EDF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Clear visual hierarchy to quickly identify priorities and allocate resources.

What You’re Viewing Is Included

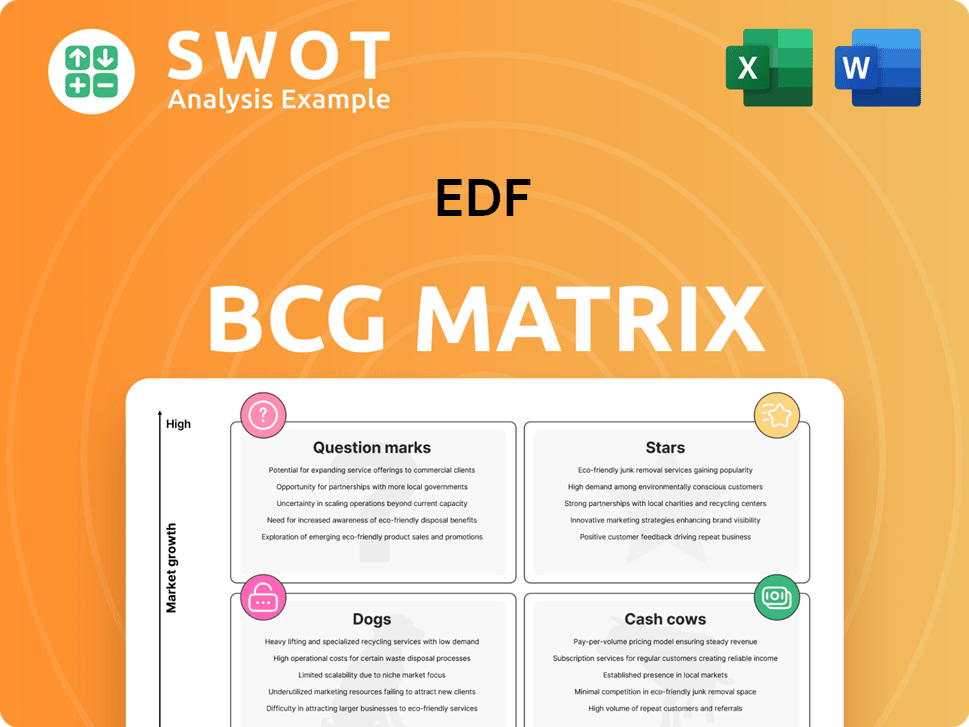

EDF BCG Matrix

The preview displays the complete BCG Matrix report you'll download after buying. It's a fully formatted, immediately usable document, free from watermarks or any demo content.

BCG Matrix Template

See how this company's products stack up using the BCG Matrix! Identify Stars, Cash Cows, Dogs, and Question Marks with our quick overview.

Understand the current market positions of each offering, and how they are likely to perform in the near future.

This sneak peek offers a basic view of the company's portfolio. For deeper analysis, we’ll examine strategic recommendations for each quadrant.

Uncover detailed quadrant placements, plus actionable advice to fuel your strategic planning.

Get the full BCG Matrix report for competitive clarity and data-backed insights.

Purchase now for a ready-to-use strategic tool. The complete analysis awaits!

Stars

EDF's French nuclear plants are a powerhouse, with a 41.3 TWh output increase in 2024, totaling 361.7 TWh. This boost comes from optimizing reactor downtimes via START 2025 and stress corrosion management. The Flamanville 3 EPR reactor's grid connection in December 2024 strengthens EDF. Nuclear accounts for about 70% of France's energy mix, vital for EDF.

In 2024, EDF's European hydropower generation surged by 12.7 TWh, reaching 55.5 TWh. This boost resulted from high availability and favorable conditions. Hydropower is a key, clean energy source for EDF. Strategic investments boosted efficiency.

EDF is significantly boosting its renewable energy presence, with a 6.7% rise in wind and solar output in 2024, hitting 28.5 TWh. This surge is fueled by new installations. Its renewable projects portfolio hit 114 GW gross, showcasing its investment. EDF Renewables UK aims for 10 GW by 2035, highlighting its commitment.

Hinkley Point C Project

The Hinkley Point C project is a "Star" for EDF, indicating high market growth and a significant market share. In 2024, the project saw the installation of its first reactor pressure vessel, a major advancement. This nuclear project is set to supply low-carbon electricity to approximately 3 million homes for over six decades. EDF's 2024 investments in Britain totaled £4.3 billion, with a portion dedicated to this project.

- First reactor pressure vessel installed in 2024.

- Expected to generate power for 60+ years.

- EDF invested £4.3 billion in Britain in 2024.

- Will provide power to approximately 3 million homes.

'Ambitions 2035' Strategy

EDF's 'Ambitions 2035' strategy is a key initiative, focusing on decarbonization and low-carbon electricity production. It involves four pillars, aiming to boost operational efficiency and drive the electric revolution. This plan includes significant investments, with successful commercial policy deployment. The strategy includes signed letters of intent for long-term industrial partnerships.

- EDF aims for 60 GW of renewable capacity by 2030.

- The plan targets €25 billion in investments for 2023-2025.

- Partnerships include collaborations for green hydrogen projects.

- EDF is committed to reducing CO2 emissions by 80% by 2050.

Hinkley Point C represents a "Star" for EDF, reflecting high growth and significant market share. The 2024 installation of its first reactor pressure vessel is a major milestone. The project is slated to supply power to approximately 3 million homes for over 60 years.

| Project | Status (2024) | Impact |

|---|---|---|

| Hinkley Point C | First reactor pressure vessel installed | Low-carbon electricity for 3M homes |

| Investment in Britain | £4.3 billion in 2024 | Supports project development |

| Operational Lifespan | 60+ years | Long-term energy provision |

Cash Cows

EDF operates eight nuclear power plant sites in the UK. Five are operational, and three are decommissioning. In 2024, UK nuclear output was 37.3 TWh, similar to 2023. EDF plans to maintain this output until 2027. They invested £8 billion since 2009 and will invest £1.3 billion more in the next three years.

EDF, via Enedis, manages France's vast electricity distribution network, covering 1.4 million km. In 2024, over 5.5 GW of renewable energy capacity was connected to the grid. Enedis, for the third year, is the 'world's smartest grid'. This network is critical for cash flow.

EDF boasts a significant presence in the G4 nations: France, the UK, Italy, and Belgium. By the close of 2024, it served 41.5 million residential customers. EDF is actively aiding these customers in lowering their carbon emissions. Furthermore, the company is expanding its network of electric vehicle charging points in these countries.

Optimisation and Risk Management Services

EDF's Cash Cows include Optimization and Risk Management Services, crucial for navigating the energy market's complexities. These services, offered through EDF Trading and EDF Energy, help manage volatility and intermittency, especially with the rise of renewables. EDF Trading optimizes EDF's generation portfolio, providing risk management solutions to customers. This sector is vital for financial stability.

- In 2023, EDF Trading's revenue was approximately €10.3 billion.

- EDF Energy's risk management services are essential for balancing the grid.

- Optimization helps maximize profits from renewable energy sources.

- These services contribute to EDF's overall financial resilience.

Low-Carbon Electricity Generation

EDF excels in low-carbon electricity, a key cash cow. In 2024, over 94% of EDF's electricity generation was carbon-free, with a carbon intensity of just 30 gCO2/kWh. This positions EDF favorably in a world focused on sustainability. Their mix of nuclear and renewables ensures reliable, eco-friendly energy.

- Carbon-Free Focus: Over 94% of electricity generation.

- Low Carbon Intensity: 30 gCO2/kWh in 2024.

- Diverse Mix: Nuclear and renewable energy sources.

- Sustainability: Provides reliable and sustainable electricity.

EDF's Cash Cows are reliable revenue streams, vital for financial stability. Optimization and risk management services generated approximately €10.3 billion in revenue for EDF Trading in 2023. Low-carbon electricity, with over 94% carbon-free generation, is another key cash cow. These areas ensure EDF's profitability and market resilience.

| Cash Cow Area | Key Features | 2024 Data/Facts |

|---|---|---|

| Optimization & Risk Management | Revenue generation, market navigation | EDF Trading: ~€10.3B revenue (2023) |

| Low-Carbon Electricity | Carbon-free generation, sustainability | 94%+ carbon-free generation, 30 gCO2/kWh |

| Customer Base | Residential customers | 41.5 million residential customers in G4 nations |

Dogs

EDF's fuel oil generation is a minor component, contributing under 1% to its total power in 2024. The shift towards renewables further diminishes fuel oil's importance. EDF's strategy involves decarbonizing its energy portfolio. This includes reducing fossil fuel dependency, like fuel oil, to meet climate goals.

Coal generation constitutes a small part of EDF's energy mix. In 2024, coal represented just 2% of its total power generation capacity. EDF is moving away from coal to cut emissions. Investments are focused on renewables and nuclear energy to replace coal plants.

EDF faces lower profitability in thermal energy due to decreasing prices. In 2024, lower market prices impacted EDF's EBITDA. The company is focused on enhancing its economic performance. This is to ensure sufficient funding for renewable energy and nuclear power investments.

ARENH (Regulated Access to Historical Nuclear Electricity)

ARENH, crucial for French industrial energy, expires in 2025, affecting EDF's revenue. EDF aims to secure more contracts through ongoing negotiations. A progress update is expected by the end of January. This transition requires strategic adaptation for EDF.

- ARENH allows EDF to sell nuclear electricity at a fixed price of €42/MWh.

- In 2023, EDF's nuclear output was 278.7 TWh.

- The French government is discussing future nuclear energy market regulations.

- Negotiations are crucial to maintain market share.

Gas Businesses in Lower Price Environment

EDF's gas business faces lower profitability. Reduced price volatility and decreased prices have negatively affected the company's EBITDA. EDF is actively adjusting to the evolving market landscape. The company is emphasizing renewable energy and nuclear power to mitigate the impacts of lower gas prices.

- In 2024, EDF's EBITDA was notably impacted by gas market conditions.

- EDF's strategic shift includes significant investments in renewable energy.

- Nuclear power remains a key part of EDF's energy mix strategy.

- The company is adapting to the lower gas price environment to ensure long-term financial stability.

In the EDF BCG matrix, Dogs represent businesses with low market share and low growth potential. These segments often struggle, demanding resources without significant returns. EDF is reducing its involvement in these underperforming areas, refocusing on core strengths.

| Category | Description | EDF Example |

|---|---|---|

| Characteristics | Low market share; low growth. | Potentially, certain fossil fuel operations. |

| Strategic Action | Divest, liquidate, or minimize investment. | Reducing exposure to fuel oil and coal. |

| Financial Impact | Limited profitability; potential for losses. | Lower EBITDA contribution from underperforming sectors. |

Question Marks

EDF is investigating Small Modular Reactors (SMRs) through its NUWARD project, currently in the conceptual design phase. SMRs offer flexible, scalable electricity generation. The global SMR market is projected to reach $60 billion by 2030. This could expand EDF's nuclear portfolio and meet low-carbon energy demands.

Energy storage is a critical area, especially in defence. EDF's 2025 plans highlight funding for advanced battery and hydrogen solutions. Advanced batteries support electric vehicles and renewable energy grids. Global energy storage market was valued at $21.6 billion in 2023.

EDF is heavily investing in electric vehicle (EV) charging infrastructure, primarily through Pod Point, where it holds a 54.05% stake. The company is actively expanding its network of EV charging points across the G4 countries. This strategic move aligns with the rising demand for EVs, presenting a strong growth opportunity. In 2024, the EV market is expected to grow significantly.

Smart Grid Technologies

EDF's investment in smart grid technologies aims to bolster energy distribution stability and security, a key focus in their BCG Matrix. These technologies fortify civilian infrastructure, improving urban power grid resilience against various threats. Smart grids, incorporating AI, can optimize energy use, boosting efficiency and cutting waste. This strategic move positions EDF to adapt to evolving energy demands and market shifts.

- In 2024, global smart grid investments reached approximately $30 billion, with projections showing continued growth.

- AI-driven demand-response systems are estimated to save up to 10% in energy consumption in optimized grids.

- Cybersecurity for smart grids is a $5 billion market, reflecting the importance of protecting these systems.

International Renewable Energy Projects

EDF's international renewable energy projects represent a "Question Mark" in its BCG matrix. These ventures, spanning various global markets, offer potential for growth and diversification. However, they face uncertainties due to shifting energy policies, especially in the United States. EDF must strategically manage these foreign investments alongside the consolidation of its nuclear fleet. The energy transition landscape adds to the complexity of this portfolio.

- Growth in renewables could be a key factor.

- Policy shifts in the United States pose a challenge.

- Nuclear fleet consolidation is a priority.

- Uncertainty is a major characteristic.

EDF's international renewable projects are "Question Marks" in its BCG Matrix, representing high growth potential coupled with significant uncertainty. These ventures face risks like changing energy policies and require careful strategic management. In 2024, the global renewable energy market was valued at over $1 trillion, highlighting the opportunities.

| Category | Characteristics | Data |

|---|---|---|

| Growth Potential | High | Global renewables market exceeding $1T in 2024 |

| Uncertainty | Significant | Policy shifts and market volatility |

| Strategic Need | Careful Management | Balancing risk and opportunity |

BCG Matrix Data Sources

This EDF BCG Matrix utilizes public financial reports, market research, and expert analysis for strategic decisions.