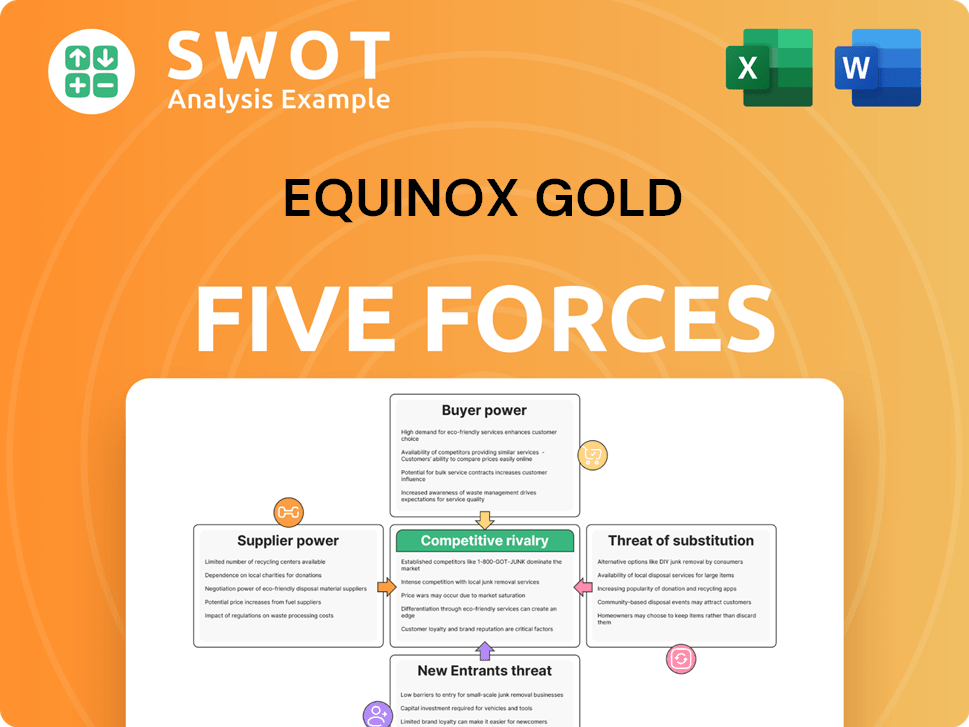

Equinox Gold Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

What is included in the product

Analyzes Equinox Gold's position, evaluating competitive forces impacting pricing, and profitability.

Quickly identify threats/opportunities, armed with a dynamic, auto-updating view of the competitive landscape.

Same Document Delivered

Equinox Gold Porter's Five Forces Analysis

This is the complete Porter's Five Forces analysis of Equinox Gold. The preview you are currently viewing is identical to the fully formatted document you will receive immediately after your purchase.

Porter's Five Forces Analysis Template

Equinox Gold faces moderate buyer power due to fluctuating gold prices, impacting revenue predictability. Supplier power is also moderate; mining equipment and services have alternatives. The threat of new entrants is low, given high capital requirements and regulatory hurdles. Substitute threats are limited, with gold's unique properties. Competitive rivalry is intense within the gold mining sector, with several established players.

Unlock the full Porter's Five Forces Analysis to explore Equinox Gold’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Equinox Gold faces supplier power due to limited specialized equipment providers. These suppliers, holding significant bargaining power, can dictate prices. Increased equipment costs directly impact Equinox Gold's profitability, potentially squeezing margins. In 2024, the mining equipment market saw price hikes, affecting firms like Equinox Gold. Passing these costs to customers becomes crucial for maintaining financial health.

If suppliers consolidate, Equinox Gold faces fewer choices, strengthening their power. This could mean higher prices and reduced flexibility. For example, in 2024, the price of key mining consumables like cyanide increased due to supplier concentration. Equinox Gold should cultivate relationships with various suppliers to lower this risk.

Equinox Gold's input costs, like energy and steel, are affected by commodity prices. When prices rise, suppliers gain bargaining power and may increase prices. For instance, steel prices in 2024 saw fluctuations, impacting construction and equipment costs. Equinox Gold may need to seek alternative suppliers to manage these costs. In 2024, gold prices traded around $2,000/oz, influencing the company's profitability and supplier relations.

Dependence on specific suppliers

Equinox Gold's reliance on specific suppliers can significantly impact its operations. The company might depend on a few key suppliers for essential services or equipment, increasing its vulnerability to price hikes or supply chain disruptions. If a critical supplier faces financial difficulties or ceases operations, Equinox Gold would need to quickly find alternative sources. For example, in 2024, supply chain issues caused delays and increased costs for many mining companies.

- Supplier concentration can lead to higher costs.

- Disruptions from suppliers can halt production.

- Finding replacements can be time-consuming.

- Supplier financial health is a key risk.

Geopolitical influences

Geopolitical instability and trade tensions can disrupt supply chains, increasing supplier bargaining power. For Equinox Gold, trade tensions might introduce tariffs, raising input costs. Delays could also arise from geopolitical events. In 2024, gold prices saw fluctuations due to global events.

- Geopolitical events can cause delays and increase costs.

- Trade tensions may lead to tariffs on inputs.

- Supplier bargaining power is heightened during instability.

- Gold price volatility reflects global impacts.

Equinox Gold faces supplier power due to specialized equipment and input costs. Concentrated suppliers and commodity price fluctuations increase their bargaining power, potentially raising costs. Geopolitical instability and trade tensions can further disrupt supply chains, affecting profitability.

| Factor | Impact on Equinox Gold | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Higher costs, reduced flexibility | Cyanide price increase, impacting production costs |

| Commodity Price Fluctuations | Increased input costs, margin squeeze | Steel price volatility, impacting construction costs |

| Geopolitical Instability | Supply chain disruptions, delays | Trade tensions affecting tariffs and gold prices |

Customers Bargaining Power

Gold, as a commodity, trades on global markets, which dictates its price. Individual buyers have minimal leverage to negotiate prices with Equinox Gold. The company must accept the prevailing market rate. In 2024, gold prices fluctuated, impacting revenue. For example, in Q3 2024, gold averaged around $2,000 per ounce.

The gold market features numerous buyers, like jewelers and investors, diluting the influence of any individual. This widespread demand prevents any single buyer from dictating terms to Equinox Gold. In 2024, global gold demand, driven by investment and central bank purchases, reached approximately 4,899 tons. This diversified demand base limits the bargaining power of customers over Equinox Gold. Therefore, no single buyer possesses significant leverage.

The demand for gold fluctuates with price changes, impacting gold producers like Equinox Gold. In 2024, gold jewelry sales showed sensitivity to price hikes. High prices can deter consumers, affecting the revenue Equinox Gold gets. For example, in the first half of 2024, a 10% rise in gold prices led to a 5% drop in jewelry sales.

Access to information

Customers of Equinox Gold have significant bargaining power due to readily available information on gold prices. This allows them to easily compare prices across different producers, enhancing their ability to negotiate favorable terms. The transparency in the gold market, where prices are widely publicized, enables customers to shop around effectively.

- Gold prices are tracked globally, with real-time data available from sources like the London Bullion Market Association (LBMA).

- In 2024, the average gold price was approximately $2,070 per ounce.

- This price transparency gives customers a strong basis for negotiation.

- Equinox Gold's ability to maintain competitive pricing is crucial.

Central bank influence

Central banks' actions heavily impact gold prices, affecting Equinox Gold's revenue. Their buying and selling activities can significantly shift market dynamics. For instance, reduced central bank purchases can lead to lower gold prices, hurting Equinox Gold. This highlights the crucial role of central banks in the company's financial outcomes.

- Central banks hold a substantial amount of global gold reserves.

- Changes in central bank gold buying can shift market sentiment.

- Lower demand from central banks can decrease gold prices.

- Equinox Gold's profitability is sensitive to these price fluctuations.

Equinox Gold faces moderate customer bargaining power. Customers have access to transparent, real-time pricing data, enhancing their negotiation leverage. However, the diverse customer base, including jewelers and investors, prevents any single entity from significantly influencing prices.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Transparency | High, enabling comparisons | LBMA gold price: ~$2,070/oz |

| Customer Diversity | Reduces buyer influence | Global demand: ~4,899 tons |

| Price Sensitivity | Affects demand | 10% price rise, ~5% drop in jewelry sales (H1) |

Rivalry Among Competitors

The gold mining sector, including companies like Equinox Gold, is highly competitive due to the presence of many players. This intense rivalry can squeeze profit margins. Equinox Gold competes with both major global miners and smaller firms. In 2024, the gold price fluctuated, impacting all producers. This environment demands operational efficiency and strategic agility.

Industry consolidation is a key factor in the gold mining sector. Mergers and acquisitions, like the Equinox Gold and Calibre Mining deal, are becoming more prevalent. This trend results in larger, more competitive entities. These bigger companies can wield greater market influence. In 2024, Equinox Gold produced 550,000 ounces of gold.

Geographic diversification exposes Equinox Gold to varied competitive pressures. Operating across the Americas, it encounters distinct market dynamics. Tailoring strategies to regional conditions is crucial. For example, Equinox Gold's 2024 production guidance spans multiple mines in different countries. This highlights the need for localized competitive responses.

Cost of production

Companies with lower production costs possess a significant competitive edge in the gold mining industry. Equinox Gold must vigilantly manage its production expenses to remain competitive. Effective cost control is crucial for maintaining profitability, particularly during periods of fluctuating gold prices. In 2024, Equinox Gold's all-in sustaining costs (AISC) were approximately $1,400-$1,500 per ounce.

- Lower AISC allows for profitability even when gold prices drop.

- Equinox Gold aims to optimize costs across its operations.

- Cost management is vital for long-term sustainability.

- Efficient operations improve competitiveness.

Barriers to exit

High initial investments and strict environmental rules form significant exit barriers, keeping competition fierce. This can force firms to stay in the market, even when losses occur, intensifying the pressure on other players. Equinox Gold must understand that unprofitable operations can persist, affecting the competitive landscape. In 2024, the gold mining sector faced increased regulatory scrutiny, potentially raising these exit barriers.

- Significant capital investments.

- Environmental regulations.

- Continued competition.

- Potential for unprofitable operations.

Equinox Gold faces intense competition within the gold mining industry due to many players vying for market share. Mergers and acquisitions, such as the Calibre Mining deal, create larger competitors. Companies with lower production costs hold a competitive edge, with Equinox Gold's 2024 AISC between $1,400-$1,500 per ounce.

| Factor | Impact | Example (2024) |

|---|---|---|

| Market Rivalry | High due to numerous players | Many competitors vying for market share |

| Consolidation | Creates larger, stronger entities | Equinox Gold and Calibre Mining deal |

| Cost Management | Critical for profitability | Equinox Gold AISC: $1,400-$1,500/oz |

SSubstitutes Threaten

Gold competes with stocks, bonds, real estate, and cryptos. In 2024, the S&P 500 rose over 20%, influencing investment choices. Higher returns elsewhere can decrease gold demand. Bitcoin's volatility in 2024, with significant price swings, also impacts gold's appeal. Alternatives' performance directly affects Equinox Gold.

Other precious metals, like silver, platinum, and palladium, can replace gold in some uses. Their price changes impact gold demand. If silver becomes cheaper, demand for gold could decrease. In 2024, silver's price fluctuated, affecting investor choices. This substitution risk is a key consideration.

Recycled gold acts as a substitute for newly mined gold, especially when prices are up. High gold prices incentivize recycling, boosting the supply of recycled gold. This increased supply can reduce the need for newly mined gold. In 2024, the World Gold Council reported that recycling significantly impacted the gold market. Around 1,238 tons of gold were recycled globally.

Technological advancements

Technological advancements pose a threat to Equinox Gold. Innovations that diminish gold's use in electronics or other areas could lower demand. For example, the electronics sector consumed around 326 tonnes of gold in 2024, a decrease from previous years due to material substitutions. New technologies might also lessen gold's appeal. This could impact Equinox Gold's revenues and profitability.

- Substitution of gold in electronics is a key trend.

- The electronics sector’s gold consumption is decreasing.

- Technological changes can directly affect gold demand.

- Equinox Gold's financial performance is at risk.

Changes in consumer preferences

Changes in consumer preferences pose a threat to Equinox Gold. A decline in interest in gold jewelry or other gold products could decrease demand. Shifting tastes, like a preference for digital assets over traditional gold, can also impact demand. The World Gold Council reported a drop in gold jewelry demand in 2023, indicating a changing market. This trend highlights the importance of understanding consumer behavior.

- 2023 saw a decrease in gold jewelry demand.

- Consumer preferences are evolving.

- Digital assets could be a substitute.

- Equinox Gold needs to monitor these changes.

Substitute assets like stocks, bonds, and cryptos affect gold demand. The S&P 500 rose over 20% in 2024, impacting investor choices. Cheaper alternatives like silver also influence gold’s appeal. These factors directly impact Equinox Gold.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Stocks | Higher returns reduce gold demand | S&P 500 +20% |

| Silver | Cheaper silver decreases gold demand | Silver price fluctuated |

| Recycled Gold | Increases supply, reduces need for new gold | 1,238 tons recycled |

Entrants Threaten

The gold mining industry demands substantial capital for exploration, development, and ongoing operations, which forms a significant hurdle for new companies. This high capital requirement acts as a major deterrent, making entry difficult. In 2024, the average cost to build a new gold mine ranged from $500 million to over $1 billion, a significant barrier. This high initial investment requirement limits the number of potential new entrants.

The gold mining industry faces substantial barriers to entry, primarily due to long lead times. Discovering a gold deposit and bringing it into production can span several years, deterring quick market entry. The permitting process itself is notoriously lengthy and complex, adding to the delay. Equinox Gold, for example, experienced project delays. In 2024, the average time to bring a new mine online was approximately 7-10 years.

Stringent regulations pose a significant barrier for new gold mining entrants. Compliance with environmental and safety standards drives up initial capital expenditures and ongoing operational costs. For instance, environmental remediation can cost millions; Equinox Gold's all-in sustaining costs (AISC) per ounce were $1,467 in 2023. These costs make it harder for new firms to compete.

Access to resources

New entrants face hurdles in securing resources. Established gold miners control many prime gold deposits, creating a barrier. Equinox Gold competes with these incumbents. This limits the availability of new gold assets. Securing land and permits can be costly and time-consuming.

- Equinox Gold's 2023 proven and probable gold reserves were 6.5 million ounces.

- Securing permits and licenses can take several years.

- Established firms often have existing infrastructure and relationships.

- New entrants need significant capital for exploration and development.

Economies of scale

Established gold mining companies like Equinox Gold often benefit from significant economies of scale, providing them with a cost advantage. These larger companies can spread their fixed costs over a higher volume of production, leading to lower per-unit costs. New entrants face challenges competing on cost, especially in the initial stages of their operations.

- Equinox Gold's all-in sustaining costs (AISC) were approximately $1,387 per ounce in 2024.

- Larger companies can negotiate better deals with suppliers.

- Economies of scale impact profitability.

- New entrants may require higher gold prices to be profitable.

The gold mining sector presents formidable barriers to new entrants, primarily due to the high capital needed. Building a new mine can cost over $1 billion. Long lead times, averaging 7-10 years, and complex permitting processes further deter new companies.

Stringent regulations and the control of prime gold deposits by established firms also restrict market access. Equinox Gold's AISC in 2024 was approximately $1,387 per ounce. New entrants struggle against these established players with economies of scale.

| Factor | Impact on New Entrants | 2024 Data |

|---|---|---|

| Capital Requirements | High initial investment | Mine construction costs: $500M-$1B+ |

| Lead Times | Extended project timelines | Avg. 7-10 years to production |

| Regulations | Increased operational costs | Equinox Gold AISC: ~$1,387/oz |

Porter's Five Forces Analysis Data Sources

Equinox Gold analysis utilizes company filings, financial reports, and market research to understand its competitive landscape.