Epic Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epic Systems Bundle

What is included in the product

Tailored exclusively for Epic Systems, analyzing its position within its competitive landscape.

Instantly visualize Epic's competitive landscape with color-coded force intensity levels.

Preview Before You Purchase

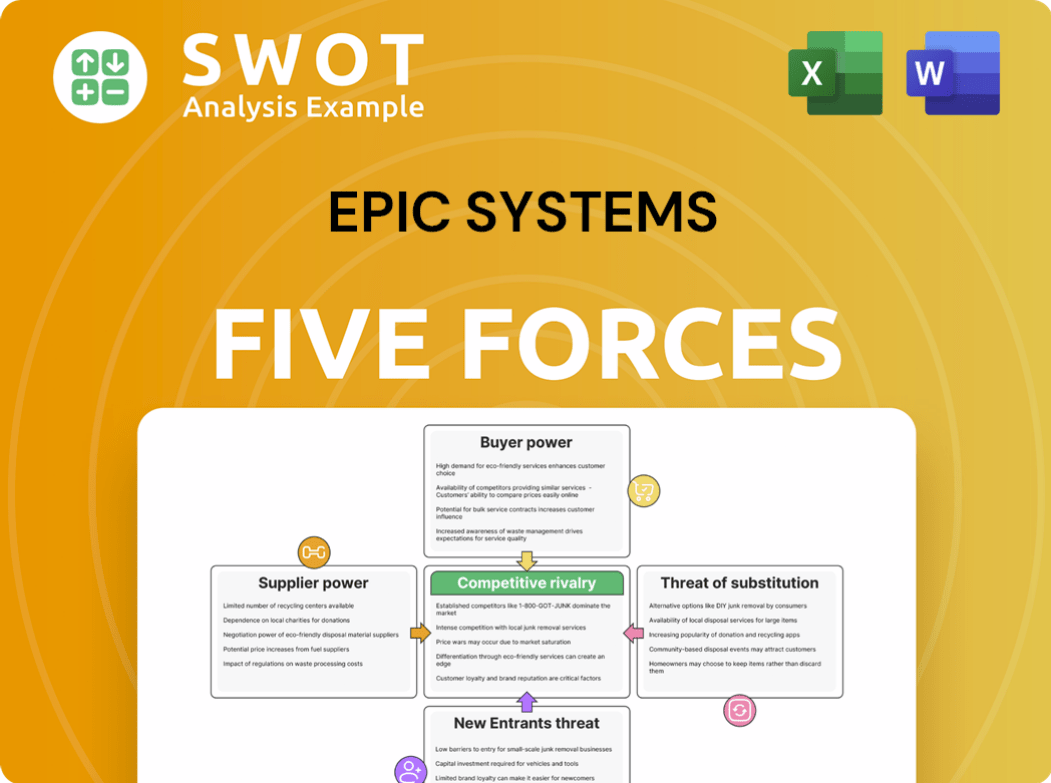

Epic Systems Porter's Five Forces Analysis

You're previewing the comprehensive Epic Systems Porter's Five Forces analysis. This document examines competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants. It provides a detailed understanding of Epic's market position and industry dynamics. The full document is professionally formatted and ready for immediate use after your purchase.

Porter's Five Forces Analysis Template

Epic Systems faces a complex competitive landscape. Buyer power is moderate due to the concentrated healthcare market. Supplier power is also moderate, influenced by technology providers. The threat of new entrants is low, with high barriers. The threat of substitutes is moderate, with some alternative solutions. Competitive rivalry is high, dominated by key players.

Ready to move beyond the basics? Get a full strategic breakdown of Epic Systems’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Epic Systems benefits from limited specialized suppliers in the healthcare software industry. The scarcity of vendors offering comprehensive EHR solutions, like Epic, boosts their bargaining power. The more specialized the technology, the more influence suppliers wield. In 2024, the EHR market is projected to reach $38 billion, highlighting supplier control.

Switching costs in the EHR market are high due to complex data migration, staff training, and workflow adjustments. These costs make healthcare providers less likely to switch, strengthening the supplier's position. Epic's market share was about 35% in 2024, indicating its strong position. Organizations face significant investment, leading to vendor lock-in.

Epic Systems' proprietary technology strengthens supplier power. Interoperability issues and unique features create customer dependence. This reliance supports Epic's pricing and contract terms. For instance, in 2024, Epic's revenue reached approximately $7 billion, showcasing its market dominance. This dominance is backed by its control over crucial healthcare IT solutions.

Strong brand reputation

Epic Systems benefits from a powerful brand and substantial market presence, especially with major hospitals. This strong reputation enables Epic to demand higher prices and greater leverage in negotiations. Their established track record and extensive features make Epic a preferred choice for many hospitals. Epic's robust market position, with over 250 million patients' records managed, strengthens its bargaining power. In 2024, Epic's revenue is estimated to be around $4 billion.

- Epic's brand strength allows premium pricing.

- Dominant market share gives negotiation advantages.

- Hospitals often choose Epic for its proven success.

- 2024 revenue is approximately $4 billion.

Focus on long-term relationships

Epic Systems prioritizes long-term partnerships with its clients, which can create customer dependence. This dependence may restrict customers' ability to negotiate better pricing or terms. Epic's focus on client success sometimes reduces flexibility in pricing strategies. In 2024, the healthcare IT market saw Epic's revenue grow, indicating strong client loyalty. This loyalty can limit the bargaining power of customers.

- Customer retention rates for Epic often exceed 95%.

- Epic's market share in the U.S. hospital EHR market is above 30%.

- Average contract length for Epic's systems is 7-10 years.

Epic Systems faces limited supplier bargaining power due to its strong market position. Its proprietary technology and brand strength reduce dependency on external suppliers. In 2024, Epic's revenue of approximately $7 billion shows strong control.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | U.S. Hospital EHR Market | Above 30% |

| Revenue | Epic's Revenue | Around $7 billion |

| Customer Retention | Epic's Retention Rate | Exceeds 95% |

Customers Bargaining Power

The consolidation of healthcare providers significantly boosts customer bargaining power, especially for large entities. Hospitals and healthcare systems merging into larger networks gain leverage. These larger organizations can negotiate lower prices and more favorable terms. For example, in 2024, the top 10 health systems accounted for over 25% of U.S. hospital admissions.

While Epic Systems dominates the EHR market, alternatives like Oracle Health (Cerner) and MEDITECH exist. These options provide customers with some bargaining power. In 2024, Epic held about 33% of the market. The availability of alternatives allows healthcare providers to negotiate. Switching costs remain a key consideration, though.

Government regulations and incentives significantly shape customer power in the EHR market. Interoperability initiatives, like those promoted by the 21st Century Cures Act, are designed to enhance data sharing, potentially reducing vendor lock-in. However, Epic has also benefited from regulations that favor comprehensive systems. In 2024, the EHR market is expected to reach $38 billion, with government policies continuing to influence vendor and customer dynamics.

Demand for value-based care

The move to value-based care boosts demand for EHRs that handle data, population health, and care coordination. Clients want systems showing better patient results and lower costs, increasing their negotiating strength. Hospitals need systems that prove their worth to succeed. The value-based care market is projected to reach $1.6 trillion by 2024, according to a report by Grand View Research.

- Value-based care models are growing.

- Clients want to see better results and lower costs.

- Hospitals need systems that demonstrate value.

- The value-based care market is large.

Access to open-source solutions

The rise of open-source EHR solutions and modular systems is shifting the balance of power. Customers now have more choices, potentially reducing their dependence on a single vendor like Epic. These open-source alternatives offer a cost-effective solution for specific needs, increasing customer bargaining power. This flexibility allows organizations to tailor their systems.

- Open-source EHR market share grew by 15% in 2024.

- Modular EHR systems can save organizations up to 20% on initial costs.

- Customer demand for open-source solutions increased by 25% in the last year.

Large healthcare networks wield significant bargaining power, negotiating favorable terms. Competition from alternatives like Oracle Health gives customers leverage. Government policies and value-based care models further shape customer influence.

| Factor | Impact | Data (2024) |

|---|---|---|

| Network Consolidation | Increased bargaining power | Top 10 health systems: >25% of US admissions |

| Market Alternatives | Negotiating leverage | Epic market share: ~33% |

| Value-Based Care | Demand for performance data | Market size: $1.6T |

Rivalry Among Competitors

The Electronic Health Record (EHR) market shows high concentration, with major players like Epic Systems and Oracle Health. This concentration fosters intense competition for market share. Leaders fight for dominance. Epic holds a significant market share. In 2024, Epic's revenue rose, showing its strong position.

EHR vendors compete by differentiating products through features, functionality, and user experience. The competitive landscape pushes for comprehensive solutions catering to healthcare providers' needs. Epic Systems invests heavily in R&D, using AI and machine learning for a competitive edge. Innovation is vital to remain at the forefront. In 2024, Epic's R&D spending was approximately $1.2 billion.

Pricing strategies, like bundled offerings and subscriptions, are vital in the EHR market. Vendors use price to gain and keep customers, especially with healthcare cost pressures. Epic faces competition from vendors like Cerner (now Oracle Health), which also uses pricing to attract clients. In 2024, the EHR market saw price wars due to budget constraints. Pricing is a key factor.

Interoperability challenges

Interoperability challenges persist, hindering seamless data exchange between EHR systems. This fuels competition as vendors, like Epic Systems, strive for superior solutions. Seamless data exchange is crucial for care coordination and attracting clients. Epic, with a 36% market share in 2024, faces rivals improving interoperability. The push for better data flow intensifies competitive rivalry.

- Limited data standardization across systems complicates interoperability.

- Vendors invest heavily in interfaces to connect with various EHRs.

- The ONC's initiatives aim to improve data sharing.

- Lack of true interoperability can create vendor lock-in effects.

Focus on customer satisfaction

In the Electronic Health Records (EHR) market, competitive rivalry strongly hinges on customer satisfaction. Vendors battle it out by offering superior support services, efficient implementation, and comprehensive training to retain customers. Customer happiness directly impacts loyalty and market share, making it a crucial factor. For instance, Epic Systems has a 28% market share in the US EHR market, which is a testament to its customer satisfaction efforts.

- Customer satisfaction is a key differentiator.

- Support services, implementation, and training are vital.

- Loyalty is crucial for market share.

- Epic Systems' market share reflects its success.

Intense competition marks the EHR market, driven by leaders like Epic. Differentiation through features and innovation, especially AI, is key. Pricing strategies and interoperability, with initiatives from the ONC, also affect competition. Customer satisfaction significantly impacts market share.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | Epic Systems | 36% |

| R&D Spending | Epic Systems | ~$1.2B |

| Customer Satisfaction | Impact on Loyalty | 28% market share |

SSubstitutes Threaten

Healthcare organizations face the threat of substitute software solutions. Many can choose practice management systems or revenue cycle management tools instead of a comprehensive EHR. For instance, in 2024, the market for healthcare IT solutions, including substitutes, reached over $150 billion. Specific solutions like athenahealth or Cerner's offerings can fulfill some EHR functions.

Paper-based systems, though declining, serve as a substitute for EHRs. Smaller healthcare providers might use them, offering a less efficient alternative. Despite their limitations, these systems remain a viable, though less attractive, option. In 2024, approximately 5-10% of healthcare providers still used primarily paper-based methods. The cost savings can be significant, potentially up to 70%, but come at the expense of efficiency and data accessibility.

The outsourcing of healthcare services, like medical billing and data analysis, presents a threat to EHR systems. Outsourcing can reduce the need for comprehensive EHR systems. Organizations may choose to outsource to third-party providers, potentially using different technology platforms. Outsourcing can decrease reliance on EHRs. In 2024, the global healthcare outsourcing market was valued at approximately $450 billion, showcasing significant growth.

Telehealth and remote monitoring

The increasing adoption of telehealth and remote patient monitoring presents a substitute threat to traditional EHR systems. These technologies offer alternatives for patient consultations and data collection, potentially lessening the reliance on in-house EHR features. Remote patient monitoring, for example, is projected to reach a market size of $1.7 billion by 2024. This shift indicates a growing preference for remote solutions.

- Telehealth market is valued at $62.7 billion in 2024.

- Remote patient monitoring market is projected to reach $1.7 billion by 2024.

- The use of remote monitoring is expected to grow, substituting some EHR functions.

- These remote solutions are becoming increasingly popular alternatives.

AI-driven solutions

AI-driven solutions are emerging substitutes for some EHR functionalities. These tools streamline clinical documentation, diagnosis, and decision support. They boost efficiency, potentially lessening reliance on traditional EHR features. The global AI in healthcare market was valued at $12.8 billion in 2023 and is projected to reach $196.1 billion by 2032. AI offers enhanced efficiency.

- Market Growth: The AI in healthcare market is experiencing significant expansion.

- Efficiency Gains: AI streamlines workflows, improving operational efficiency.

- Substitution Risk: AI tools can replace some EHR functionalities.

- Financial Impact: AI adoption could influence EHR market dynamics.

The threat of substitutes for Epic Systems comes from various sources, including healthcare IT solutions and paper-based systems. Outsourcing and telehealth also offer alternatives, influencing the market. AI-driven solutions further provide substitutes, impacting traditional EHR functionalities.

| Substitute Type | Impact on Epic | 2024 Data |

|---|---|---|

| Healthcare IT | Offers alternatives | Market: $150B+ |

| Paper-based Systems | Less efficient alternative | 5-10% use |

| Telehealth | Remote patient monitoring | $1.7B market |

Entrants Threaten

The EHR market demands substantial capital for software development, infrastructure, and regulatory compliance, with Epic Systems investing billions. High capital requirements, like the estimated $1 billion needed to build a basic EHR system, create a significant barrier. This limits the threat of new entrants, as substantial investment is needed to compete, impacting market dynamics in 2024.

Stringent regulatory requirements significantly impact new entrants in the EHR market. Healthcare's complex rules for data security and privacy act as a barrier. Meeting these standards demands substantial investment. Compliance costs for EHR systems can exceed $10 million, as seen in recent audits. This deters smaller firms.

Epic Systems benefits from strong brand loyalty within the EHR market, a significant barrier to entry. Many healthcare providers are hesitant to switch from well-established systems. In 2024, Epic held around 35% of the U.S. hospital EHR market. Switching costs and trust are critical factors. This makes it challenging for new entrants to compete effectively.

Network effects

EHR systems experience network effects, boosting value with more users. This strengthens established vendors like Epic. Epic's vast user base and network give them a competitive edge. A large network is an advantage in this market. For example, in 2024, Epic's market share was estimated to be around 35%, showcasing its strong network effect.

- Epic's large user base enhances its competitive advantage.

- Network effects make it harder for new entrants to compete.

- Established vendors benefit from interconnected healthcare providers.

- Market share data from 2024 supports this analysis.

Rapid technological advancements

The EHR market is experiencing rapid technological advancements, including artificial intelligence, cloud computing, and enhanced interoperability standards. New entrants face the challenge of keeping pace with these innovations. Innovation is crucial for competitiveness.

- AI in healthcare is projected to reach $67.4 billion by 2024.

- Cloud computing adoption in healthcare is growing, with a market size of $35.1 billion in 2023.

- Interoperability standards are essential for data exchange.

- New entrants must invest heavily in R&D to compete effectively.

The EHR market's high entry barriers, including substantial capital and stringent regulations, protect existing players like Epic. In 2024, building a basic EHR system costs about $1 billion, deterring new entrants. Strong brand loyalty and network effects further fortify this defense.

| Factor | Impact on New Entrants | Data (2024) |

|---|---|---|

| Capital Needs | High barrier due to development and compliance costs | Basic EHR system cost: ~$1B |

| Regulatory Hurdles | Complex data and security rules | Compliance costs can exceed $10M |

| Brand Loyalty | Established firms benefit, making it hard to switch | Epic's market share: ~35% |

Porter's Five Forces Analysis Data Sources

Our analysis is informed by industry reports, financial statements, and market research data. We also use company filings and competitive intelligence for deep insights.