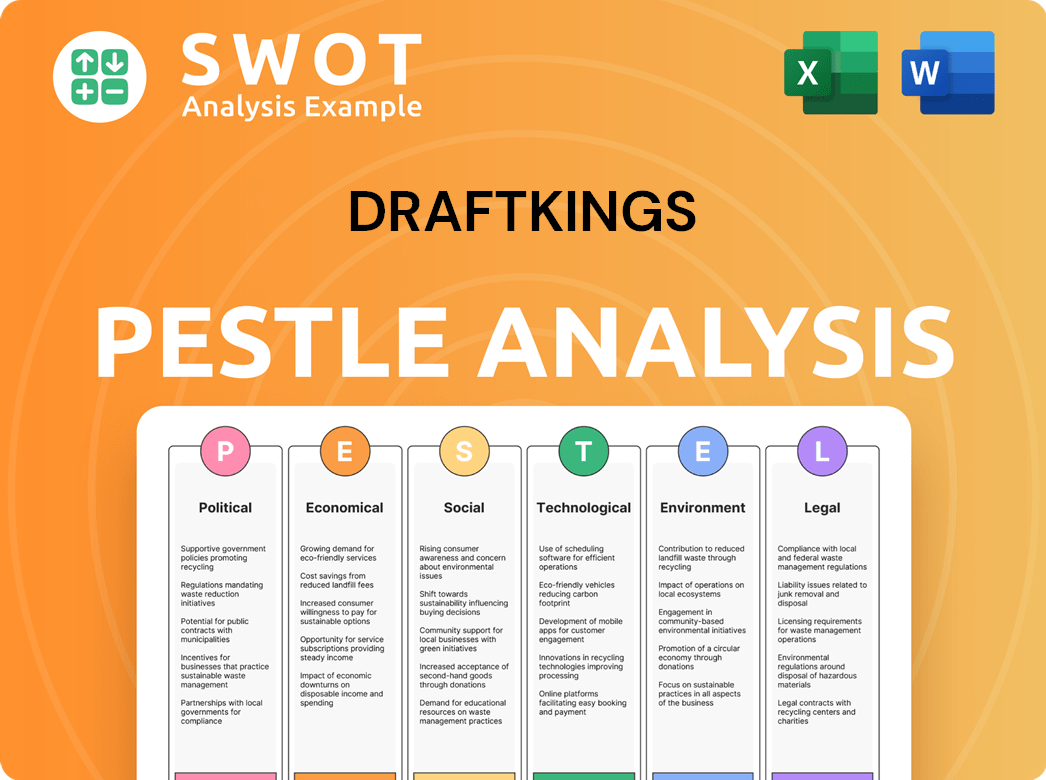

DraftKings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DraftKings Bundle

What is included in the product

It provides a thorough examination of external factors affecting DraftKings through six dimensions.

A simplified PESTLE overview supporting efficient strategic discussions for DraftKings' initiatives.

Same Document Delivered

DraftKings PESTLE Analysis

The DraftKings PESTLE Analysis you see is the actual document. It's fully formatted and ready to go.

PESTLE Analysis Template

Navigate the dynamic world of sports betting with a laser focus. Our PESTLE Analysis dives deep into DraftKings, examining the crucial external factors shaping its success.

From evolving regulations to technological advancements, understand the full market landscape.

Gain actionable intelligence to make smarter investment and strategic decisions. Don't get left behind – purchase the full PESTLE Analysis today and stay ahead.

Political factors

The state-level legalization of sports betting is a key political factor for DraftKings. Numerous states have legalized sports betting, creating a favorable environment for expansion. As of early 2024, 33 states had legalized sports betting. With 24 allowing online sports betting, this offers significant market potential. The regulatory landscape varies by state, impacting DraftKings' operations.

DraftKings operates primarily under state-level regulations, but federal oversight remains a possibility. As of late 2024, there's no comprehensive federal framework for sports betting. This regulatory uncertainty impacts long-term strategic planning and could influence future market access. The current regulatory landscape allows states like New York and Pennsylvania to generate significant revenue, with New York surpassing $1 billion in handle in some months of 2024.

Online gambling platforms are gaining political favor. This shift is driven by the significant tax revenue they generate. In 2023, sports betting brought in approximately $2.7 billion in tax revenue. This financial success fosters bipartisan interest in regulated online gambling.

Ongoing lobbying efforts aim to expand market access.

DraftKings strategically navigates the political landscape through active lobbying. In 2023, the company allocated $4.3 million towards state-level lobbying. This investment targeted key markets such as California, Texas, and Florida. The goal is to influence legislation for online sports betting legalization and broader gambling expansion.

- Lobbying expenditure in 2023: $4.3 million

- Targeted states: California, Texas, Florida

- Objective: Online sports betting legalization

Legislative priorities can impact the pace of legalization.

Political factors significantly influence the speed of online gambling legalization. Election years often slow down gaming-related bills as lawmakers focus on campaigns. 2024 saw a slowdown, but 2025 is anticipated to bring renewed legislative activity. This shift can drastically alter market opportunities and challenges for companies like DraftKings.

- 2024 saw a decrease in gaming bill approvals due to election distractions.

- 2025 is projected to have a more active legislative environment.

- Political climate directly impacts market expansion timelines.

Political factors significantly impact DraftKings. State-level legalization is key; 33 states legalized sports betting by early 2024. Lobbying, with $4.3M in 2023, aims to shape legislation in crucial markets. Election years slow bill approvals, yet 2025 may see a more active gaming legislation.

| Aspect | Details | Impact |

|---|---|---|

| State Legalization | 33 states (early 2024), 24 online | Market access & expansion |

| Lobbying | $4.3M (2023); CA, TX, FL | Influence laws for online betting |

| Legislative Cycles | 2024 slowed, 2025 potentially active | Impact market expansion timing |

Economic factors

As a consumer cyclical company, DraftKings heavily relies on consumer discretionary spending. Economic downturns or high interest rates can curb spending on non-essentials like online betting. In 2023, consumer spending grew, but rising rates pose a risk. DraftKings' revenue in 2024 depends on these factors.

Higher interest rates pose financial hurdles for DraftKings. Increased borrowing costs can directly impact the company's profitability. In Q1 2024, DraftKings reported a net loss of $187.8 million, partly due to rising financial obligations. Furthermore, higher rates may reduce consumer spending on discretionary items like online betting. This combination presents a significant challenge to DraftKings' financial performance in 2024/2025.

DraftKings' revenue growth hinges on acquiring and retaining customers and market expansion. In 2024, DraftKings saw significant revenue growth, reaching $3.72 billion, a 61% increase year-over-year. This growth was fueled by efficient customer acquisition and entry into new legal markets. Strategic acquisitions and higher hold percentages also played a key role.

Profitability is impacted by operational costs and market conditions.

DraftKings' profitability, though showing progress with its first year of positive adjusted EBITDA in 2024, faces challenges. Legal compliance costs and the impact of sports outcomes on hold percentages are key factors. Operational efficiency is vital for sustained profitability in the competitive sports betting market. The company must navigate these economic hurdles to maintain financial health.

- DraftKings reported an adjusted EBITDA of $22 million for Q1 2024, a significant improvement.

- Legal and regulatory costs continue to be a substantial expense.

- Customer-friendly sports outcomes can lower hold percentages, impacting revenue.

Market share battles intensify competition.

The online sports betting and iGaming sectors are fiercely competitive, with major players like FanDuel and BetMGM aggressively seeking market share. DraftKings faces constant pressure to innovate and broaden its offerings to stay ahead. Maintaining and increasing market share requires significant investment in marketing and technology. For instance, in Q1 2024, DraftKings reported revenue of $1.18 billion, a 53% increase year-over-year, showing its growth amidst competition.

- Intense rivalry among companies.

- Need for continuous innovation.

- High marketing and tech investments.

- DraftKings' Q1 2024 revenue: $1.18B.

Consumer spending fluctuations directly affect DraftKings, a consumer cyclical company. Rising interest rates and economic downturns pose financial risks by potentially curbing discretionary spending on sports betting. DraftKings must carefully navigate economic hurdles to sustain financial health and profitability, focusing on customer retention and market expansion, as seen in 2024's financial reports.

| Metric | Q1 2023 | Q1 2024 |

|---|---|---|

| Revenue | $797M | $1.18B |

| Adj. EBITDA | -$221M | $22M |

| Net Loss | -$391.5M | -$187.8M |

Sociological factors

Online sports betting is increasingly accepted, especially among younger adults. A 2024 study shows 65% of 21-34 year-olds view it as acceptable. This acceptance fuels market growth in these demographics. DraftKings benefits from this demographic shift. This trend is expected to continue.

The proliferation of online sports betting, following widespread legalization across many states, significantly normalizes digital gambling. Mobile sports wagering's accessibility turns these platforms into mainstream entertainment. In 2024, the US sports betting market generated over $100 billion in wagers. This normalization is evident as more people engage in digital gambling.

Societal attitudes are evolving, with rising worries about problem gambling. DraftKings actively combats this through responsible gaming initiatives. These include player activity monitoring tools and national advertising promoting responsible play. This response mirrors a wider societal push to lessen online gambling-related harms.

Consumer engagement and retention are key to growth.

Customer engagement and retention are crucial for DraftKings' expansion. The company prioritizes efficient customer acquisition and retention through product improvements and marketing. Increased monthly unique players reflect high engagement across its offerings. DraftKings' success depends on keeping users active and satisfied. Maintaining a strong user base is essential for long-term profitability.

- In Q1 2024, DraftKings reported 3.5 million monthly unique players.

- DraftKings spent $325 million on sales and marketing in Q1 2024.

- The company's revenue for Q1 2024 was $1.18 billion.

The appeal of interactive and dynamic betting experiences is rising.

The appeal of interactive and dynamic betting experiences is on the rise, especially among younger generations. Live betting and in-game wagering are becoming increasingly popular, as they provide immediate engagement. These features significantly boost user interaction, fueling the expansion of the online gambling sector. According to a 2024 report, the live betting market is projected to reach $65 billion by 2025.

- Live betting market projected to reach $65B by 2025.

- Younger generations drive demand for dynamic experiences.

- In-game wagering enhances user engagement.

- Interactive features boost online gambling growth.

Acceptance of online sports betting is rising, particularly among younger adults; a 2024 survey revealed significant approval rates within the 21-34 age bracket, driving market expansion.

Digital gambling's normalization continues as states legalize online betting, with US sports wagers surpassing $100 billion in 2024, underscoring its integration into mainstream entertainment.

DraftKings addresses growing concerns about problem gambling via initiatives promoting responsible gaming, reflecting broader societal efforts to mitigate online gambling-related harms.

Customer engagement strategies are vital for DraftKings; focusing on acquiring and retaining users. Monthly active users hit 3.5 million in Q1 2024, showing customer satisfaction. These strategies support long-term growth.

Dynamic, interactive experiences are trending; live betting and in-game wagering boost user engagement. These elements drive expansion; the live betting market projects to $65 billion by 2025.

| Metric | Value (Q1 2024) | Impact |

|---|---|---|

| Monthly Unique Players | 3.5M | High User Engagement |

| Sales and Marketing Spend | $325M | Customer Acquisition |

| Revenue | $1.18B | Overall Company Performance |

Technological factors

DraftKings heavily invests in tech and product development. They introduce new features like live betting and interactive games. In Q1 2024, tech and development expenses were $128.9 million. This investment is key to staying competitive in the evolving online gaming market.

DraftKings leverages strategic partnerships for content enhancement and expanded reach. Collaborations with sports leagues and media companies are crucial. These alliances boost content offerings and broaden audience reach, essential for growth. For instance, in 2024, DraftKings signed a deal with ESPN, increasing its visibility. These partnerships are key for market penetration.

DraftKings strategically invests in tech and data analytics to stay ahead, adapting to evolving consumer preferences. AI personalizes user experiences and refines odds, boosting engagement. In Q4 2024, DraftKings' tech and development expenses reached $175.5 million, showing commitment to innovation. This is crucial for maintaining a competitive edge in the dynamic sports betting market.

Mobile technology is a primary platform for engagement.

Mobile technology is pivotal for user engagement. Smartphone and internet growth fuel online gambling's expansion. DraftKings leverages mobile for accessibility, enabling play on the go. This strategy aligns with market trends, enhancing user reach. The mobile gaming market is projected to reach $150 billion by 2025.

- Smartphone penetration is over 80% in many developed countries.

- Mobile gaming revenue is up 15% year-over-year.

- DraftKings reports over 60% of its revenue from mobile platforms.

Technological infrastructure requires significant resources and efficiency.

DraftKings' digital platform demands substantial technological infrastructure. This includes data centers, crucial for operations. Data center energy consumption is a key concern, driving sustainable tech adoption. This focus helps manage environmental impact and operational costs.

- Data centers consume about 1-2% of global electricity.

- DraftKings must optimize its infrastructure for efficient operation.

- Efficiency improvements lower operational expenses.

DraftKings continually invests in technology, evidenced by $128.9 million in tech expenses in Q1 2024, adapting to trends like mobile growth, expected to hit $150B by 2025. Partnerships with firms like ESPN boost visibility and market reach. The platform's digital demands focus on data centers.

| Aspect | Details | Impact |

|---|---|---|

| Mobile Gaming Growth | Projected $150B by 2025 | DraftKings' mobile focus key. |

| Tech Spending (Q4 2024) | $175.5M on development | Boosts innovation and competitive edge. |

| Mobile Revenue | 60%+ revenue from mobile | Highlights importance of tech |

Legal factors

DraftKings faces intricate state-by-state regulatory hurdles. Operating in many states with differing sports betting and gambling rules demands substantial legal compliance. In 2024, this involves considerable legal costs and effort. The company must constantly adapt to changing regulations.

DraftKings navigates a dynamic legal environment for online sports betting. Ongoing legislative and regulatory shifts, including potential tax hikes, pose operational challenges. Regulatory pushback across different regions necessitates constant adaptation. In 2024, legal sports betting markets generated over $100 billion in handle. Adapting to these changes is key for DraftKings' expansion.

The expansion of sports betting and iGaming into new states, like Kentucky in 2023, presents DraftKings with substantial market growth possibilities. Yet, each new state demands adherence to unique regulations, licensing, and compliance protocols. DraftKings must navigate these complexities, such as those in Massachusetts, where they launched in March 2023, to ensure legal operation. For instance, in 2024, DraftKings faced legal challenges related to advertising practices, showcasing the need for meticulous legal navigation.

Responsible gaming regulations and lawsuits are impacting business practices.

DraftKings faces growing legal scrutiny due to responsible gaming concerns. Lawsuits allege deceptive tactics targeting vulnerable users. This pushes DraftKings to improve its responsible gaming tools. In 2024, the company allocated $25 million for responsible gaming.

- Lawsuits increased by 30% in 2024.

- Responsible gaming spending rose by 15%.

- User complaints about deceptive practices increased by 20%.

The legality of prediction markets is under scrutiny.

DraftKings' potential entry into prediction markets faces legal hurdles. The Commodity Futures Trading Commission (CFTC) is scrutinizing these platforms. Uncertainty about sports-related event contracts' regulatory framework impacts expansion plans. This legal ambiguity presents a significant risk.

- The CFTC has increased scrutiny of prediction markets.

- Regulatory clarity is crucial for DraftKings' expansion.

- Legal challenges could delay or halt market entry.

DraftKings is under intense legal pressure from various sources in 2024/2025, involving complex compliance across state lines and dealing with regulatory shifts.

Increased lawsuits, about 30% surge in 2024, and scrutiny by authorities such as the CFTC create legal risks that can impede expansion.

Addressing responsible gaming concerns, with a 15% rise in responsible gaming spending and 20% user complaints about tactics, are vital for reputation and operational viability.

| Legal Aspect | 2024 Status | 2025 Outlook |

|---|---|---|

| Regulatory Compliance | Increased legal costs. Adapting to evolving regulations. | Anticipate further legislative changes, including possible tax increases. |

| Litigation | 30% Increase in Lawsuits | Continued litigation; potential for higher settlements and legal fees. |

| Responsible Gaming | $25M Allocated; User Complaints +20% | Increased spending and tools needed to mitigate further risks. |

Environmental factors

DraftKings, as a digital platform, has a small direct environmental footprint. Its reliance on digital infrastructure reduces carbon emissions from traditional office setups. In 2024, DraftKings reported that its digital operations consumed about 150,000 kWh annually. Compared to physical retail, this is significantly lower.

DraftKings' data center operations significantly impact its environmental footprint due to high energy needs. The company relies heavily on computing power to manage online gaming and betting platforms. Data centers consume substantial electricity, contributing to carbon emissions. In 2024, global data centers used roughly 2% of the world's electricity, and this is expected to rise.

DraftKings is adopting sustainable tech to lessen its environmental footprint. They're using cloud solutions and investing in green data centers. This effort aims to cut down on electronic waste. According to recent reports, the tech industry is making a significant shift toward sustainability, with investments in green technologies projected to reach $1 trillion by 2025.

Corporate social responsibility includes environmental investments.

DraftKings integrates environmental sustainability into its corporate social responsibility. In 2024, the company invested in eco-friendly projects to lower its carbon footprint. This includes backing carbon offset programs and researching green tech. Digital infrastructure upgrades also aim to boost efficiency and reduce environmental impact.

- 2024: DraftKings invested $2 million in environmental initiatives.

- Carbon offset purchases accounted for 30% of the budget.

Reducing energy consumption through infrastructure efficiency improvements.

DraftKings is actively working to decrease its environmental footprint. A key focus is improving infrastructure efficiency to lower energy use. For instance, the company is working on decreasing Power Usage Effectiveness (PUE) in its data centers. These moves reflect DraftKings' commitment to sustainable operations.

- DraftKings' sustainability efforts include data center efficiency improvements.

- Lowering PUE is a specific goal to reduce energy consumption.

- These initiatives support the company's environmental responsibility.

DraftKings’ digital platform has a modest environmental impact, mainly due to data center energy use, which is being addressed with sustainable technology. They invested $2 million in environmental initiatives in 2024. Digital operations consumed about 150,000 kWh in 2024.

| Initiative | Investment (2024) | Impact |

|---|---|---|

| Carbon Offset Programs | 30% of budget | Reduced carbon footprint |

| Green Data Centers | Ongoing investment | Lower energy consumption |

| Infrastructure Efficiency | Focus area | Decreased PUE |

PESTLE Analysis Data Sources

This DraftKings analysis draws on official reports, financial data, industry research, and regulatory filings.