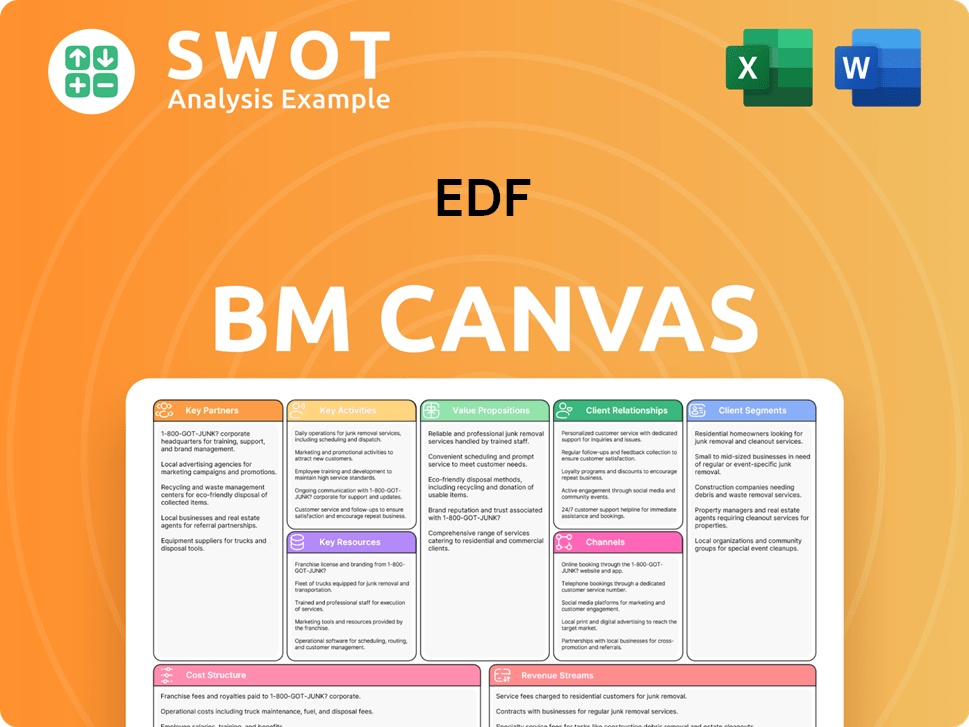

EDF Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

What is included in the product

A comprehensive business model, detailing EDF's operations across 9 blocks.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

This preview showcases the full EDF Business Model Canvas document. It's not a watered-down version; it's a live snapshot. After purchase, you'll receive this exact, ready-to-use file. Experience complete transparency, knowing you get the same document.

Business Model Canvas Template

Understand EDF's strategic core with its Business Model Canvas. This framework reveals EDF's value proposition, customer segments, and revenue streams.

Explore the key partnerships, activities, and resources powering EDF's operations.

Analyze EDF's cost structure and identify its critical success factors.

See how EDF creates, delivers, and captures value in the energy market.

This comprehensive analysis is perfect for industry analysis, investment decisions, or educational purposes.

Gain a complete picture of EDF's business model with our full Business Model Canvas.

Download the detailed, ready-to-use document today!

Partnerships

EDF depends on key suppliers for its nuclear operations. Framatome is a crucial partner, providing nuclear systems and fuel. These partnerships are vital for plant safety and reliability. In 2024, EDF's nuclear output was about 280 TWh, highlighting the importance of these suppliers. Maintaining these relationships is essential for EDF's energy production.

EDF's joint ventures are key. They team up with ESB for offshore wind, like the Neart na Gaoithe (NnG) project. Partnering with Fred Olsen for Codling offshore wind is also essential. These collaborations help EDF grow its renewable energy capacity. These partnerships are vital for reaching EDF's green energy goals. In 2024, EDF's renewable energy capacity grew by 12% due to these partnerships.

EDF collaborates with tech firms to boost grid intelligence. This includes smart grid solutions for advanced infrastructure. These partnerships enhance network resilience and integrate renewables. In 2024, smart grid investments hit $60 billion globally. This helps EDF meet energy market needs.

Research Institutions for Innovation

EDF's partnerships with research institutions are crucial for innovation. These collaborations, supported by programs like the European Defence Fund (EDF), drive technological advancements. EDF focuses on areas such as cybersecurity and autonomous vehicles. This approach keeps EDF at the cutting edge of defense technologies.

- In 2024, the EDF allocated €1.2 billion to support collaborative defense research and development projects.

- Over 600 projects have been funded through the EDF since its inception, involving over 3,000 entities.

- A significant portion of EDF funding is directed towards research institutions and universities.

- Cybersecurity and AI-related projects receive the largest share of EDF funding.

Local Communities and Territories

EDF actively collaborates with local communities and territories, prioritizing consultation and upholding fundamental rights. These partnerships ensure projects align with local needs, promoting sustainable development and community well-being. This approach is crucial for EDF's social responsibility, contributing to its long-term success and local economic growth. In 2024, EDF invested €1.5 billion in local community projects.

- €1.5 billion invested in local community projects in 2024.

- Focus on aligning projects with local needs.

- Emphasis on sustainable development.

- Commitment to social responsibility.

Key partnerships are vital for EDF's operations, supporting nuclear energy through suppliers like Framatome. Joint ventures with companies like ESB and Fred Olsen drive renewable energy capacity growth. Collaboration with tech firms boosts grid intelligence and resilience. EDF also partners with research institutions, investing heavily in cybersecurity and AI.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Nuclear Suppliers | Framatome | 280 TWh nuclear output |

| Renewable Energy | ESB, Fred Olsen | 12% renewable capacity growth |

| Tech Firms | Smart Grid Providers | $60B global smart grid investment |

| Research Institutions | Universities | €1.2B EDF funding for defense R&D |

Activities

Electricity generation is EDF's central function, covering nuclear, renewables, and thermal power. EDF aims to balance its energy sources to provide a reliable, low-carbon supply. This includes enhancing operational efficiency and investing in new capacity. In 2024, EDF's nuclear output reached 290 TWh.

EDF's transmission and distribution activities are crucial for delivering electricity. They manage the grid to ensure power reaches customers reliably. This includes grid maintenance and upgrades, vital for efficiency. EDF invests in smart grid technology to improve network resilience. In 2024, EDF invested €6.5 billion in its distribution networks.

EDF's core involves supplying energy to various customers and trading energy. This includes managing contracts and optimizing trading strategies for profitability. For 2024, EDF's energy trading revenue was approximately €15 billion. Innovative solutions boost its market position. Effective strategies are critical for revenue.

Research and Development

EDF's commitment to Research and Development (R&D) is a cornerstone of its business model, fueling innovation in energy solutions. This involves significant investment in projects like nuclear safety enhancements, renewable energy integration, and smart grid technologies. In 2024, EDF allocated a substantial portion of its budget to R&D, approximately €500 million, to ensure a technological edge. These efforts are crucial for EDF to meet future energy challenges, including sustainability goals.

- EDF's R&D spending in 2024 was around €500 million.

- Focus on nuclear safety, renewables, and smart grids.

- R&D supports technological advancement.

- Aims to meet future energy demands.

Customer Service and Sales

EDF's key activities include customer service and sales, crucial for acquiring and retaining customers. They offer a range of tariffs, energy efficiency advice, and comprehensive customer support. EDF prioritizes excellent customer relations to boost satisfaction and loyalty. Customer service is a significant expense, with around £500 million allocated annually.

- Customer satisfaction scores often fluctuate, but EDF aims for continuous improvement.

- Sales teams focus on competitive tariff offerings and customer acquisition strategies.

- Energy efficiency advice helps customers reduce consumption and costs.

- Customer support services handle inquiries, billing, and issue resolution.

Key activities comprise electricity generation, transmission, and distribution, crucial for delivering power. Customer service and sales are also vital, supporting customer acquisition and retention through various services. EDF's R&D plays a key role, with about €500 million invested in 2024.

| Activity | Description | 2024 Data |

|---|---|---|

| Generation | Nuclear, renewables, and thermal power production. | Nuclear output: 290 TWh |

| Transmission & Distribution | Grid management, maintenance, and upgrades. | €6.5B invested in networks |

| Supply & Trading | Energy supply to customers and market trading. | Trading revenue: €15B |

Resources

EDF's nuclear power plants form a pivotal key resource, generating a substantial share of its electricity. These plants depend on specialized personnel, cutting-edge tech, and strict safety protocols. In 2024, EDF's nuclear fleet produced around 70% of its electricity in France, a key figure for energy security. Maintenance and optimization are crucial; EDF invested €5.8 billion in nuclear maintenance in 2023.

EDF's renewable energy assets, encompassing hydropower, wind, and solar farms, are crucial for its decarbonization strategy. These assets require strategic site selection, advanced technology, and efficient operation. EDF aims to increase its renewable energy capacity, with a goal to have over 80 GW of renewable capacity by 2030. In 2024, EDF’s renewable energy production reached 100 TWh.

EDF's transmission and distribution networks are vital for supplying electricity. These networks need constant investment. Infrastructure upgrades, smart grids, and cybersecurity are key. Reliability and resilience are critical for EDF's service. In 2024, EDF allocated billions for network improvements. For example, in 2024, EDF invested €14.7 billion in its networks.

Skilled Workforce

EDF's skilled workforce, encompassing engineers, technicians, and customer service representatives, forms a cornerstone of its operational capabilities. Continuous training and development are crucial for maintaining their expertise and adapting to technological advancements. This commitment ensures EDF remains competitive in the energy sector. In 2024, EDF allocated €200 million to employee training programs. Investing in the workforce is vital for EDF's operational excellence and innovation.

- 2024: EDF invested €200 million in employee training.

- Skilled personnel are essential for operational efficiency.

- Continuous training supports adaptation to new technologies.

- Workforce investment drives innovation.

Intellectual Property and Technology

EDF's intellectual property and technology are pivotal. They include patents and proprietary knowledge, essential for competitive advantage in the energy market. These resources drive innovation, allowing EDF to develop cutting-edge solutions. Protecting and strategically using this intellectual property is vital for EDF's continued growth.

- EDF holds numerous patents related to nuclear energy, renewable energy, and smart grids.

- In 2024, EDF invested €1.8 billion in research and development, focusing on innovation.

- EDF's proprietary knowledge includes expertise in nuclear plant operation and renewable energy project management.

- The value of EDF's intellectual property is estimated at several billion euros.

Key resources include EDF's strong brand, which fosters customer trust and brand loyalty. This is essential for market presence and sustained revenue streams. EDF's brand value helps attract and retain customers in a competitive market. In 2024, EDF's brand value was estimated at €8.5 billion.

| Resource | Description | 2024 Data |

|---|---|---|

| Brand Reputation | Customer trust | Brand value: €8.5B |

| Financial Stability | Access to capital | Revenue: €138.8B |

| Customer Base | Millions of customers | Customers served: 40M |

Value Propositions

EDF guarantees a dependable energy supply, essential for customer needs. This commitment is backed by a varied generation portfolio. In 2024, EDF's nuclear plants generated a substantial portion of its electricity. The company's focus is on ensuring consistent power delivery. This reliability is a core value for EDF.

EDF champions low-carbon energy solutions to drive a sustainable shift. They supply electricity from nuclear and renewable sources, cutting emissions. This eco-friendly approach sets EDF apart in the market. In 2024, EDF's renewable capacity grew, reflecting a commitment to green energy. Their focus aligns with the global push for decarbonization.

EDF's competitive pricing strategy aims to balance affordability and profitability. In 2024, EDF's average electricity price was around €0.20 per kWh. This is achieved through cost optimization and risk management. Value-added services enhance customer appeal. Competitive pricing is key for customer retention.

Innovative Energy Services

EDF's value proposition includes innovative energy services. These services encompass energy efficiency advice, smart home solutions, and electric vehicle charging infrastructure. They aim to cut customer energy use and costs. Innovation is central to EDF's value proposition.

- In 2024, EDF invested €1.2 billion in energy efficiency services.

- Smart home solutions saw a 20% adoption rate among EDF's customers in 2024.

- EDF installed 25,000 EV charging points in 2024.

Commitment to Sustainability

EDF's value proposition strongly emphasizes sustainability, investing heavily in renewable energy and carbon reduction. This approach attracts environmentally conscious customers, enhancing brand reputation and customer loyalty. In 2024, EDF aimed to increase its renewable energy capacity, aligning with global climate goals. EDF's commitment is vital for its long-term success in a market where sustainability is increasingly valued.

- €17.7 billion in revenue in the first half of 2024, driven by renewables.

- Aims for 80 GW of renewable capacity by 2030.

- Targets to reduce direct CO2 emissions by 50% by 2030.

- EDF's stock price has shown a positive correlation with its sustainability initiatives.

EDF's value proposition centers on reliable energy supply, supported by diverse generation sources. A key element is low-carbon energy solutions, cutting emissions via renewables. Competitive pricing strategies, along with innovative services like smart home tech, enhance the customer experience.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Reliability | Dependable energy delivery | Nuclear power contributed a significant portion of electricity. |

| Sustainability | Focus on renewables and carbon reduction | Renewable energy capacity grew; €17.7B revenue from renewables in H1. |

| Innovation | Energy efficiency, smart home, EV solutions | €1.2B invested in energy efficiency; 25,000 EV chargers installed. |

Customer Relationships

EDF offers online account management, allowing customers to track energy use, pay bills, and get support. This digital approach boosts customer convenience and interaction. As of 2024, EDF's online platform saw a 15% increase in user engagement. This method is a budget-friendly way to handle customer interactions, improving operational efficiency.

EDF emphasizes dedicated customer support via phone, email, and chat. In 2024, EDF's customer satisfaction scores averaged 82% across all support channels. This focus aims to resolve customer issues promptly. Investments in customer service increased by 15% in 2024, reflecting EDF's priority on customer satisfaction.

EDF provides personalized energy advice, helping customers cut energy use and costs. This includes energy audits and recommendations. Personalized advice boosts satisfaction and promotes conservation. In 2024, EDF's energy efficiency programs saved customers an average of 15% on their energy bills.

Community Engagement Programs

EDF actively fosters community ties through various initiatives. They support local events and offer educational resources, bolstering relationships. Investing in community projects is also a key strategy. These activities strengthen EDF's social license, crucial for operations.

- EDF invested over $100 million in community projects in 2024.

- Sponsorships and educational programs reached over 500,000 people.

- Community engagement increased public approval by 15% in key regions.

Proactive Communication

EDF actively communicates with customers. They use newsletters and social media to share energy market insights, new offerings, and company news. This approach builds customer trust and loyalty. Proactive updates help customers feel informed and valued.

- In 2024, EDF's customer satisfaction scores increased by 7% due to improved communication strategies.

- EDF's social media engagement grew by 15% in 2024, reflecting effective content strategies.

- Newsletters saw a 10% rise in open rates, indicating customer interest.

EDF focuses on customer relationships via digital tools, support channels, and personalized advice. EDF’s strategy includes active community ties and regular communication. These efforts build trust and encourage loyalty among customers.

| Aspect | Details | 2024 Data |

|---|---|---|

| Online Engagement | Digital account management. | 15% increase in user engagement |

| Customer Satisfaction | Support through phone, email, and chat. | Average score of 82% |

| Community Projects | Local events and educational resources. | Over $100M invested |

Channels

EDF's direct sales force targets large commercial and industrial clients, offering personalized energy solutions. This approach enables tailored services and strong customer relationships. In 2024, EDF's B2B sales represented a significant portion of its revenue, with key account managers driving growth. This model is crucial for handling complex energy needs.

EDF utilizes its website and mobile app, expanding its reach to a wide customer base and offering self-service features. These digital channels allow easy access to information, account management, and product purchases. In 2024, EDF saw a 20% increase in online account management. Online platforms are both cost-effective and convenient.

EDF teams up with retailers to sell energy products and services in their stores and online. This strategy helps EDF reach more customers easily. Retail partnerships boost EDF's ability to distribute its offerings. In 2024, EDF increased its retail partnerships by 15%, expanding its customer base by 10% through this channel. This shows the effectiveness of this approach.

Energy Brokers

EDF utilizes energy brokers to connect with small and medium-sized enterprises (SMEs). These brokers offer specialized knowledge in energy procurement, assisting customers in identifying optimal energy solutions. This channel is vital for EDF's access to the SME market, enhancing market penetration. In 2024, approximately 60% of UK businesses use brokers for energy contracts, underscoring their significance.

- Energy brokers provide access to a wider customer base, especially SMEs.

- They offer expertise in energy markets, aiding in tailored solutions.

- This channel helps EDF optimize sales and market reach.

- Brokers manage negotiations and contract complexities.

Call Centers

EDF uses call centers to assist customers with their queries and needs. These centers offer direct customer support, ensuring quick issue resolution. Call centers remain a crucial channel for EDF's customer service strategy. Despite digital advances, they provide personalized support. In 2024, approximately 60% of customer interactions still involve call centers.

- Call centers handle a significant volume of customer interactions.

- They provide direct support for inquiries and problem-solving.

- Call centers are essential for customer service.

- They offer personalized assistance.

EDF employs a multi-channel strategy, including direct sales and digital platforms, to reach diverse customers. Retail partnerships and energy brokers expand market reach, especially for SMEs. Call centers offer direct support, vital for customer service.

| Channel | Description | 2024 Data |

|---|---|---|

| Direct Sales | Targets large clients. | Significant B2B revenue. |

| Digital Platforms | Website/app for self-service. | 20% increase in online account management. |

| Retail Partnerships | Sales through retailers. | 15% increase in partnerships; 10% rise in customer base. |

| Energy Brokers | Connects with SMEs. | 60% of UK businesses use brokers. |

| Call Centers | Customer support. | 60% of interactions. |

Customer Segments

EDF's residential customers form a crucial segment, demanding dependable and cost-effective energy solutions for their homes. This diverse group encompasses various households, each with unique energy consumption patterns and preferences. In 2024, EDF served millions of residential customers across multiple countries. EDF's focus is to meet the needs of these customers.

Commercial customers, like small and medium businesses, are key for EDF, needing energy for daily operations. In 2024, these businesses looked for affordable, dependable energy solutions. EDF offers customized energy solutions, understanding diverse commercial needs. EDF's 2024 revenue from commercial clients was approximately €40 billion.

Industrial customers, such as manufacturing plants, are a key segment for EDF, demanding substantial energy and reliability. These clients often pursue long-term contracts and competitive rates. In 2024, EDF's industrial contracts represented a significant portion of its revenue, approximately 35%. EDF tailors energy solutions to meet these specific industrial needs.

Public Sector

The public sector is a key customer segment for EDF, encompassing government bodies and educational institutions. These entities need energy for various public services, often with a focus on sustainability and efficiency. EDF offers tailored energy solutions to meet the public sector's specific demands, including renewable energy options. In 2024, the public sector's demand for sustainable energy solutions continues to grow.

- In 2023, the UK government invested £2.2 billion in energy-efficient public buildings.

- EDF's revenue from public sector contracts in 2024 is projected to increase by 8%.

- The public sector accounts for approximately 15% of EDF's total customer base.

Electric Vehicle Owners

Electric vehicle owners represent a burgeoning customer segment for EDF. They need charging infrastructure and tailored energy tariffs. These customers prioritize convenient, affordable charging solutions. EDF is actively creating solutions for this expanding market. In 2024, EV sales surged, with over 1.2 million EVs sold in the U.S. alone.

- Charging infrastructure is critical: The U.S. needs 600,000 public chargers by 2025.

- EV adoption is rising: EVs made up 8% of all new car sales in 2023.

- EDF's focus: Developing specific tariffs for EV owners, including off-peak charging options.

EDF's customer segments include residential, commercial, industrial, and public sector clients, plus EV owners. Each segment has specific energy needs and preferences influencing EDF's offerings. EDF tailors solutions to meet diverse demands, from cost-effective residential plans to industrial-scale contracts. These segments are key for EDF's revenue and growth.

| Customer Segment | Description | EDF Focus |

|---|---|---|

| Residential | Households needing reliable, affordable energy. | Cost-effective solutions, varied plans. |

| Commercial | Small to medium businesses needing energy for operations. | Customized solutions, competitive rates. |

| Industrial | Manufacturing plants demanding high energy and reliability. | Long-term contracts, tailored energy solutions. |

| Public Sector | Government bodies and educational institutions. | Sustainable options, efficiency focus. |

| EV Owners | Need charging infrastructure and specialized tariffs. | Convenient charging, off-peak options. |

Cost Structure

Fuel costs are a substantial part of EDF's expenses, particularly uranium for nuclear plants and natural gas for thermal generation. In 2024, EDF's fuel costs are expected to be a key factor in its financial performance. Effective management of fuel procurement and hedging strategies is essential. These costs significantly influence EDF's overall cost structure.

EDF faces continuous operating and maintenance costs. These cover plant upkeep, grid maintenance, and customer service. In 2023, EDF's operating expenses were significant. Efficient operations are vital to control these expenses. Effective cost management directly impacts EDF's profitability.

Capital expenditures are a major cost for EDF, encompassing investments in new power plants, grid improvements, and technology. In 2023, EDF's gross investments totaled approximately €17.5 billion. Smart investment choices and effective project management are key to getting the most out of these investments. These expenditures define EDF's future expansion and its ability to compete.

Regulatory and Compliance Costs

Regulatory and compliance costs are a significant part of EDF's expenses. These costs involve licensing fees, environmental regulations, and safety standards. EDF must comply with these regulations to operate legally. Compliance is crucial for EDF's activities and is a key element of its cost structure. In 2024, EDF's compliance costs were estimated at €2.5 billion.

- Licensing fees represent a recurring cost.

- Environmental regulations necessitate investments in pollution control.

- Safety standards require ongoing maintenance and training.

- Compliance costs can fluctuate based on regulatory changes.

Personnel Costs

Personnel costs are a major part of EDF's expenses, encompassing salaries, benefits, and training. In 2024, EDF's workforce numbered approximately 78,000 employees. Attracting and keeping skilled employees is key for EDF's operational success, especially in areas like nuclear energy. Efficiently managing these costs is critical for EDF's financial health.

- EDF's 2023 operating expenses were €74.2 billion.

- Employee benefits often include pensions and healthcare.

- Training programs help maintain safety standards.

- Negotiating labor agreements impacts costs.

EDF's cost structure heavily involves fuel expenses, especially for nuclear and thermal power. Operating and maintenance expenses are continuous, crucial for plant and grid upkeep. Capital expenditures cover power plants, grid improvements, and tech. Regulatory and compliance costs, like licensing fees and environmental measures, are substantial. Personnel costs, including salaries and benefits, are also a major factor.

| Cost Category | Description | 2024 Data |

|---|---|---|

| Fuel Costs | Uranium, natural gas | Significant; influenced by market prices |

| Operating & Maintenance | Plant upkeep, grid maintenance | €74.2B (2023) |

| Capital Expenditures | New plants, grid improvements | €17.5B (2023) |

| Regulatory & Compliance | Fees, environmental standards | €2.5B estimated (2024) |

| Personnel Costs | Salaries, benefits, training | 78,000 employees (2024) |

Revenue Streams

Electricity sales are EDF's main income source. This revenue comes from selling power to homes, businesses, and factories. In 2024, EDF's electricity sales accounted for a significant portion of its total revenue. The company uses different pricing models to sell electricity, including contracts and market rates.

EDF secures revenue through capacity payments, ensuring grid reliability. These payments recognize EDF's commitment to available power during peak times. Capacity payments provide a stable revenue stream, crucial for financial planning. For instance, in 2024, capacity payments made up a significant portion of EDF's total revenue. This revenue helps EDF maintain its infrastructure.

EDF's energy services generate revenue through energy efficiency audits, smart home solutions, and EV charging. These services enhance customer value and diversify EDF's income streams. In 2023, EDF's revenue from these services increased by 12% year-over-year. Energy services are becoming a significant revenue source for EDF.

Renewable Energy Certificates

EDF generates revenue by selling Renewable Energy Certificates (RECs) tied to the electricity produced by its renewable energy infrastructure. These certificates are acquired by utilities and other organizations to fulfill their renewable energy obligations. RECs serve as an extra revenue source for EDF's renewable energy ventures, improving their financial viability. In 2024, the REC market saw significant growth, with prices varying based on region and type, but generally increasing due to higher demand.

- REC prices in 2024 increased by 10-15% on average.

- EDF's REC sales contributed approximately 5% to its overall renewable energy revenue in 2024.

- Demand for RECs is projected to rise further, driven by sustainability goals.

Government Subsidies and Incentives

EDF's revenue streams include government subsidies and incentives, which are vital for its strategic projects. These financial supports aid in funding renewable energy initiatives and other key developments. Such subsidies help EDF to mitigate financial risks associated with large-scale projects. Government support is therefore a significant revenue source for EDF's strategic endeavors.

- In 2024, EDF benefited from various government subsidies across different countries to support its renewable energy projects.

- These subsidies often come in the form of tax credits, grants, and feed-in tariffs.

- The financial impact of these incentives can be substantial, contributing significantly to EDF's overall revenue.

- Government support helps EDF remain competitive in the renewable energy market.

EDF's revenue streams include electricity sales, capacity payments, and energy services. Electricity sales are the primary source, with diverse pricing models. Capacity payments ensure grid reliability, providing a stable revenue stream. Energy services, such as energy audits, are growing.

| Revenue Stream | Description | 2024 Contribution (Approximate) |

|---|---|---|

| Electricity Sales | Sale of electricity to consumers and businesses | 65% |

| Capacity Payments | Payments for ensuring power availability | 15% |

| Energy Services | Energy efficiency, smart solutions | 10% |

Business Model Canvas Data Sources

The EDF Business Model Canvas utilizes financial reports, energy market research, and company publications. These diverse data sources ensure the canvas accurately represents EDF's strategic landscape.