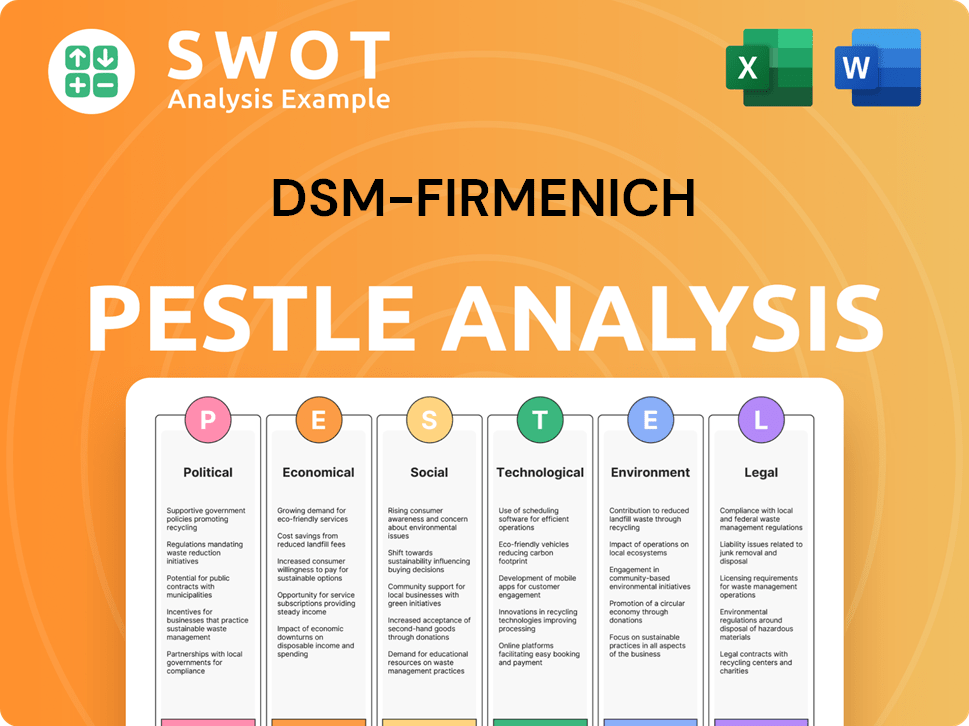

DSM-Firmenich PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSM-Firmenich Bundle

What is included in the product

Analyzes the external factors impacting DSM-Firmenich using PESTLE framework, assessing threats and chances.

Provides a concise version perfect for high-level overviews & strategic presentations.

Full Version Awaits

DSM-Firmenich PESTLE Analysis

Preview this DSM-Firmenich PESTLE Analysis. This preview showcases the complete, professionally structured document.

You'll download this same file right after purchase, ready to use.

There are no alterations between the preview and the purchased analysis.

The final product you receive perfectly matches this preview.

PESTLE Analysis Template

Uncover how DSM-Firmenich is influenced by the world around it. Our PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors shaping their market position. This includes everything from regulatory shifts to consumer trends. Dive deep with our comprehensive insights. Download the full report today and gain a competitive advantage.

Political factors

Governments worldwide regulate food, health, and beauty ingredients, affecting product development and market access. These regulations, constantly evolving, impact dsm-firmenich's operations. The company closely monitors these changes. For example, in 2024, the EU updated its food labeling rules. This demands adaptation of product formulations and labeling for market compliance.

Trade agreements and tariffs significantly impact DSM-Firmenich's operations. Higher tariffs increase raw material and product costs. Geopolitical issues and trade disputes, like those affecting the EU and China, create market instability. In 2024, DSM-Firmenich reported that global trade uncertainties increased supply chain expenses by approximately 2%. Diversified sourcing across regions helps offset tariff risks.

DSM-Firmenich operates globally, making it vulnerable to political instability risks. Unstable regions can disrupt supply chains and manufacturing. The company's diversified global presence, with operations in over 50 countries, mitigates this risk. In 2024, approximately 40% of DSM-Firmenich's sales were in emerging markets, demonstrating its broad geographic exposure.

Lobbying and Industry Associations

DSM-Firmenich actively engages in lobbying and collaborates with industry associations to shape policies impacting its sectors. This strategic involvement ensures the company remains informed about regulatory changes and can advocate for beneficial industry conditions. For example, in 2024, the company spent approximately $1.2 million on lobbying efforts in the US. These efforts help maintain a competitive edge and influence industry standards.

- Lobbying expenditures: approximately $1.2 million in 2024.

- Focus areas: nutrition, health, and beauty regulations.

- Goal: to influence policy and regulatory decisions.

- Method: active participation in industry associations.

Government Support for Innovation and Sustainability

Government policies significantly influence dsm-firmenich. Initiatives supporting R&D in sustainable ingredients are beneficial. Singapore's agrifood ecosystem support offers innovation opportunities. These initiatives create a favorable environment for dsm-firmenich. This boosts its sustainability efforts.

- Singapore's R&D spending in 2024 reached $2.5 billion.

- EU Green Deal supports sustainable business practices.

- China's 14th Five-Year Plan prioritizes green technology.

Political factors profoundly affect DSM-Firmenich's operations, from regulatory compliance to market access. Trade policies, such as tariffs, can significantly alter operational costs and supply chain stability. The company actively lobbies, spending ~$1.2M in 2024. Government R&D support, like Singapore's $2.5B investment, creates innovation opportunities.

| Political Factor | Impact | Example/Data (2024) |

|---|---|---|

| Regulations | Compliance costs, market access | EU food labeling updates |

| Trade Agreements | Cost increases, supply chain risks | Trade uncertainty increased costs by ~2% |

| Lobbying | Policy influence | $1.2M spent in US |

Economic factors

Global economic health significantly impacts consumer spending on dsm-firmenich products. Economic growth, inflation, and recessions affect demand in diverse markets. In 2024, global GDP growth is projected around 3.2%, impacting demand. Inflation rates, like the EU's 2.6% in March 2024, influence consumer behavior. Recession risks, though lessened, remain a factor, especially in Europe.

DSM-Firmenich faces currency exchange rate risks due to its global presence. These fluctuations influence reported revenues and costs. For example, in 2024, currency effects impacted Adjusted EBITDA. Understanding these impacts is critical for financial performance analysis.

Raw material price volatility significantly impacts dsm-firmenich. Costs of vitamins and natural ingredients fluctuate due to supply issues and market dynamics. This volatility directly affects the company's cost of goods sold. For example, in 2024, ingredient costs rose by 5%, impacting profitability. This necessitates careful risk management.

Integration and Synergy Delivery

The integration of DSM and Firmenich is crucial for DSM-Firmenich's economic performance. Synergies from the merger are expected to boost Adjusted EBITDA. In 2024, the company anticipates realizing €150 million in cost synergies. By 2025, this is projected to reach €350 million, enhancing profitability significantly.

- Cost synergies are a major driver of financial performance.

- Sales synergies are also expected to contribute to growth.

- DSM-Firmenich is focused on delivering these synergies.

- The company's financial outlook is positively impacted.

Divestment of Animal Nutrition & Health Business

The planned divestment of DSM-Firmenich's Animal Nutrition & Health business is a pivotal economic decision. This separation aims to reshape the company's financial landscape, allowing for a sharper focus on core businesses. The strategic move, announced in 2023, is projected to streamline operations. It also intends to unlock value and enhance shareholder returns.

- Expected completion of the divestment by the end of 2024 or early 2025.

- Animal Nutrition & Health generated approximately €3.5 billion in sales in 2023.

- The divestment is part of a broader strategy to concentrate on Health, Nutrition & Care.

DSM-Firmenich is impacted by global economic shifts; 2024 global GDP growth is about 3.2%, and EU inflation is at 2.6% in March 2024. Currency fluctuations and raw material price volatility significantly affect the company, with ingredient costs increasing 5% in 2024. The merger's synergies, targeting €150 million in cost savings in 2024, are essential for economic performance.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Affects Demand | Projected 3.2% |

| Inflation (EU) | Consumer Behavior | 2.6% (March 2024) |

| Ingredient Costs | Cost of Goods | Increased by 5% |

Sociological factors

Consumer preferences are shifting towards natural, sustainable, and ethically sourced products. DSM-Firmenich's innovation in plant-based proteins and sustainable fragrances mirrors these trends. The global market for natural ingredients is projected to reach $46.7 billion by 2025. This creates opportunities for DSM-Firmenich. Their focus on these areas positions them well.

Growing health and wellness awareness boosts demand for nutritional ingredients and supplements. DSM-Firmenich's focus on health aligns with this trend. The global health and wellness market is projected to reach $7 trillion by 2025. This positions DSM-Firmenich well. Their Health, Nutrition & Care segment saw sales of €5.8 billion in 2024.

An aging global population significantly influences demand for health and nutrition products. dsm-firmenich can meet diverse age-related nutritional needs. In 2024, the global geriatric population (65+) is 771 million. The market for supplements for seniors is projected to reach $19.7 billion by 2025.

Social Impact and Corporate Responsibility

Consumers and stakeholders now highly value corporate social responsibility. dsm-firmenich's 'Progress for People' strategy, encompassing nutritional solutions and ethical sourcing, directly addresses these expectations. The company's initiatives have led to positive impacts, as evidenced by increased brand trust. This commitment enhances their market position.

- In 2023, dsm-firmenich reported that 65% of its revenue was linked to products contributing to health and nutrition.

- dsm-firmenich's efforts in ethical sourcing have resulted in a 20% reduction in the carbon footprint of its supply chain by 2024.

Workforce Diversity and Inclusion

Workforce diversity and inclusion are increasingly vital for companies like dsm-firmenich. The company actively promotes these values in its hiring processes. In 2024, dsm-firmenich reported that 43% of its management positions were held by women. The company is also focused on creating an environment where all employees can succeed. This commitment reflects broader societal shifts towards greater equity and representation.

- 43% of management positions held by women (2024).

- Focus on inclusive recruitment practices.

- Emphasis on creating a thriving workplace for all employees.

Consumers prioritize ethics; DSM-Firmenich's 'Progress for People' strategy resonates well. Increased demand for inclusive environments aligns with DSM-Firmenich's diversity focus, which is beneficial. The global market is expected to witness positive dynamics.

| Sociological Factor | Impact on DSM-Firmenich | Data |

|---|---|---|

| CSR & Ethical Sourcing | Boosts Brand Trust | 65% of revenue linked to health and nutrition products in 2023 |

| Workforce Diversity | Enhances Innovation | 43% management by women in 2024 |

| Aging Population | Increased Demand | Geriatric population of 771M in 2024 |

Technological factors

Technological advancements and R&D are vital for DSM-Firmenich to create new ingredients and solutions. The company heavily invests in R&D, with expenditures reaching €574 million in 2023. This investment supports innovation and helps drive market growth. The firm's focus on science and technology is key to its success.

Biotechnology and fermentation are key for dsm-firmenich's sustainable ingredient development. The company uses these methods in fragrance creation and alternative protein production. In 2024, the global fermentation market was valued at $68.6 billion, expected to reach $105.6 billion by 2029. This growth highlights biotechnology's increasing importance.

Digitalization and data analytics are crucial for DSM-Firmenich, streamlining R&D, manufacturing, and supply chains. This boosts operational efficiency significantly. In 2024, the global data analytics market is valued at approximately $274 billion. DSM-Firmenich likely uses AI-driven tools to optimize processes, reducing costs and improving product development timelines. This strategic use of tech is vital for maintaining a competitive edge.

Advancements in Food Processing Technologies

Advancements in food processing offer DSM-Firmenich chances for its ingredients. The company's work on plant-based proteins' texture and taste is key. Innovation supports market growth and new product development. DSM-Firmenich is investing in this area. In 2024, the plant-based food market was valued at $36.3 billion.

- DSM-Firmenich's focus on enhancing plant-based proteins.

- Investment in food processing innovation.

- The global plant-based food market is growing.

- New technologies create ingredient opportunities.

Development of New Delivery Systems

Technological factors significantly influence DSM-Firmenich, especially regarding new delivery systems. Advancements in ingredient delivery enhance product effectiveness and consumer satisfaction, vital in health and nutrition. These innovations enable targeted release and improved bioavailability of nutrients and active ingredients. The market for advanced delivery systems is growing, with a projected value of $32.5 billion by 2027.

- DSM-Firmenich invests heavily in R&D, allocating approximately 7% of sales to innovation.

- The global market for encapsulation and controlled release technologies is expected to reach $47.5 billion by 2029.

- Improved delivery systems can increase the absorption rate of nutrients by up to 40%.

DSM-Firmenich relies on tech advancements, investing €574M in R&D in 2023. Biotechnology is key; the fermentation market was valued at $68.6B in 2024. Digitalization and data analytics improve efficiency in its operations and production.

| Tech Aspect | 2023/2024 Data | Impact |

|---|---|---|

| R&D Spending | €574M (2023) | Supports Innovation |

| Fermentation Market | $68.6B (2024) | Key for Sustainability |

| Data Analytics Market | $274B (2024) | Improves Efficiency |

Legal factors

Compliance with FDA regulations is crucial for dsm-firmenich, especially for ingredients in food and pharmaceuticals in the US. The company must navigate complex regulatory pathways, including approvals for new food ingredients. For example, in 2024, the FDA approved several new food additives, impacting the company's product development. dsm-firmenich's adherence ensures product safety and market access. These regulations directly affect its ability to innovate and commercialize products.

DSM-Firmenich, operating in personal care and beauty, faces chemical and product safety regulations. These rules govern the use of ingredients, affecting product formulation and safety assessments. Compliance is crucial. The global personal care market was valued at $511 billion in 2024, and is projected to reach $580 billion by 2025.

DSM-Firmenich heavily relies on intellectual property to safeguard its innovations. Securing patents is a key strategy for protecting its competitive edge. This legal protection is essential in the ingredients market. DSM-Firmenich's R&D spending in 2024 was significant, reflecting its commitment to innovation and patentable discoveries. The company's patent portfolio is a valuable asset.

Labor Laws and Employment Regulations

DSM-Firmenich must adhere to labor laws and employment regulations across various countries, which is critical for its global operations. This includes compliance with minimum wage standards, working hours, and workplace safety. Non-compliance can lead to significant financial penalties and reputational damage. For example, in 2024, the company faced several labor-related audits in its European facilities.

- Compliance with the EU's Working Time Directive is essential, with potential fines up to €20,000 per violation.

- Adherence to local labor laws, such as those in India, where penalties for non-compliance can reach ₹500,000.

- Stringent regulations in the US regarding employee classification and overtime, with potential back pay liabilities.

Anti-trust and Competition Laws

DSM-Firmenich operates within a complex legal landscape, particularly concerning anti-trust and competition laws. Given its substantial market presence, the company is under constant scrutiny to ensure fair market practices. This is especially critical during significant corporate actions like mergers and acquisitions. These actions can trigger regulatory reviews to prevent monopolies or anti-competitive behaviors.

- In 2023, the European Commission fined several flavor and fragrance companies, including DSM-Firmenich's competitors, for anti-competitive practices.

- DSM-Firmenich's acquisitions are subject to review by regulatory bodies like the FTC and the European Commission.

DSM-Firmenich's legal obligations include FDA compliance for food/pharma ingredients; violating them results in market access issues. Chemical & product safety regulations in the $580B personal care market (2025 forecast) also apply. Patents protect R&D investments, with labor laws (wage, safety) mandating compliance. Anti-trust laws prevent unfair market practices.

| Legal Factor | Impact | Example (2024/2025) |

|---|---|---|

| FDA Regulations | Product approval & market access | FDA approved new food additives, impacting product development. |

| Chemical Safety | Product formulation, safety assessments | Personal care market projected at $580B (2025). |

| Intellectual Property | Competitive edge, R&D investments | Significant R&D spending in 2024; patent portfolio protection. |

| Labor Laws | Financial penalties, reputation | Audits in Europe; penalties (India: ₹500,000). |

| Anti-Trust | Fair market practices | EU fines; acquisitions reviewed by FTC, EC. |

Environmental factors

Growing worries about climate change are pushing companies to reduce their carbon emissions. dsm-firmenich aims for net-zero emissions by 2045, demonstrating its dedication to environmental sustainability. In 2023, the company reported a 10% reduction in Scope 1 and 2 emissions. This commitment is crucial for long-term value creation.

Sourcing raw materials impacts biodiversity and natural resources. dsm-firmenich emphasizes responsible sourcing. In 2024, the company invested €30 million in sustainable initiatives. They aim for 100% sustainably sourced key ingredients by 2030, reducing environmental impact.

Water scarcity and quality pose environmental challenges for DSM-Firmenich. The company's manufacturing processes rely on water, making responsible water management crucial. DSM-Firmenich discloses its water usage, aiming for improved water performance. In 2023, the company's water withdrawal was 14.6 million m3.

Waste Management and Circular Economy

DSM-Firmenich faces evolving regulations and societal pressures concerning waste management and circular economy practices. These factors significantly impact its operations, particularly in packaging and product lifecycle management. The company must adapt to reduce waste and embrace circular economy principles to remain competitive and meet sustainability targets. For example, in 2024, the global waste management market was valued at approximately $2.1 trillion, projected to reach $2.8 trillion by 2028.

- Packaging represents a key area for circular economy initiatives.

- Regulations like the EU's Packaging and Packaging Waste Directive drive change.

- Consumer demand for sustainable products is increasing.

- DSM-Firmenich's investments in recyclable materials are crucial.

Sustainable Sourcing and Supply Chain Environmental Impact

Sustainable sourcing and supply chain environmental impact are crucial for dsm-firmenich. The company focuses on sustainability from raw material sourcing to transportation. They work with suppliers to implement environmental management systems and promote sustainable practices. In 2024, dsm-firmenich aimed to reduce its Scope 3 emissions by 15% and increase the use of sustainably sourced materials. This commitment aligns with global sustainability goals.

- 2024: 15% reduction target for Scope 3 emissions.

- Focus on sustainably sourced materials.

Environmental factors significantly impact dsm-firmenich, demanding a focus on sustainability. The company targets net-zero emissions by 2045, reporting a 10% reduction in Scope 1 and 2 emissions by 2023. Responsible sourcing, backed by €30 million in 2024, and water management are also vital, as is adaptation to circular economy regulations.

| Factor | Details | 2024/2025 Impact |

|---|---|---|

| Emissions | Net-zero target, reduction progress. | 15% Scope 3 emissions reduction aim, ongoing progress reports. |

| Sourcing | Responsible sourcing of raw materials. | 100% sustainable key ingredients target by 2030. |

| Waste | Adapting to circular economy & waste management. | Global waste management market valued at $2.1T (2024), expected $2.8T by 2028. |

PESTLE Analysis Data Sources

This DSM-Firmenich PESTLE uses reliable sources, including industry reports, government data, and financial databases.