DraftKings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DraftKings Bundle

What is included in the product

Tailored analysis for DraftKings' product portfolio.

Clean, distraction-free view optimized for C-level presentation. DraftKings BCG Matrix presents key data in a clear, concise format.

Delivered as Shown

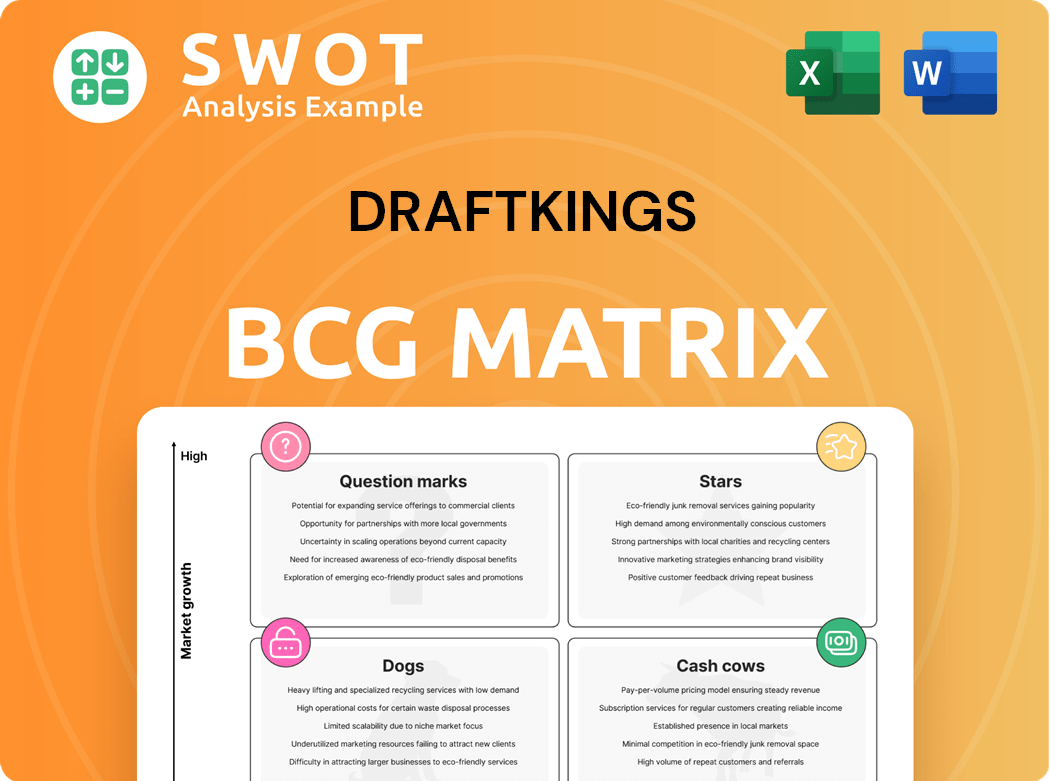

DraftKings BCG Matrix

The DraftKings BCG Matrix you're viewing is identical to the purchased version. This ready-to-use document offers a clear strategic overview. No extra steps are needed; download and implement immediately. It's designed for professional analysis and presentation.

BCG Matrix Template

DraftKings navigates a dynamic sports betting landscape. Analyzing its offerings through a BCG Matrix offers strategic clarity. Are its platforms Stars, dominating the market? Which products are Cash Cows, generating steady revenue? Understanding the Dogs and Question Marks is crucial. This framework helps identify growth potential and resource allocation. Purchase the full BCG Matrix for data-backed insights and strategic recommendations.

Stars

DraftKings holds a dominant market position, ranking among the top two sports betting firms in the US. This is supported by its strong presence in states with favorable regulations. In 2024, DraftKings reported a 46% increase in revenue, highlighting its ability to attract and retain users. Its brand recognition and established user base solidify its leadership in the competitive market.

DraftKings demonstrates impressive revenue growth, achieving a 30% year-over-year increase in 2024, reaching $4.7 billion. Projections for fiscal year 2025 estimate a 35% revenue growth. This strong performance underscores high demand and effective strategies. DraftKings' ability to expand revenue streams solidifies its "Star" status.

DraftKings shines as a "Star" due to its tech-forward approach. The company invests heavily in innovation, creating personalized experiences and dynamic features. This includes AI-driven insights, with technology acquisitions. In 2024, DraftKings invested $250 million in technology.

Strategic Acquisitions

DraftKings has strategically acquired companies like Jackpocket and Simplebet to broaden its offerings and boost its tech. These moves have opened doors to new markets, improved customer interaction, and fueled revenue. Effective integration of these acquisitions strengthens DraftKings' competitive edge by creating business synergies.

- Jackpocket acquisition cost: $750M.

- Simplebet acquisition year: 2024.

- DraftKings revenue growth (2023): 61%.

- Q1 2024 Revenue: $1.23B.

Positive EBITDA

DraftKings reached a major financial milestone in 2024 by achieving its first full year of positive adjusted EBITDA. This positive EBITDA reflects better profitability and efficient cost management. The company's capacity to generate positive earnings highlights its long-term growth potential. DraftKings is well-positioned to seize opportunities in the online gaming sector.

- Positive Adjusted EBITDA: Achieved in 2024, a first for the company.

- Financial Performance: Demonstrates improved profitability and cost management.

- Growth Potential: Underlines the company's ability to capitalize on market opportunities.

- Market Position: Well-positioned in the online gaming market.

DraftKings, a "Star," leads with innovation, including AI and acquisitions, such as Simplebet in 2024. It shows robust revenue growth, up 30% in 2024 to $4.7B, with a projected 35% rise for 2025. DraftKings achieved its first full year of positive adjusted EBITDA in 2024.

| Metric | 2024 Data | Details |

|---|---|---|

| Revenue Growth | +30% | Reached $4.7 Billion |

| Tech Investment | $250M | In innovation |

| Adjusted EBITDA | Positive | First full year |

| Jackpocket Acquisition | $750M | Cost |

| Q1 2024 Revenue | $1.23B | Quarterly Revenue |

Cash Cows

DraftKings' Daily Fantasy Sports (DFS) platform is a cash cow. It consistently generates revenue and cash flow. In Q3 2023, DraftKings reported $109 million in DFS revenue. The platform has a loyal user base and requires relatively low maintenance investment. DFS provides a stable financial foundation.

DraftKings benefits from a well-established brand, crucial in attracting and retaining customers. This strong brand recognition is a key asset, particularly in the competitive sports betting market. In 2024, DraftKings' brand value supported its market share growth. This brand strength translates into customer loyalty and increased revenue. The brand's reputation significantly boosts its overall performance.

DraftKings' mobile sportsbook app remains a cash cow, fueled by consistent user engagement and revenue. The app's popularity is evident, with DraftKings reporting a 30% year-over-year revenue increase in Q4 2023, reaching $1.23 billion. A smooth user experience enhances this app's strong market position. This app contributes significantly to the company's profitability.

Expansion into New Jurisdictions

DraftKings' expansion into new jurisdictions, with mobile sports betting live in 25 states and Washington, D.C., provides a stable revenue stream. This wide presence ensures a consistent income flow. Securing licenses and establishing operations in new areas is crucial for DraftKings' success. In 2024, DraftKings' revenue grew, fueled by these expansions. The company's ability to enter new markets is key.

- DraftKings is live in 25 states and D.C.

- Geographic expansion drives revenue.

- Securing licenses is a key factor.

- Revenue growth in 2024.

Improved Sportsbook Hold

DraftKings' "Cash Cows" status is bolstered by its improved Sportsbook hold. This is fueled by a rise in parlay bets, boosting profitability. A higher hold percentage means more revenue per bet. DraftKings' optimization of sportsbook operations is vital for financial success.

- DraftKings reported a 10.5% hold in Q4 2023.

- Parlay bets often have higher hold percentages.

- Increased hold directly improves revenue.

- This strategy is a key performance driver.

DraftKings' cash cows are its DFS platform, mobile sportsbook, and established brand. In Q3 2023, DFS revenue was $109 million, highlighting its consistent revenue generation. The mobile sportsbook app saw a 30% YoY revenue increase in Q4 2023, reaching $1.23 billion, fueled by strong user engagement.

| Cash Cow | Key Feature | Financial Data (2023/2024) |

|---|---|---|

| DFS Platform | Loyal User Base | Q3 2023 Revenue: $109M |

| Mobile Sportsbook | User Engagement | Q4 2023 Revenue: $1.23B (30% YoY) |

| Brand Recognition | Attracts Customers | Supports market share growth |

Dogs

DraftKings operates in a competitive market, leading to higher promotional spending. In 2024, DraftKings' marketing expenses reached $1.05 billion. This spending is essential to acquire and retain customers. High costs can squeeze profit margins. Managing promotional strategies is key for competitiveness.

Unfavorable sports outcomes, like unexpected game results, can significantly impact DraftKings' financials, leading to revenue volatility. For instance, DraftKings reported a 2024 Q1 net loss of $83.9 million. The company's ability to manage these unpredictable events is crucial for stable performance. DraftKings must mitigate risks from these outcomes to maintain consistent financial results.

DraftKings operates in a highly regulated iGaming sector, facing state-level restrictions. These regulations, plus potential tax hikes, can restrict market access and profitability. Regulatory uncertainties can pose operational challenges. Navigating these hurdles is vital for long-term growth. In 2024, DraftKings' revenue rose to $1.23 billion, reflecting market volatility.

Negative Net Income

DraftKings, categorized as a "Dog" in the BCG Matrix, showcases negative net income despite revenue growth. This situation suggests rising costs, possibly indicating cost management inefficiencies. Such losses can undermine financial stability, making it harder to attract and retain investors. Improving the cost structure is vital for long-term success.

- In 2023, DraftKings' net loss was approximately $1.05 billion.

- Revenue increased by 61% in 2023, but expenses grew as well.

- The company’s focus is now on achieving profitability.

- Investors are closely watching cost-cutting strategies.

Lower ARPMUP

DraftKings' "Dogs" quadrant reflects a concerning trend. While the company saw an increase in unique players, the average revenue per monthly unique payer (ARPMUP) declined. This drop in ARPMUP can negatively affect overall revenue growth. The company needs to focus on strategies to boost ARPMUP to improve profitability and financial performance.

- Declining ARPMUP: Despite a 40% increase in monthly unique payers, ARPMUP decreased in 2024.

- Revenue Impact: Lower ARPMUP directly affects total revenue generation.

- Profitability Challenge: Increasing ARPMUP is vital for improving the bottom line.

- Strategic Focus: Monetization strategies are crucial for DraftKings.

DraftKings, a "Dog" in the BCG Matrix, struggles with profitability despite revenue gains. The company's net loss was around $1.05 billion in 2023. It indicates high costs and a need for better cost management strategies to enhance financial stability.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Net Loss (USD) | -$1.05B | -$700M |

| Revenue (USD) | $3.2B | $4B |

| ARPMUP (USD) | $88 | $85 |

Question Marks

DraftKings sees international expansion as a major growth path, facing regulatory hurdles and competition. Success could unlock new revenue streams. In 2024, they eyed European and Latin American markets. Navigating these challenges is vital for long-term growth. International revenue grew to $193.9 million in Q1 2024.

DraftKings' foray into prediction markets, such as 'DraftKings Predict', faces regulatory hurdles and market unknowns. The regulatory environment for these markets remains in flux. Success hinges on navigating these uncertainties effectively. If successful, this could unlock a new growth area. In 2024, the global prediction market was valued at around $1.5 billion.

DraftKings' iGaming expansion, especially in states like New York and Illinois, marks a high-growth opportunity. However, it faces regulatory challenges and competition. The iGaming market's potential is substantial, with 2024 revenue projected at $6.2 billion. Securing licenses and establishing a strong iGaming presence is key for DraftKings' success.

Subscription Model

DraftKings' exploration of a subscription model, such as DraftKings Sportsbook+, is a strategic move to secure recurring revenue. This approach, although innovative, hinges on customer acceptance and the value customers find in the subscription perks. A successful subscription model could stabilize DraftKings' income flow. The long-term feasibility depends on refining offerings and boosting subscriber numbers.

- DraftKings' Q3 2023 revenue reached $790 million, a 57% increase year-over-year, demonstrating strong revenue growth.

- The company's marketing expenses in Q3 2023 were approximately $242 million, indicating significant investment in customer acquisition.

- DraftKings' monthly unique payers (MUPs) grew to 2.2 million in Q3 2023, a 40% increase, showing a growing user base.

Mergers and Acquisitions

DraftKings' approach to mergers and acquisitions (M&A) is a significant part of its growth strategy. Successful M&A hinges on how well DraftKings can integrate new businesses and generate added value. Strategic acquisitions are intended to broaden DraftKings' product lines and expand its market presence. The company's future success will depend on its skill in identifying and merging with successful acquisitions.

- In 2024, DraftKings has been actively involved in acquisitions to strengthen its position in the sports betting market.

- These acquisitions are aimed at enhancing their technology, user base, or market share.

- The success of these deals is crucial for DraftKings' long-term growth and profitability.

- Effective integration of acquired entities is key to realizing the expected synergies.

DraftKings' international expansion, prediction markets, iGaming ventures, and subscription models fit the Question Mark profile, requiring strategic decisions. These areas, while offering high growth potential, face regulatory, competitive, and customer adoption challenges. The company must invest strategically and adapt swiftly to realize their potential. In 2024, DraftKings' stock price fluctuated significantly, reflecting market uncertainty.

| Strategic Area | Challenges | 2024 Data |

|---|---|---|

| International Expansion | Regulatory, Competition | Q1 Revenue: $193.9M |

| Prediction Markets | Regulatory, Market unknowns | Global Market: ~$1.5B |

| iGaming Expansion | Regulatory, Competition | US Market: $6.2B Proj. |

| Subscription Model | Customer acceptance | Stock Fluctuations |

BCG Matrix Data Sources

The DraftKings BCG Matrix relies on financial reports, market analysis, and industry growth projections from trusted sources for each quadrant.