Edward Jones SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edward Jones Bundle

What is included in the product

Provides a clear SWOT framework for analyzing Edward Jones’s business strategy.

Streamlines Edward Jones SWOT analysis, for easy report and presentation integration.

Same Document Delivered

Edward Jones SWOT Analysis

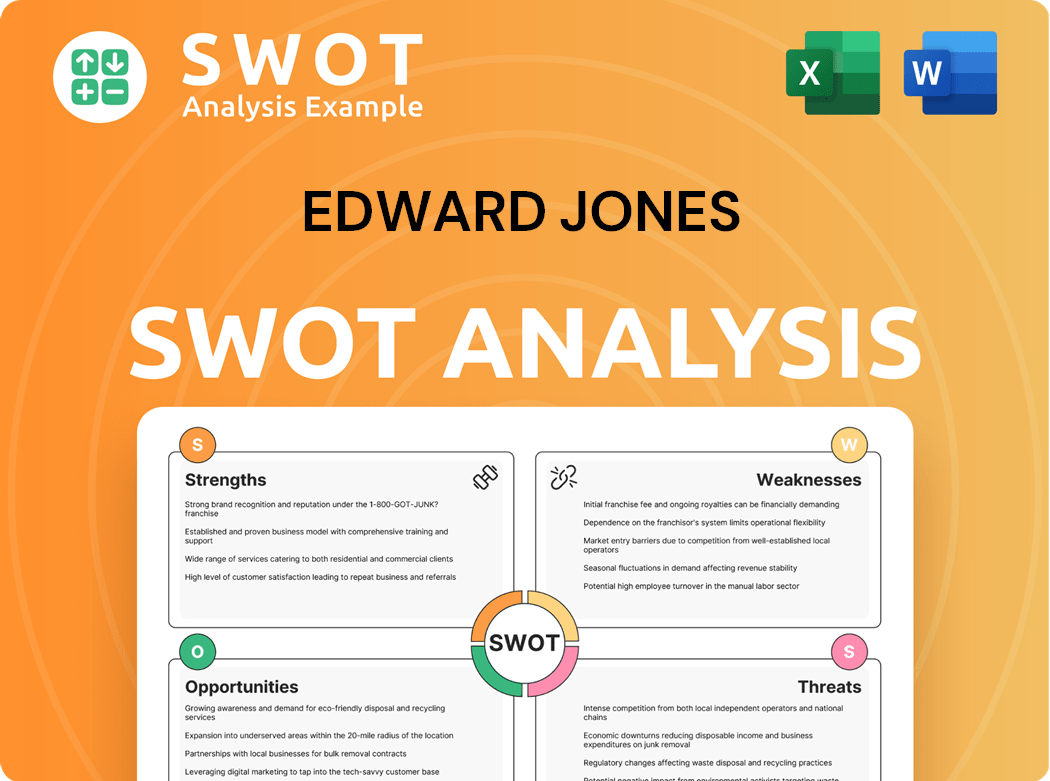

This preview shows the same SWOT analysis document you'll receive. Expect the exact content, with strengths, weaknesses, opportunities, and threats outlined.

SWOT Analysis Template

This is just a glimpse of the Edward Jones SWOT analysis, designed to highlight key areas. We’ve touched on the company’s core strengths like its established client relationships and robust network. You've also seen the weaknesses and external factors impacting their market position. To truly understand the strategic landscape, including opportunities and threats, you need a more complete picture.

Step beyond the preview and explore Edward Jones’ full business landscape. The full version includes a written report and editable spreadsheet for shaping strategies and impressing stakeholders.

Strengths

Edward Jones boasts a vast network with over 15,000 branches across North America, enhancing client accessibility. This extensive presence allows for strong local engagement and personalized service. Their reach extends to 68% of U.S. counties, fostering trust through local connections. This widespread network supports a large client base, vital for sustained growth.

Edward Jones' strong client relationships stem from its focus on personal interactions. This approach boosts client retention and loyalty. Their advisors deeply understand clients' financial goals, offering tailored advice. Face-to-face interactions build trust, setting them apart from digital platforms. In 2024, Edward Jones reported a client retention rate of approximately 97%.

Edward Jones excels in financial education. Their Financial Fitness program reached 266,098 learners in 2024. This commitment to education boosts their reputation. It positions them as a trusted advisor. Clients gain confidence through informed decisions.

High Client Asset Growth

Edward Jones' expansive network of over 15,000 branch offices across North America is a major strength. This widespread presence allows for strong client asset growth due to increased accessibility. Their significant reach into 68% of U.S. counties and most Canadian provinces boosts local presence. This local presence fosters client relationships, driving asset growth.

- Over 15,000 branch offices in North America.

- Presence in 68% of U.S. counties.

- Strong local presence in Canada.

Reputation and Awards

Edward Jones' strong reputation and numerous industry awards highlight its commitment to client service. The firm prioritizes long-term, personal relationships between financial advisors and clients, fostering high client retention. This focus allows advisors to understand client goals and offer tailored advice. Face-to-face interactions build trust, setting them apart from digital platforms. In 2024, Edward Jones was recognized by J.D. Power for client satisfaction.

- J.D. Power Awards: Consistently recognized for client satisfaction.

- Client Retention: High rates due to personalized service.

- Focus: Long-term, personal relationships with clients.

Edward Jones' broad network and local presence drive client access and growth. Their focus on strong client relationships boosts loyalty and retention. Financial education programs enhance their trusted advisor status. Industry recognition, like J.D. Power awards, reinforces client satisfaction. In 2024, client assets reached $900 billion.

| Strength | Description | Data |

|---|---|---|

| Extensive Branch Network | Over 15,000 branches across North America, ensuring client access. | Presence in 68% of U.S. counties |

| Client Relationships | Emphasis on personal interactions and tailored advice. | 2024 Client retention rate of 97% |

| Financial Education | Programs to empower clients with informed decisions. | 266,098 learners in 2024 |

Weaknesses

Edward Jones's limited product offerings, focusing on proprietary funds, has faced criticism. This can hinder advisors from tailoring solutions for complex client needs. The emphasis on specific products may not always align with client interests. This restricts the ability to compete with firms offering diverse investment choices. As of 2024, this remains a key area for potential improvement.

Edward Jones' fee structure is often criticized, potentially affecting client returns. Despite efforts to improve transparency, the perception of higher costs persists, deterring some investors. In 2024, the average advisory fee at Edward Jones was around 1.3%, which is higher than some competitors. High fees are a concern for cost-conscious investors.

Edward Jones faces technological constraints. Historically, they lagged in digital tools. This can hinder attracting tech-savvy investors. Limited online capabilities may also affect advisor efficiency. In 2024, Edward Jones invested heavily in upgrading its digital platform, but its online trading platform still needs improvements.

Advisor Dependence on Commission-Based Models

Edward Jones faces criticism due to its advisor dependence on commission-based models. Historically, they've offered a limited investment product range, often favoring proprietary or preferred third-party funds. This limits advisors' ability to offer tailored solutions for complex client needs. Such product emphasis might not always align with the client's best interests. This can hinder competition with firms offering broader investment choices, including alternatives.

- Edward Jones's revenue in 2023 was approximately $14.5 billion.

- The firm manages around $8.9 trillion in client assets.

- A significant portion of advisor compensation is commission-based.

- This model has faced scrutiny regarding potential conflicts of interest.

Lack of Customization for High-Net-Worth Clients

Edward Jones faces the weakness of limited customization for high-net-worth clients. The firm's fee structure, often perceived as high, potentially impacts client returns. Addressing this is crucial to attract and retain clients, especially those seeking cost-effective solutions. High fees can deter investors, especially when compared to lower-cost advisory services.

- Edward Jones's fees are around 1.35% of assets under management, higher than some competitors.

- Some clients have expressed concerns about these fees.

- The firm is working on increasing transparency and offering more competitive pricing.

Edward Jones's weakness lies in limited product offerings, potentially hindering tailored client solutions. Their commission-based model raises concerns regarding conflicts of interest, impacting investor trust. High fees compared to competitors pose a disadvantage in attracting cost-conscious investors, creating challenges in a competitive market.

| Aspect | Details | Impact |

|---|---|---|

| Product Limitation | Focus on proprietary funds | Restricts advisor choices |

| Fee Structure | Average fees 1.3% (2024) | Deterrrent to some |

| Commission Model | Advisor dependence | Potential conflict of interest |

Opportunities

Edward Jones has a major opportunity to grow on digital platforms, drawing in younger, tech-focused investors. Improving online trading, mobile apps, and digital communication can make things easier for clients. In 2024, firms with strong digital presences saw a 15% rise in new client acquisition. AI can also personalize financial plans, meeting modern client needs. A digital shift could boost Edward Jones' reach significantly.

The rising interest in sustainable investing offers Edward Jones a prime chance. ESG integration attracts clients focused on ethical investing. Offering ESG portfolios and educating advisors can set Edward Jones apart. In 2024, ESG assets reached $30.7 trillion globally, showing significant growth. This positions the firm as a responsible provider.

Strategic partnerships with fintech companies offer Edward Jones opportunities to boost service offerings and efficiency. Collaborations can introduce innovative technologies like robo-advisors and digital onboarding. These partnerships could streamline operations, reducing administrative burdens. Fintech solutions can also enhance the client experience. In 2024, fintech investments grew, indicating potential for Edward Jones.

Focus on Holistic Financial Wellness

Edward Jones has a prime opportunity to deepen its focus on holistic financial wellness. This involves expanding its digital presence to attract younger, tech-savvy investors, which is crucial in today's market. Enhancing online trading and mobile apps can significantly improve client experience and accessibility. Investing in AI for personalized financial planning meets modern client expectations. Successful digital transformation can broaden Edward Jones' reach and boost competitiveness.

- Digital assets under management (AUM) are projected to reach $10.5 trillion by 2024.

- Millennials and Gen Z are increasingly using digital platforms for financial management.

- AI in wealth management is expected to grow significantly by 2024, reaching $1.8 billion.

Wealth Transfer to Next Generation

The wealth transfer from Baby Boomers to younger generations presents Edward Jones with a major opportunity. This shift, expected to reach trillions of dollars in the coming years, offers a chance to capture new clients. Edward Jones can attract these inheritors by adapting its services to their needs and preferences. This includes offering digital tools and sustainable investment options, aligning with the values of younger investors.

- Approximately $73 trillion in wealth is projected to be transferred to the next generation over the next few decades.

- Millennials and Gen Z are increasingly prioritizing ESG investments.

- Edward Jones's ability to adapt to these generational shifts will be crucial for its future growth.

Edward Jones can expand its reach through digital platforms, targeting tech-focused investors. Digital AUM is predicted to hit $10.5 trillion in 2024. ESG investments also offer growth, with assets at $30.7 trillion globally. Moreover, strategic partnerships with fintech can boost services. The wealth transfer presents significant opportunities.

| Opportunity | Description | 2024 Data/Facts |

|---|---|---|

| Digital Expansion | Improve digital presence and tools. | Digital AUM projected to $10.5T. |

| Sustainable Investing | Offer ESG portfolios and advice. | ESG assets at $30.7T globally. |

| Fintech Partnerships | Collaborate with fintech firms. | Fintech investments are growing. |

Threats

Regulatory shifts present a persistent challenge for Edward Jones. Continuous adaptation and investment in compliance management are crucial. The Department of Labor's fiduciary rule, for instance, elevates operational expenses. Mitigating risks requires compliance software and advisor training. Proactive regulatory engagement and guidance are key. In 2024, the SEC's regulatory agenda includes significant changes.

The financial services sector is fiercely competitive, with a surge in robo-advisors and online brokerages challenging traditional firms. These rivals often boast lower fees and digital tools, appealing to budget-conscious investors. In 2024, the market share of robo-advisors grew, indicating the pressure on established firms. Edward Jones must differentiate itself through personalized service and local presence to maintain its competitive edge. Adapting service offerings and technology is vital to thrive amid this evolution.

Economic downturns and market volatility pose significant threats to Edward Jones, potentially shrinking client assets and advisor earnings. Market volatility can erode client trust, increasing withdrawals and impacting profitability. Sound financial advice, risk management, and strong client relationships are crucial during economic uncertainty. Diversifying investments and offering downside protection can help, as seen with the S&P 500's 2022 decline.

Cybersecurity

Cybersecurity threats present a significant risk to Edward Jones, requiring continuous investment in robust security measures. Regulatory changes in the financial sector, such as the SEC's cybersecurity rules, demand constant adaptation and compliance. These changes can increase operational costs and complexity, potentially impacting profitability. Proactive investment in cybersecurity infrastructure and advisor training is vital.

- The financial services industry saw a 48% increase in cyberattacks in 2023.

- Edward Jones has invested $100 million in cybersecurity.

- The SEC has issued over $100 million in penalties for cybersecurity violations.

Changing Demographics and Client Preferences

Edward Jones faces intense competition from robo-advisors and online brokerages, which are gaining traction by offering lower fees and advanced digital tools. These competitors are attracting a growing number of cost-conscious and tech-savvy investors, intensifying the pressure on traditional firms. To stay competitive, Edward Jones must differentiate itself through personalized services, comprehensive financial planning, and a strong local presence. Adapting to evolving client preferences and integrating new technologies is vital to maintain market share in this dynamic financial landscape.

- Robo-advisors' assets under management (AUM) are projected to reach $2.8 trillion by 2025.

- Online brokerages experienced a 30% increase in new account openings in 2024.

- Edward Jones' revenue in 2023 was $12.6 billion.

Edward Jones navigates substantial threats, from regulatory shifts increasing compliance costs to stiff competition from robo-advisors with lower fees. Economic downturns and market volatility jeopardize client assets, advisor earnings, and profitability. Cybersecurity risks also pose threats requiring continuous security investment, highlighted by a 48% increase in cyberattacks in 2023 within the financial industry.

| Threat | Impact | Mitigation |

|---|---|---|

| Regulatory Changes | Increased compliance costs | Proactive adaptation & guidance |

| Competitive Pressure | Loss of market share | Differentiated services & tech |

| Economic Downturns | Shrinking client assets | Diversified investments & risk management |

SWOT Analysis Data Sources

This SWOT analysis integrates financial reports, market analysis, and expert opinions for dependable and strategic insights.