Epic Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epic Systems Bundle

What is included in the product

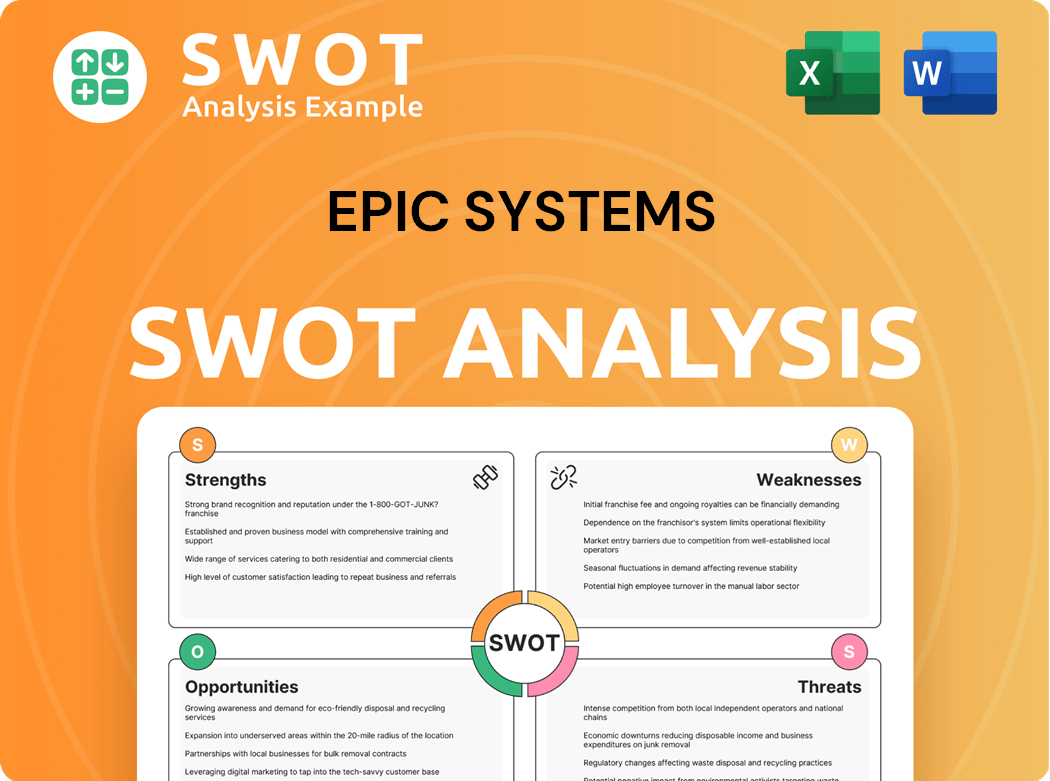

Analyzes Epic Systems’s competitive position through key internal and external factors

Simplifies complex data, making strategy planning quick and accessible.

Preview Before You Purchase

Epic Systems SWOT Analysis

You're seeing a live preview of the actual Epic Systems SWOT analysis document. Purchase to instantly download the complete report with full details. This is the exact professional-grade analysis you'll receive. No changes, just in-depth strategic insights.

SWOT Analysis Template

Epic Systems dominates the healthcare IT sector, a position built on robust strengths like integrated solutions and massive market share. Yet, it faces weaknesses like a complex implementation process and high costs. Opportunities lie in expanding cloud services and international growth. Threats include rising competition and data security risks. Want the full story behind Epic's market positioning and potential? Purchase the complete SWOT analysis to gain actionable insights and strategic planning tools.

Strengths

Epic Systems boasts substantial market dominance in the EHR sector, especially with major hospitals and health systems. This leadership position provides a significant competitive edge. Epic's widespread adoption fuels a strong network effect, making it challenging for rivals to compete. In 2024, Epic's EHR systems were used by approximately 26% of U.S. hospitals.

Epic's integrated platform provides a significant strength. Their suite covers clinical documentation and revenue cycle management, streamlining workflows. This comprehensive approach enhances data sharing across departments, boosting efficiency. Seamless integration reduces reliance on external systems, cutting costs. In 2024, Epic's revenue reached approximately $4.6 billion, reflecting its platform's value.

Epic's software offers extensive customization, adapting to diverse healthcare needs. This includes tailoring workflows and patient management. Its scalability ensures the system grows with the organization. For example, in 2024, Epic served over 300 million patients, showing its adaptability. This flexibility is a key strength.

Strong Customer Base

Epic Systems boasts a formidable customer base, dominating the EHR market with a substantial market share, especially among major hospitals and healthcare systems. This strong position gives Epic a significant competitive edge, solidifying its reputation as an industry leader. Widespread adoption creates a powerful network effect, making it tough for rivals to compete. Epic's revenue in 2023 was estimated to be around $4.6 billion, reflecting its strong customer relationships.

- Market Share: Epic holds over 30% of the US hospital EHR market.

- Client Retention: Epic's customer retention rate exceeds 95%.

- Network Effect: High adoption creates barriers to entry for competitors.

Innovation and Development

Epic Systems' strength lies in its innovation and development, providing a fully integrated suite of healthcare solutions. This comprehensive approach covers clinical documentation and revenue cycle management. Streamlining workflows and improving data sharing are key benefits. The seamless integration reduces the need for third-party systems, lowering complexity and costs.

- Epic's revenue in 2024 is estimated to be around $4.6 billion.

- Over 250 million patient records are managed within Epic systems as of late 2024.

- Epic spends approximately 20% of its revenue on research and development.

Epic's substantial market share in the EHR sector, with over 30% of the U.S. hospital market, showcases significant strength. Its fully integrated platform, which includes both clinical and financial modules, streamlines healthcare workflows efficiently. Moreover, the strong network effect and high client retention rates, exceeding 95%, underscore its market leadership.

| Key Strength | Details | 2024 Data |

|---|---|---|

| Market Dominance | Leading position in EHR market. | ~26% of U.S. hospitals use Epic; revenue ~ $4.6 billion |

| Integrated Platform | Comprehensive suite of healthcare solutions. | Manages over 250 million patient records |

| Client Retention | High customer loyalty and retention. | Retention rate above 95% |

Weaknesses

Implementing Epic's EHR system demands a significant upfront investment. Smaller healthcare organizations may struggle with the high costs of software licenses and infrastructure. IT support further increases the financial burden. This can be a major deterrent, especially for clinics with tight budgets. In 2024, initial setup costs can range from $500,000 to several million dollars.

Epic's robust customization capabilities, while beneficial, introduce complexity. Healthcare providers often need substantial IT support and training to manage the system effectively. The extensive options can overwhelm users, potentially causing operational inefficiencies. For example, in 2024, implementation costs for Epic averaged between $500,000 to $3 million depending on the size of the organization.

Epic Systems has faced criticism for interoperability limitations. Healthcare providers report challenges exchanging patient data with other EHR systems. This can hinder care coordination. In 2024, the ONC reported that about 60% of hospitals faced data-sharing issues. This issue impacts efficiency.

Customer Support Issues

Epic Systems faces weaknesses, including customer support issues. The substantial initial investment required for its EHR system can be a barrier. High costs for licenses, hardware, and IT support make it inaccessible to smaller healthcare organizations. These costs often put Epic out of reach for smaller clinics. In 2024, the average EHR implementation cost was $80,000-$150,000 per provider.

- High Implementation Costs

- Cost Barriers for Smaller Organizations

- Software and Hardware Expenses

- IT Support Costs

Vendor Lock-in

Epic's vendor lock-in presents weaknesses despite its customization strengths. Implementation and management complexity can rise, demanding significant IT support and training. New users might find navigating customization options overwhelming, leading to inefficiencies. Organizations may face challenges in switching systems due to high switching costs. The healthcare IT market was valued at $144.9 billion in 2023, indicating substantial vendor influence.

- Complexity from extensive customization.

- High implementation and maintenance costs.

- Potential for user inefficiency due to complexity.

- Challenges in switching to alternative systems.

Epic's weaknesses include substantial upfront investment needs, with 2024 setup costs up to millions. Interoperability challenges, as in 60% of hospitals facing data-sharing issues, hinder data exchange. Further, high vendor lock-in complicates system switching, with the 2023 IT market valued at $144.9B.

| Weakness | Description | 2024 Data |

|---|---|---|

| High Implementation Costs | Significant initial investment | $500,000 - millions |

| Interoperability Issues | Challenges in data exchange | 60% of hospitals face issues |

| Vendor Lock-in | Switching systems are difficult | Healthcare IT Market: $144.9B (2023) |

Opportunities

Epic Systems can expand into global markets, capitalizing on the increasing demand for EHR systems worldwide. This expansion diversifies revenue, reducing dependence on the U.S. market. Adapting software to meet country-specific regulations is vital. In 2024, the global EHR market was valued at $38 billion, presenting a significant growth opportunity.

Telehealth integration is a major opportunity for Epic Systems. The growing use of telehealth allows Epic to connect its EHR with telehealth platforms. This integration can improve how healthcare providers offer remote care. In 2024, the telehealth market is expected to reach $60 billion, showing significant growth potential.

Integrating AI and ML into Epic's EHR can boost clinical support and improve patient results. AI tools analyze patient data to identify patterns, predict risks, and personalize care. These innovations can set Epic apart and draw in new clients. The global AI in healthcare market was valued at $11.6 billion in 2023, expected to reach $187.9 billion by 2030.

Data Analytics and Reporting

Epic Systems can leverage data analytics and reporting to gain a competitive edge. This involves enhancing its software to offer advanced analytics capabilities. The market for healthcare analytics is projected to reach $68.7 billion by 2024. By providing robust reporting tools, Epic can help healthcare providers make data-driven decisions.

- Advanced analytics capabilities.

- Market size for healthcare analytics.

- Data-driven decisions.

Focus on Patient Engagement

Epic Systems can capitalize on telehealth's rise by integrating its EHR with telehealth platforms. This integration allows for efficient remote care delivery, improving patient engagement. Epic's infrastructure offers a strong foundation for innovative telehealth solutions. In 2024, telehealth utilization increased by 20% in some areas, highlighting this opportunity.

- Telehealth adoption is growing, with a 15-25% increase in virtual care utilization projected annually.

- Epic can expand its market share by offering integrated telehealth solutions.

- Investment in telehealth could yield significant returns, given the market's growth.

- Enhanced patient engagement leads to better health outcomes and increased revenue.

Epic Systems can tap into global EHR demand, projected at $38B in 2024. Telehealth integration is a lucrative path, aiming at a $60B market in 2024. Further growth lies in AI/ML enhancements. The healthcare analytics market reached $68.7 billion in 2024.

| Opportunity | Market Size (2024) | Strategic Benefit |

|---|---|---|

| Global EHR Expansion | $38 billion | Diversified Revenue |

| Telehealth Integration | $60 billion | Improved Remote Care |

| AI/ML Integration | $11.6B (2023), $187.9B (2030) | Enhanced Clinical Support |

| Data Analytics | $68.7 billion | Data-Driven Decisions |

Threats

The EHR market is intensifying, with rivals like Oracle Cerner and MEDITECH expanding their offerings. These competitors are investing heavily, presenting viable alternatives to healthcare organizations. This heightened competition could pressure Epic's pricing strategies. In 2024, Oracle Cerner's revenue grew by 5%, indicating their market presence.

Cybersecurity threats pose a significant risk to Epic Systems. Healthcare organizations are increasingly targeted by cyberattacks, potentially compromising patient data and disrupting services. Epic's EHR system is a prime target due to its central role in storing sensitive information. A data breach could severely harm Epic's reputation and lead to substantial financial and legal penalties. In 2024, healthcare data breaches cost an average of $10.9 million. Continuous investment in robust cybersecurity is crucial.

Changes in healthcare regulations pose a threat to Epic Systems. Data privacy and interoperability updates necessitate software and practice adjustments. Compliance costs and time investments are significant concerns. Non-compliance risks penalties and legal issues; for example, in 2024, HIPAA violations resulted in fines exceeding $1 million.

Economic Downturn

Economic downturns pose a significant threat to Epic Systems. The healthcare industry is sensitive to economic fluctuations, potentially impacting hospital budgets and IT spending. During economic slowdowns, healthcare organizations might delay or reduce investments in new EHR systems or upgrades. This could lead to decreased revenue and slower growth for Epic Systems.

- In 2024, healthcare spending growth slowed to an estimated 4.8%, down from 9.8% in 2021, reflecting economic pressures.

- A recession could force hospitals to postpone EHR implementations, impacting Epic's sales.

- Reduced IT budgets might lead to project delays and cost-cutting measures.

Lawsuits and Legal Challenges

Healthcare organizations face growing cyberattack threats, potentially compromising patient data and disrupting operations. Epic's EHR system, a central repository of sensitive information, is a prime target for hackers. A significant data breach could severely harm Epic's reputation, leading to legal and financial consequences. Continuous investment in cybersecurity measures is crucial to mitigate this risk.

- Cybersecurity spending in healthcare reached $12.8 billion in 2024, reflecting the escalating threat landscape.

- Data breaches in healthcare cost an average of $10.9 million per incident in 2024, according to IBM.

- Epic Systems faced several lawsuits related to data privacy in 2024, highlighting the legal risks.

Epic faces stiff competition, particularly from Oracle Cerner, who saw revenue growth of 5% in 2024. Cybersecurity is a major concern; breaches in healthcare cost about $10.9M each in 2024, impacting patient data. Changing healthcare regulations and potential economic downturns also threaten profitability.

| Threat | Description | 2024 Impact |

|---|---|---|

| Competition | Oracle Cerner and MEDITECH expanding offerings | Oracle Cerner grew revenue by 5% |

| Cybersecurity | Increasing cyberattacks, data breaches | $10.9M average cost per breach |

| Regulations/Economy | HIPAA changes, economic slowdown | Healthcare spending slowed to 4.8% growth. |

SWOT Analysis Data Sources

This SWOT analysis relies on public financial records, market analyses, and expert insights for accurate strategic insights.