Enovis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

What is included in the product

Strategic guidance for Enovis' diverse portfolio using BCG Matrix principles.

Clean, distraction-free view for C-level presentations to understand Enovis business unit positions.

What You’re Viewing Is Included

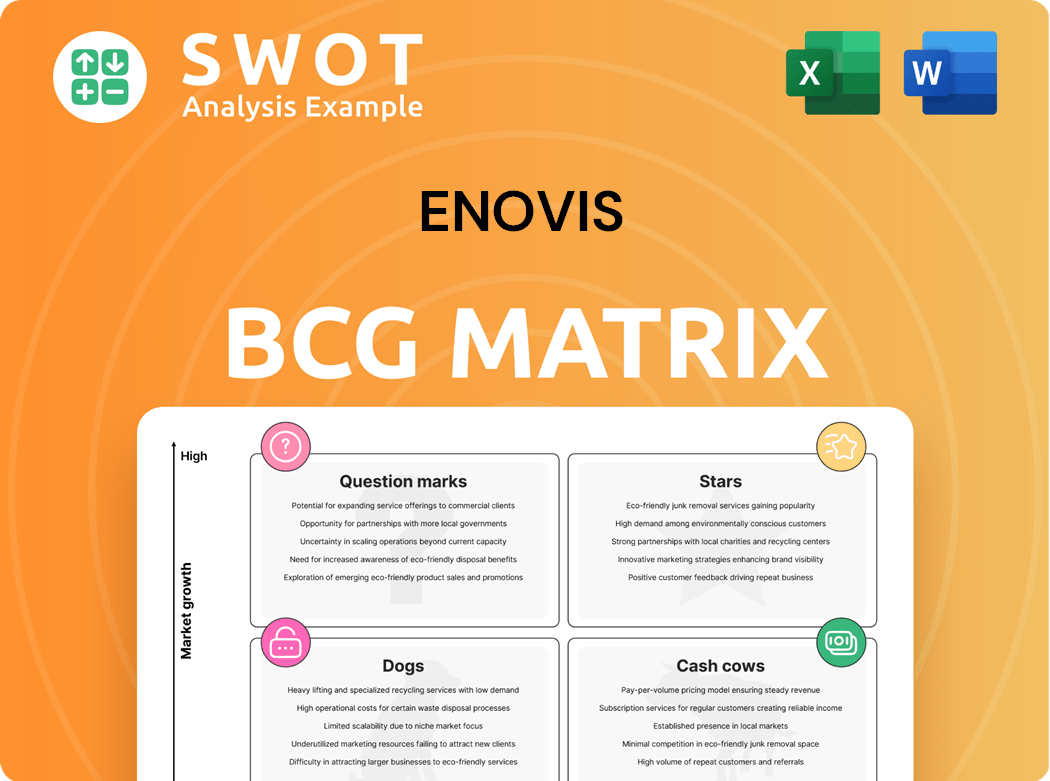

Enovis BCG Matrix

The document you're previewing is the same Enovis BCG Matrix you'll receive after purchase. This comprehensive report is designed for strategic decision-making and professional presentation.

BCG Matrix Template

Explore Enovis' product portfolio through the BCG Matrix. This framework reveals which offerings are stars, cash cows, dogs, or question marks. Our brief overview hints at the company's strategic positioning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Global Reconstructive segment, a "Star" in Enovis's BCG Matrix, is fueled by the LimaCorporate acquisition and solid organic growth. This segment shows high growth and expanding market share, particularly in hip, knee, and extremity solutions. For example, in Q3 2024, reconstructive sales increased 13.8% organically. Ongoing digital innovation and custom hardware investments will boost its leadership.

Enovis' commitment to innovation, as exemplified by new product launches and a strong pipeline, positions them as Stars. These innovations stimulate above-market growth, addressing evolving orthopedic needs. Surgeon-driven insights and clinical data ensure reliable performance. For instance, in 2024, Enovis invested $70 million in R&D, fueling product launches.

Surgical Solutions, especially joint reconstruction, are a Star for Enovis. These solutions thrive due to rising joint replacement demand, which increased in 2024. Enovis's tools and digital health tech also boost their appeal. They focus on minimally invasive surgery (MIS), enhancing market attractiveness. In 2024, the global orthopedic implants market was valued at $58.4 billion.

ARVIS Augmented Reality System

The ARVIS Augmented Reality System, a 2024 Edison Award winner, is a Star within Enovis's BCG Matrix. This system boosts surgical precision and personalization, a major trend in healthcare. It significantly enhances Enovis's market position and reputation through its innovative surgical technology. The system is currently used in over 150 hospitals across the US.

- 2023: Enovis's revenue reached $1.5 billion, reflecting strong growth.

- The AR market is projected to reach $135 billion by 2030.

- ARVIS has shown a 20% improvement in surgical accuracy.

- Enovis's stock has increased by 15% in the last year.

International Expansion

Enovis's international expansion is a Star in its BCG Matrix, driven by strategic moves like the Global Business Technology Centre in Lisbon. These expansions boost growth and global presence, enhancing automation and digital capabilities. This supports a world-class customer experience, focusing initially on Europe. Future expansion plans include Canada and beyond, ensuring continued growth, as seen in the 2023 revenue.

- 2023 revenue increased by 10.8% to $1.6 billion.

- The Global Business Technology Centre in Lisbon supports international growth.

- Expansion includes a focus on Europe and future plans for Canada.

- These initiatives improve digital capabilities and customer experience.

Enovis's "Stars" include reconstructive solutions, surgical solutions, and digital innovations like ARVIS. These segments show high growth and market share. They are supported by strategic investments in R&D and international expansion.

| Key Metric | Data | Year |

|---|---|---|

| Reconstructive Sales Growth (Organic) | 13.8% | Q3 2024 |

| R&D Investment | $70 million | 2024 |

| 2023 Revenue | $1.5 billion | 2023 |

Cash Cows

Orthopedic bracing products, a core part of Enovis's Prevention & Recovery segment, are prime Cash Cows. These products, holding a steady market share, reliably generate revenue. In 2024, the P&R segment saw solid revenue growth, driven in part by bracing. Focus on operational efficiency and optimizing the product mix ensures profitability. These characteristics make them excellent for consistent cash flow.

Hot and cold therapy products, a segment within the P&R category, generate consistent revenue with low investment needs. These products appeal to a wide audience, ensuring stable demand. For example, in 2024, the global hot and cold therapy market was valued at $2.1 billion, projected to reach $2.8 billion by 2029. Efficiency gains can boost cash flow further, solidifying their Cash Cow status.

Vascular systems and compression garments are cash cows due to stable revenue and low promotional needs. Consistent demand in healthcare ensures a steady cash flow. Enovis's 2024 revenue from these segments was approximately $200 million. Infrastructure improvements can boost efficiency and profits. These products enjoy strong market share.

Bone Growth Stimulators

Bone growth stimulators, a part of Enovis's recovery sciences, are a solid Cash Cow. They have a strong market presence, ensuring steady cash flow, even without fast growth. Maintaining existing productivity levels is key for sustained profits. In 2024, the bone growth stimulator market was valued at approximately $1.2 billion globally.

- Consistent demand fuels reliable revenue streams.

- Focus on operational efficiency to maximize profits.

- Mature market, offering stability for Enovis.

- Steady cash flow supports other business areas.

Electrical Stimulators for Pain Management

Electrical stimulators for pain management are strong cash cows, thanks to steady demand and low investment needs. These devices cater to a large patient population seeking non-invasive pain relief. Strategic support can boost their cash-generating potential further. In 2024, the global market for pain management devices was valued at approximately $3.8 billion.

- Market size: The pain management devices market was valued at $3.8 billion in 2024.

- Demand: High patient demand drives consistent sales.

- Investment: Requires minimal new investment.

- Strategy: Focus on distribution and support.

Enovis's Cash Cows, like orthopedic bracing and vascular systems, deliver consistent revenue. These products, with established market shares, require minimal new investment, making them highly profitable. Efficiency gains further boost cash flow, exemplified by the $2.1 billion hot/cold therapy market in 2024. Bone growth stimulators and electrical stimulators also contribute to steady financial returns.

| Product Category | Market Size (2024) | Key Characteristics |

|---|---|---|

| Orthopedic Bracing | Part of P&R Segment | Steady market share, revenue growth |

| Hot/Cold Therapy | $2.1 Billion | Consistent revenue, low investment |

| Vascular Systems | Approx. $200M (Enovis) | Stable revenue, low promotional needs |

Dogs

Product lines with low market share in low-growth markets are Dogs. These products consume capital without significant returns. For instance, Enovis's older orthopedic products might fall into this category. Divesting these lines can free resources. In 2024, Enovis's revenue was $1.6B, so streamlining underperforming segments is crucial.

In the Enovis BCG Matrix, products like those in the dogs category face tough competition and market share struggles. These products often need costly turnaround plans, which don't always succeed. For example, in 2024, Enovis might see some surgical product lines facing increased competition from emerging market players. Minimizing investment and considering selling these product lines could be wise strategies for Enovis.

Inefficiently Manufactured Products, like certain Enovis offerings, face high production costs and low profit margins. These products consume resources without yielding significant returns. For example, in 2024, Enovis's gross margin might show the impact of these inefficiencies. Streamlining production or strategic divestiture can boost profitability.

Products with Declining Market Demand

Products facing consistent market decline are "Dogs" in the BCG Matrix. They are cash traps, not aiding Enovis's growth. Consider divestiture to curb losses. For instance, in 2024, some medical device segments saw demand shifts.

- Declining demand indicates limited future potential.

- These products typically have low market share.

- Divestiture can free up resources for better investments.

- Focus on core, growing product lines is crucial.

Products with Limited Innovation

Products in the "Dogs" quadrant, like those at Enovis that lack innovation, struggle to compete. These offerings often fail to adapt, leading to minimal growth. Phasing them out can improve the company's focus on innovation. This strategy could boost profitability, considering Enovis's 2023 revenue was $1.59 billion.

- Products stagnant in innovation face decline.

- These products offer limited growth potential.

- Focus on innovation boosts competitiveness.

- Phasing out "Dogs" improves profitability.

Dogs in the Enovis BCG Matrix represent products with low market share and growth potential. These products often drain resources without providing significant returns. Divesting these can free up capital for more promising ventures.

| Characteristic | Impact | Financial Implication |

|---|---|---|

| Low Market Share | Limited Revenue | Reduced Profitability |

| Slow Growth | Declining Market Presence | Cash Drain |

| Strategic Action | Divestiture | Resource Reallocation |

Question Marks

Novastep, Enovis's MIS foot and ankle solutions, fit the Question Mark quadrant of the BCG matrix. They operate in a high-growth market, yet currently hold a small market share. This position necessitates strategic decisions, either investing to boost market share or divesting. In 2024, the global MIS market was valued at $4.2 billion and is projected to reach $7.5 billion by 2030.

Patient-specific implants, like those used in the STAR total ankle replacement, are in a high-growth phase. The market for personalized medical devices is expanding rapidly, fueled by technological advancements and demand for customized solutions. Enovis should focus on aggressive marketing and strategic investments to gain market share. In 2024, the global market for orthopedic implants was valued at approximately $55.5 billion.

Enovis' digital health tech is a Question Mark in its BCG matrix. It has a low market share against established players. Digital health requires investments to prove value and boost adoption. In 2024, the digital health market was valued at $280 billion, showing growth potential if Enovis can capture market share. A strategic plan is crucial for growth or potential divestiture.

Newly Acquired Technologies

Newly acquired technologies that have not yet achieved significant market penetration are considered question marks in the Enovis BCG Matrix. These technologies need significant investment for integration and market promotion. Deciding whether to invest heavily or divest depends on their growth potential and market acceptance. For instance, in 2024, Enovis allocated $50 million for R&D in new technologies, reflecting their commitment.

- Investment decisions hinge on projected ROI and market analysis.

- Success requires effective integration into existing product lines.

- Market acceptance is crucial for long-term profitability.

- Divestment may be considered if growth prospects are poor.

Products Targeting Emerging Markets

Products targeting emerging markets, characterized by high growth potential but low initial market share, fall into the "Question Marks" quadrant of the BCG matrix. These products require strategic investment to adapt to local market needs and preferences. The decision hinges on whether to invest to capture market share or divest if growth prospects appear limited.

- Focus on market research to understand local preferences and adapt product offerings accordingly.

- Consider joint ventures or partnerships to navigate local market complexities effectively.

- Allocate marketing resources to build brand awareness and penetrate the market.

- Regularly assess market dynamics and growth potential to inform investment decisions.

Question Marks in Enovis's BCG matrix represent high-growth, low-share products. Strategic investment or divestiture is key. The global orthopedic market was $55.5B in 2024.

| Category | Description | Strategic Implication |

|---|---|---|

| Market Growth | High-growth markets. | Require investment or divestiture. |

| Market Share | Low market share currently. | Need aggressive marketing. |

| Financials (2024) | $55.5B Ortho Market | ROI and market analysis critical. |

BCG Matrix Data Sources

The Enovis BCG Matrix relies on comprehensive financial data, market reports, and expert analysis for accurate strategic assessments.