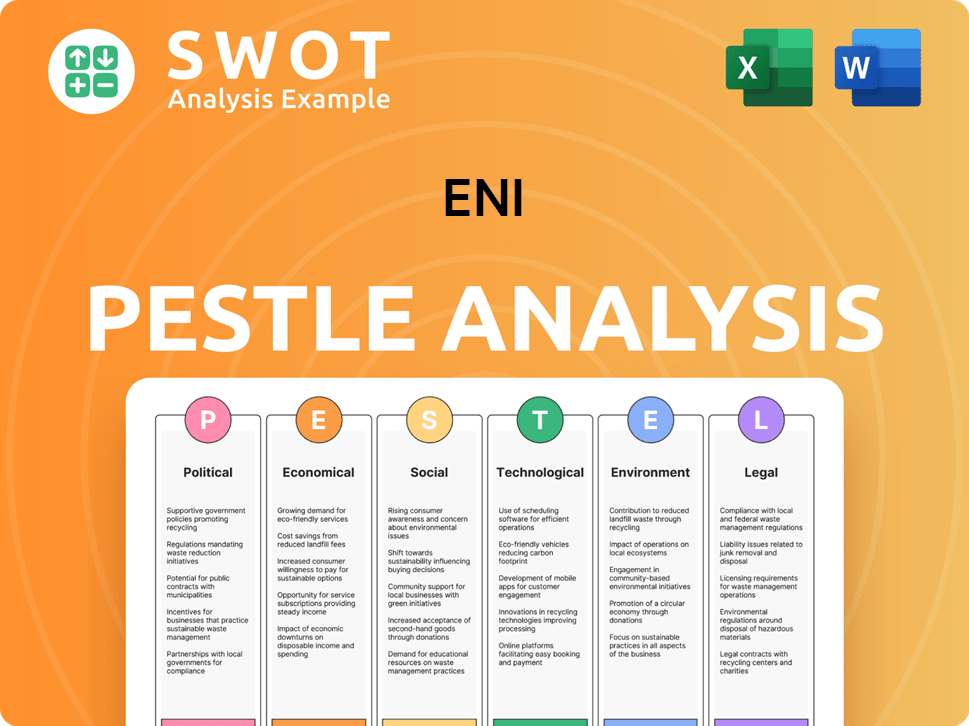

Eni PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eni Bundle

What is included in the product

Eni PESTLE analyzes external factors: Political, Economic, Social, etc. providing insightful evaluation backed by relevant data.

Facilitates identification of all major drivers of the Eni environment so decision-making becomes more robust.

Preview Before You Purchase

Eni PESTLE Analysis

This is the actual Eni PESTLE analysis. The comprehensive overview you're previewing reflects the exact document you'll download after purchase.

PESTLE Analysis Template

Discover the external factors impacting Eni with our PESTLE analysis. We explore political, economic, social, technological, legal, and environmental influences. Our analysis provides a concise overview of the complex landscape shaping Eni's strategy. Identify opportunities and mitigate risks with our actionable insights. Get the full PESTLE analysis now!

Political factors

Eni's global operations are heavily influenced by geopolitical stability. Political risks, especially in regions with significant oil and gas reserves, like Nigeria and Libya, can disrupt production. In 2024, political instability in these areas led to production delays and increased operational costs. For example, Eni's 2024 reports highlighted a 5% decrease in output due to geopolitical challenges in key production zones.

Government regulations significantly shape Eni's operations. Environmental standards, taxation, and energy policies directly impact the company's strategies. The energy transition and support for renewables are crucial. Eni navigates diverse regulatory landscapes globally. In 2024, Eni invested €3.8 billion in decarbonization projects.

International relations and trade policies significantly influence Eni. Sanctions and trade agreements impact operational capabilities. The war in Ukraine prompted energy supply diversification. In 2024, Eni's investments in non-Russian gas sources increased. Geopolitical shifts continue reshaping energy markets.

Government Support for Energy Transition

Government support significantly impacts Eni's shift to renewables and carbon capture. Italy's Mattei Plan, fostering energy ties with African nations, is key. In 2024, Italy increased renewable energy investments by 15%. Supportive policies accelerate Eni's decarbonization. These initiatives shape Eni's strategic direction.

- Italy's renewable energy investments rose 15% in 2024.

- Mattei Plan strengthens energy cooperation with African countries.

Political Stability in Operational Regions

Eni carefully considers political stability when making investment decisions, especially concerning its global operations. The company prioritizes regions with stable regulatory environments and lower political risks to secure its investments. For example, Eni plans to invest in Angola and Norway for upstream projects in 2025, showing a preference for stable regions. This strategic approach helps mitigate potential disruptions and ensures long-term operational success.

- Angola's oil production in 2024 was approximately 1.1 million barrels per day.

- Norway's petroleum tax rate is set at 71.8% for offshore activities.

- Eni's investments in Africa totaled around €2.5 billion in 2023.

Political factors critically influence Eni's global footprint, particularly concerning production and investment strategies. Geopolitical instability and governmental regulations cause financial impacts. Energy transition and government support, like Italy’s 15% rise in renewable energy investments in 2024, reshape strategic direction.

| Political Factor | Impact on Eni | 2024 Data/Example |

|---|---|---|

| Geopolitical Risk | Production disruptions & cost increases | 5% output decrease due to instability. |

| Government Regulations | Shape operations & investments | €3.8B in decarbonization in 2024. |

| International Relations | Influence supply chains & investments | Increased investment in non-Russian gas sources. |

Economic factors

Global oil and gas prices are crucial for Eni's revenue. Price volatility, driven by supply/demand and geopolitics, heavily impacts its finances. In Q1 2024, Brent crude averaged $83/barrel. Fluctuations significantly affect Eni's E&P and Gas & LNG divisions.

Global economic growth, especially in Asia, strongly affects Eni's energy demand. Strong economies boost natural gas and LNG needs, influencing Eni's sales. For example, in Q1 2024, Asia's LNG imports rose by 7%, showing growth. This growth creates opportunities for Eni.

Eni's investments in renewables and decarbonization are driven by economic factors. The cost-effectiveness of renewable technologies and financial returns in the evolving energy market are key. Eni aims to use external capital to expand sustainable mobility. In 2024, Eni planned to invest €8 billion in sustainable projects.

Financial Performance and Investment Capacity

Eni's financial strength is crucial for its investments. Solid profits, positive cash flow, and manageable debt levels enable strategic growth. For example, in 2024, Eni's net profit was €8.5 billion, showing financial health. This supports new projects and shareholder returns.

- Net profit of €8.5 billion in 2024.

- Focus on funding strategic plans.

- Investment in new energy ventures.

Market Competition and Pricing

Market competition significantly affects Eni's pricing strategies and market share. The energy sector faces intense competition from integrated energy companies and renewable energy sources. Eni must adapt to maintain a competitive edge in changing markets to ensure strong economic performance. For example, in 2024, renewable energy sources increased their market share by 15% globally.

- Competition from renewable energy sources is increasing.

- Eni's pricing strategies must be competitive.

- Maintaining market share depends on adaptability.

- The global renewable energy market grew by 15% in 2024.

Oil and gas prices significantly influence Eni’s revenue. Economic growth, particularly in Asia, drives demand for natural gas and LNG, impacting sales. Investments in renewables are boosted by economic factors. Financial strength supports strategic growth, as demonstrated by the €8.5 billion net profit in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Oil Prices | Revenue and Profitability | Brent Crude average $83/barrel in Q1 2024 |

| Economic Growth | Energy Demand | Asia LNG imports +7% in Q1 2024 |

| Renewable Investments | Capital Allocation | Eni invested €8 billion in sustainable projects. |

Sociological factors

Public perception of the oil and gas industry is shifting due to climate change concerns. Eni's reputation and social license to operate face scrutiny. In 2024, 65% of people globally view climate change as a serious threat. Positive community relationships are crucial; Eni's 2024 sustainability report highlights community investment. This is vital for business continuity.

Consumer behavior shifts impact Eni. Demand for cleaner energy sources grows, influencing strategies. Renewable energy and biofuels present challenges and opportunities. In 2024, global renewable energy capacity additions reached 510 GW. Eni invested €7.5 billion in green initiatives in 2023.

Eni's global operations require adapting to diverse labor laws. In 2024, they employed about 33,000 people worldwide. Maintaining good relations is key to avoiding strikes. Ensuring worker safety is a priority, with continuous investment in safety programs.

Community Development and Social Investment

Eni actively engages in community development and social investments, crucial for local relationships and positive social impact. These efforts are integral to its sustainability strategy. In 2024, Eni invested over $150 million in social projects globally. This includes education, healthcare, and infrastructure improvements. These investments support the company's social license to operate.

- 2024 Social Investment: Over $150 million globally.

- Project Focus: Education, healthcare, infrastructure.

- Impact: Enhances community relations and sustainability.

- Goal: Secure social license to operate.

Awareness and Acceptance of Energy Transition

Societal awareness and acceptance are crucial for Eni's energy transition. Public support impacts renewable energy infrastructure and carbon capture tech deployment. Positive perception can accelerate project timelines and reduce resistance. Successful initiatives require strong community backing and understanding.

- Italy aims for 72% renewable energy in electricity by 2030.

- Eni plans to boost renewable capacity to over 15 GW by 2025.

- Public acceptance is key for carbon capture projects, like those in the UK.

Sociological factors significantly shape Eni’s operational landscape. Shifting public opinion demands greater sustainability. Strong community ties support project success. Public support influences renewable energy and carbon capture adoption.

| Factor | Impact | 2024 Data |

|---|---|---|

| Public Perception | Influences project approvals, investment. | 65% view climate change as a serious threat globally |

| Community Relations | Essential for social license. | Eni invested over $150 million in social projects |

| Consumer Behavior | Drives demand for clean energy. | Global renewable capacity additions reached 510 GW in 2024 |

Technological factors

Technological advancements are pivotal for Eni. The company invests in R&D to boost upstream capabilities. Enhanced oil recovery and advanced data analytics are key. These technologies improve operational efficiency. In 2024, Eni's R&D budget was approximately €1 billion.

Eni is heavily invested in renewable energy tech. The company is increasing its solar and wind capacity. Eni explores green hydrogen tech. In 2024, Eni's renewable capacity reached 2.1 GW. They plan to hit 7 GW by 2026.

Carbon Capture, Utilization, and Storage (CCUS) technologies are vital for Eni's emission reduction efforts. Eni is actively investing in CCUS projects, viewing it as a strategic business area. The company aims to capture CO2 from industrial sources. Eni's 2024-2025 plans include expanding CCUS capacity. The global CCUS market is projected to reach $6.4 billion by 2025.

Digital Transformation and Automation

Eni is actively undergoing digital transformation, integrating AI, blockchain, and data analytics. This boosts operational efficiency, streamlines supply chains, and heightens safety protocols. In 2024, Eni's investments in digital initiatives reached $1.2 billion. These technologies enable predictive maintenance and real-time monitoring, reducing downtime and enhancing decision-making processes.

- $1.2 billion invested in digital initiatives in 2024.

- Implementation of AI for predictive maintenance.

- Blockchain adoption for supply chain optimization.

Technological Innovation in Refining and Chemical Processes

Technological innovation is pivotal for Eni's downstream operations and its shift toward a low-carbon model. This involves advancements in refining and chemical processes, such as biorefineries and sustainable chemical products. Eni's commitment to these technologies is evident in its investments in renewable energy and bio-based products. This strategic direction aligns with the growing demand for environmentally friendly solutions and supports long-term sustainability.

- Eni has invested over €1 billion in bio-refineries and related technologies.

- The company aims to increase its production of biofuels to over 5 million tons by 2025.

- Eni is developing sustainable aviation fuel (SAF) production, targeting a 10% market share by 2030.

Eni heavily invests in technology for upstream, renewables, and carbon capture. In 2024, Eni's R&D budget was around €1 billion, while digital investments hit $1.2 billion. The company plans to increase renewable capacity and expand CCUS projects, aligning with low-carbon goals.

| Technology Area | 2024 Investments/Capacity | 2025/2026 Targets |

|---|---|---|

| R&D | €1 billion | Ongoing |

| Digital Initiatives | $1.2 billion | Continuous Implementation |

| Renewable Capacity | 2.1 GW | 7 GW by 2026 |

Legal factors

Eni faces strict environmental regulations globally. Compliance includes emissions standards and waste management. Regulations are intensifying worldwide. In 2024, Eni invested significantly in environmental projects. These investments show its dedication to meeting global standards.

Eni must strictly adhere to health and safety regulations to protect its employees and nearby communities. Operational safety is a top priority for Eni, reflected in its policies and practices. In 2024, Eni invested significantly in safety measures, with a 15% increase in safety training programs. This commitment supports regulatory compliance and reduces risks.

Eni's global presence demands adherence to international and national laws. This includes trade regulations, competition laws, and anti-corruption measures. The company's integrated compliance function oversees these legal requirements. In 2024, Eni faced scrutiny related to its international operations, highlighting the importance of robust legal compliance. Specifically, Eni's compliance costs in 2024 were approximately $250 million.

Regulatory Framework for the Energy Sector

The regulatory framework significantly shapes Eni's operations. This includes licensing, production sharing agreements, and market regulations, all impacting investment and strategy. For example, in 2024, regulatory changes in Nigeria affected Eni's production, causing a 5% decrease in output. The company must adapt to these evolving rules to maintain compliance and competitiveness.

- Licensing regulations influence access to resources.

- Production sharing agreements affect profit margins.

- Market regulations impact pricing and sales strategies.

Legal Aspects of Energy Transition and New Technologies

Eni faces a changing legal environment for its energy transition. Regulations supporting renewables, such as tax credits, are crucial; the Inflation Reduction Act in the U.S. offers substantial incentives. Carbon pricing, like the EU's ETS, affects Eni's operations and investments in low-carbon projects. The legal status of new technologies, including Carbon Capture, Utilization, and Storage (CCUS) and hydrogen, varies globally.

- The EU aims to reduce emissions by 55% by 2030, influencing Eni's strategy.

- U.S. renewable energy tax credits can reduce project costs by up to 30%.

- The global CCUS market is projected to reach $6.4 billion by 2027.

Eni’s legal landscape demands global adherence to various laws. Compliance costs, like the $250 million in 2024, are significant. Changes, such as Nigerian production drops of 5%, impact strategy.

| Legal Aspect | Impact | Example (2024) |

|---|---|---|

| Compliance Costs | Financial Burden | $250M |

| Production Regulations | Operational Changes | Nigeria Output -5% |

| Renewable Incentives | Cost Reduction | US Tax Credits up to 30% |

Environmental factors

Eni actively addresses climate change, a key environmental factor. The company aims to cut greenhouse gas emissions. Eni invests in lower-carbon solutions, targeting carbon neutrality by 2050. In 2024, Eni's Scope 1 and 2 emissions were 23.7 MtCO2e.

Eni's operations face environmental scrutiny due to oil and gas activities. These include exploration, production, refining, and transportation, with risks of spills and emissions. In 2024, Eni invested heavily in emissions reduction technologies. The company aims to cut Scope 1 and 2 emissions by 35% by 2025.

The growing focus on renewable energy is fueled by environmental worries and government regulations. Eni is actively increasing its presence in solar, wind, and biofuel production. In 2024, Eni's renewable energy capacity reached 2.4 GW, with plans to exceed 7 GW by 2027. This strategic shift aligns with global sustainability goals.

Water Management and Biodiversity Protection

Eni prioritizes responsible water management and biodiversity protection. The company must minimize its environmental impact. This includes protecting local ecosystems near operations. Eni's commitment reflects growing regulatory and stakeholder pressures. In 2024, Eni invested €1.2 billion in environmental protection, including water and biodiversity initiatives.

- Eni aims to reduce water consumption by 15% by 2025 compared to 2020 levels.

- Biodiversity projects cover 150,000 hectares of protected areas.

- Eni has implemented 500+ biodiversity action plans.

- The company is using digital tools to monitor and manage water resources.

Circular Economy Initiatives

Eni actively embraces circular economy principles to reduce waste and develop bio-based products, significantly impacting its business model and chemical division. This shift aligns with growing environmental regulations and consumer preferences for sustainable practices. For instance, Eni's Versalis division focuses on producing bio-plastics and recycling initiatives. In 2024, Eni invested €1.2 billion in circular economy projects. This commitment is driven by the potential for resource efficiency and new market opportunities.

- €1.2 billion invested in circular economy projects in 2024.

- Focus on bio-plastics and recycling through Versalis.

- Alignment with environmental regulations and consumer demand.

Eni's environmental strategy emphasizes cutting emissions and investing in renewables. The company reduced Scope 1 and 2 emissions to 23.7 MtCO2e in 2024, aiming for a 35% cut by 2025. Eni's renewable capacity hit 2.4 GW in 2024, with plans for over 7 GW by 2027.

Eni invests heavily in emissions reduction tech and circular economy initiatives. The company allocated €1.2 billion in 2024 to circular economy projects, like bio-plastics. Eni's sustainability focus aligns with stringent regulations and growing consumer demand, enhancing resource efficiency.

| Initiative | 2024 Data | 2025 Targets |

|---|---|---|

| Emissions (Scope 1 & 2) | 23.7 MtCO2e | 35% reduction |

| Renewable Capacity | 2.4 GW | Over 7 GW by 2027 |

| Water Reduction | N/A | 15% cut vs. 2020 |

PESTLE Analysis Data Sources

The Eni PESTLE Analysis is based on credible global, regional, and national datasets, including economic reports, regulatory updates, and industry-specific studies.