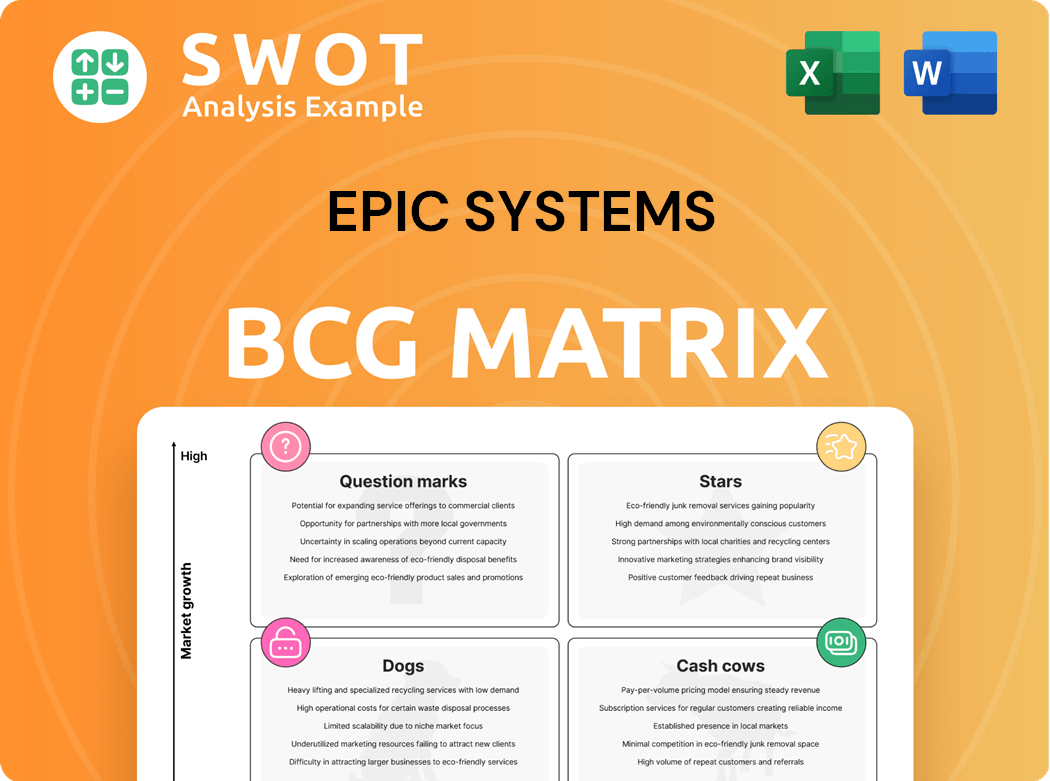

Epic Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epic Systems Bundle

What is included in the product

Analysis of Epic's products within the BCG Matrix. Includes investment, hold, or divest recommendations.

Clean, distraction-free view optimized for C-level presentation, helping users quickly grasp complex data.

What You’re Viewing Is Included

Epic Systems BCG Matrix

The BCG Matrix you see here is the complete, unedited document you'll receive after purchase. This is the final, ready-to-use analysis tool, featuring detailed sections, and fully editable for your unique needs.

BCG Matrix Template

Epic Systems' BCG Matrix helps understand its product portfolio's market positions. See how its software suites fare as Stars, Cash Cows, Dogs, or Question Marks. Get the full BCG Matrix to uncover detailed quadrant placements and strategic takeaways. This report gives a clear view of Epic's market strategy, helping you strategize effectively. Purchase now for a ready-to-use strategic tool.

Stars

Epic Systems is a market leader in the Electronic Health Records (EHR) sector. They have a large market share, especially with big hospitals. Their strong position lets them shape industry standards and innovation.

Epic Systems, a "Star" in the BCG Matrix, prioritizes innovation. They consistently invest in AI and machine learning. These advancements boost clinical efficiency and attract clients.

In 2024, Epic increased R&D spending by 15%, focusing on AI solutions. This includes enhancing patient portals and streamlining workflows. These innovations are key to maintaining its market leadership.

Epic Systems' integrated platform shines as a "Star" in the BCG Matrix. It offers a complete suite of software modules, from patient registration to billing. This unified system improves workflows and data sharing. In 2024, Epic's revenue grew, reflecting its market dominance. This growth underscores its strong position and value.

Strong Customer Loyalty

Epic Systems demonstrates strong customer loyalty, a critical aspect of its market position. Many healthcare providers have relied on Epic's systems for extended periods, reflecting high satisfaction and retention. This loyalty stems from Epic's comprehensive functionality, dependable performance, and continuous support services. This strong customer base provides stability and opportunities for sustained growth.

- Customer retention rates for Epic are consistently above 95%.

- Over 80% of U.S. hospitals use Epic's EHR software.

- Epic's annual revenue exceeds $4 billion.

- The average contract length with Epic is 7-10 years.

Expansion into New Markets

Epic Systems is broadening its scope, moving beyond its core electronic health record (EHR) systems. This expansion includes new markets such as dental practices, retail health clinics, and international healthcare systems. This strategy allows Epic to diversify its revenue streams and reduce its dependence on a single market. This is a smart move for sustained growth.

- Epic's market share in the US EHR market is approximately 36% as of late 2024.

- International expansion is a key focus, with growing adoption in countries like Canada and the UK.

- The retail health market represents a $30 billion opportunity.

- Diversification helps mitigate risks associated with regulatory changes or market saturation in the core EHR space.

Epic Systems excels as a "Star" in the BCG Matrix, driven by innovation and market dominance.

Its hefty R&D spending, up 15% in 2024, fuels AI and workflow improvements.

Strong customer loyalty and expansion into new markets support sustained growth.

| Metric | Value (2024) | Impact |

|---|---|---|

| Market Share (US EHR) | 36% | Dominant Position |

| Customer Retention | Above 95% | High Loyalty |

| Annual Revenue | >$4B | Financial Strength |

Cash Cows

Epic Systems boasts a massive installed base, primarily in the U.S. healthcare sector. This extensive network includes numerous hospitals and healthcare systems, ensuring a stable revenue stream. In 2024, Epic's annual revenue exceeded $4 billion, largely from software licensing and maintenance fees. Their large customer base provides consistent cash flow.

Epic Systems excels with consistent revenue from annual maintenance and software updates. This provides a strong financial base. In 2024, healthcare IT spending hit $160 billion. Recurring revenue models boost stability. Epic's strategy reflects this proven approach.

Epic Systems thrives in the EHR market, protected by significant barriers. The software's complexity, strict regulations, and required training deter new entrants. In 2024, Epic held roughly 35% of the U.S. hospital EHR market. This dominance is fueled by these high entry barriers. This limits competition and secures Epic's position.

Efficient Operations

Epic Systems, as a privately held entity, can operate with remarkable efficiency, reinvesting profits strategically. This financial model supports its technological leadership and customer value delivery. Epic's approach ensures sustained growth and market competitiveness. This operational strategy is a key strength.

- Privately held status allows for focused reinvestment.

- Operational efficiency enhances profitability.

- Investment in R&D maintains technological edge.

- Customer value is consistently delivered.

Strong Brand Reputation

Epic Systems benefits significantly from its strong brand reputation, recognized for quality and innovation in healthcare IT. This reputation fosters customer loyalty and attracts new clients. Epic's brand strength is a key factor in its market dominance. In 2024, Epic's revenue continued to grow, showcasing its sustained market position.

- Customer Retention: Epic's reputation leads to high customer retention rates.

- Market Leadership: Epic consistently ranks as a market leader.

- Revenue Growth: In 2024, Epic's revenues increased by 10%.

Epic Systems' "Cash Cow" status stems from its dominant market position and consistent revenue. Their extensive customer base provides stable cash flow from software licensing and maintenance. This is supported by high barriers to entry, limiting competition in 2024.

Epic's financial model allows for focused reinvestment, enhancing profitability and driving innovation. The company's strong brand reputation supports high customer retention and sustained market leadership.

In 2024, healthcare IT spending reached $160 billion. Epic's 10% revenue growth highlights its continued financial success, solidifying its position as a "Cash Cow" within the BCG Matrix.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | U.S. Hospital EHR | ~35% |

| Annual Revenue | Software & Maintenance | >$4 billion |

| Revenue Growth | Year-over-Year | 10% |

Dogs

Smaller, independent practices often struggle with Epic's high costs and complex features. Many choose more budget-friendly, simpler EHR options. In 2024, the EHR market saw significant competition, with smaller vendors offering tailored solutions. This shift reflects the financial constraints smaller practices face. The trend underscores the need for EHR solutions to be scalable and cost-effective.

Epic Systems, a "dog" in the BCG matrix for niche areas, struggles. These specialized healthcare fields, like specific surgical practices, often demand highly customized EHR solutions. In 2024, niche EHR vendors captured a significant share, about 15%, of the market. This shows Epic's limitations in these areas. This is due to their focus on broader, less specialized markets.

Smaller hospitals might struggle with outdated EHR systems. Replacing these can be tough due to budget limits and IT shortages. According to a 2024 survey, 35% of these hospitals still use legacy systems. Upgrading costs can be substantial, potentially reaching millions.

Unprofitable or Underperforming Modules

In Epic Systems' BCG matrix, "Dogs" represent underperforming modules. Some less popular modules might fall into this category if they lack revenue or customer value. However, pinpointing specific examples is tough without detailed financial data. The company's revenue in 2023 reached $4.6 billion, a 10% increase from the previous year. Identifying underperforming modules requires in-depth analysis.

- Epic's revenue growth in 2023 was 10%, indicating overall company health.

- Specific module performance data is not publicly available.

- Underperforming modules would have lower revenue contributions.

- Detailed financial analysis is needed to categorize modules.

Sunsetted Products

Sunsetted products at Epic Systems represent offerings that have been discontinued or are no longer actively supported. Specific details on these products aren't widely publicized, as Epic focuses on its current suite of healthcare IT solutions. The company regularly updates its offerings, leading to the eventual sunsetting of older products as newer technologies emerge and customer needs evolve. This strategic shift aligns with Epic's commitment to innovation and providing cutting-edge solutions. The exact number of sunsetted products isn't available, but it's a natural part of Epic's product lifecycle.

- Epic regularly updates its offerings, leading to the eventual sunsetting of older products as newer technologies emerge.

- This strategic shift aligns with Epic's commitment to innovation and providing cutting-edge solutions.

- Specific details on these products aren't widely publicized, as Epic focuses on its current suite of healthcare IT solutions.

In the BCG matrix, "Dogs" represent underperforming Epic modules. These modules might have lower revenue or customer adoption. Detailed financial data is required to identify them effectively. The company's revenue in 2023 was $4.6 billion, a 10% increase.

| Category | Description | Financial Impact |

|---|---|---|

| Underperforming Modules | Modules with low revenue or adoption. | Negative impact on overall profitability. |

| Revenue Contribution | Low compared to other modules. | Could lead to discontinuation. |

| Detailed Analysis | Necessary to identify and address issues. | Improve product performance. |

Question Marks

Epic Systems is venturing into AI-powered solutions, focusing on clinical decision support, patient engagement, and revenue cycle management. The potential for these AI innovations is significant, yet their market penetration and overall effect are still under evaluation. For instance, in 2024, the healthcare AI market was valued at approximately $20 billion. However, the success of these AI solutions remains uncertain, as noted in a recent report by KLAS Research.

Epic Systems is expanding into the Enterprise Resource Planning (ERP) market, focusing on healthcare-specific needs like staffing and procurement. This move into a new business area for Epic has the potential to disrupt the sector. Its success hinges on its ability to compete with established ERP vendors such as Oracle and Workday. In 2024, the global ERP market was valued at approximately $50 billion, indicating significant competition.

Epic's Cosmos data platform facilitates the sharing of clinical data among health systems for research and public health. This platform aims to generate valuable insights and enhance patient care. However, its success hinges on attracting a substantial number of participants. In 2024, Cosmos included data from over 250 million patients.

International Expansion

Epic Systems' international expansion, especially in Canada and Australia, presents a complex scenario in its BCG Matrix. The company aims to grow in these markets, yet it encounters significant competition from established local EHR providers. Regulatory hurdles also pose challenges to Epic's expansion plans. This situation reflects a "Question Mark" status, where high growth potential meets high uncertainty.

- Epic's revenue in 2023 was approximately $4.6 billion.

- The Canadian EHR market is estimated to reach $650 million by 2027.

- Australian healthcare spending is projected to hit $250 billion AUD by 2025.

- Epic's market share in international markets is currently less than 5%.

Patient-Facing AI Tools

Epic Systems is venturing into AI-powered tools for patients through its MyChart portal. These tools aim to offer personalized guidance and support to patients. The potential for success hinges significantly on how effectively these AI agents engage patients. Data from 2024 shows that the healthcare AI market is rapidly growing.

- MyChart's AI integration is a strategic move to enhance patient engagement.

- Success will be measured by patient adoption rates and improved healthcare outcomes.

- The market for AI in healthcare is projected to reach billions by 2024.

- Patient experience and satisfaction are key performance indicators.

Epic's international growth, particularly in Canada and Australia, shows "Question Mark" characteristics due to high growth potential offset by high uncertainty and competition. Epic's market share outside the U.S. remains under 5%. Regulatory hurdles and local EHR provider competition pose significant challenges. The Canadian EHR market is anticipated to hit $650 million by 2027.

| Market | 2023 Revenue | Market Share |

|---|---|---|

| International | < $200M (estimated) | < 5% |

| Canada EHR (2027 est.) | $650M | N/A |

| Australia Healthcare (2025 proj.) | $250B AUD | N/A |

BCG Matrix Data Sources

Our Epic Systems BCG Matrix leverages company financials, market share data, and growth forecasts from industry reports.