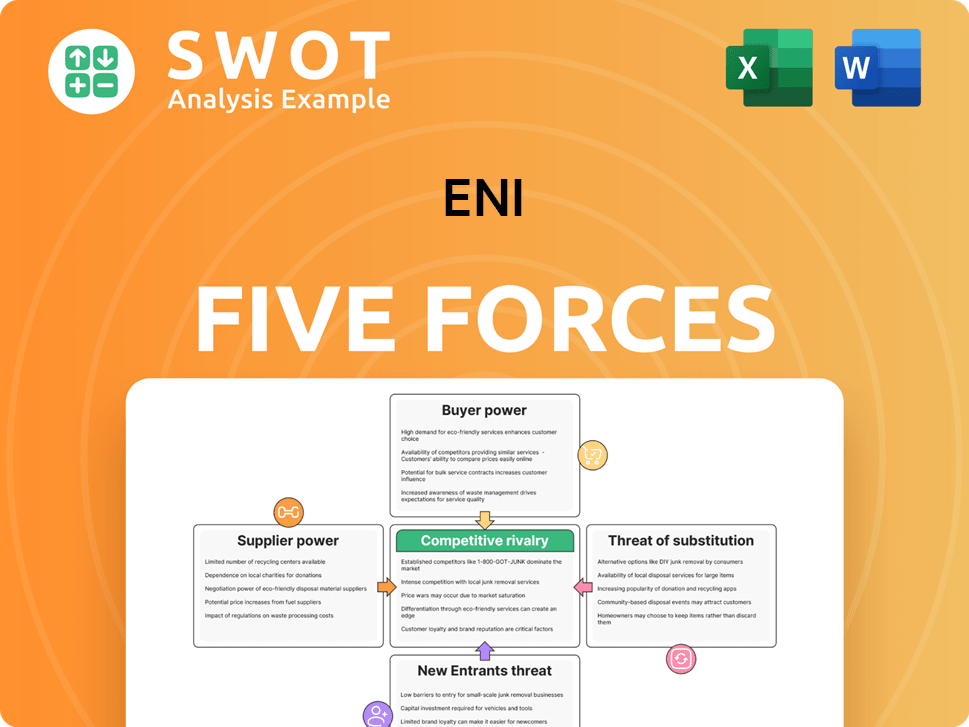

Eni Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

What is included in the product

Analyzes Eni's competitive landscape, assessing its position through industry data and strategic insights.

Swap in your own data, labels, and notes to reflect current business conditions.

What You See Is What You Get

Eni Porter's Five Forces Analysis

This is a comprehensive Five Forces analysis for Eni. The preview you see contains the complete report you'll receive. It's fully formatted, detailing competitive rivalry, supplier power, and more. This exact document will be immediately available upon purchase. Get instant access to this ready-to-use analysis.

Porter's Five Forces Analysis Template

Eni faces a complex competitive landscape shaped by the oil and gas industry's inherent dynamics. Buyer power is considerable, especially from governments and large industrial consumers. Supplier power, largely due to the availability of raw materials and technology, also influences Eni. The threat of new entrants remains moderate, considering high capital requirements. Substitute products, such as renewable energy, pose a growing, long-term challenge. Competitive rivalry is intense among the industry's key players, requiring continuous adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Eni’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Eni faces strong supplier power due to the limited specialized suppliers like Schlumberger. This concentration gives suppliers leverage in pricing and terms. The 2023 market for drilling equipment, valued at $12 billion, amplifies this power. Eni's options are limited, impacting its cost structure and profitability.

The energy sector's reliance on specialized suppliers grants them considerable bargaining power. High technical expertise is crucial, allowing suppliers to dictate terms and pricing. This is evident in the industry's R&D spending, averaging about 4.2% of revenue, and the demand for certifications like ISO 9001:2015.

Eni's long-term contracts, spanning 5-10 years, with suppliers like Baker Hughes, impact its bargaining power. These deals, valued between $150M-$450M, ensure supply stability. However, they restrict Eni's ability to adapt to market changes or seek better prices. In 2024, Eni's focus is on renegotiating these contracts to improve its competitive edge.

Influence on Material Pricing

Suppliers significantly influence material pricing, especially during market fluctuations. Crude oil prices, averaging about $80/barrel in 2023, showcase this impact on drilling services and materials demand. Steel prices, crucial for drilling, rose by 15% in the last quarter, indicating supplier control over costs.

- Crude oil prices averaged around $80/barrel in 2023.

- Steel prices, essential for drilling, increased by 15% in the last quarter.

Strategic Partnerships

Eni's strategic partnerships with tech providers can heighten supplier power due to dependency. Access to innovation and a competitive edge hinges on these alliances. The company invests substantially in technology collaborations. Eni has a network of partnerships, focusing on innovation.

- 12 active technology partnerships.

- €345 million annual investment in tech collaboration.

- 7 joint technology development agreements.

Eni encounters substantial supplier power, especially from specialized providers in the oil and gas industry. Suppliers hold pricing leverage and terms. Long-term contracts, like those with Baker Hughes, limit Eni's flexibility to adapt to price shifts. The dependency on technology partnerships further increases supplier influence.

| Metric | Value | Source/Year |

|---|---|---|

| Average Crude Oil Price | $80/barrel | 2023 |

| Steel Price Increase (Last Quarter) | 15% | 2024 |

| R&D Spending (Industry Avg.) | 4.2% of Revenue | 2024 |

Customers Bargaining Power

Customers in the oil and gas sector show strong price sensitivity, intensifying their negotiation power. In 2022, Brent crude oil averaged about $101.13 per barrel, reflecting price volatility. This sensitivity lets customers seek better deals. They often use rival suppliers' prices to get lower rates.

Large-scale clients, such as major refiners and petrochemical companies, wield considerable bargaining power. They can negotiate favorable terms due to the substantial volumes of crude oil they require. For instance, in 2023, Saudi Aramco produced roughly 9 million barrels per day, giving its large clients leverage. This volume-based negotiation impacts pricing.

The global oil and gas market features diverse competitors and supply chains, enhancing customer options. Customers exploit competitive pricing from alternative suppliers for better terms, pressuring firms like Eni to adapt pricing. This heightens customer bargaining power. In 2024, global crude oil prices fluctuated significantly, impacting negotiation leverage.

Quality Considerations

Customers' focus on oil quality, comparing different types against benchmarks like Brent Blend, WTI, and Dubai/Oman, gives them some leverage. Buyers select oil based on density and sulfur content. While buyers have choices, their power is limited. In 2024, Brent crude averaged about $82 per barrel, WTI around $78, and Dubai/Oman near $80, showing price variations.

- Oil quality is crucial for customers.

- Buyers compare oil prices against benchmarks.

- Choices exist based on oil characteristics.

- Price differences exist across benchmarks.

Potential for Demand Shifts

The bargaining power of customers is evolving, particularly with shifts in demand. The rise of EVs and better fuel efficiency are set to alter gasoline demand, potentially peaking around 2025. This could empower buyers, squeezing refining margins. Companies must adapt to stay competitive.

- In 2024, global EV sales increased, with over 14 million sold, indicating a growing shift away from gasoline.

- Fuel efficiency standards continue to improve, reducing gasoline consumption per vehicle.

- Refining margins are sensitive to demand fluctuations, impacting profitability.

- Companies are investing in alternative energy to adapt to the changing market.

Customers' bargaining power in the oil and gas industry stems from price sensitivity and market competition. Large buyers, like refiners, negotiate favorable terms based on volume. The fluctuating oil prices in 2024, with Brent at $82 per barrel, reflect customer leverage. Demand shifts, like the rise in EVs (over 14 million sold in 2024), are reshaping customer influence.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High negotiation power | Brent avg. $82/barrel |

| Buyer Size | Volume-based leverage | Saudi Aramco ~9M bpd |

| Demand Shift | Changing influence | EV sales >14M |

Rivalry Among Competitors

Global oil and gas firms grapple with intense price competition. Crude oil grade, extraction costs, and OPEC's output impact this. In 2024, Brent crude prices fluctuated, affecting profitability. This rivalry prompts efficiency and cost-cutting. For example, in Q3 2024, several companies reported margin squeezes.

Industry consolidation is intensifying competitive rivalry. The dominance of large exploration and production operators is reshaping the landscape. For instance, in 2024, major oil and gas mergers totaled over $200 billion, signaling increased concentration. This creates efficiency gains for larger players. Smaller contractors may struggle to compete in this environment.

Geopolitical tensions heavily influence competition, potentially affecting crude oil supplies and prices. The Russia-Ukraine war and Middle East conflicts cause market volatility and shifts. For example, in 2024, Brent crude oil prices fluctuated, impacting company strategies. Companies must adapt to these uncertainties.

Focus on Operational Efficiency

With West Texas Intermediate (WTI) prices potentially staying in the high $60s to low $70s, operational efficiency is crucial for oil companies' profitability. Service providers are responding by bundling services and investing in digital technologies to cut costs. This strategic shift intensifies competitive rivalry within the energy sector, pushing for greater efficiency. The focus on efficiency is also apparent in 2024, with many companies aiming to reduce operational expenses by 10-15%.

- 2024 saw a 12% increase in digital technology adoption among oil service providers.

- Bundled service offerings increased by 8% in the first half of 2024.

- The average operational cost reduction target for oil companies in 2024 was 13%.

Technological Innovation

Competitive rivalry in the oil and gas sector is significantly shaped by technological innovation. Companies are actively integrating digital technologies such as AI, machine learning, and IoT to boost operational efficiency and gain a competitive edge. These technologies enable better decision-making, minimize downtime, and improve overall efficiency. Investments in AI within the oil and gas industry are anticipated to surge, with the market projected to hit USD 13 billion by 2034.

- AI adoption enhances predictive maintenance, optimizing asset utilization.

- Data analytics improves exploration and production strategies.

- Digital twins simulate and optimize operational scenarios.

- Automation reduces operational costs and human error.

Competitive rivalry in the oil and gas sector is fierce due to price wars and consolidation. Geopolitical events like the Russia-Ukraine war add volatility. Efficiency and tech adoption are key, with AI in the industry expected to hit $13B by 2034.

| Aspect | Details | 2024 Data |

|---|---|---|

| Digital Tech Adoption | Oil service providers | 12% increase |

| Bundled Services | Increase in offerings | 8% rise (H1) |

| Operational Cost Cuts | Targeted reduction | Avg. 13% |

SSubstitutes Threaten

The rise of renewable energy presents a substantial threat to oil and gas firms. Projections indicate global EV sales might hit 10 million by 2025. This could cut oil demand by 350,000 barrels daily. Consequently, oil companies are diversifying into renewables and sustainable practices.

The rise of electric vehicles (EVs) poses a significant threat to traditional oil product demand. This shift compels companies like Eni to diversify into renewables. EV adoption is accelerating; in 2024, global EV sales reached approximately 14 million. Building charging infrastructure is key for energy firms.

Major oil and gas firms are now significantly investing in substitutes like renewable energy, hydrogen fuel, and energy storage. This strategic shift is a direct response to the growing demand for sustainable alternatives. For instance, in 2024, BP announced plans to increase its investment in renewable energy projects. Companies are exploring tier 2 and tier 3 acreage to offset production flattening.

LNG Reliance

The threat of substitutes for Eni, particularly regarding LNG, is significant. LNG reliance offers opportunities, especially with rising Asian demand. However, European gas demand is falling, influenced by renewables and efficiency. Eni must adapt to these market shifts to maintain competitiveness.

- Asian LNG demand rose significantly in 2024, driven by economic growth.

- European gas demand decreased by approximately 5% in 2024 due to renewable energy adoption.

- Eni's strategic response includes investments in renewable energy projects to diversify.

Biofuel Expansion

The rise of biofuels poses a substitute threat to Eni's traditional oil and gas business. Eni is actively expanding its biofuel production capabilities to counter this. By 2030, Eni aims for substantial biofuel capacity, including sustainable aviation fuel (SAF) production. This strategic shift lessens the impact of potential substitutes.

- Eni plans a significant increase in biofuel capacity by 2030.

- SAF production is a key part of Eni's biofuel strategy.

- Diversification into biofuels mitigates the substitute threat.

- Biofuel expansion supports long-term business sustainability.

The threat of substitutes impacts Eni through renewable energy and EVs. Global EV sales in 2024 hit approximately 14 million, affecting oil demand. Biofuels and LNG market dynamics also present challenges and opportunities for Eni.

| Substitute | Impact on Eni | 2024 Data |

|---|---|---|

| Renewable Energy | Decreased fossil fuel demand | EV sales: ~14M; EU gas demand decline: ~5% |

| Electric Vehicles | Reduced oil product demand | EV adoption continues to rise globally |

| Biofuels | Mitigation of oil impact | Eni's biofuel capacity expansion by 2030 |

Entrants Threaten

The oil and gas sector demands massive capital investments, acting as a major barrier. Deep-water projects in the Gulf of Mexico, for instance, have high breakeven points. These projects often need oil prices above $60/barrel to be profitable, as of 2024. This high cost makes it hard for new firms to compete with established companies.

The dominance of National Oil Companies (NOCs) poses a significant threat. NOCs control a large share of global reserves, hindering new entrants. For example, Saudi Aramco and other Middle Eastern NOCs control over 50% of proven reserves. Moreover, these companies are investing in low-carbon tech, strengthening their position.

The oil and gas sector requires significant technical prowess, acting as a hurdle for new entrants. Established companies possess robust R&D and tech partnerships. For instance, in 2024, Shell invested $1.7 billion in R&D. New firms must match this to compete.

Government Regulations

Government regulations can significantly deter new entrants in an industry. These rules, often favoring existing players, pose compliance challenges. New firms need considerable resources to navigate these obstacles. For example, in 2024, the pharmaceutical industry faced stringent FDA regulations.

- FDA approval processes can cost new entrants millions of dollars.

- Compliance with environmental standards adds substantial expenses.

- Established firms often have dedicated regulatory affairs departments.

- New companies struggle with these costs and expertise gaps.

Integrated Value Chains

Established Integrated Oil Companies (IOCs) like Eni wield a significant advantage due to their integrated value chains, which encompass exploration, production, refining, and distribution. This integration allows for operational efficiencies and economies of scale, making it challenging for new entrants to compete directly. IOCs have substantial financial resources, enabling them to invest heavily in innovation and continuously improve existing technologies. New entrants often struggle to match this level of investment and expertise, requiring them to identify niche markets or develop disruptive technologies to overcome these barriers.

- Eni's 2023 net profit was EUR 8.3 billion, demonstrating its financial strength.

- The global oil and gas industry's capital expenditure in 2023 was approximately $500 billion.

- Renewable energy investments by major oil companies increased by 20% in 2024.

- New entrants often focus on renewable energy to bypass IOC dominance, with solar and wind power capacity growing significantly.

Threat of new entrants in the oil and gas sector is moderate due to high barriers. Massive capital needs and the dominance of existing players, such as Saudi Aramco, create substantial hurdles. Rigorous government regulations and established IOCs with integrated value chains further restrict market entry.

| Barrier | Description | Impact |

|---|---|---|

| Capital Costs | High upfront investments | Discourages new entrants |

| NOC Dominance | Control of global reserves | Limits market access |

| Regulations | Stringent compliance needs | Adds expenses & delays |

Porter's Five Forces Analysis Data Sources

This analysis leverages financial reports, market share data, and industry reports for assessing each force.