Enovis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

What is included in the product

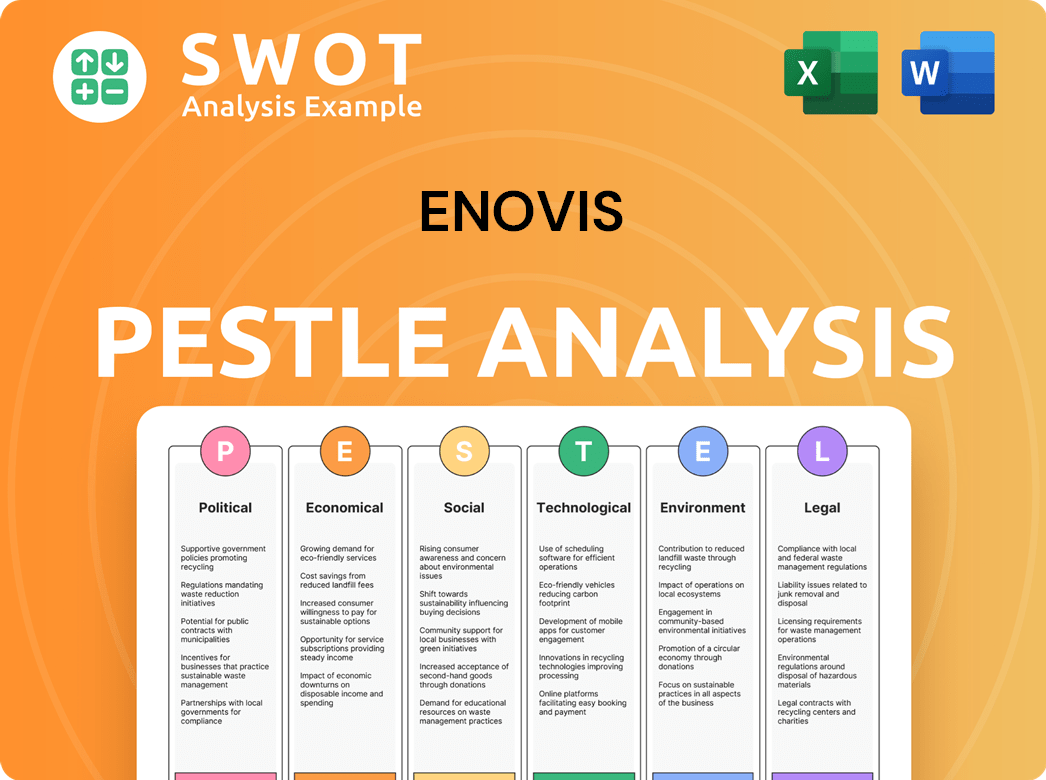

Analyzes Enovis through Political, Economic, Social, Technological, Environmental & Legal factors.

A clear, brief summary perfect for high-level overviews and initial discussions.

Preview the Actual Deliverable

Enovis PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. This Enovis PESTLE Analysis preview offers a comprehensive look at the company's strategic environment.

PESTLE Analysis Template

Our PESTLE analysis of Enovis unveils critical external factors impacting its business. From shifting regulations to evolving market dynamics, we dissect key areas affecting the company's strategy. Understand the political landscape, economic trends, social shifts, and technological advancements. This comprehensive analysis offers invaluable insights for strategic planning, investment decisions, and market research. Don't miss the complete breakdown – download the full PESTLE analysis now!

Political factors

Government healthcare spending and reimbursement policies directly influence Enovis' product demand. In the US, CMS spending is projected to reach $2.3 trillion in 2024. Any changes in reimbursement rates for orthopedic devices, like those Enovis offers, will affect profitability. For example, a 2024 CMS proposal could alter payments for certain procedures.

Global trade policies and tariffs significantly affect Enovis, impacting manufacturing and distribution costs. With facilities in Tijuana, Mexico, changes in trade agreements directly affect its supply chain and expenses. For instance, the USMCA agreement's updates could alter operational costs. In 2024, the average tariff rate on medical devices was around 2.5%. Fluctuations can significantly impact profitability.

Enovis faces political risks globally, impacting operations and supply chains. Ongoing geopolitical tensions, like the Ukraine conflict, create uncertainty. For instance, supply chain disruptions increased costs by 5% in 2023. Political instability in key markets may decrease market demand.

Regulatory Environment Changes

Changes in political leadership or priorities can significantly impact Enovis's regulatory environment. Shifts can lead to alterations in product approval timelines, compliance demands, and how easily products reach the market. For instance, new administrations might introduce stricter or more lenient rules for medical device approvals. The FDA, which regulates medical devices in the US, approved 822 premarket approvals (PMAs) and 510(k) clearances in 2023. These figures can fluctuate based on political and regulatory decisions.

- FDA approved 510(k) clearances: 510 in 2023.

- Premarket approvals (PMAs): 822 in 2023.

- Changes in political priorities can affect the approval process.

Government Initiatives in Healthcare

Government initiatives in healthcare significantly impact Enovis. Policies promoting preventative care or supporting specific medical fields can create opportunities. For instance, increased funding for orthopedic treatments could boost Enovis's sales of related products. Conversely, regulations like price controls could pose challenges. Alignment with favorable initiatives is crucial for growth.

- The US government spent $4.5 trillion on healthcare in 2022.

- Preventative care spending is projected to rise by 5% annually.

- Medicare and Medicaid reimbursements significantly influence orthopedic device sales.

Political factors profoundly shape Enovis's financial outcomes and operational strategies. Changes in healthcare spending, particularly CMS reimbursements, directly affect product demand. Global trade policies and political stability significantly impact manufacturing, distribution costs, and supply chain efficiency. Regulatory shifts under new leadership can also alter product approval and market access.

| Aspect | Impact | Data |

|---|---|---|

| Healthcare Spending | Affects demand | CMS spending $2.3T in 2024 |

| Trade Policies | Influences costs | Avg. tariff on med. devices 2.5% |

| Political Stability | Impacts supply chain | Supply chain disruption cost +5% in 2023 |

Economic factors

Overall economic conditions and trends in healthcare spending significantly impact the medical technology sector. In 2024, total U.S. healthcare spending is projected to reach $4.8 trillion, with continued growth expected. Economic expansions typically boost healthcare expenditure, while recessions can curb demand. For example, in 2023, spending on medical devices was approximately $200 billion.

Inflationary pressures pose a significant challenge to Enovis. Rising costs in raw materials, labor, and transportation directly impact its operations. For example, in Q1 2024, the medical devices sector saw a 3% increase in input costs. Enovis' ability to control and pass these costs to consumers is key to profitability. The company's financial performance will be affected by how effectively it manages these pressures.

Enovis, operating globally, faces currency risk. A strong U.S. dollar, for example, can reduce the value of international sales when translated. In 2024, currency fluctuations impacted many multinational firms. Analyze Enovis's specific geographic revenue breakdown to assess the most vulnerable markets. Consider hedging strategies to mitigate these risks.

Supply Chain Disruptions

Economic events and conditions can significantly disrupt global supply chains, affecting Enovis's operations. The scarcity and higher costs of essential components and materials can impact production. For example, in 2024, supply chain issues increased manufacturing costs by about 5-7% for many firms. These disruptions ultimately affect profitability.

- Increased Manufacturing Costs: Supply chain issues raised costs by 5-7% in 2024.

- Impact on Production: Disruptions can lead to reduced production levels.

- Profitability Effects: Higher costs and production issues directly impact profits.

Market Capitalization and Stock Price Volatility

Market capitalization and stock price are indirectly linked to economic health. Economic downturns can erode investor confidence, impacting stock prices. Enovis faced non-cash charges in 2024 due to market volatility.

A strong economy typically boosts stock prices, increasing market capitalization. Conversely, economic uncertainty can lead to price declines. Investor sentiment is key.

- Enovis' market cap fluctuates with economic cycles.

- Non-cash charges can arise from stock price drops.

- Investor confidence is crucial for stock performance.

Economic conditions greatly influence the med-tech sector's growth. U.S. healthcare spending hit $4.8T in 2024, affecting companies like Enovis. Inflation impacts Enovis's profitability due to rising costs.

Currency fluctuations present risk for international sales. Supply chain issues increased manufacturing costs for many firms by about 5-7% in 2024, influencing the market. Investor confidence is key to Enovis’s stock performance, linked to overall economic health.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Healthcare Spending | Affects demand | Projected $5T+ in 2025 |

| Inflation | Increases costs | Input cost increase 3% in Q1 |

| Supply Chains | Manufacturing disruption | Cost raised 5-7% |

Sociological factors

An aging population boosts demand for orthopedic and rehabilitation products. Globally, the 65+ age group is rapidly growing, projected to reach 1.6 billion by 2050. This demographic shift directly increases the need for Enovis' offerings.

Growing public understanding of musculoskeletal health, preventive measures, and rehabilitation benefits fuels demand for Enovis' tech. Health campaigns and information access boost awareness. In 2024, musculoskeletal disorders affected 54% of US adults. The global orthopedics market, valued at $59.6B in 2023, is projected to reach $77.8B by 2028.

Lifestyle shifts, with more people engaging in sports and fitness, affect injury rates and demand for orthopedic solutions. Increased activity fuels demand for prevention and recovery products. Globally, the sports medicine market is expected to reach $9.8 billion by 2025. This growth reflects rising activity levels.

Patient Expectations and Preferences

Patient preferences significantly influence Enovis's market. Demand is rising for advanced tech and quicker recovery procedures. Minimally invasive surgeries are becoming more popular. The global market for orthopedic devices is projected to reach $69.7 billion by 2025.

- Demand for less invasive procedures is increasing.

- Patients want faster recovery times.

- The orthopedic devices market is growing.

Healthcare Access and Inequality

Societal factors significantly impact Enovis' market. Healthcare access, insurance coverage, and quality disparities affect product demand and distribution. Inequality limits market penetration, particularly in underserved areas. Understanding these dynamics is crucial for strategic planning and social responsibility.

- In 2024, approximately 8.5% of the U.S. population lacked health insurance.

- Disparities in healthcare access disproportionately affect minority and low-income populations.

- Enovis can address these inequalities by targeting products to underserved communities.

- Market penetration can be enhanced by focusing on affordability and accessibility.

Healthcare disparities significantly influence Enovis. Around 8.5% of the U.S. lacked health insurance in 2024. Targeted efforts and accessible products are key to market expansion. Addressing inequalities is vital for both strategy and societal impact.

| Factor | Impact on Enovis | 2024/2025 Data |

|---|---|---|

| Healthcare Access | Affects product demand | 8.5% uninsured in U.S. |

| Insurance Coverage | Influences market reach | Focus on affordable products. |

| Social Inequality | Limits market penetration | Disparities affect minority groups. |

Technological factors

Enovis must stay ahead with tech advancements in orthopedic implants. Innovation in biomaterials, 3D printing, and personalized implants is key. The global orthopedic devices market is forecast to reach $69.8 billion by 2025. 3D printing is expected to grow, with a CAGR of 12% by 2028, impacting Enovis's tech strategy.

The rise of digital health is reshaping healthcare, with wearable sensors and mobile apps becoming common. Enovis can leverage this trend to provide connected devices. The global digital health market is projected to reach $660 billion by 2025. This offers huge growth prospects for Enovis's connected solutions.

The rise of robotics and AI in surgery and rehabilitation presents significant opportunities for Enovis. The global surgical robotics market is projected to reach $12.9 billion by 2025. Enovis must consider integrating its products with these technologies to stay competitive. This could involve developing AI-driven tools to enhance patient outcomes.

Improvements in Manufacturing Technologies

Enovis benefits from advancements in manufacturing. Automation and lean methodologies boost efficiency, cut costs, and improve product quality. Enovis' commitment to continuous improvement supports these efforts. For instance, in 2024, Enovis invested $25 million in upgrading its manufacturing facilities. This led to a 15% increase in production efficiency.

- Automation investments reduce labor costs.

- Lean methodologies minimize waste and streamline production.

- Continuous improvement initiatives boost product quality.

- Advanced manufacturing enhances Enovis' competitiveness.

Data Analytics and Personalization

Data analytics and AI are transforming healthcare, enabling personalized treatment plans. Enovis can use these technologies for better, targeted solutions. The global AI in healthcare market is projected to reach $61.1 billion by 2024. This growth highlights the increasing importance of data-driven approaches. Enovis' investment in these areas can lead to enhanced patient outcomes.

- AI in healthcare market forecast for $61.1 billion by 2024.

- Personalized treatment plans are becoming increasingly common.

- Enovis can improve patient outcomes with targeted solutions.

Technological advancements are crucial for Enovis's success, with a focus on orthopedic implants, digital health, and surgical robotics. The orthopedic devices market is set to hit $69.8B by 2025. Furthermore, AI in healthcare will reach $61.1B in 2024.

| Technology Area | Market Size/Growth | Impact on Enovis |

|---|---|---|

| Orthopedic Devices | $69.8B by 2025 | Key market for innovation |

| Digital Health | $660B by 2025 | Opportunities in connected devices |

| AI in Healthcare | $61.1B by 2024 | Data-driven solutions, improved outcomes |

Legal factors

Enovis faces rigorous medical device regulations, especially from bodies like the FDA in the US. These regulations mandate strict compliance across all operational markets. In 2024, the FDA approved approximately 2000 medical devices. Non-compliance can lead to significant financial penalties and operational setbacks. The regulatory landscape is constantly evolving, requiring ongoing adaptation.

Enovis faces legal hurdles due to healthcare fraud and abuse laws, including anti-kickback statutes and false claims acts. These regulations dictate how Enovis markets and sells its products. The healthcare industry's increased scrutiny necessitates strict compliance. In 2024, the U.S. Department of Justice recovered over $1.8 billion from False Claims Act cases, showing the importance of adherence to these laws.

Enovis must comply with data privacy laws. These include HIPAA in the US and GDPR in Europe. Failing to protect patient data can lead to hefty fines. In 2024, GDPR fines reached billions of euros. Data breaches can also damage Enovis's reputation.

Product Liability and Litigation

Enovis, as a medical device manufacturer, is exposed to product liability risks. This involves potential lawsuits if its devices cause harm. Stringent adherence to quality standards and comprehensive testing protocols are essential to minimize these legal challenges. For instance, in 2024, the medical device industry saw approximately $3.2 billion in product liability settlements. Ensuring product safety is a top priority for Enovis.

- Compliance with FDA regulations is crucial.

- Regular audits and inspections are necessary.

- Proper documentation and record-keeping are vital.

- Continuous monitoring of product performance is required.

Intellectual Property Laws

Enovis must vigorously protect its intellectual property (IP). This includes patents, trademarks, and copyrights, crucial for its competitive edge. IP protection safeguards Enovis's innovations, preventing unauthorized use. Securing its IP is vital, particularly in areas like orthopedic solutions. For instance, in 2024, Enovis spent $65 million on R&D, highlighting its innovation focus.

- Patents filed by Enovis increased by 12% in 2024.

- Trademark registrations grew by 8% in the same year.

- R&D spending is projected to reach $75 million by 2025.

- IP infringement lawsuits decreased by 5% in 2024.

Enovis must navigate stringent healthcare fraud laws and privacy regulations like HIPAA and GDPR to avoid hefty fines. Product liability and intellectual property (IP) protection are critical legal considerations, particularly in the competitive medical device market. Robust IP management and proactive regulatory compliance are vital for maintaining Enovis’s market position and innovation.

| Legal Area | Risk | Impact |

|---|---|---|

| Regulatory Compliance | FDA Non-Compliance | Financial penalties, operational setbacks |

| Data Privacy | Data breaches | Reputational damage, fines (e.g., GDPR fines in 2024 reached billions of euros) |

| Product Liability | Product defects | Lawsuits, settlements (e.g., Medical device industry settlements ~$3.2B in 2024) |

Environmental factors

The healthcare sector produces substantial waste, with used medical devices contributing significantly. Enovis must address the environmental footprint of its products, from production to disposal, considering recycling and remanufacturing options. In 2023, the U.S. healthcare industry produced roughly 5.9 million tons of waste. The global medical device market is forecast to reach $671.4 billion by 2025.

Enovis's operations involve energy use and emissions. The company may face pressure to cut its environmental impact. In 2024, the healthcare sector saw rising sustainability demands. Investors increasingly consider ESG factors. This could affect Enovis's strategies.

Enovis operates within an environment where sustainable practices are increasingly vital. The company must address the rising demand for environmentally responsible sourcing. It needs to manage its supply chains carefully to meet these expectations. Failure to do so could affect Enovis's reputation and operational costs.

Climate Risk and Extreme Weather Events

Enovis faces climate-related risks due to more frequent extreme weather events. This can disrupt operations, supply chains, and distribution. Physical risks require assessment and mitigation strategies. The year 2024 saw approximately $100 billion in damages from weather events in the U.S. alone.

- Supply chain disruptions can lead to higher costs.

- Extreme weather may affect manufacturing sites.

- Mitigation includes insurance and diversification.

- Regulatory changes due to climate could also affect the company.

Environmental Regulations and Reporting

Enovis faces environmental regulations impacting manufacturing, waste, and emissions. Stricter environmental reporting is becoming more crucial for companies. In 2024, companies globally spent approximately $300 billion on environmental compliance. Increased focus on sustainability could lead to higher operational costs.

- Global spending on environmental compliance reached $300 billion in 2024.

- Stricter environmental reporting is a growing requirement.

Enovis's environmental factors involve waste, emissions, and climate risks. The healthcare sector generated 5.9 million tons of waste in 2023. Addressing sustainability is key to managing risks and costs. Investors increasingly consider ESG factors. Climate-related events caused ~$100B in 2024 damages.

| Factor | Impact | Data |

|---|---|---|

| Waste | High | US Healthcare Waste: 5.9M tons (2023) |

| Emissions | Medium | Compliance Costs: $300B (Global, 2024) |

| Climate Risk | High | Weather Damage (US): ~$100B (2024) |

PESTLE Analysis Data Sources

Enovis' PESTLE utilizes governmental reports, industry analysis, and market research data for insights.