery fleet electrified. The company is investing heavily in sustainable aviation fuels (SAF) to reduce emissions.

- DHL invested €7 billion by 2030 to reduce emissions.

- SAF use reduced carbon emissions by 30% in 2024.

- Over 30,000 e-vehicles are in use worldwide as of late 2024.

E-commerce technology platforms

E-commerce technology platforms significantly affect Deutsche Post DHL's shipping service integration and data exchange capabilities. These platforms dictate how efficiently orders are processed, shipped, and tracked. The company leverages these technologies to enhance its logistics network and customer experience. In 2024, e-commerce sales grew by 9.4% globally, underscoring the importance of these platforms.

- Integration with platforms like Shopify and Amazon.

- Real-time tracking and data analytics for optimized delivery.

- Automated fulfillment processes and warehouse management.

- Enhancements in customer service through digital tools.

Deutsche Post employs extensive automation, investing heavily in digital transformation, allocating €1.5 billion in 2024, reducing labor costs by 15%. The company integrates digitalization, enhancing its operations with online booking and tracking systems; the digital logistics market was valued at $35.8B in 2024. Data analytics and AI are used to optimize routes, potentially reducing fuel by 15% by 2024.

| Technological Factor | Impact | Data |

|---|---|---|

| Automation | Efficiency & Cost Reduction | €1.5B invested in 2024, 15% labor cost reduction. |

| Digitalization | Enhanced Logistics | $35.8B global digital logistics market (2024) |

| Data Analytics/AI | Optimized Operations | Fuel consumption reduction by 15% by 2024. |

Legal factors

Deutsche Post DHL Group's Post & Parcel Germany faces postal regulations. These include licensing and service obligations. In 2023, the division's revenue was about €18.2 billion. These regulations influence pricing and market competition. The company must comply with these rules.

Deutsche Post DHL Group faces antitrust scrutiny due to its significant market share. In 2023, the European Commission fined several companies, showing active enforcement. Recent investigations focus on parcel delivery pricing practices. Compliance costs and potential legal battles are ongoing risks. These laws impact strategic decisions, requiring careful market behavior.

Deutsche Post must comply with labor laws globally. This includes working hours, wages, and worker rights. In 2024, labor costs represented a significant portion of operational expenses. For example, in 2024, the company spent approximately €20 billion on personnel expenses.

Data protection and privacy laws

Deutsche Post DHL Group faces significant legal challenges regarding data protection and privacy. The company handles extensive customer and shipment data, making it subject to stringent regulations like the GDPR. Non-compliance can result in hefty fines; for example, in 2023, a major tech firm was fined €40 million under GDPR. Robust data security measures and adherence to compliance protocols are essential.

- GDPR compliance is crucial for international operations.

- Data breaches can lead to significant financial and reputational damage.

- Ongoing monitoring and updates to data protection practices are necessary.

Transportation and safety regulations

Deutsche Post DHL Group must adhere to extensive transportation and safety regulations across various modes of transport. Compliance is crucial to maintain operational safety and avoid legal repercussions. In 2024, the company invested significantly in safety technologies and training programs. These measures are aimed at reducing accidents and ensuring regulatory compliance.

- In 2024, Deutsche Post DHL Group spent over €500 million on safety and compliance initiatives.

- The company conducts over 100,000 safety audits annually to ensure adherence to regulations.

- DHL's safety record shows a 15% reduction in incidents over the past three years.

Deutsche Post must comply with postal regulations, impacting pricing. Antitrust scrutiny is significant, influencing strategic choices due to its market share. Data protection (GDPR) and transport safety laws present significant challenges. Compliance costs are high.

| Area | Regulation | Impact |

|---|---|---|

| Postal | Licensing, service obligations | Pricing, market competition |

| Antitrust | Market share dominance | Compliance costs, legal battles |

| Data Privacy | GDPR, data security | Fines, reputational damage |

Environmental factors

Climate change is intensifying regulatory scrutiny on carbon emissions. Deutsche Post DHL Group aims for net-zero emissions by 2050. This includes investments in electric vehicles and sustainable fuels. In 2023, the group reduced CO2 emissions by 16% compared to 2007 levels.

Deutsche Post DHL Group is actively investing in sustainable fuels and technologies to cut emissions. This includes using sustainable aviation fuels and switching to electric vehicles. In 2024, the group aimed to have 60% of its first- and last-mile delivery fleet electrified. The company plans to invest €7 billion by 2030 to reduce its carbon footprint.

Deutsche Post DHL Group focuses on reducing waste and increasing recycling rates across its global operations. The company's sustainability strategy includes targets for waste reduction and the use of recycled materials in packaging. For example, in 2024, they aimed to increase the use of sustainable packaging. Their efforts align with the growing demand for eco-friendly practices. This is influenced by stricter environmental regulations worldwide.

Noise and air pollution regulations

Deutsche Post faces stringent regulations concerning noise and air pollution, especially in densely populated urban environments. These rules influence the company's logistics, demanding cleaner vehicle fleets and potentially reconfiguring delivery routes. In 2024, the EU tightened emission standards, pushing companies like Deutsche Post to invest in electric vehicles to comply. This shift impacts operational costs and infrastructure needs.

- EU's Euro 7 emission standards, effective from 2025, mandate lower pollutant levels.

- Deutsche Post aims to have 70% of its first and last-mile delivery fleet electrified by 2030.

- Investments in electric vehicles and charging infrastructure are significant, with costs potentially affecting profitability.

- Urban access restrictions for polluting vehicles necessitate route adjustments and operational flexibility.

Customer demand for sustainable logistics

Customer demand for sustainable logistics is significantly increasing, pushing Deutsche Post DHL to adapt. Consumers are increasingly prioritizing environmentally friendly shipping, expecting transparent emissions reporting. This shift necessitates greener logistics solutions, influencing service offerings and operational strategies. A 2024 survey showed a 30% rise in customer preference for sustainable shipping options.

- 2024: 30% rise in customer preference for sustainable shipping.

- Growing demand influences service offerings.

- Companies must provide greener solutions.

Deutsche Post DHL Group focuses on reducing emissions, targeting net-zero by 2050. Key strategies involve electric vehicle investments and sustainable fuel adoption, cutting CO2 emissions by 16% by 2023. Regulations like EU's Euro 7, effective from 2025, and customer demand drive the shift to greener logistics, significantly influencing operational strategies.

| Environmental Aspect | Strategy | 2024/2025 Data |

|---|---|---|

| Emissions Reduction | Invest in EVs, sustainable fuels | 60% electrified fleet in 2024; Euro 7 standards from 2025. €7B investment by 2030. |

| Waste Management | Reduce waste, use recycled materials | Targeted sustainable packaging increase |

| Regulatory Compliance | Adhere to pollution, noise rules | Urban access restrictions, route adjustments, EVs needed |

PESTLE Analysis Data Sources

This PESTLE analysis draws on reputable sources like industry reports, economic forecasts, and government publications.