EDF PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EDF Bundle

What is included in the product

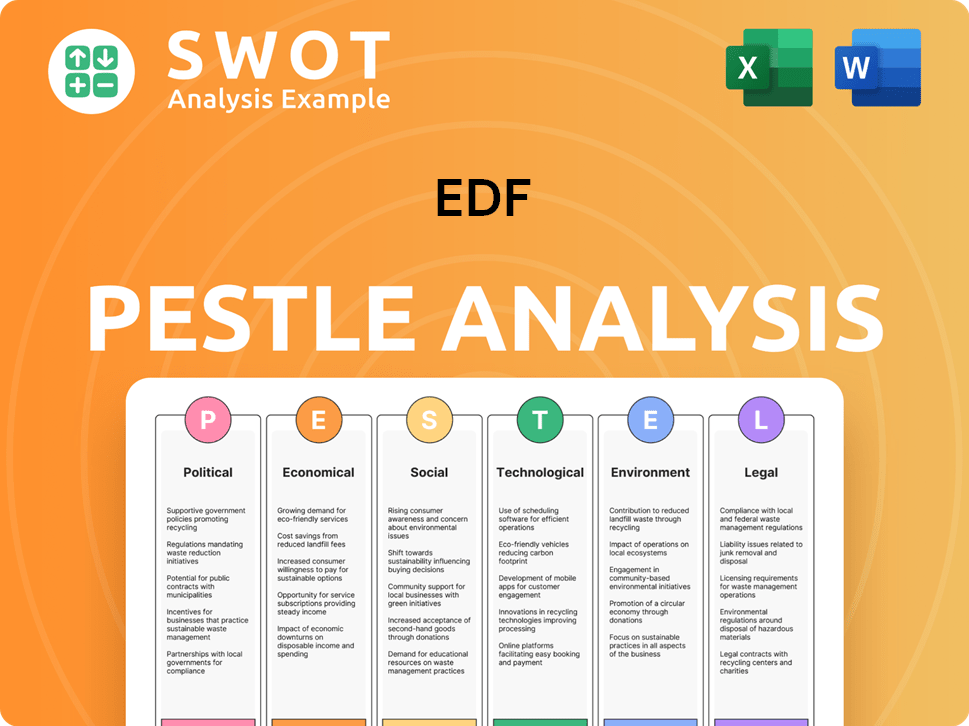

The EDF PESTLE Analysis scrutinizes the company's external macro-environment across Political, Economic, etc. factors.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

What You See Is What You Get

EDF PESTLE Analysis

The preview showcases the EDF PESTLE analysis in its entirety.

You're seeing the actual, fully formatted document.

Upon purchase, you'll receive this exact, ready-to-use file.

No content variations, just the document displayed here.

The content and structure won't change!

PESTLE Analysis Template

Unlock critical insights into EDF's strategic landscape with our expertly crafted PESTLE Analysis. Explore how political, economic, social, technological, legal, and environmental factors influence the company's operations. We delve into regulatory changes, market shifts, and emerging trends to provide a holistic view. This analysis is perfect for investors, analysts, and business professionals seeking a comprehensive understanding. Don't miss the opportunity to enhance your strategic planning. Download the full PESTLE Analysis now and gain a competitive edge!

Political factors

EDF, predominantly owned by the French government, navigates a landscape shaped by political influence. This ownership subjects EDF to government policies impacting energy strategies and infrastructure investments. For example, the French state holds around 84% of EDF's capital as of late 2024. Government decisions on nuclear power, like the construction of new reactors, directly affect EDF's financial commitments and operational planning. Electricity price regulations, influenced by political objectives, also impact EDF's revenue and profitability, as evidenced by the 2023-2024 price cap policies.

Government energy policies focusing on decarbonization and renewables heavily influence EDF's strategy. The ARENH mechanism in France, requiring EDF to sell nuclear power at a set price, significantly impacts revenue. As of early 2024, the French government is reviewing energy regulations. EDF's financial performance will be affected by these policy shifts. In 2023, EDF's net financial debt was €64.5 billion.

EDF's global presence exposes it to various political risks. Geopolitical instability can disrupt energy markets and supply chains. For example, the Russia-Ukraine war has significantly impacted European energy security. The European push for energy independence, amplified since 2022, influences EDF's investment decisions. EDF's revenue in 2023 was €139.7 billion.

Public Opinion and Political Pressure

Public opinion significantly affects EDF, especially regarding nuclear power and environmental impact. Concerns about energy prices and climate change create political pressure. EDF must manage public sentiment to influence policy decisions and regulatory changes. For example, in 2024, renewable energy sources saw increased public support across Europe.

- Public support for nuclear energy varies, with some regions favoring it for its low carbon emissions.

- Energy price volatility continues to be a major concern for consumers and policymakers.

- Environmental regulations, like the EU's Green Deal, push EDF to invest in sustainable energy.

Labour Relations and Industrial Action

EDF's relationship with labor unions and the risk of industrial action are key political factors. Ongoing negotiations about pay and working conditions can cause operational disruptions. These disputes could delay project completion and impact EDF's financial performance. For instance, labor unrest in the nuclear sector could lead to significant financial losses.

- 2023 saw increased industrial action across the energy sector.

- Negotiations with unions are expected to continue in 2024 and 2025.

- Strikes could potentially impact power generation and distribution.

Political influence significantly impacts EDF due to government ownership and policy. The French government holds about 84% of EDF's capital. Regulatory changes and energy policies, like price caps, directly affect EDF’s revenue.

Geopolitical instability and the push for energy independence, amplified since 2022, shape investment decisions. Public opinion and labor relations, including negotiations and potential strikes, are crucial.

Public support for nuclear and renewables influences policy and investment decisions, with industrial action posing financial risks. EDF's financial debt was €64.5 billion in 2023, while revenue reached €139.7 billion.

| Factor | Impact | Example |

|---|---|---|

| Government Ownership | Policy influence, investment direction | French state holds ~84% of EDF capital |

| Energy Policies | Revenue & strategy changes | Price caps, ARENH mechanism, Green Deal |

| Public & Labor Relations | Operational & financial risks | Nuclear concerns, union negotiations, 2023 strikes |

Economic factors

EDF's financial health is sensitive to energy price swings. Higher wholesale electricity and gas prices can be a boon, while drops can hurt revenue. Increased nuclear and hydropower output helps, but market prices remain key. In 2024, EDF navigated volatility, with strategies adapting to price shifts.

EDF faces significant investment demands due to the energy transition and infrastructure development. Securing financing is vital for projects like new nuclear reactors. In 2024, EDF's gross debt was around €64.5 billion, highlighting the importance of debt management. EDF is investing heavily in renewables to lower its carbon footprint.

Broader economic conditions, including inflation rates and GDP growth, heavily influence EDF. Inflation, at 2.3% in France in March 2024, raises operational costs. Economic growth, with a projected 0.8% GDP increase for France in 2024, can boost electricity demand. The economic outlook in France and Europe significantly shapes EDF's market, impacting its financial performance and strategic decisions.

Government Subsidies and Financial Support

As a state-owned entity, Électricité de France (EDF) often receives government backing, including subsidies and financial aid, especially for strategic projects. The specifics of this support hinge on political and regulatory decisions, impacting EDF's financial planning. For instance, financing new nuclear power plants is still being defined, potentially affecting EDF's capital expenditures. In 2024, EDF received approximately €1.7 billion in state aid.

- State aid to EDF in 2024 was about €1.7 billion.

- Financing models for new nuclear projects are still evolving.

- Government support impacts EDF's financial strategies.

Currency Exchange Rates

EDF, as a global entity, faces currency exchange rate risks. These fluctuations affect the Euro value of its foreign earnings and investments. For instance, a weaker Euro boosts the value of non-Euro revenues. Financial planning and risk management are crucial for EDF to navigate these currency impacts effectively.

- In 2024, the EUR/USD exchange rate varied significantly, impacting EDF's financials.

- Hedging strategies are employed to mitigate currency risks on international projects.

- Fluctuations can influence reported profits and the competitiveness of EDF's international operations.

EDF’s financial health strongly correlates with energy prices, impacted by inflation and economic growth. Inflation, at 2.3% in France (March 2024), affects operating costs. France's 2024 GDP growth of 0.8% influences electricity demand.

| Metric | Value |

|---|---|

| French Inflation (March 2024) | 2.3% |

| France GDP Growth (2024, est.) | 0.8% |

| EDF State Aid (2024) | €1.7B |

Sociological factors

Public acceptance is crucial for EDF. Societal views on energy sources, like nuclear and renewables, directly impact project support. A 2024 study showed 65% support for renewable energy in France. Maintaining public trust is vital for EDF's operations and the energy transition.

EDF is a major employer, crucial for skills development in energy. The shift to new technologies demands skilled workers, making EDF's ability to attract and train talent vital. EDF plans to hire significantly in the coming years, with approximately 2,000 new hires in the UK by 2025. This includes roles in nuclear and renewable energy.

Energy affordability is a significant sociological factor. Public scrutiny of EDF's pricing strategies is high. In 2024, 13.2% of U.S. households struggled to pay energy bills. Social and political pressure greatly impacts EDF's actions. EDF's role in reducing energy poverty faces constant evaluation.

Community Engagement and Local Impact

EDF's operations significantly affect local communities through power plants and infrastructure. Positive community relations are crucial for project success and involve addressing local concerns. EDF's community investment in 2024 reached €150 million. This includes supporting education, healthcare, and infrastructure projects.

- €150 million invested in community projects in 2024.

- Focus on education, healthcare, and infrastructure.

- Positive community relations are essential for project success.

Changing Consumption Patterns

Societal shifts significantly impact EDF. Electrification, including transport and heating, boosts electricity demand, requiring infrastructure adjustments. Energy efficiency awareness further shapes consumption. EDF must adapt its services to align with these changes.

- In 2024, electric vehicle sales rose, increasing electricity demand.

- European Union's focus on energy efficiency standards influences consumption patterns.

- EDF invests in smart grids to manage evolving energy needs.

Societal trends strongly influence EDF's strategies. Shifts in energy consumption, like rising EV adoption, are key. EDF navigates this by investing in infrastructure, adapting to changing needs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Public Opinion | Impacts project support | 65% support for renewables in France |

| Community Relations | Project success crucial | €150M community investment |

| Energy Affordability | Influences pricing | 13.2% US households struggle |

Technological factors

Developments in nuclear reactor technology, like EPRs and SMRs, are vital for EDF's future energy mix. New build designs and advancements in nuclear fuel technology are pivotal. France plans to invest €50 billion in nuclear power through 2030. This includes extending the lifespan of existing reactors and constructing new ones.

Technological advancements in renewables like solar and wind influence EDF's strategy. These improvements boost efficiency and reduce costs. EDF invests significantly in these technologies, aiming for a greener energy mix. For instance, in 2024, EDF increased its renewable energy capacity by 10%, enhancing its decarbonization efforts.

EDF is heavily investing in grid modernization, crucial for integrating renewables. Smart grids, featuring digital tech and smart meters, enhance efficiency. In 2024, EDF planned to allocate €1.5 billion for grid upgrades. This boosts reliability and supports decentralized energy.

Digitalization and Data Analytics

Digitalization, data analytics, and AI are pivotal for EDF. These technologies optimize operations, enhancing predictive maintenance for infrastructure like nuclear plants. They also improve energy management services and demand forecasting. EDF's digital transformation initiatives aim to cut costs and boost efficiency, aligning with sustainability goals.

- EDF invested €1.5 billion in digital transformation between 2021-2023.

- Predictive maintenance reduced unplanned outages by 15% in 2024.

- Smart grid deployments increased energy efficiency by 10% in pilot areas.

Development of Energy Storage Solutions

Technological advancements in energy storage are crucial for EDF. Battery storage and other technologies help manage the inconsistency of renewables, ensuring grid stability. EDF's capacity to adopt and use these technologies is a key tech factor. The global energy storage market is projected to reach $17.3 billion by 2024. By 2025, the EU aims to have 50% of its energy from renewables.

- Battery storage market is growing fast.

- EU's renewable energy goals drive innovation.

- EDF needs to integrate new tech.

- Ensuring grid stability is a focus.

EDF's strategy hinges on tech advances, particularly in nuclear power and renewables. Investments in grid modernization and digital solutions enhance efficiency and grid stability, with a €1.5 billion grid upgrade allocation in 2024. Energy storage, essential for balancing renewables, aligns with the EU's push for 50% renewable energy by 2025.

| Technology Area | EDF Initiatives | 2024/2025 Data |

|---|---|---|

| Nuclear Power | EPR, SMR tech, fuel tech, reactor life extension | France's €50B investment by 2030; Predictive maintenance decreased unplanned outages by 15%. |

| Renewable Energy | Solar, wind power investments | EDF increased renewable energy capacity by 10% in 2024; EU aiming for 50% renewable energy by 2025. |

| Grid Modernization | Smart grids, digital tech, smart meters | €1.5B allocated for grid upgrades in 2024; Smart grid deployment increased energy efficiency by 10% in pilot areas. |

Legal factors

EDF operates within a framework of national and European energy regulations. These rules cover generation, transmission, and supply. Compliance is essential for market access and operations.

Regulations dictate market structure, pricing, and environmental standards. For example, the EU's Emissions Trading System impacts EDF's costs. In 2024, the carbon price was around €80/tonne.

Safety standards are also critical. EDF must adhere to nuclear safety rules, which are stringent. Recent data shows about 20% of EDF's budget goes to comply with these standards.

Changes in these regulations can significantly affect EDF's financial performance. Updated directives on renewable energy targets will likely increase investments. The EU aims for 42.5% renewable energy by 2030.

Non-compliance results in fines and operational restrictions. EDF has faced penalties for issues like nuclear waste management. In 2024, EDF's revenue was approximately €130 billion.

EDF faces strict nuclear safety regulations due to its nuclear power plants. Adherence to these rules and oversight are crucial legal aspects. In 2024, EDF's nuclear operations must comply with updated international safety standards. Failure to meet these standards can result in significant penalties and operational disruptions. EDF's 2024 budget includes substantial allocations for safety upgrades, around €2 billion, reflecting the importance of regulatory compliance.

EDF faces environmental regulations concerning emissions, waste, and water use. Compliance is key for operations and permits. In 2024, EDF invested €1.8 billion in environmental protection. Non-compliance can lead to significant fines and operational disruptions, as seen in past cases.

Competition Law

EDF faces rigorous competition law scrutiny. This impacts its market strategies and pricing. Recent EU regulations aim to boost renewable energy competition. EDF's mergers and acquisitions are closely monitored. Compliance costs can be significant, affecting profitability.

- EU antitrust investigations can lead to hefty fines, as seen with other energy firms.

- National competition authorities also oversee EDF's activities within specific countries.

- The European Commission's focus is on promoting fair competition and consumer protection.

- EDF must navigate complex legal landscapes to ensure compliance.

Contract Law and International Agreements

EDF's operations are heavily reliant on contracts, including those for fuel and power purchase agreements, all governed by contract law. International agreements significantly influence EDF's cross-border ventures and energy trading activities. These agreements set the legal framework for EDF's global operations and collaborations. Breaching these contracts can result in substantial financial and reputational consequences. In 2024, EDF's legal expenses related to contract disputes and compliance reached €150 million.

- Contractual disputes have led to significant financial impacts, with settlements and legal fees.

- International agreements are crucial for EDF's cross-border projects and trading activities.

- Compliance with these legal frameworks is vital for EDF's operations.

EDF is under national/EU energy regulations, including generation and supply. Compliance is essential for market access. Safety standards and nuclear regulations are crucial; about 20% of EDF's budget is spent on these. Recent updates on renewable energy targets and carbon pricing at €80/tonne in 2024 are key drivers.

| Legal Area | Key Regulation | Impact on EDF |

|---|---|---|

| Nuclear Safety | International Safety Standards | €2B for safety upgrades (2024 budget) |

| Environmental | Emissions, Waste, Water | €1.8B invested in 2024 for protection |

| Competition Law | EU Antitrust Laws | Significant compliance costs affect profitability |

Environmental factors

Climate change significantly shapes EDF's energy transition strategy, pushing for decarbonization of electricity generation. The company focuses on reducing greenhouse gas emissions and investing in low-carbon tech. EDF aims to cut direct emissions by 50% by 2030, compared to 2017 levels. In 2024, EDF invested €16 billion in renewable energy projects.

EDF faces significant environmental challenges in nuclear waste management. This involves safe storage, transport, and disposal of radioactive materials. Strict regulations and public scrutiny are constant factors. In 2024, the global nuclear waste market was valued at $25 billion, projected to reach $35 billion by 2029.

EDF's activities, including its power plants and transmission lines, can significantly affect local ecosystems. The company must evaluate and minimize the environmental damage. For example, cooling water use can disrupt aquatic life, and land use can lead to habitat loss. In 2024, EDF invested €1.2 billion in environmental protection.

Resource Availability and Water Management

EDF faces environmental challenges related to resource availability and water management. Climate change and droughts can reduce water availability, impacting hydropower and nuclear plant cooling. Effective water management is crucial for EDF's operations. In 2023, EDF's hydropower production was 81.4 TWh.

- Hydropower production in 2023 was 81.4 TWh.

- Water scarcity poses a risk to operations.

- EDF invests in water management strategies.

Extreme Weather Events

Extreme weather events, such as storms and floods, are becoming more frequent and intense, posing a significant risk to EDF's infrastructure. These events can disrupt power generation and transmission, affecting service reliability. EDF must invest in building resilience to these climate-related challenges to protect its operations and assets. In 2024, extreme weather caused over $10 billion in damages to energy infrastructure globally.

- Increased frequency of extreme weather events.

- Potential disruptions in power generation and transmission.

- Need for infrastructure resilience investments.

- Financial impact of weather-related damages.

EDF focuses on decarbonization and reducing emissions to mitigate climate change impacts, targeting a 50% reduction in direct emissions by 2030 versus 2017 levels, with €16 billion invested in renewable projects in 2024. The company addresses nuclear waste management through safe storage and disposal, with the global market valued at $25 billion in 2024, growing to $35 billion by 2029. EDF minimizes environmental damage from its activities, investing €1.2 billion in environmental protection in 2024, and managing resources, as seen in 2023's 81.4 TWh hydropower output.

| Environmental Factor | Description | Financial Data/Stats (2024) |

|---|---|---|

| Climate Change | Decarbonization and emission reduction targets. | €16B in renewables; Target of 50% emission cut by 2030 (vs. 2017) |

| Nuclear Waste | Safe management of radioactive waste. | Global market valued at $25B, projected to $35B by 2029. |

| Ecosystem Impact | Minimizing environmental damage of activities. | €1.2B invested in environmental protection. |

PESTLE Analysis Data Sources

EDF's PESTLE uses government publications, economic data providers, and energy industry reports.