DSM-Firmenich Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSM-Firmenich Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, ensuring effortless distribution and concise insights.

What You’re Viewing Is Included

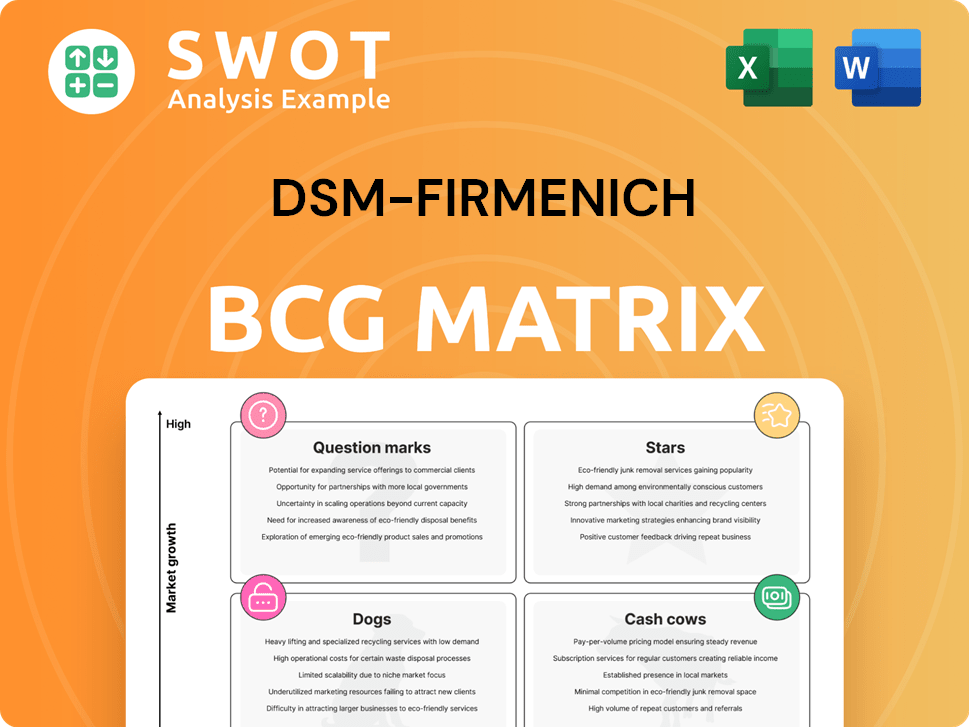

DSM-Firmenich BCG Matrix

The preview showcases the complete DSM-Firmenich BCG Matrix you'll receive. This means no hidden content or alterations; the document you see is the same high-quality report you'll download instantly.

BCG Matrix Template

Explore DSM-Firmenich's market strategy through a quick BCG Matrix overview. See how their diverse product portfolio aligns within Stars, Cash Cows, Dogs, and Question Marks. This snapshot hints at their investment priorities and growth potential. Want the full picture? Get the complete BCG Matrix for detailed quadrant analysis, strategic recommendations, and actionable insights.

Stars

DSM-Firmenich's Perfumery & Beauty (P&B) segment is a "Star" in the BCG Matrix. The P&B sector saw a notable increase in sales, with a 6.5% organic sales growth in 2023. This growth is driven by strong demand for unique fragrances and innovative products. The merger has boosted value for clients.

The Taste, Texture & Health (TTH) segment within DSM-Firmenich benefits from integrated solutions and cross-selling. Investments in areas like AI, R&D, and plant-based products are key. TTH focuses on better-for-you options, aligning with health trends. In 2024, the global health and wellness market is valued at over $7 trillion.

DSM-Firmenich's Health, Nutrition & Care (HNC) is a Star, targeting high-growth, high-margin sectors. This segment thrives on innovation, offering consumer-focused solutions. Personalized nutrition and solutions for micronutrient deficiencies are key. In 2024, the nutrition market is projected to reach $450 billion, fueled by health trends.

Innovation in Fragrance Encapsulation

DSM-Firmenich is pioneering fragrance innovation with products like PopScent Eco Max and HaloScent BerryBoost. PopScent Eco Max uses biodegradable ingredients for long-lasting fragrance. HaloScent BerryBoost, a dual-release profragrance, boosts product appeal. In 2024, the global fragrance market is valued at approximately $48 billion, with encapsulation technologies growing rapidly.

- PopScent Eco Max provides sustained fragrance release.

- HaloScent BerryBoost improves product experiences.

- Applications are in home and hair care products.

- The market growth rate is projected at 5-7% annually.

Sustainability Initiatives

DSM-Firmenich, a 'Star' in its BCG Matrix, aggressively pursues sustainability. The company aims for net-zero greenhouse gas emissions by 2045. They also involve 30,000+ suppliers in their Responsible Sourcing Program. This focuses on ethical raw material sourcing.

- 2023: DSM-Firmenich reported a 3.5% reduction in Scope 1 and 2 GHG emissions.

- 2024 Goal: Further reduce Scope 1 and 2 emissions by 5%.

- Responsible Sourcing: Over 90% of key raw materials are ethically sourced.

- Investment: €100M allocated to sustainable initiatives.

DSM-Firmenich's "Stars" showcase strong growth and market leadership.

The Perfumery & Beauty segment, with 6.5% organic sales growth in 2023, capitalizes on unique fragrances.

The Health, Nutrition & Care segment, targeting high-margin sectors, will likely keep growing fast.

| Segment | 2023 Sales Growth | Market Focus |

|---|---|---|

| Perfumery & Beauty | 6.5% | Fragrances, Innovation |

| Health, Nutrition & Care | High Growth | Consumer Health |

| Sustainability | -3.5% GHG Reduction | Ethical Sourcing |

Cash Cows

DSM-Firmenich's vitamin business, categorized as a Cash Cow, has faced market volatility. A vitamin transformation program has helped cut costs. This boosted adjusted EBITDA, reflecting improved profitability. The focus remains on enhancing efficiency and cash flow within this segment.

DSM-Firmenich's specialty ingredients, like those in food and personal care, are market leaders, generating consistent cash flow. These ingredients benefit from a strong market presence, with annual revenue in 2024 estimated at $2.5 billion. The company is innovating using biotechnology and receptor biology, aiming to expand market share and profitability. This segment shows resilience, with steady demand even during economic fluctuations, reflecting its "Cash Cow" status.

Before the divestment, the Feed Enzymes Alliance, a partnership with Novozymes, was a significant revenue generator. The alliance utilized DSM-Firmenich's sales network. This segment was a cash cow. DSM-Firmenich sold its 37.5% stake in 2024.

Fortified Foods

DSM-Firmenich's fortified foods business is a cash cow, leveraging a strong market position. The company focuses on fortifying staple foods to combat global malnutrition. This segment's consistent demand ensures a stable cash flow, supporting financial stability. DSM-Firmenich collaborates with organizations like the UN World Food Programme.

- DSM-Firmenich has a strong position in fortified foods.

- The company fortifies staple foods like flour, oil, and rice.

- This segment benefits from consistent demand.

- It contributes to stable cash flow.

Cosmetic Ingredients

DSM-Firmenich's cosmetic ingredients, such as UV filters and peptides, are cash cows. These ingredients contribute to stable revenue streams due to consistent demand in personal care. The company's focus on multifunctional and wellness-focused products ensures continued relevance. DSM-Firmenich reported €2.5 billion in sales for its health, nutrition & care segment in 2023.

- Steady revenue from ingredients like UV filters and vitamins.

- Focus on multifunctional and wellness-focused products.

- €2.5 billion in sales in 2023 for health, nutrition & care.

DSM-Firmenich's Cash Cows generate consistent revenue and cash flow. They hold strong market positions in sectors like specialty ingredients and fortified foods. Strategic focus areas include efficiency, innovation, and collaborations.

| Segment | Description | Financials (2024 Est.) |

|---|---|---|

| Specialty Ingredients | Market leaders in food & personal care. | $2.5 billion in annual revenue |

| Fortified Foods | Focus on fortifying staple foods. | Consistent demand & cash flow |

| Cosmetic Ingredients | UV filters, peptides; wellness products | €2.5 billion in 2023 sales (Health, Nutrition & Care) |

Dogs

DSM-Firmenich plans to divest Animal Nutrition & Health (ANH). This move follows increased competition. The company is exploring sale options for ANH. In 2024, the ANH market faced shifts. This strategic shift allows focus on core consumer areas.

DSM-Firmenich divested its yeast extract business to Lesaffre. This strategic move, finalized in 2024, streamlined the company’s focus. The divestment is part of a larger portfolio realignment. The goal is to concentrate on nutrition, health, and beauty, key growth areas.

DSM-Firmenich divested its marine lipids activities to KD Pharma Group. This strategic move streamlines the company's focus. The divestment aligns with prioritizing high-growth segments. In 2024, such moves are part of portfolio optimization, enhancing strategic agility. This allows for resource reallocation.

Commodity Vitamins

The commodity vitamins segment, a "Dog" in DSM-Firmenich's BCG matrix, struggles with market volatility and low prices. DSM-Firmenich is actively restructuring its vitamin business to cut costs and improve its assets. The company's goal is to lessen its vulnerability to fluctuations in vitamin earnings. In 2023, DSM-Firmenich reported that the vitamin business faced headwinds.

- Market volatility and low prices impact profitability.

- DSM-Firmenich aims to reduce risk.

- Restructuring includes cost-cutting and asset optimization.

- Vitamin business showed challenges in 2023.

Certain Legacy Firmenich Activities

DSM-Firmenich is strategically reshaping its business, shedding activities that don't fit its long-term vision. This includes divesting from segments that are less aligned with current market trends. The goal is to optimize resources and concentrate on core, high-growth areas. This restructuring is part of a broader effort to enhance efficiency and focus.

- Divestments aim to streamline operations.

- Focus on high-growth areas.

- Adapting to changing consumer demands.

- Enhancing efficiency.

The "Dog" status in the BCG matrix signifies low market share and growth for DSM-Firmenich's commodity vitamins. This segment faces challenges like price volatility. DSM-Firmenich aims to mitigate risk through cost-cutting.

| Category | Details |

|---|---|

| Market Challenges | Price volatility, low growth |

| Strategic Response | Cost-cutting, restructuring |

| 2023 Performance | Vitamin business faced headwinds |

Question Marks

DSM-Firmenich is exploring plant-based meat ingredients. This market is evolving, with high growth potential. The company focuses on taste and texture improvements through R&D. In 2024, the plant-based meat market was valued at approximately $5.3 billion.

The probiotics and microbiome solutions market is expanding, yet DSM-Firmenich's foothold is still evolving. They're investing in R&D to fuel innovation. These solutions boast high growth prospects, but demand substantial investment. In 2024, the global probiotics market was valued at approximately $65 billion.

DSM-Firmenich is venturing into personalized nutrition, customizing diet plans and supplements. This area is nascent, requiring investments in tech and data analytics. High growth is expected, yet consumer adoption and scalability pose challenges. The global personalized nutrition market was valued at $10.7 billion in 2024.

Methane-Reducing Feed Supplement (Bovaer)

Bovaer, DSM-Firmenich's methane-reducing feed supplement, is a 'Star' in the BCG matrix, given its high growth potential in the sustainability-focused market. DSM-Firmenich retains ownership, but Bovaer's market share and long-term success are still developing. The company needs to prove Bovaer's effectiveness and scalability for broad adoption. In 2024, DSM-Firmenich reported strong initial uptake, with Bovaer usage expanding across several key regions.

- High Growth Potential: Bovaer addresses the growing demand for sustainable agricultural practices.

- Uncertainty: While promising, Bovaer's market share and long-term success are not yet fully realized.

- Scalability: DSM-Firmenich must demonstrate the ability to produce and distribute Bovaer widely.

- 2024 Performance: Initial positive feedback and expanding usage indicate growth, but continued adoption is crucial.

Algae-Based Alternatives to Fish Oil (Veramaris)

Veramaris, a joint venture between DSM-Firmenich and Evonik Industries, represents a "question mark" in the BCG matrix. This algae-based alternative to fish oil is a new business with significant growth potential. DSM-Firmenich is retaining its share in Veramaris, indicating a commitment to its future. The market's nascent stage requires Veramaris to compete with established fish oil sources.

- Veramaris focuses on producing omega-3 fatty acids.

- In 2024, the global omega-3 market was valued at approximately $3.5 billion.

- The company needs to demonstrate its sustainability advantages.

- Veramaris aims to capture market share in a competitive environment.

Veramaris is a "question mark" due to its growth potential and market entry. It produces omega-3 fatty acids, competing with traditional fish oil. DSM-Firmenich needs to establish market share and prove its sustainability. The 2024 omega-3 market was ~$3.5B.

| Aspect | Details | Implication |

|---|---|---|

| Market Position | New entrant in the omega-3 market. | Requires significant investment and market penetration. |

| Growth Potential | High, with increasing demand for sustainable alternatives. | Offers potential for high returns if successful. |

| Challenges | Competition with established fish oil and proving sustainability advantages. | Needs to demonstrate value to gain market share. |

BCG Matrix Data Sources

This BCG Matrix draws on financial filings, market share analysis, and expert sector reports for robust strategic insights.