Enovis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

What is included in the product

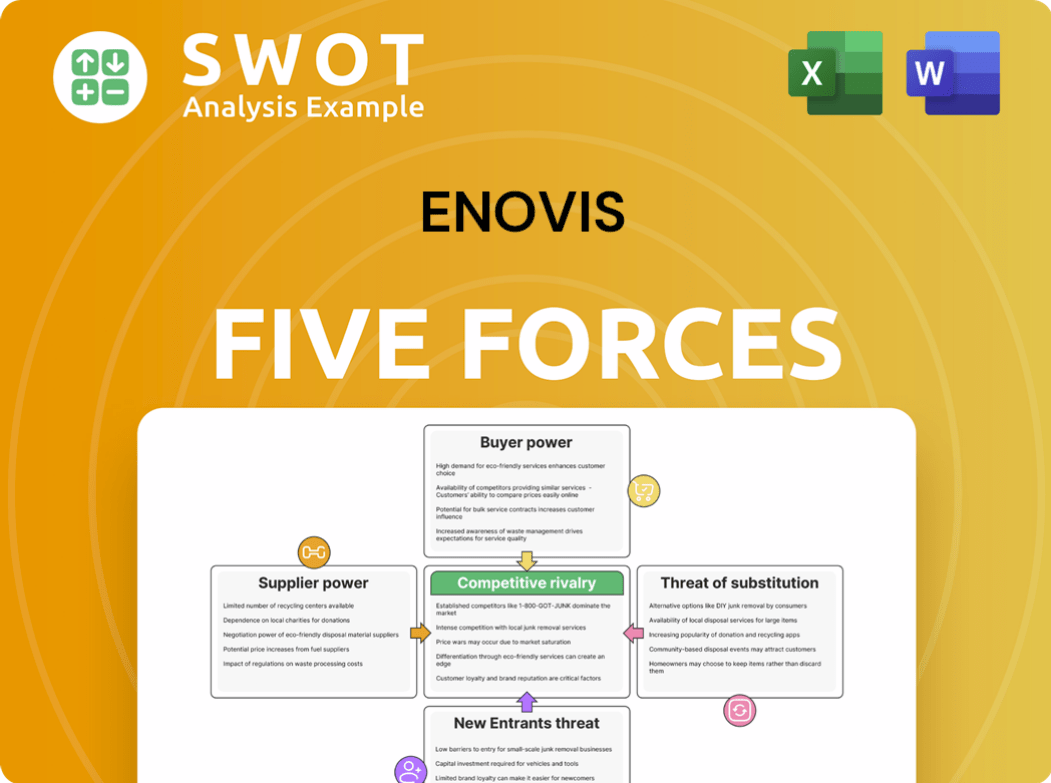

Analyzes Enovis' competitive environment by evaluating the forces shaping industry profitability and strategic positioning.

Quickly visualize competitive landscapes: know strengths/weaknesses at a glance.

What You See Is What You Get

Enovis Porter's Five Forces Analysis

This preview showcases the complete Enovis Porter's Five Forces analysis you'll receive. It details the competitive landscape affecting Enovis. The document examines each force: threat of new entrants, bargaining power of suppliers and buyers, threat of substitutes, and rivalry. This is the full, ready-to-use analysis file you'll receive.

Porter's Five Forces Analysis Template

Enovis faces a complex competitive landscape, shaped by factors like supplier bargaining power, particularly for specialized materials. The threat of new entrants remains moderate due to industry regulations and capital requirements. Competitive rivalry is intense, with established players vying for market share. Buyer power is relatively balanced. The threat of substitutes is a concern, as alternative treatments emerge.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Enovis's real business risks and market opportunities.

Suppliers Bargaining Power

Supplier concentration significantly affects Enovis's bargaining power. Fewer suppliers, especially for specialized components, increase supplier power. Enovis, producing medical devices, probably depends on specific materials, limiting its supplier options. This can lead to higher prices and less favorable terms, impacting profitability. In 2024, the medical device industry faced supply chain disruptions, potentially strengthening suppliers' positions.

High switching costs for Enovis would increase supplier power. If changing suppliers requires re-engineering, Enovis becomes dependent. This dependence allows suppliers to negotiate better terms. For instance, the medical device industry faces high switching costs. In 2024, Stryker reported a gross profit margin of 64.2%, reflecting supplier influence.

Suppliers gain power by forward integration, becoming direct competitors. If Enovis's suppliers can make and sell orthopedic solutions, their leverage grows. This threat pushes Enovis to accept worse terms. For instance, in 2024, the market saw increased supplier consolidation, raising concerns.

Availability of substitute inputs

The availability of substitute inputs significantly impacts supplier power within Enovis's operational framework. If Enovis can readily swap to different materials or components, suppliers' leverage diminishes. Standardized inputs further limit supplier control. For instance, in 2024, Enovis sourced approximately 60% of its raw materials from suppliers offering readily available alternatives. This strategic sourcing approach helps mitigate potential supply chain disruptions.

- Substitute availability directly affects supplier influence.

- Standardized inputs weaken supplier power.

- Enovis's sourcing strategy reduces dependency.

- Approximately 60% of raw materials in 2024 had available substitutes.

Impact of Enovis's purchases on supplier profits

Enovis's influence over suppliers hinges on the proportion of revenue they contribute. If Enovis is a major client, suppliers' bargaining power decreases significantly. Suppliers become more flexible in pricing and terms to keep Enovis as a customer. This dependency allows Enovis to negotiate more favorable deals.

- Enovis's 2023 revenue reached $1.6 billion, highlighting its substantial market presence.

- Suppliers dependent on Enovis for a large share of their income face reduced pricing power.

- Negotiating leverage increases for Enovis when suppliers are highly reliant.

- This dynamic can lead to cost savings for Enovis.

Supplier power significantly influences Enovis's operations. High concentration and specialized components strengthen suppliers. Switching costs and forward integration also boost supplier leverage. Substitute availability and Enovis's revenue share with suppliers can mitigate this power.

| Factor | Impact on Supplier Power | Enovis Example (2024) |

|---|---|---|

| Supplier Concentration | Higher concentration = Increased power | Medical device components; few suppliers. |

| Switching Costs | High costs = Increased power | Re-engineering needs; increased dependency |

| Forward Integration | Suppliers become competitors; increase power | Suppliers begin selling orthopedic solutions |

| Substitute Availability | High availability = Reduced power | Approximately 60% of raw materials have substitutes. |

| Enovis's Revenue Share | High share = Reduced power | Enovis's $1.6B revenue in 2023 gives leverage |

Customers Bargaining Power

A concentrated customer base significantly boosts buyer power. For Enovis, this means if major hospitals or GPOs drive sales, they can strongly influence pricing and conditions. For example, if 70% of Enovis's revenue comes from only 10 key accounts, these customers hold substantial leverage. The fewer the customers, the more power they wield.

Low switching costs significantly boost customer bargaining power. If hospitals easily switch orthopedic solutions, they gain leverage. Standardized products and available alternatives lower these costs. In 2024, the orthopedic devices market was valued at $60.3 billion, intensifying competition and switching ease. This dynamic compels companies to offer better terms.

Customers gain power by backward integration, potentially making their own orthopedic solutions. This is rare, but large hospital systems could do it. Such a move could pressure Enovis on pricing and innovation, impacting profitability. For example, Enovis's 2024 revenue was approximately $1.6 billion.

Price sensitivity of customers

Customers' price sensitivity significantly boosts their bargaining power, especially in healthcare. In environments like the US, where healthcare costs continue to rise, patients and providers are increasingly focused on price. This heightened sensitivity leads to tougher negotiations. Hospitals, facing pressure from payers to reduce costs, actively seek lower prices from suppliers.

- US healthcare spending reached $4.5 trillion in 2022.

- Hospitals' margins have been squeezed due to rising expenses.

- Value-based care models emphasize cost-effectiveness.

Availability of information to customers

Customers today wield significant power, largely due to the easy access to information. They can readily compare products and prices, enhancing their ability to negotiate. This transparency shifts the balance of power towards the buyer. For instance, in 2024, online reviews and price comparison websites saw a 20% increase in usage, reflecting this trend.

- Increased price sensitivity.

- Higher demand for product quality.

- Greater customer loyalty.

- More informed purchasing decisions.

Customer bargaining power significantly impacts Enovis. Key customers can pressure pricing, especially if concentrated. Low switching costs and price sensitivity amplify this power. Digital transparency further empowers customers, influencing negotiations.

| Factor | Impact | Data (2024) |

|---|---|---|

| Concentration | High leverage | 70% revenue from 10 accounts |

| Switching costs | Increased power | Ortho market $60.3B |

| Price sensitivity | Tougher negotiations | US healthcare spend $4.5T (2022) |

Rivalry Among Competitors

A high number of competitors typically escalates rivalry. The orthopedic solutions market is packed with both major and emerging companies. This competitive environment pushes Enovis to distinguish its offerings and retain its market position. For instance, in 2024, the orthopedic devices market was highly fragmented, with no single company holding a dominant market share.

Low competitor concentration fuels intense rivalry. Fragmented markets, lacking dominant players, trigger aggressive pricing and marketing. This can compress profit margins. For instance, in 2024, the medical device market saw numerous players, intensifying competition. This dynamic is evident in Enovis's struggle to maintain margins amid competitive pressures.

Slow industry growth intensifies competitive rivalry. In a market that isn't growing fast, companies fight harder for market share. This often results in price wars and higher marketing costs. For instance, in 2024, the global orthopedic devices market grew modestly, intensifying competition among key players like Stryker and Zimmer Biomet. This scenario forces companies to innovate and cut costs to stay competitive.

Product differentiation

Low product differentiation intensifies rivalry in the orthopedic market. When solutions like Enovis' offerings are largely similar to competitors', price becomes a key differentiator. This commoditization reduces pricing power, making competition fiercer. For instance, the global orthopedic devices market, valued at $59.3 billion in 2023, sees intense competition.

- Enovis' revenue in 2023 was approximately $1.5 billion.

- Key competitors include Zimmer Biomet, Stryker, and Johnson & Johnson.

- These companies compete on price, service, and brand reputation.

- Differentiation efforts focus on innovation and specialized solutions.

Exit barriers

High exit barriers significantly intensify competitive rivalry within an industry. When companies find it challenging or costly to leave a market, they often persist in competing, even if profitability is low. This situation can lead to prolonged periods of intense competition, potentially driving down prices and squeezing profit margins. For instance, the manufacturing sector frequently faces high exit barriers due to substantial capital investments and specialized equipment. These barriers can include contractual obligations, specialized assets, or emotional attachments to the business.

- High exit barriers often lead to overcapacity and price wars.

- Industries with high exit barriers include manufacturing and airlines.

- Companies may continue operating to recoup sunk costs, intensifying competition.

- Exit barriers can include long-term contracts or government regulations.

Intense rivalry characterizes the orthopedic solutions market. Numerous competitors, including Zimmer Biomet and Stryker, compete fiercely. This competition impacts Enovis, affecting pricing and innovation strategies.

| Aspect | Details | Impact on Enovis |

|---|---|---|

| Market Fragmentation | No single dominant player; high number of competitors | Increased price competition, pressure on margins |

| Product Differentiation | Low differentiation; products are often similar | Price becomes a key differentiator, reducing pricing power |

| Industry Growth | Modest growth in the orthopedic devices market in 2024 | Intensified competition for market share |

SSubstitutes Threaten

The threat of substitutes significantly impacts Enovis within the orthopedic market. Alternatives like physical therapy and pain medication pose a considerable challenge. For instance, in 2024, the global pain management market was valued at approximately $36 billion. The more accessible and effective these substitutes, the more pressure Enovis faces.

The threat of substitutes hinges on their price-performance compared to Enovis' products. If alternatives like non-surgical treatments offer similar benefits at a lower cost, they become more appealing. This price-performance consideration is key for Enovis. For instance, in 2024, the rise of less invasive procedures has increased the need for price competitiveness.

Low switching costs amplify the threat of substitutes. For Enovis, if patients readily shift from surgical to non-surgical options, the threat rises. Easy adoption of substitutes makes the industry vulnerable. In 2024, the non-surgical orthopedic market grew, indicating potential substitution. This shift impacts Enovis's surgical revenue.

Buyer propensity to substitute

Buyer propensity to substitute significantly impacts the threat of substitutes for Enovis. High substitution willingness amplifies this threat, driven by patient preferences, physician recommendations, and insurance coverage. For example, if patients readily switch treatments, the threat intensifies. In 2024, the global orthopedic devices market was valued at approximately $59.3 billion, with a projected compound annual growth rate (CAGR) of 3.3% from 2024 to 2032, indicating potential for substitute products. This includes a variety of options, from non-surgical to alternative therapies.

- Patient preferences for less invasive options.

- Physician recommendations favoring alternatives.

- Insurance coverage influencing treatment choices.

- Availability and efficacy of alternative treatments.

Perceived level of product differentiation

Low perceived product differentiation significantly elevates the threat of substitutes. When customers see orthopedic solutions as similar to alternatives, they're more price-sensitive. This lack of distinction reduces brand loyalty, making switching easier. For instance, Enovis might face competition from physical therapy.

- The global physical therapy market was valued at $40.5 billion in 2023.

- It is projected to reach $58.6 billion by 2030.

- The CAGR is expected to be 5.4% from 2023 to 2030.

- This growth indicates strong demand for alternatives.

The threat of substitutes, like physical therapy and pain medication, presents a significant challenge to Enovis. The orthopedic devices market was valued at about $59.3 billion in 2024. The rise of less invasive procedures increases the need for Enovis's price competitiveness.

If alternatives are easily accessible, the threat increases significantly. This is driven by patient preferences and physician recommendations. The global physical therapy market was valued at $40.5 billion in 2023.

Low product differentiation elevates the threat as customers are price-sensitive. This can be seen in the growing availability of alternatives. Enovis needs to differentiate its products to avoid easy substitution.

| Factor | Impact | Data |

|---|---|---|

| Price-Performance | Key consideration for Enovis | 2024: Rise of less invasive procedures |

| Switching Costs | Low costs amplify threat | 2024: Non-surgical market growth |

| Differentiation | Low differentiation increases threat | 2023: Physical Therapy Market $40.5B |

Entrants Threaten

High barriers to entry significantly decrease the threat of new competitors in the orthopedic solutions market. Substantial capital investments, stringent regulatory approvals, and strong brand recognition act as deterrents. These factors protect established companies from new competition. For example, Enovis faced high barriers, with R&D spending reaching $78.5 million in 2023. These barriers help maintain market stability.

High capital requirements significantly increase barriers to entry in the orthopedic solutions market. Developing, manufacturing, and marketing these solutions demands substantial investment in R&D, facilities, and sales infrastructure. In 2024, companies like Enovis allocated significant capital to these areas, with R&D spending often exceeding 10% of revenues. This financial hurdle, exemplified by the need for advanced manufacturing plants costing millions, discourages new entrants.

Stringent regulatory hurdles significantly increase barriers to entry. Medical devices face rigorous testing and approval processes by agencies like the FDA. This includes clinical trials. In 2024, it can take years and millions of dollars to get a device approved by the FDA. Navigating these pathways is time-consuming and costly, discouraging new entrants.

Brand reputation

A strong brand reputation significantly deters new entrants. Enovis, alongside other established firms, leverages its well-known brand and the trust it has built with healthcare providers. New competitors face a considerable hurdle, requiring substantial investments in marketing and branding to gain recognition and credibility. The cost to build brand awareness can be substantial, with marketing expenses often representing a significant portion of a new company’s budget, potentially exceeding millions of dollars in the initial years, as seen in the competitive medical device market. Brand loyalty further solidifies this barrier, making it difficult for newcomers to displace incumbents.

- Enovis's brand strength is a major advantage.

- New entrants face high marketing costs.

- Building brand recognition takes time.

- Established brands have customer trust.

Access to distribution channels

Access to distribution channels poses a significant threat to new entrants in the orthopedic solutions market. Established players like Enovis have built strong relationships with hospitals and clinics, creating barriers for newcomers. These channels are essential for reaching customers and generating sales, making it difficult for new companies to compete. Without access to these distribution networks, new entrants struggle to get their products to market effectively, limiting their ability to gain market share.

- Enovis leverages its established distribution network to reach a wide customer base.

- New entrants face challenges in securing partnerships with hospitals and clinics.

- Limited distribution access hinders market penetration for new orthopedic solutions.

- The established distribution networks provide a competitive advantage to existing companies.

The threat of new entrants in the orthopedic solutions market is generally low due to significant barriers. High capital requirements, such as substantial R&D investments, deter newcomers. In 2024, R&D spending in this sector often exceeded 10% of revenues. Stringent regulatory processes and the need for FDA approval also pose major hurdles, with approval timelines potentially spanning years and costs in the millions. Moreover, strong brand recognition and established distribution networks, as seen with Enovis, further restrict entry, as new firms must overcome marketing costs and build customer trust.

| Barrier | Impact | Example (2024) |

|---|---|---|

| High Capital Costs | Discourages Entry | R&D >10% of Revenue |

| Regulatory Hurdles | Time and Cost | FDA Approval Years |

| Brand Recognition | Customer Trust | Enovis Brand Loyalty |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Enovis utilizes SEC filings, industry reports, market data, and competitor analysis to understand competitive dynamics.