Equinox Gold Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

What is included in the product

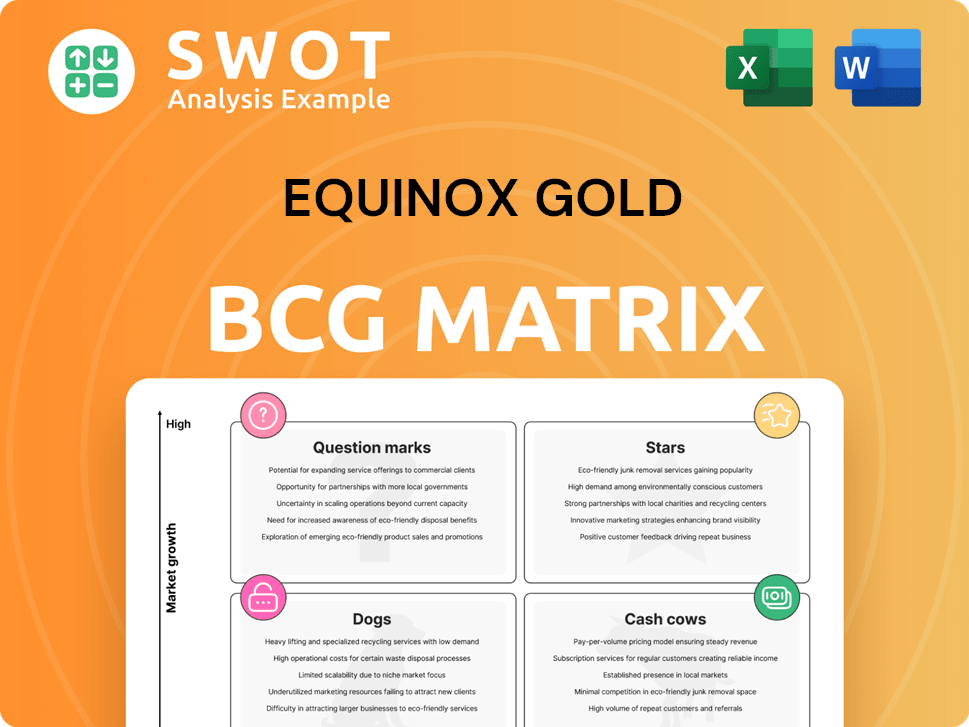

Equinox Gold's BCG Matrix analyzes its gold assets. This examines investment, holding, or divestment strategies.

One-page overview placing each business unit in a quadrant.

Full Transparency, Always

Equinox Gold BCG Matrix

The BCG Matrix preview is the complete document you'll download. It's a ready-to-use strategic tool designed for business insights and planning.

BCG Matrix Template

Equinox Gold's BCG Matrix reveals its product portfolio's strengths and weaknesses, helping you understand where to invest.

Are its gold mines Stars, generating high revenue in a fast-growing market, or are they Dogs, requiring significant resources with low growth?

This initial glimpse showcases how Equinox Gold strategically positions itself.

Purchase the full BCG Matrix and unlock detailed quadrant placements, data-driven recommendations, and a strategic roadmap.

Gain a competitive edge and make informed investment choices with the complete analysis.

It's your shortcut to understanding Equinox Gold's market position and making smart decisions.

Stars

The Greenstone Mine in Ontario, Canada, began commercial production in November 2024, a pivotal moment for Equinox Gold. This mine is set to significantly boost Equinox Gold's output. Greenstone is projected to yield roughly 390,000 ounces of gold annually for the initial five years. Equinox Gold's full ownership underscores its commitment.

The Fazenda Mine, part of Equinox Gold's portfolio, has extended its operational life to 2033, thanks to successful exploration. This extension is crucial, enhancing Equinox Gold's long-term production capabilities. The mine's history and increased reserves solidify its role in generating consistent cash flow. In 2024, the mine produced 50,000 ounces of gold.

The Aurizona expansion is a "Star" for Equinox Gold, indicating high growth and market share. This Brazilian mine expansion boosts gold production, a key strategic move. In Q3 2024, Aurizona produced 30,960 ounces of gold. This growth project could significantly increase annual gold output.

Merger Synergies

The merger of Equinox Gold and Calibre Mining is a strategic move, aiming to form a leading gold producer focused on the Americas. This union is projected to yield about 950,000 ounces of gold in 2025, with potential for over 1.2 million ounces per year. The integration enhances portfolio diversification, thus lowering overall risk and boosting shareholder value significantly.

- Production Target: Approximately 950,000 ounces of gold in 2025.

- Long-Term Goal: Potential to surpass 1.2 million ounces annually.

- Strategic Benefit: Enhanced portfolio diversification and risk reduction.

- Financial Impact: Significant shareholder value creation expected.

Strong 2024 Performance

Equinox Gold's 2024 performance shines, marking it as a "Star" in the BCG Matrix. The company's financial health is evident through its record-breaking 2024 results. This strong showing is a testament to its effective growth strategy and operational prowess. The company's success is further highlighted by the commencement of production at the Greenstone Mine, contributing significantly to its robust performance.

- 623,579 ounces of gold sold in 2024.

- $1.5 billion in revenue.

- Operating cash flow of $430 million.

- Production from the Greenstone Mine.

Equinox Gold's "Stars" like Aurizona and the 2024 performance highlight its high growth. The Greenstone Mine's 390,000-ounce annual yield boosts production. The merger with Calibre aims for 950,000 ounces in 2025.

| Metric | 2024 Result |

|---|---|

| Gold Sold (ounces) | 623,579 |

| Revenue ($B) | $1.5 |

| Operating Cash Flow ($M) | $430 |

Cash Cows

Mesquite Gold Mine in California is a cash cow for Equinox Gold, delivering consistent performance. The mine's reliable production and cost-effectiveness generate a steady cash flow. In 2024, Mesquite produced around 150,000 ounces of gold. This asset requires lower capital expenditures, making it a valuable contributor.

The Santa Luz Gold Mine, a key asset for Equinox Gold in Brazil, consistently generates revenue. As a mature operation, it demands less capital for marketing and distribution. In Q3 2024, Santa Luz produced 25,469 ounces of gold. Optimizing infrastructure boosts its cash flow, increasing profitability.

The RDM Gold Mine in Brazil is a consistent cash generator for Equinox Gold. Its steady output helps balance the company's growth initiatives. In 2024, RDM contributed significantly to Equinox's overall gold production. Operational enhancements are key to boosting its profitability.

Los Filos Gold Mine (Conditional)

The Los Filos Gold Mine could become a cash cow for Equinox Gold if community agreements are finalized. These agreements are crucial for continued operations. Equinox Gold needs to secure long-term deals with all three local communities. Success hinges on these agreements.

- 2023 Los Filos production: 170,780 ounces of gold.

- 2024 guidance: 150,000 - 165,000 ounces of gold.

- One community agreement is still pending.

Fazenda Technical Report

Equinox Gold's Fazenda mine, highlighted in the updated technical report, is a "Cash Cow" in their BCG matrix. The report projects mine operations extending to 2033, increasing the mine's lifespan. In 2025, Equinox Gold forecasts gold production between 635,000 and 750,000 ounces. The company anticipates cash costs of $1,075 to $1,175 per ounce and AISC of $1,455 to $1,550 per ounce for the same period.

- Mine life extension to 2033.

- 2025 gold production: 635,000-750,000 ounces.

- 2025 cash costs: $1,075-$1,175/oz.

- 2025 AISC: $1,455-$1,550/oz.

Equinox Gold's cash cows consistently generate revenue with low capital needs. Mines like Mesquite and Santa Luz demonstrate steady output. In 2024, the Fazenda mine extended its operational life to 2033.

| Mine | Location | 2024 Production (oz) |

|---|---|---|

| Mesquite | California | ~150,000 |

| Santa Luz | Brazil | 25,469 (Q3) |

| Fazenda | Brazil | N/A (Extended Life) |

Dogs

Assets like those not crucial to Equinox Gold's strategic goals or with poor performance are "dogs." These assets may hinder capital use. Selling them could unlock funds for better ventures. In 2024, Equinox Gold's focus is on core projects. This would be a smart move, considering gold prices.

Operations with high production costs and low margins place Equinox Gold in the dogs category. These mines might struggle to profit, especially if gold prices drop. For instance, in 2024, some of Equinox's operations likely saw tighter margins. Turnaround plans may be ineffective, making divestiture a better choice.

Properties with limited exploration potential are classified as dogs. These assets offer little growth opportunity. Equinox Gold's 2024 report showed some mines with limited upside. Focusing on better prospects is key for resource allocation. This strategy aims to maximize returns.

Assets Facing Significant Environmental Challenges

Assets like those facing major environmental or regulatory issues often end up in the "Dogs" quadrant of a BCG matrix. These assets struggle due to rising costs and operational disruptions, potentially impacting overall profitability. For instance, in 2024, regulatory changes increased compliance costs for certain mining operations. Selling these assets can prevent future liabilities and free up resources for more promising ventures.

- High Compliance Costs: Environmental regulations lead to increased operational expenses.

- Operational Disruptions: Regulatory changes can halt or delay projects.

- Liability Mitigation: Selling reduces potential environmental and financial risks.

- Resource Allocation: Allows investment in more profitable areas.

Underperforming Expansion Projects

Expansion projects that underperform or fail to meet return expectations are considered dogs. Equinox Gold might reassess these projects, especially if they're unlikely to boost returns. Continuing to invest in underperforming projects can be a poor use of capital. Divesting these projects can free up resources for better investments.

- Equinox Gold's 2023 production was 550,590 ounces of gold, a slight decrease from 2022.

- The company's all-in sustaining costs (AISC) in 2023 were $1,477 per ounce, indicating potential cost issues.

- Poor performance could lead to a reevaluation of their growth strategy.

- Focusing on core assets and optimizing operations could be a strategic shift.

Dogs in the BCG matrix represent assets with low market share in slow-growing markets. Equinox Gold may categorize underperforming mines as dogs. This categorization helps identify assets for potential sale to reallocate resources.

Specifically, in 2023, Equinox Gold's AISC of $1,477 per ounce might flag certain operations. These assets can strain profitability and capital. Strategically, selling these assets enables investment in more promising areas.

In 2024, the company focused on optimizing core projects. This strategic shift potentially includes divesting underperforming assets to maximize returns. The key is to use resources effectively.

| Category | Characteristics | Strategic Action |

|---|---|---|

| High Cost Operations | High AISC, low margins | Divestiture |

| Limited Exploration | Low growth potential | Asset sale |

| Regulatory Issues | Increased compliance cost | Reduce future liabilities |

Question Marks

The Valentine Gold Mine, part of Equinox Gold's portfolio, currently fits the "question mark" category. Acquired via the Calibre Mining merger, its future is uncertain until mid-2025. The mine's success, aiming for 175,000-195,000 ounces annually, will reclassify it. This project represents a key investment for Equinox Gold.

The Los Filos expansion project's future hinges on community negotiations. A positive outcome could transform Los Filos into a "star," increasing Equinox Gold's value. However, failure could relegate it to a "dog." In 2024, Equinox Gold's production guidance was 525,000-575,000 gold ounces. The expansion's impact is substantial.

Phase 2 of Castle Mountain's expansion is a question mark in Equinox Gold's BCG Matrix. Its success hinges on permit approvals and timely construction. Projected production boosts are crucial for its future classification. In 2024, Equinox Gold's gold production was approximately 510,000 ounces. The expansion aims to significantly increase this.

Early-Stage Exploration Projects

Equinox Gold's early-stage exploration projects are classified as question marks in the BCG matrix. These ventures have high growth prospects but involve substantial risk, similar to other gold exploration companies in 2024. Successful exploration could significantly boost Equinox's reserves and production. However, there's a risk of these projects not yielding expected results.

- Equinox Gold's 2023 exploration budget was approximately $60 million.

- Early-stage projects have a failure rate of about 80%, based on industry averages.

- Successful discoveries can increase a company's market capitalization significantly.

- Risk is mitigated through diversification across multiple projects.

Calibre Mining Integration

The integration of Calibre Mining is a question mark for Equinox Gold in its BCG Matrix. The success hinges on how well Equinox combines Calibre's assets and operations. Equinox Gold reported record results for 2024, with 623,579 ounces of gold sold and $1.5 billion in revenue. The integration's effectiveness will determine the merger's value creation.

- Equinox Gold produced 621,870 ounces of gold in 2024.

- Revenue reached $1.5 billion in 2024.

- Operating cash flow was $430 million.

Several Equinox Gold projects, like Valentine Gold Mine and early-stage explorations, currently reside in the "question mark" category. Success hinges on factors like mine performance and exploration outcomes. High growth potential is combined with significant risk, as seen with industry averages. Effective integration of Calibre Mining is also crucial.

| Project | Status | Key Factors |

|---|---|---|

| Valentine Gold Mine | Question Mark | Production, integration |

| Los Filos Expansion | Question Mark | Community negotiation |

| Castle Mountain Phase 2 | Question Mark | Permits, construction |

| Exploration Projects | Question Mark | Exploration success |

| Calibre Mining Integration | Question Mark | Operational synergy |

BCG Matrix Data Sources

The Equinox Gold BCG Matrix utilizes financial reports, market growth analyses, and sector forecasts for a data-driven approach.