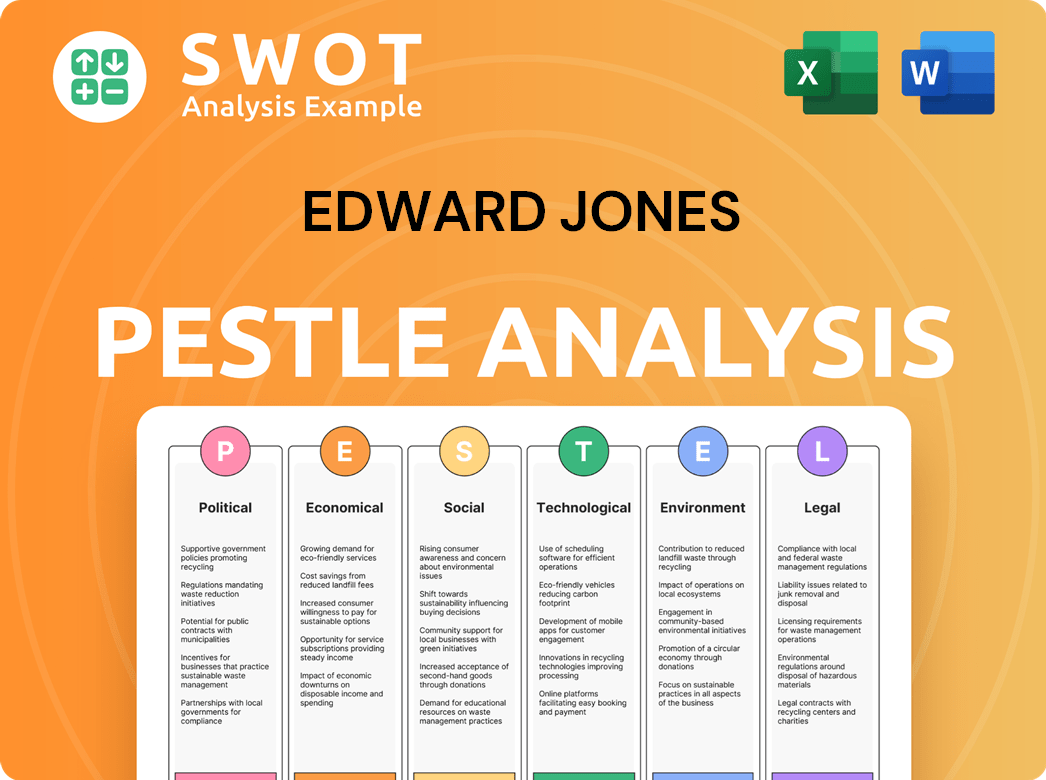

Edward Jones PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edward Jones Bundle

What is included in the product

Uncovers how external forces influence Edward Jones through PESTLE: Political, Economic, Social, Technological, Legal, and Environmental aspects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

Edward Jones PESTLE Analysis

This Edward Jones PESTLE analysis preview is the actual file you'll download post-purchase. Everything here, from the headings to the content, is fully formatted.

PESTLE Analysis Template

Navigate the complexities of Edward Jones with our targeted PESTLE Analysis.

Uncover how political shifts, economic climates, and technological advances impact their strategies.

We break down the external factors influencing their growth and challenges, from regulatory changes to societal trends.

This analysis is perfect for investors, strategists, and anyone wanting an edge.

Gain vital insights to make informed decisions about the company's future.

Download the full PESTLE Analysis now and access actionable intelligence instantly.

See how Edward Jones is really operating!

Political factors

Government policies and regulations are crucial for Edward Jones. Changes in areas like taxation and investment product regulations directly affect operations. The political climate in the US will likely shape the regulatory environment in 2025. There might be less strict rules for banks and more opportunities for mergers. For example, the SEC's budget for 2024 was $2.4 billion, impacting regulatory enforcement.

Geopolitical risks, including conflicts and trade shifts, inject market uncertainty. For Edward Jones, operating mainly in North America, these factors impact investment outcomes and client trust. In 2024, global trade growth was around 3%, and it's expected to be 3.2% in 2025. Increased tariffs and trade friction are expected, potentially affecting investment strategies.

Political stability is vital for economic confidence. Upcoming elections in the US and UK in 2024 could alter policies. The U.S. has a projected 2024 GDP growth of 2.1%, influenced by political outcomes. The UK's economic outlook, with a 0.7% growth forecast, is also subject to election impacts. Policy shifts can significantly affect financial markets.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly shape the financial services sector. Increased government spending, like the $1.9 trillion American Rescue Plan in 2021, can boost economic growth. Conversely, tax increases or spending cuts can slow growth, impacting investment strategies. These shifts directly affect interest rates and inflation, crucial factors for Edward Jones clients.

- U.S. federal debt reached $34 trillion in early 2024.

- The Federal Reserve's interest rate decisions influence bond yields and investment returns.

- Inflation, as of March 2024, was around 3.5%, impacting investment decisions.

International Relations and Sanctions

Edward Jones, with its presence in Canada, faces risks from international relations and sanctions. Financial institutions must adapt to evolving sanctions, impacting cross-border activities. For example, in 2024, the Office of Foreign Assets Control (OFAC) issued over 100 new sanctions. Further changes in this area are anticipated.

- Compliance costs for financial institutions rose by 15% in 2024 due to sanctions.

- Canada's trade with sanctioned nations decreased by 10% in the last year.

- Over 30% of financial institutions reported increased scrutiny of international transactions.

Political factors critically shape Edward Jones's operations and investment strategies. Regulatory changes driven by the US political climate, including those from the SEC, influence compliance. Elections in the US and UK in 2024 bring policy shifts that could impact financial markets and economic outlook.

| Political Aspect | Impact on Edward Jones | Data/Fact (2024/2025) |

|---|---|---|

| Regulations & Policies | Compliance Costs, Investment Products | SEC Budget: $2.4B (2024). Compliance costs up 15%. |

| Geopolitical Risks | Market Uncertainty, Client Trust | Global trade growth: 3% (2024), 3.2% (2025 est.) |

| Economic Confidence | Investment Decisions, Policy Impacts | U.S. GDP growth (2024): 2.1%. UK GDP: 0.7% (forecast). |

Economic factors

Interest rate fluctuations, primarily set by central banks, heavily affect borrowing costs and consumer spending. Anticipated rate cuts in 2025, potentially mirroring the Federal Reserve's projections, could alter the appeal of various investments. For example, the Federal Reserve held rates steady in May 2024, but future cuts are expected. This impacts investment decisions.

Inflation, which erodes purchasing power, has shown signs of moderation. However, tariffs could lead to a renewed inflation impulse in 2025. The Consumer Price Index (CPI) rose 3.3% in May 2024, down from 4.9% in April 2023. Deflation, though less discussed, signals economic weakness.

Economic growth is crucial for investment success. US GDP growth may slow in 2025, potentially impacting investment returns. The Federal Reserve projects a GDP growth of 2.1% for 2024, with a possible slowdown. Recession risks are a key concern for investors.

Consumer Spending and Confidence

Client confidence significantly influences Edward Jones' operations, as it directly affects clients' investment decisions. A decline in consumer spending, potentially triggered by economic uncertainties, could lead to reduced client activity. For instance, the Consumer Confidence Index in February 2024 was at 106.7, indicating a cautious but not panicked consumer sentiment. Financial pressures, such as rising inflation or interest rates, could further impact investment behaviors.

- Consumer spending accounts for about 70% of U.S. GDP.

- The Federal Reserve's actions on interest rates heavily influence consumer spending habits.

- Inflation rates, like the 3.2% recorded in February 2024, erode purchasing power.

- Changes in employment rates affect consumer confidence.

Employment and Labor Market Conditions

Employment and labor market conditions significantly affect financial health and investment decisions. A strong labor market typically boosts consumer spending and investment, while rising unemployment can decrease both. Recent data shows the U.S. unemployment rate was at 3.9% as of May 2024.

Wage growth is also a key indicator; higher wages support increased savings and investment. However, forecasts suggest a slowdown in job growth for 2025.

Edward Jones's analysis should consider these factors, as shifts in employment and wages directly impact market trends. Investors should be prepared for potential market volatility due to labor market adjustments.

- U.S. unemployment rate: 3.9% (May 2024)

- Expectation: Job growth deceleration in 2025

Economic factors, including interest rates and inflation, strongly impact financial decisions. The Federal Reserve's moves, like holding rates steady in May 2024, influence investment strategies. Consumer spending, a key driver of GDP, is affected by employment and economic confidence.

| Economic Indicator | Current Status (2024) | Impact |

|---|---|---|

| Interest Rates | Held steady (May 2024) | Affects borrowing and investment appeal |

| Inflation (CPI) | 3.3% (May 2024) | Erodes purchasing power; impacts spending |

| Unemployment Rate | 3.9% (May 2024) | Influences consumer confidence and spending |

Sociological factors

The aging global population, especially in developed markets, fuels demand for retirement planning. Edward Jones caters to individual investors, a demographic increasingly focused on wealth management. Data from 2024 indicates a rise in individuals seeking retirement advice. This demographic shift presents opportunities.

Changing investor preferences significantly impact Edward Jones. Evolving client expectations, like personalized and digital services, shape interactions. Younger generations demand seamless digital experiences. In 2024, 70% of millennials use digital platforms for financial management. Edward Jones must adapt to stay competitive.

Financial literacy significantly impacts the demand for financial services. Edward Jones' financial literacy programs can broaden its client reach. In 2024, the U.S. saw about 59% of adults considered financially literate. Higher literacy rates correlate with increased demand for financial planning. Edward Jones aims to capitalize on this trend.

Wealth Transfer and Generational Differences

The ongoing wealth transfer to younger generations is reshaping the financial landscape. This shift presents Edward Jones and similar firms with opportunities to attract new clients. Younger investors often have different priorities, such as sustainable investing. Firms must adapt to these evolving expectations.

- $70 trillion is expected to transfer to younger generations in the coming decades.

- Millennials and Gen Z show strong interest in ESG investments.

- Younger investors often prefer digital financial tools.

Social Attitudes Towards Investing and Financial Advice

Public trust in financial institutions and advisors significantly influences client decisions. Edward Jones needs to cultivate strong relationships to maintain client loyalty. A 2024 study showed that 68% of investors prioritize trust when choosing an advisor. Building trust is vital for attracting and keeping clients.

- Client acquisition and retention depend on public trust.

- Strong relationships are essential for success.

- Demonstrating value builds trust with clients.

- Trust influences investor choices.

Shifting demographics highlight the need for retirement planning and wealth management services. Millennials and Gen Z drive the demand for digital and ESG-focused solutions. Building and maintaining trust with clients is crucial for acquiring and retaining clients in the current market.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Aging Population | Increased demand for retirement services | Retirement-age population expected to grow by 20% by 2030. |

| Digital Preferences | Demand for digital financial tools | 75% of millennials use digital platforms for financial management. |

| Trust | Impact on client acquisition & retention | 68% of investors prioritize trust when choosing an advisor. |

Technological factors

The digital transformation reshapes financial services, demanding robust online platforms. Edward Jones must invest in tech to provide client access and transactions. In 2024, digital banking users rose to 70%, and mobile banking grew by 15%. This is crucial for Edward Jones's future.

Artificial Intelligence (AI) is reshaping wealth management. AI enhances decision-making and automates client interactions. Predictive analytics and risk management are also improved by AI. By 2024, AI in finance could reach $20 billion. Edward Jones can use AI to boost efficiency and client service.

Cybersecurity and data protection are critical due to growing tech use. Financial firms face stricter regulations on data security. The global cybersecurity market is projected to reach $345.7 billion in 2024. Data breaches cost an average of $4.45 million per incident in 2023, highlighting the need for robust security measures.

Data Analytics and Business Intelligence

Data analytics and business intelligence are crucial for Edward Jones. They can gather and analyze extensive data to understand client behavior and predict market trends. This capability allows for personalized investment strategies and improved client service. The global business intelligence market is projected to reach $33.3 billion in 2024.

- Personalized recommendations.

- Risk assessment.

- Market trend forecasting.

FinTech Innovation and Competition

The FinTech sector's growth and the rise of robo-advisors are intensifying competition in wealth management, pressuring fees. Edward Jones, like other traditional firms, must evolve its service offerings and pricing to stay competitive. The industry is seeing significant shifts, with digital platforms attracting new investors and assets. Adapting to these technological changes is crucial for Edward Jones's strategic planning.

- FinTech investments reached $190 billion globally in 2024.

- Robo-advisors managed over $1 trillion in assets by early 2025.

- Average fees for robo-advisors are around 0.25% compared to higher fees at traditional firms.

Technology significantly affects Edward Jones' operations and strategy, with digital transformation leading the way. AI is increasingly vital for enhancing decision-making and automation. Cybersecurity and data analytics are critical due to rising risks. These tech advancements require strategic responses for long-term success.

| Technological Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| Digital Transformation | Client access, transaction platforms. | 70% digital banking users (2024). |

| AI Adoption | Decision-making, automation. | AI in finance: $20B by 2024. |

| Cybersecurity | Data security and regulation. | $345.7B cybersecurity market (2024). |

Legal factors

Edward Jones, as a financial advisory firm, must comply with many regulations. These rules cover investment products, client suitability, and required disclosures. The industry constantly monitors regulatory changes and enforcement actions. In 2024, the SEC and FINRA continued to increase scrutiny. The firm must adapt to these changes to maintain compliance.

Consumer protection laws are crucial, especially in finance. Edward Jones must comply with regulations like data privacy rules, which affect how they manage client data. These laws ensure client information is secure and used ethically. Recent data shows that the financial sector faces increasing scrutiny regarding data breaches, with costs rising yearly. For example, in 2024, the average cost of a financial data breach was over $6 million.

Edward Jones operates under stringent regulations that dictate the fiduciary duties of its financial advisors, ensuring they prioritize client interests. These standards, shaped by bodies like the SEC and FINRA, impact investment recommendations and account management. For example, the SEC's Regulation Best Interest requires brokers to act in clients' best interest. Failure to comply can lead to penalties and reputational damage. In 2024, the SEC continued to focus on enforcement, with settlements reaching millions of dollars in cases of fiduciary duty breaches.

Privacy and Data Security Regulations

Edward Jones must adhere to stringent data privacy laws to protect client information. Regulations like GDPR and CCPA dictate how firms handle personal data. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of global annual turnover. In 2024, data breaches cost companies an average of $4.45 million globally, highlighting the financial risks.

- GDPR fines can be up to 4% of global annual turnover.

- Average cost of a data breach in 2024: $4.45 million.

Employment Laws and Labor Regulations

Edward Jones, as a major financial services firm, is significantly impacted by employment laws and labor regulations. These regulations govern various aspects, from hiring and compensation to workplace safety and employee relations. Compliance with these laws is crucial to avoid legal issues and maintain a positive work environment. The financial services sector, including Edward Jones, must also adhere to specific industry-related labor standards.

- In 2024, the U.S. Department of Labor reported over $2.3 billion in back wages recovered for workers due to violations.

- The Equal Employment Opportunity Commission (EEOC) reported over 60,000 charges filed in 2023, highlighting ongoing employment disputes.

Edward Jones is significantly impacted by employment and labor regulations. These laws cover hiring, compensation, workplace safety, and employee relations. In 2024, the U.S. Department of Labor recovered over $2.3 billion in back wages for workers due to violations. Adherence to these laws is crucial for the firm.

| Regulation Type | Impact on Edward Jones | 2024/2025 Data |

|---|---|---|

| Employment Law | Hiring, compensation, workplace safety | $2.3B back wages recovered by DOL in 2024 |

| Labor Standards | Employee relations | Over 60,000 charges filed with EEOC in 2023 |

| Industry-Specific | Compliance and Operations | Financial firms must align with sector labor guidelines. |

Environmental factors

ESG investing is gaining traction, with assets in ESG funds reaching $3.79 trillion globally by early 2024. This growth is driven by increasing investor demand for sustainable investments. Regulatory changes are also shaping the market. The EU's Sustainable Finance Disclosure Regulation (SFDR) is a key example, influencing reporting standards.

Climate change poses risks and opportunities for financial firms. For example, investments in fossil fuels face increasing scrutiny, while green technologies offer growth. According to the IPCC, global temperatures are expected to rise by 1.5°C above pre-industrial levels by 2040. Firms must manage climate risks effectively.

Sustainability reporting requirements are increasing, impacting financial institutions. This includes potential climate and ESG disclosure mandates. The SEC's climate disclosure rule, expected in 2024, is a key example. In 2023, ESG assets grew to $30.6 trillion globally.

Resource Scarcity and Environmental Costs

Resource scarcity and environmental costs present indirect risks to Edward Jones' investments and the economy. Climate change impacts, like extreme weather events, can disrupt supply chains and increase operational expenses. The World Bank estimates that climate change could push over 100 million people into poverty by 2030. These factors influence the profitability and sustainability of businesses.

- Rising sea levels threaten coastal infrastructure, potentially impacting real estate and insurance sectors.

- Increased demand for sustainable practices can lead to higher operational costs for companies not adapting.

- The transition to renewable energy sources creates both challenges and opportunities for investment.

- Regulatory changes related to carbon emissions can affect investment decisions.

Reputational Risk Related to Environmental Issues

Edward Jones faces reputational risk tied to its environmental impact and the eco-performance of its investment recommendations. Public opinion increasingly scrutinizes firms' environmental stewardship, influencing brand value and client trust. Any perceived shortcomings in sustainability efforts can damage Edward Jones' image and client relationships. This is especially true as environmental, social, and governance (ESG) investing gains prominence.

- ESG assets are projected to reach $50 trillion by 2025, showing the growing importance of environmental factors.

- A 2024 study revealed that 70% of consumers consider a company's environmental practices when making purchasing decisions.

- Edward Jones has faced scrutiny regarding its investments in companies with significant environmental footprints.

Environmental factors significantly influence Edward Jones. Climate change, including rising sea levels, poses infrastructure and financial risks, especially for coastal assets. Increased demand for sustainability leads to operational cost considerations. The ESG market's projected $50 trillion value by 2025 highlights this increasing importance.

| Impact Area | Specific Concern | Financial Implication |

|---|---|---|

| Climate Risk | Extreme Weather | Supply chain disruption, higher operational expenses. |

| Regulatory Change | Carbon Emissions | Impacts investment decisions due to changing compliance standards. |

| Consumer Behavior | Sustainable Practices | 70% of consumers consider environmental practices in purchasing. |

PESTLE Analysis Data Sources

This Edward Jones PESTLE Analysis incorporates data from government agencies, financial publications, and market research. Key trends are sourced from trusted reports.