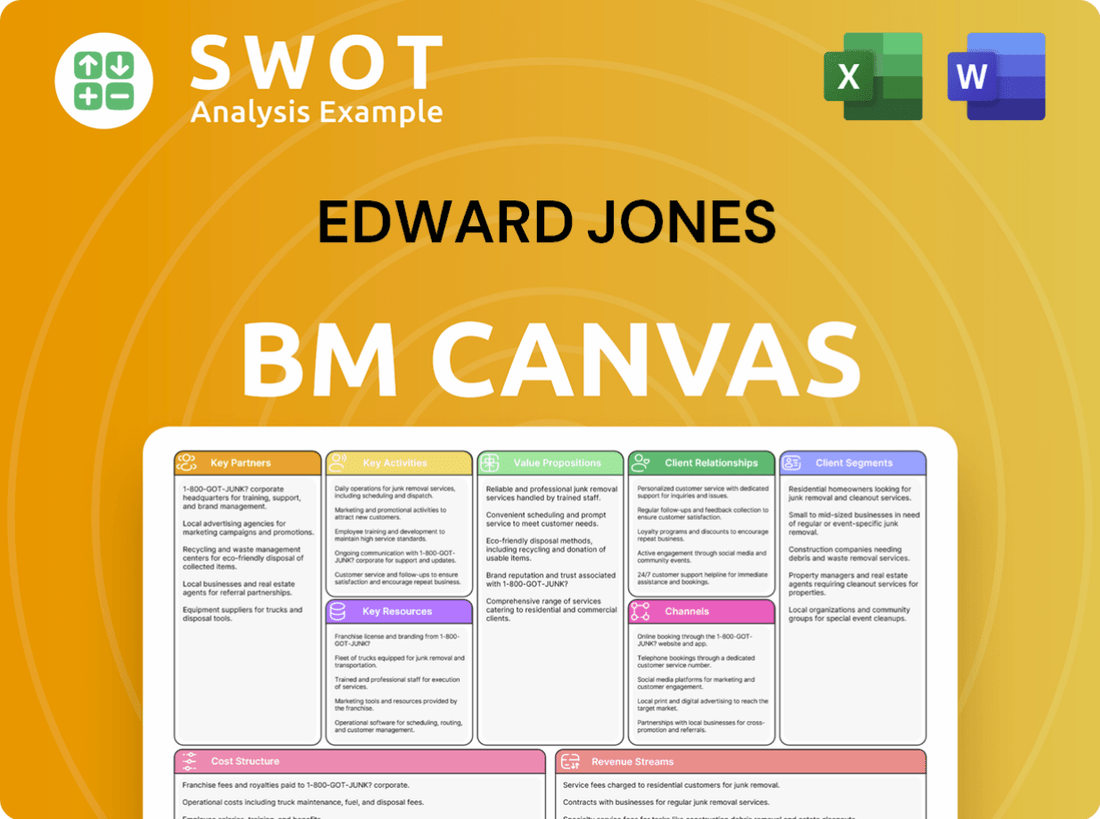

Edward Jones Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edward Jones Bundle

What is included in the product

Edward Jones' BMC provides a comprehensive overview, detailing customer segments, channels, and value propositions with full detail.

Clean and concise layout ready for boardrooms or teams.

Delivered as Displayed

Business Model Canvas

This preview showcases the Edward Jones Business Model Canvas, exactly as it will be delivered. After purchase, you'll instantly receive the same comprehensive document, fully accessible.

Business Model Canvas Template

Explore Edward Jones's business model with a detailed Business Model Canvas. This analysis uncovers their customer-centric approach, emphasizing personalized financial advice. Discover how they leverage a network of local offices and trusted advisors for growth. Understand their revenue streams, from commissions to asset management fees, in a clear format. Gain strategic insights into Edward Jones's key partnerships and cost structure. Download the full canvas for a comprehensive strategic overview!

Partnerships

Edward Jones strategically forms alliances to broaden its service scope. These partnerships offer specialized products, like the recent U.S. Bank collaboration. This allows Edward Jones to provide co-branded banking products. In 2024, such alliances boosted client satisfaction. The firm's revenue increased by 7% due to these partnerships.

Custodians are vital partners for Edward Jones, safeguarding client assets. These relationships ensure secure investment management. In 2024, Edward Jones managed over $800 billion in client assets, underscoring the importance of reliable custodians. They maintain the integrity of client funds and securities.

Technology providers are essential for Edward Jones, offering software and infrastructure for advisors. They enable efficient client account management and advice delivery. Edward Jones leverages platforms such as Salesforce Financial Services Cloud and Envestnet MoneyGuide for financial planning. Using technology, Edward Jones aims to enhance client experience.

Insurance Companies

Edward Jones's key partnerships with insurance companies are crucial for offering clients a wide array of financial products. This collaboration allows them to provide insurance solutions like life insurance and annuities, addressing clients' varied financial needs. By integrating insurance, Edward Jones crafts more comprehensive financial plans for its clients, enhancing their overall service offerings. In 2024, the insurance sector's revenue is projected to be around $1.5 trillion.

- Provides access to insurance products like life insurance and annuities.

- Enhances holistic financial planning for clients.

- Supports risk management solutions.

- Contributes to a comprehensive financial service offering.

Professional Organizations

Edward Jones teams up with professional organizations to boost advisor skills. These collaborations provide continuous learning and keep advisors informed. The firm highly values certifications like CFP, with a significant number of advisors holding them. This commitment ensures high-quality advice for clients.

- Partnerships with organizations enhance advisor knowledge.

- Advisors receive updates on industry standards.

- CFP certifications are a key focus.

- These efforts aim to improve client service.

Edward Jones's key partnerships are central to its business model. These alliances expand service offerings, improving client satisfaction. In 2024, these collaborations helped boost the company's revenue by 7%.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Custodians | Asset protection | Managed over $800B in assets |

| Technology Providers | Efficient client management | Improved client experience |

| Insurance Companies | Comprehensive solutions | $1.5T projected sector revenue |

Activities

Edward Jones's primary focus is offering tailored financial advice to individual investors. Advisors assess client goals, risk appetite, and timelines to develop personalized investment plans. They prioritize building enduring client relationships. In 2024, Edward Jones managed over $8.5 trillion in client assets. The firm's strategy emphasizes face-to-face interactions.

A key activity at Edward Jones is investment management, which includes selecting and overseeing investments to meet client goals. This involves asset allocation, diversification, and portfolio adjustments. In 2024, Edward Jones expanded its services, offering more Separately Managed Account (SMA) options. The firm's focus on personalized financial advice is evident in its investment management approach. Edward Jones had roughly $8.6 billion in assets under management in 2023.

Creating comprehensive financial plans is a central activity for Edward Jones, assisting clients in reaching their financial goals. This involves retirement, education, estate, and tax planning. Edward Jones is increasing its financial planning services, enabling advisors to charge fees for these. In 2024, the firm managed over $800 billion in assets, highlighting the significance of its planning services.

Client Relationship Management

Client Relationship Management is a cornerstone of Edward Jones' approach. Building and sustaining strong client relationships is vital for their business model, ensuring customer loyalty and long-term financial health. This involves regular communication, personalized service tailored to individual client needs, and proactive support to address any concerns or opportunities. The firm emphasizes face-to-face consultations and localized service experiences, fostering trust and understanding.

- In 2023, Edward Jones reported over 7 million clients.

- The firm's client retention rate remains high, often exceeding 95%.

- Edward Jones advisors conduct an average of 12-15 client meetings per month.

- Over 90% of Edward Jones branches are located in the United States and Canada.

Compliance and Regulatory Oversight

Compliance and regulatory oversight are vital for Edward Jones. This includes following financial regulations and upholding ethical standards. The firm conducts regular audits and provides ongoing training to its advisors. For example, Edward Jones mandates annual ethics and conduct training for all associates. Regulatory compliance is crucial in the financial industry.

- In 2024, the SEC and FINRA have increased scrutiny on compliance in the financial sector.

- Edward Jones faces ongoing compliance costs, which impact operational expenses.

- Advisors must stay current with evolving regulations to avoid penalties.

- Training programs help advisors understand and adhere to compliance requirements.

Investment management is central, with asset allocation and portfolio adjustments. Financial planning, covering retirement and taxes, is a key service for clients. Client relationship management, with over 7 million clients in 2023, focuses on personalized service.

| Key Activities | Description | 2024 Data |

|---|---|---|

| Investment Management | Selecting and overseeing investments to meet client goals. | $8.6B assets under management in 2023 |

| Financial Planning | Creating comprehensive financial plans for clients. | Managed over $800 billion in assets. |

| Client Relationship Management | Building and sustaining strong client relationships. | Client retention rate exceeds 95%. |

Resources

Edward Jones' vast network of financial advisors is its cornerstone. These advisors are key for client relationships and personalized financial advice. The firm boasts over 19,000 financial advisors as of late 2024. They are vital for client engagement and service delivery across North America.

Edward Jones's vast branch network, with over 14,000 locations, is a key resource. This extensive network ensures local presence and client accessibility, fostering face-to-face interactions. It's the largest in the U.S., providing personalized service to 7 million clients. This direct client access is a crucial differentiator.

Edward Jones' investment platform is a crucial resource, offering access to diverse products like stocks, bonds, and ETFs. This platform supports advisors in managing client portfolios, ensuring effective investment strategies. In 2024, the firm managed over $8.5 trillion in assets, reflecting the platform's importance. The platform’s capabilities enable advisors to tailor solutions, aligning with client needs.

Technology Infrastructure

Technology infrastructure is critical at Edward Jones for supporting its advisors and managing client accounts. This involves software for financial planning, portfolio management, and client communication. Edward Jones is currently investing in technology to improve services. In 2024, the firm's tech spending reached $1.5 billion, aiming to enhance digital client solutions.

- Investments in technology totaled $1.5 billion in 2024.

- Focus on enhancing digital client solutions.

- Software supports financial planning and portfolio management.

- Technology supports communication with clients.

Brand Reputation

Edward Jones's brand is a cornerstone of its success, representing trust and client focus. This strong reputation is a key resource, drawing in and keeping clients. The firm's commitment to long-term client relationships, offering personalized financial advice, further strengthens its brand. This approach has helped Edward Jones maintain a high client retention rate, a testament to its brand's value.

- Client loyalty is high, reflecting brand trust.

- Edward Jones's brand value is estimated at billions.

- They focus on long-term client relationships.

- The brand helps to attract and retain clients.

Edward Jones depends on its extensive network of financial advisors. They provide personalized advice to clients. Over 19,000 advisors serve clients in 2024.

The firm's vast branch network with over 14,000 locations ensures local presence. This allows direct client access. It is the largest in the U.S.

Their investment platform is key, managing over $8.5 trillion in assets in 2024. It provides access to various financial products. This platform supports advisors.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Financial Advisors | Client relationship managers. | Over 19,000 |

| Branch Network | Local presence and accessibility. | Over 14,000 locations |

| Investment Platform | Manages client portfolios. | $8.5T assets managed |

Value Propositions

Edward Jones excels in personalized financial advice, a key value proposition. They focus on individual investor needs, differentiating from larger firms. Advisors collaborate directly with clients, crafting strategies. In 2024, Edward Jones managed roughly $8.5 trillion in assets. This approach helped retain around 7 million clients.

Edward Jones' value proposition centers on long-term investing, prioritizing quality investments for steady growth. This strategy resonates with clients desiring stable financial outcomes. In 2024, the firm managed over $8.5 trillion in client assets. They offer tailored strategies to help clients reach their long-term financial objectives.

Edward Jones's value proposition centers on local, accessible service. Their vast branch network ensures clients can easily meet with advisors in their neighborhoods. This face-to-face approach is a key differentiator. In 2024, Edward Jones had over 14,000 financial advisors. Each advisor operates from a solo office, fostering personalized client relationships.

Comprehensive Financial Planning

Edward Jones excels in comprehensive financial planning, a key value proposition. They cover retirement, education, estate, and tax planning, offering clients holistic financial security. In 2024, the firm expanded fee-based planning services. This shift enhances advisor capabilities and client service.

- Focus on holistic financial planning.

- Expanding fee-based planning services.

- Enhance advisor capabilities.

- Increase client service.

Trusted Relationships

Edward Jones emphasizes building trusted relationships with clients. This is a central value proposition, fostering trust and reliability. Their business model prioritizes personal connections and customized financial advice. The firm has consistently ranked high in customer satisfaction surveys, reflecting the effectiveness of this approach. In 2023, Edward Jones managed over $7.5 trillion in client assets, a testament to its relationship-focused strategy.

- Client retention rates are consistently above industry averages, often exceeding 95%.

- Edward Jones advisors typically serve a smaller client base compared to competitors, allowing for more personalized attention.

- The firm's focus on long-term investing aligns with its emphasis on building lasting client relationships.

- A significant portion of new clients come from referrals, highlighting the value placed on trust and satisfaction.

Edward Jones provides personalized financial advice tailored to individual needs, managing about $8.5T in assets in 2024.

They focus on long-term investing strategies for stable growth, offering customized plans.

Edward Jones emphasizes local, accessible service via a vast branch network, fostering face-to-face interactions.

| Value Proposition | Details | 2024 Data |

|---|---|---|

| Personalized Advice | Focus on individual client needs | $8.5T assets under management |

| Long-Term Investing | Quality investments, steady growth | Tailored client strategies |

| Local Service | Accessible branch network | 14,000+ advisors |

Customer Relationships

Edward Jones prioritizes direct, in-person consultations with clients, a key element of their customer relationship strategy. Financial advisors meet clients individually to grasp their financial objectives and personal circumstances, offering tailored advice. This approach, central to Edward Jones' model, is supported by advisors operating from local offices, fostering personalized interactions. In 2024, Edward Jones managed over $7.6 trillion in client assets, reflecting the effectiveness of their relationship-focused model.

Edward Jones's model centers on dedicated financial advisors. Each client gets a personal advisor for consistent support. This approach fosters strong client-advisor relationships, personalizing financial plans. The firm's revenue in 2024 was approximately $14.7 billion, highlighting the importance of client relationships.

Regular communication is key for strong client relationships. Edward Jones keeps clients informed through updates on portfolio performance and market insights. This client-focused approach ensures tailored financial advisory solutions. In 2024, Edward Jones' assets under management reached $8.2 trillion, highlighting their strong client relationships.

Educational Resources

Edward Jones focuses on customer relationships by offering educational resources to help clients make informed decisions. This includes seminars, workshops, and online tools. The firm's Financial Fitness program has educated over 848,000 learners since 2020. These resources aim to build trust and provide value beyond traditional financial services.

- Seminars and workshops cover various financial topics.

- Online tools include calculators and planning resources.

- The Financial Fitness program is a key educational initiative.

- These efforts strengthen client relationships.

Proactive Support

Proactive support is crucial for Edward Jones' customer relationships, addressing evolving client needs. This approach ensures clients feel valued and well-supported. Access to comprehensive financial advice boosts client confidence, leading to stronger relationships. In 2024, Edward Jones managed over $8.7 trillion in assets, highlighting the importance of robust client relationships.

- Proactive support builds trust.

- Clients value personalized attention.

- Comprehensive advice enhances confidence.

- Strong relationships drive asset growth.

Edward Jones cultivates customer relationships through direct, in-person interactions and personalized financial advice. Advisors provide tailored support, fostering strong client-advisor relationships. These efforts led to approximately $14.7 billion in revenue for the firm in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Client Assets Managed | Total assets under management | Over $8.7 trillion |

| Revenue | Firm's total income | Approximately $14.7 billion |

| Client Interactions | Emphasis on face-to-face meetings | High Frequency |

Channels

Edward Jones heavily relies on its branch network as its main channel. This widespread network offers clients local access and personal interaction. As of late 2024, they have over 16,000 locations, the most of any U.S. brokerage. This extensive reach facilitates client relationships.

Financial advisors are key client contacts, offering tailored services. Backed by a Fortune 500 firm, they provide personalized advice. In 2024, Edward Jones managed over $880 billion in assets. Advisors come from diverse backgrounds, enriching client interactions. Edward Jones had over 19,000 financial advisors as of Q4 2024.

Edward Jones' online platform allows clients access to account details, research, and educational materials. This digital channel supports the firm's in-person advisor services. In 2024, digital engagement saw a 15% rise among Edward Jones clients. The firm is investing heavily in technology to improve client experience and convenience.

Seminars and Workshops

Edward Jones utilizes seminars and workshops as a key channel to connect with potential clients. These educational events offer valuable financial insights, helping to build brand awareness and attract new customers. The firm focuses on empowering clients with the knowledge needed for informed decision-making. In 2024, Edward Jones hosted over 30,000 client events.

- Client events are a significant part of Edward Jones's outreach strategy.

- These seminars cover a range of financial topics.

- They aim to educate and engage potential investors.

- The events are designed to build trust and relationships.

Community Involvement

Edward Jones actively engages in community involvement, which is crucial for building brand recognition and fostering trust. This strategy reinforces their commitment to local communities, a core tenet of their business model. The firm’s associates are dedicated to supporting local initiatives, enhancing their presence in the communities they serve. This commitment is evident through their extensive branch network, which spans across 68% of U.S. counties.

- Community events and initiatives are central to Edward Jones's branding.

- The firm emphasizes local presence and support.

- Edward Jones operates in a significant portion of U.S. counties.

- Associates play a key role in community engagement.

Edward Jones uses multiple channels to reach clients. Their extensive branch network, with over 16,000 locations as of late 2024, is the primary channel. Financial advisors, key client contacts, provide personalized service. Digital platforms and community events enhance client engagement.

| Channel | Description | 2024 Data |

|---|---|---|

| Branch Network | Local access, personal interaction | Over 16,000 locations |

| Financial Advisors | Personalized advice and service | Over 19,000 advisors, $880B+ assets managed |

| Digital Platform | Online account access and resources | 15% rise in digital engagement |

| Seminars & Workshops | Educational events for potential clients | Over 30,000 events hosted |

| Community Involvement | Local initiatives and brand building | Present in 68% of U.S. counties |

Customer Segments

Edward Jones primarily serves individual investors, offering personalized financial guidance. This includes those planning for retirement or education. In 2024, the firm managed around $8 trillion in client assets. They help clients reach their long-term financial objectives through customized strategies. The company has over 19,000 financial advisors.

Retirees and pre-retirees form a key customer segment. They need help managing retirement income and investments. Edward Jones offers personalized retirement plans. In 2024, the retirement market is booming.

Small business owners represent a key customer segment for Edward Jones, given their diverse financial needs. They often seek guidance on business planning, retirement savings, and investment management. In 2024, small businesses in the U.S. employed roughly 61.7 million people, highlighting the segment's significance. Edward Jones can adapt to the evolving needs of this customer base.

High-Net-Worth Individuals

Edward Jones is strategically targeting high-net-worth individuals by expanding its service offerings. This includes launching Edward Jones Generations™, a private client service designed for affluent U.S. clients. This move reflects a broader trend in the financial industry to cater to the specific needs of this demographic. The firm aims to capture a larger share of the wealth management market.

- Edward Jones's focus on high-net-worth clients is a strategic shift to capture a larger share of the wealth management market.

- Edward Jones Generations™ is a specialized service for affluent U.S. clients.

- This expansion aligns with industry trends of catering to specific client segments.

Families

Families represent a crucial customer segment for Edward Jones, especially those focused on long-term financial goals like education. Edward Jones simplifies the process of setting up education savings plans, offering tailored solutions. In 2024, the average 529 plan assets reached approximately $450,000. This focus helps families navigate complex financial decisions. This is an important area for financial planning.

- Education savings plans are a key offering.

- Average 529 plan assets were around $450,000 in 2024.

- Edward Jones provides tailored solutions.

- Families receive support for long-term goals.

Edward Jones’ customer segments span individual investors, retirees, small business owners, high-net-worth individuals, and families. These diverse groups have varied financial needs. The company aims to provide tailored solutions for each, supporting long-term financial goals. In 2024, the focus remained on personalized financial guidance.

| Customer Segment | Needs | Edward Jones's Offering |

|---|---|---|

| Individual Investors | Personalized financial guidance, retirement planning | Customized strategies and financial advice |

| Retirees/Pre-retirees | Retirement income, investment management | Personalized retirement plans |

| Small Business Owners | Business planning, retirement savings, investments | Guidance on various financial needs |

Cost Structure

A substantial expense for Edward Jones is the compensation provided to its financial advisors. This encompasses salaries, commissions, and performance-based incentives. In 2024, Edward Jones's financial advisor compensation and benefits expenses rose by 19%. This reflects the firm's investment in its advisors.

Edward Jones's cost structure heavily involves branch operations, essential for its client-focused model. Maintaining its vast network, which includes over 14,000 locations, is expensive. These costs cover rent, utilities, and office supplies across its extensive footprint. In 2024, branch expenses likely constituted a significant portion of the firm's operational costs, impacting overall profitability.

Edward Jones' cost structure includes significant investments in technology and infrastructure. This covers software, hardware, and IT support to enable operations. In 2024, IT spending is roughly 15% of total operating expenses. The firm also uses partnerships to enhance services.

Marketing and Advertising

Marketing and advertising are crucial for Edward Jones to draw in and keep clients. These costs cover digital ads, print materials, and community involvement. The firm invests heavily in client acquisition, with significant spending on branding and outreach. Edward Jones is adapting to the changing investment industry.

- In 2024, marketing spend is around $500 million.

- Digital advertising is a key focus to reach new clients.

- Community events help build client relationships.

- Adapting to digital trends is a priority.

Compliance and Regulatory

Edward Jones faces substantial costs related to compliance and regulatory demands. These expenses cover legal fees, audit costs, and essential training programs. Annually, all associates must undergo ethics and conduct training to uphold standards. This commitment to compliance is reflected in its financial reports. In 2024, the firm spent approximately $300 million on compliance.

- Legal fees and audit expenses constitute a significant portion.

- Annual ethics and conduct training is mandatory for all associates.

- Compliance costs are a recurring and substantial operational expense.

- Edward Jones allocates a dedicated budget to maintain regulatory adherence.

Edward Jones's cost structure includes significant financial advisor compensation and branch operations expenses. They invest heavily in technology and IT. Marketing and advertising are crucial with a focus on digital advertising. Additionally, Edward Jones faces substantial compliance and regulatory costs.

| Cost Category | Expense in 2024 | Notes |

|---|---|---|

| Financial Advisor Compensation | Up 19% | Includes salaries, commissions, and incentives |

| Marketing | $500 million | Focus on digital advertising and community events |

| Compliance | $300 million | Legal, audit, and training costs |

Revenue Streams

Advisory fees are a core revenue stream for Edward Jones, calculated as a percentage of AUM. This model ensures a steady, predictable income stream for the firm. Edward Jones generates revenue through advisory fees for managed account services. In 2024, AUM reached approximately $800 billion, with advisory fees significantly contributing to overall revenue.

Commissions are a key revenue stream for Edward Jones. They earn money from transactions like buying stocks, bonds, and mutual funds. This transactional approach is a core part of their business model. Edward Jones provides access to a wide range of financial instruments, increasing commission opportunities. In 2024, the financial services industry saw $12.3 billion in commission revenue.

Edward Jones is boosting revenue through financial planning fees. Advisors now charge for these services, expanding offerings. In 2024, fee-based revenue grew, showing a shift in client preferences. This strategy aligns with industry trends, increasing income diversification. The firm's focus on financial planning boosts its revenue streams.

Service Fees

Edward Jones generates revenue through service fees, which encompass charges for account maintenance, custodial services, and transaction-based activities. These fees are a consistent revenue stream, ensuring the firm receives compensation for its services irrespective of market performance. Service fees help cover the costs associated with managing client accounts and providing financial advice. In 2024, the financial services industry saw approximately $37 billion in revenue from these types of fees.

- Account maintenance fees contribute significantly to overall revenue.

- Custodial fees are charged for safeguarding client assets.

- Transaction-based fees are applied to specific services.

- These fees ensure a stable revenue source.

Interest Income

Interest income is a supporting revenue stream for Edward Jones, generated from client cash balances and margin lending. This income complements their primary revenue sources, such as advisory fees and commissions. Edward Jones's revenue model is designed to provide a comprehensive financial service. The firm focuses on diverse income streams to maintain financial stability and client service.

- Interest income contributes to Edward Jones's overall financial health.

- It's part of a larger revenue strategy that includes advisory and service fees.

- This income stream supports the firm's ability to offer a broad range of financial services.

- Edward Jones aims to provide holistic financial solutions.

Edward Jones uses advisory fees, calculated on assets under management, as a core revenue source, which in 2024, amounted to roughly $800 billion in AUM. Commissions from transactions like buying stocks and bonds also bring in revenue, with the financial services industry seeing $12.3 billion in commission revenue in 2024. Furthermore, financial planning fees and service fees, including account maintenance, custodial services, and transaction-based activities, contribute, with the industry generating approximately $37 billion from service fees in 2024.

| Revenue Stream | Description | 2024 Data (approx.) |

|---|---|---|

| Advisory Fees | Fees based on AUM | $800 billion AUM |

| Commissions | Fees from transactions | $12.3 billion industry |

| Financial Planning Fees | Fees for planning services | Growing trend |

| Service Fees | Account and transaction fees | $37 billion industry |

Business Model Canvas Data Sources

Edward Jones' BMC relies on market analyses, client feedback, and financial reports.