Deutsche Post Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deutsche Post Bundle

What is included in the product

Analyzes Deutsche Post's competitive environment, including rivalry, buyer power, and new entrant threats.

Swap in your own data, labels, and notes to reflect current business conditions.

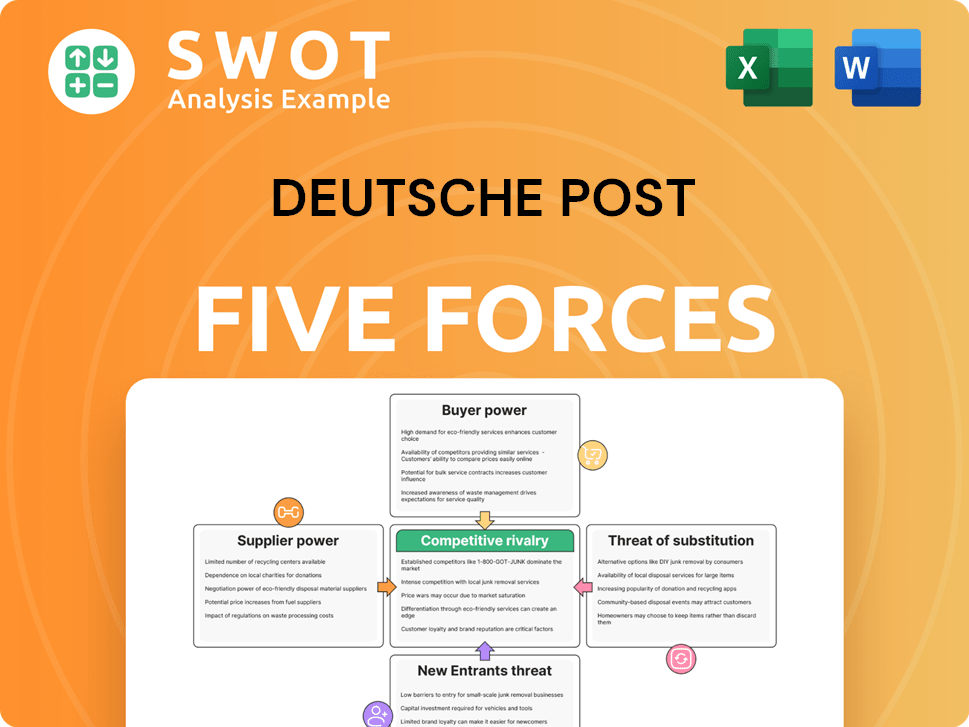

Preview the Actual Deliverable

Deutsche Post Porter's Five Forces Analysis

This preview showcases the Deutsche Post Porter's Five Forces analysis in its entirety. It meticulously examines the competitive landscape, threat of new entrants, and bargaining power. The document also assesses supplier and buyer dynamics, and industry rivalry. This in-depth analysis is exactly what you'll receive after purchasing – ready for immediate use.

Porter's Five Forces Analysis Template

Deutsche Post operates in a dynamic industry, facing pressures from multiple angles. Its bargaining power of suppliers is relatively moderate, influenced by the availability of transportation services and their cost. The threat of new entrants is limited by high capital requirements and existing brand recognition. Rivalry among existing competitors, including global logistics giants, is intense, driving price competition and service innovation. Buyer power is a factor, with large corporate clients able to negotiate favorable terms. Finally, the threat of substitutes comes from digital communication, but the need for physical goods transport remains significant.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Deutsche Post’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Deutsche Post DHL Group's diverse supplier network weakens supplier bargaining power. This dispersed base prevents dependency on any single entity. Competitive bidding among suppliers ensures cost-effectiveness and service quality. In 2024, Deutsche Post spent €80 billion on supplies, leveraging volume for favorable terms.

Deutsche Post benefits from standardized service inputs, such as vehicles and packaging. This reduces supplier power due to readily available alternatives. In 2024, the company's procurement spending was approximately €25 billion. This standardization ensures flexibility in sourcing, aiding cost control. The availability of numerous suppliers prevents any single entity from dominating terms.

DHL's strategic alliances with suppliers, like aircraft manufacturers and fuel providers, shape its bargaining power. Long-term contracts and bulk purchasing agreements help secure favorable rates. For example, in 2024, DHL's fuel expenses were a significant cost, making these deals crucial. Such partnerships reduce supplier influence, ensuring service and cost control.

Vertical integration potential

Deutsche Post has opportunities for vertical integration, though it's not fully realized. They could reduce supplier dependence by investing in their own transport or boosting packaging production. This move would grant them better control over costs and ensure more reliable supply chains. In 2024, the company's logistics segment saw revenue of approximately €67 billion, highlighting the scale at which vertical integration could impact operations.

- Investing in their own transport fleet.

- Expanding packaging production capabilities.

- Greater control over costs.

- Improve supply chain reliability.

Global sourcing options

Deutsche Post DHL Group's extensive global network enables diverse sourcing, boosting its bargaining power. This reach minimizes reliance on specific suppliers, fostering price competition. The company strategically sources goods and services worldwide, optimizing costs. This approach strengthens its position in negotiations, ensuring favorable terms.

- Global sourcing reduces dependence, enhancing bargaining power.

- Deutsche Post DHL Group operates in over 220 countries and territories.

- This broad presence allows for competitive pricing and supplier options.

- It leverages economies of scale and global market dynamics.

Deutsche Post's supplier power is reduced by its diverse sourcing and standardization. Strategic alliances further bolster its position through favorable terms. Vertical integration could enhance cost control.

| Factor | Impact | Data (2024) |

|---|---|---|

| Global Network | Reduces supplier dependence. | Operates in 220+ countries; €80B spent on supplies. |

| Standardization | Increases sourcing flexibility. | €25B procurement spending. |

| Strategic Alliances | Secures favorable rates. | Significant fuel expenses. |

Customers Bargaining Power

Deutsche Post DHL Group's extensive customer base significantly dilutes the bargaining power of individual customers. This vast network includes millions of clients, from individual consumers to large corporations. No single client contributes a disproportionate amount to the company's revenue, minimizing the impact of any single customer's demands. In 2024, the company's revenue was approximately EUR 86.2 billion, spread across its diverse customer segments, reducing its vulnerability to customer-led price pressures or service demands. This broad base bolsters stability against market volatility.

Deutsche Post's service differentiation, like express delivery and e-commerce support, increases customer dependence. Specialized services cater to specific needs, making switching difficult. This differentiation boosts loyalty and lowers price sensitivity. In 2023, DHL Express (a DP segment) saw revenue of €27.4 billion. The global express market is highly competitive, but DP's services maintain customer relationships.

For business clients, integrating Deutsche Post DHL's services into their operations creates switching costs, decreasing provider changes. These costs involve integration, retraining, and potential logistics disruptions. This "stickiness" strengthens the company's position. Deutsche Post DHL Group reported €86.1 billion in revenue for 2023, showing customer loyalty.

E-commerce growth

The e-commerce boom significantly boosts Deutsche Post DHL Group's bargaining power by increasing demand for its logistics services. As online retail expands, the need for dependable and efficient delivery solutions also grows. This trend strengthens the company’s market position and fosters customer loyalty, creating solid growth opportunities. In 2024, e-commerce sales are projected to reach $6.3 trillion globally, driving the demand for logistics.

- E-commerce sales are expected to grow by 10% in 2024.

- Deutsche Post DHL Group's revenue increased by 7.7% in 2023.

- The company handles over 1.8 billion parcels annually.

- E-commerce accounts for 60% of DHL's volume.

Customized solutions

Deutsche Post DHL Group's customized solutions strengthen customer relationships, reducing price sensitivity. Tailored services meet unique needs, adding value beyond standard delivery. This personalization boosts satisfaction and loyalty. In 2024, the company's focus on industry-specific solutions helped maintain customer retention rates. For example, revenue from its e-commerce solutions grew by 12% in the first half of 2024.

- Industry-Specific Solutions: Tailored services for sectors like healthcare and automotive.

- Customer Retention: High retention rates due to personalized offerings.

- E-commerce Growth: Significant revenue increase from tailored e-commerce services.

- Value-Added Services: Services beyond basic delivery, increasing customer lock-in.

Deutsche Post DHL Group's broad customer base limits individual customer influence, bolstered by diverse service offerings and tailored solutions. This diversification reduces vulnerability to customer price pressures. E-commerce drives demand. In 2024, e-commerce is expected to grow 10%.

| Factor | Impact | Data (2024) |

|---|---|---|

| Customer Base | Diluted Power | Millions of customers |

| Service Differentiation | Increased Loyalty | Express revenue: €27.4B (2023) |

| E-commerce Growth | Higher Demand | $6.3T global sales projected |

Rivalry Among Competitors

The logistics sector is fiercely competitive, featuring global giants like UPS and FedEx alongside regional services. Deutsche Post faces constant pressure on pricing and service quality due to this intense rivalry. This competition fuels innovation; for instance, in 2023, FedEx invested heavily in automation. The market is dynamic, with Deutsche Post's revenue at €86.1 billion in 2023, highlighting the scale of the fight.

Frequent price wars, particularly in parcel delivery, significantly affect Deutsche Post's profitability. The need to offer competitive rates erodes margins, a challenge intensified by rivals like Amazon Logistics. These pricing struggles often lead to reduced profitability for all involved, with Deutsche Post's parcel revenue impacted. For example, in 2024, the company faced margin pressures.

Deutsche Post faces intense rivalry, fueled by service innovation. Companies invest in new services, like drone delivery. This continuous innovation cycle keeps the market dynamic. In 2024, Deutsche Post invested €1.2 billion in digital transformation, enhancing its competitive edge.

Global expansion

Deutsche Post faces fierce competition as rivals broaden their global reach, increasing service area overlap. This expansion intensifies rivalry, especially in fast-growing markets. Companies aggressively compete for market share in crucial growth regions, like Asia-Pacific, where the e-commerce market is booming. For example, the Asia-Pacific e-commerce market is projected to reach $2.7 trillion in 2024.

- Global expansion by competitors increases overlap.

- Rivalry intensifies in emerging markets.

- Companies target key growth regions.

- Asia-Pacific e-commerce market is huge.

Market consolidation

Market consolidation is intensifying competition. Mergers and acquisitions are creating larger rivals. This can boost efficiency and market power. Deutsche Post DHL Group needs to adapt. In 2023, the global M&A volume in the logistics sector reached $129 billion.

- M&A activity in the logistics sector is high, reshaping the competitive landscape.

- Consolidation can lead to increased efficiency, but also greater market power for rivals.

- Deutsche Post DHL Group must strategically respond to these changes to maintain its position.

Deutsche Post operates in a highly competitive market, battling against giants like UPS and FedEx. Price wars and service innovation are common, squeezing profit margins; in 2024, margin pressure was evident. Global expansion and market consolidation intensify rivalry.

| Aspect | Details | Impact on Deutsche Post |

|---|---|---|

| Competitive Pressure | Intense from UPS, FedEx, and regional players | Requires continuous innovation and cost management |

| Pricing Dynamics | Frequent price wars, especially in parcel delivery | Erodes profit margins; impacts parcel revenue |

| Market Consolidation | M&A activity reached $129B in 2023 | Increases competition; requires strategic adaptation |

SSubstitutes Threaten

The surge in digital communication, including emails and electronic document transfers, presents a significant threat to Deutsche Post's traditional mail services, acting as a substitute. Businesses are shifting towards digital channels for their correspondence needs. In 2024, email usage continued to grow, with an estimated 347 billion emails sent and received daily worldwide. This trend directly impacts Deutsche Post's revenue streams.

Local delivery services pose a threat to Deutsche Post DHL. These services, strong in specific regions, offer last-mile delivery with speed and personalization. They compete by providing quicker, more tailored options. For example, in 2024, the local delivery market grew by 8%, capturing market share. This shift impacts Deutsche Post's broader delivery network.

The threat of in-house logistics poses a challenge for Deutsche Post DHL. Companies like Amazon have significantly invested in their own delivery networks. In 2024, Amazon's logistics costs were approximately $80 billion, demonstrating the scale of in-house operations. This trend can reduce demand for external logistics services.

Alternative transportation

Alternative transportation methods pose a threat to Deutsche Post DHL. Rail and intermodal transport can substitute trucking and air freight. These alternatives might be cheaper for certain goods and distances. They also offer environmental advantages. In 2024, rail freight in Europe accounted for roughly 18% of total freight volume, illustrating a significant alternative.

- Rail freight volume in Europe reached approximately 400 billion tonne-kilometers in 2024.

- Intermodal transport grew by about 5% in 2024, reflecting increasing adoption.

- The cost difference between trucking and rail can be up to 30% depending on distance.

- Environmental regulations are pushing for greener transport options.

3D printing

The rise of 3D printing poses a long-term threat to Deutsche Post DHL's logistics business. As 3D printing technology advances, it could decrease the need for transporting physical goods. Decentralized manufacturing, enabled by 3D printing, could disrupt traditional supply chains and reduce the volume of packages shipped. While not an immediate concern, it’s a trend to watch closely.

- 3D printing market was valued at USD 13.78 billion in 2023.

- It is projected to reach USD 50.55 billion by 2030.

- DHL invested in 3D printing solutions for spare parts.

- This shows proactive measures against this threat.

Digital communication continues to substitute traditional mail, with billions of emails sent daily, impacting Deutsche Post's revenue. Local delivery services and in-house logistics, like Amazon's $80 billion logistics cost in 2024, offer faster, more tailored alternatives. Alternative transport, such as rail freight (400 billion tonne-kilometers in Europe in 2024), also poses a threat.

| Substitute | Impact | Data (2024) |

|---|---|---|

| Digital Communication | Reduced Mail Volume | 347B emails daily |

| Local Delivery | Market Share Loss | 8% market growth |

| In-house Logistics | Reduced Demand | Amazon's $80B cost |

| Alternative Transport | Cost & Efficiency | Rail 400B tonne-km |

Entrants Threaten

The logistics industry, like Deutsche Post DHL Group's domain, demands substantial initial capital. New entrants face high costs for infrastructure, such as warehouses, and a fleet of vehicles. A global network is very capital-intensive; this protects existing firms. For example, in 2024, DHL invested billions to expand its global reach. This high barrier of entry is a significant deterrent.

Deutsche Post DHL Group’s strong brand reputation poses a significant barrier to new entrants. Its established customer relationships create trust, crucial in logistics. Building brand recognition requires substantial investment in marketing and service. In 2024, DHL's brand value was estimated at $17.1 billion, showcasing its market dominance.

Regulatory hurdles significantly impact the logistics industry, posing challenges for newcomers. Compliance with transport and safety regulations demands expertise and resources. These requirements, including environmental standards, can be costly. For example, in 2024, the EU's emission regulations increased compliance costs by 15% for logistics companies.

Economies of scale

Established companies, like Deutsche Post DHL Group, possess significant economies of scale, creating a barrier for new entrants. Large-scale operations enable cost efficiencies, making it tough for smaller firms to compete on price. Achieving these economies requires substantial investment and a solid market share. For example, in 2024, DHL's global revenue was approximately €86.2 billion, showcasing its scale.

- Cost Advantages: Economies of scale reduce per-unit costs, giving incumbents a pricing advantage.

- Investment Needs: New entrants need massive capital for infrastructure and operations.

- Market Share: High market share is essential to leverage economies of scale effectively.

- Operational Efficiency: Established players have optimized processes and networks.

Technological advancements

The logistics industry, including Deutsche Post DHL, is heavily impacted by technological advancements, making it challenging for new entrants. Keeping pace with innovations like AI, blockchain, and IoT demands continuous investment in automation and digital solutions. These investments create a significant barrier to entry, as new companies must be technologically advanced to compete. The market is rapidly evolving, with digital transformation reshaping operations across the board. This constant need for technological upgrades can deter smaller players from entering the market.

- The global logistics market was valued at USD 9.17 trillion in 2023.

- DHL is investing heavily in its digital transformation.

- New entrants face high capital expenditure for technology.

- The industry sees increasing use of AI and automation.

The threat of new entrants to Deutsche Post DHL Group is moderate due to significant barriers. High capital investments are necessary for infrastructure, like warehouses and transport fleets. Regulatory compliance and technological advancements further increase the challenges for newcomers in the logistics sector.

| Barrier | Impact | Example (2024) |

|---|---|---|

| Capital Needs | High | DHL invested billions to expand its global network. |

| Brand Reputation | Strong | DHL's brand value estimated at $17.1 billion. |

| Regulation | Costly | EU emission regulations increased costs by 15%. |

Porter's Five Forces Analysis Data Sources

Our Porter's analysis leverages Deutsche Post's reports, industry analyses, and competitor data. We also use market research, financial publications, and governmental sources.