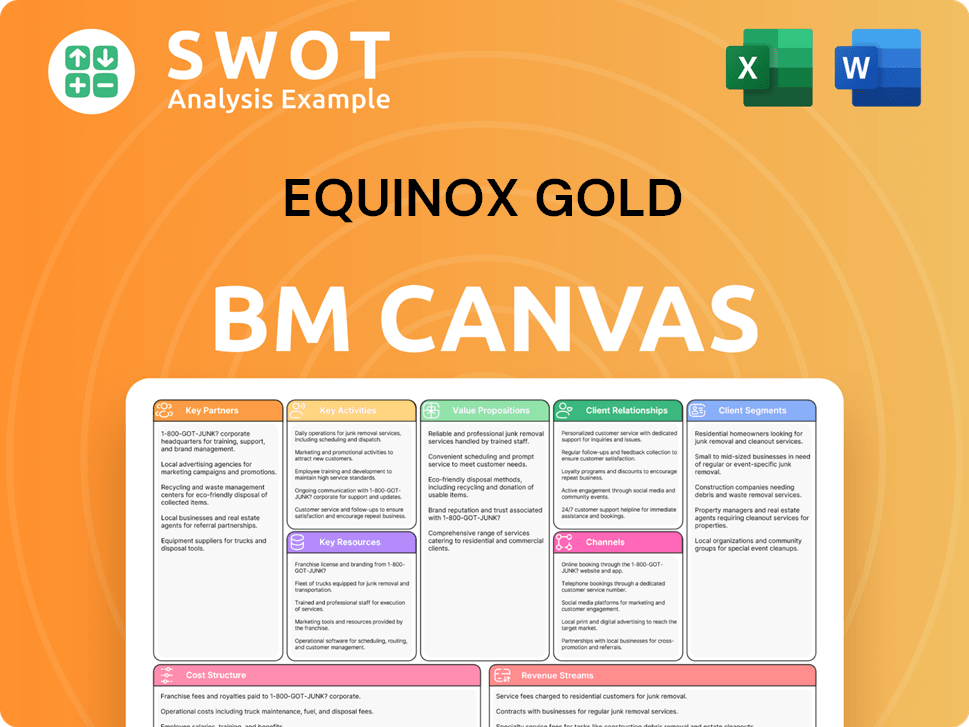

Equinox Gold Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equinox Gold Bundle

What is included in the product

Equinox Gold's BMC details customer segments, channels, and value propositions. It offers insights for presentations and funding discussions.

Condenses Equinox Gold's complex strategy into a clear, digestible format for quick review.

Delivered as Displayed

Business Model Canvas

This preview shows a live view of the Equinox Gold Business Model Canvas document. After purchase, you'll receive this exact, ready-to-use file. It's formatted as seen here, with all content accessible for immediate use. No changes or hidden sections; the file you get is identical. Edit, present, and utilize the complete document immediately.

Business Model Canvas Template

Understand Equinox Gold's strategy with its Business Model Canvas. This tool reveals key activities, customer segments, and revenue streams. Analyze partnerships and cost structures for a complete picture. It's essential for investors and analysts. Get the full canvas for detailed insights!

Partnerships

Equinox Gold strategically teams up with other mining firms to share expertise, cutting costs and boosting efficiency. These alliances give access to new tech and talent, driving innovation and productivity. Partnerships help manage risks in exploration, supporting sustainable growth; in 2024, Equinox Gold's partnerships included collaborations focused on operational improvements.

Equinox Gold's success hinges on solid community agreements, vital for operational licenses and project progress. These agreements create jobs, support local economies, and fund local infrastructure. By building trust, Equinox Gold minimizes disruptions. In 2024, community investment totaled $18.5 million, reflecting this commitment.

Equinox Gold's success hinges on strong ties with government and regulatory bodies. These partnerships are crucial for securing permits and licenses, ensuring operations meet environmental standards. Compliance with safety and legal requirements is a top priority, fostering trust. In 2024, Equinox Gold's focus on transparent practices helped navigate regulatory hurdles, avoiding project delays.

Suppliers and Contractors

For Equinox Gold, key partnerships with suppliers and contractors are essential for smooth mining operations. These partners deliver critical equipment, materials, and services, supporting everything from drilling to maintenance. Strong relationships secure competitive pricing and timely, high-quality services, crucial for cost-efficiency. Effective supply chain management is a core part of Equinox Gold's strategy.

- In 2024, Equinox Gold's total operating costs were approximately $1.55 billion.

- Equinox Gold relies on various contractors for specialized services, including mining and processing activities.

- Efficient supply chain management helps in controlling costs and improving operational performance.

- Successful partnerships contribute significantly to the company's operational effectiveness.

Financial Institutions

Financial institutions are vital for Equinox Gold, providing essential capital for exploration, development, and expansion. Equinox Gold collaborates with banks and investment firms to secure loans and equity financing. These partnerships enable access to capital at competitive rates, supporting growth and financial stability. In 2024, Equinox Gold managed its debt effectively, with total debt at $275 million as of Q3 2024. Prudent financial management is crucial for investing in the future and creating shareholder value.

- Securing Capital: Partnerships with financial institutions provide access to funds for projects.

- Debt Management: Equinox Gold actively manages its debt levels to maintain financial health.

- Favorable Terms: Strong relationships lead to better interest rates and financing conditions.

- Strategic Growth: Access to capital supports the company's expansion plans and long-term goals.

Equinox Gold's success is significantly shaped by key partnerships.

These collaborations with financial institutions, suppliers, and others ensure operational efficiency and financial strength.

In 2024, Equinox Gold maintained effective supply chain management to help control costs and improve operational performance, while managing its debt at $275 million as of Q3 2024.

| Partnership Type | Benefit | 2024 Data |

|---|---|---|

| Financial Institutions | Capital Access | Total Debt: $275M (Q3) |

| Suppliers/Contractors | Cost Efficiency | Operating Costs: $1.55B |

| Mining Firms | Tech and Efficiency | Collaborations for Improvement |

Activities

Equinox Gold actively seeks new gold deposits via exploration. In 2024, they invested significantly in exploration, allocating a substantial portion of their capital. This included drilling and geological surveys to find and define gold resources, which is vital for future mine development. They conduct feasibility studies and environmental assessments. This strategy aims to sustain growth and boost shareholder value.

Equinox Gold's primary activity revolves around extracting gold ore from its mines. This involves open-pit and underground mining methods to maximize production. Key operations include drilling, blasting, and ore hauling. In 2024, Equinox Gold's operations produced approximately 540,000 ounces of gold. They utilize skilled personnel and advanced tech for safe, efficient mining.

Equinox Gold's key activities include ore processing and refining. Extracted ore is processed to extract gold. This involves crushing, grinding, and leaching to dissolve gold. Gold doré bars are produced using techniques like CIP/CIL. In 2023, Equinox Gold produced 532,975 ounces of gold.

Project Development and Expansion

Equinox Gold focuses on expanding production through new projects and existing mine expansions. This involves securing permits, building processing facilities, and developing infrastructure. These activities require significant capital and careful planning. Equinox Gold uses experienced project management teams and follows rigorous methodologies for timely and budget-conscious project completion. Successful project development is crucial for long-term growth and boosting shareholder value.

- In 2024, Equinox Gold invested significantly in projects like the AurMac project, aiming to increase gold production.

- The company's budget allocation for project development and expansion was approximately $100 million in 2024.

- Equinox Gold's project pipeline included feasibility studies and construction phases across various global locations.

- The company's growth strategy aims for a 20% increase in gold production by 2026 through these projects.

Environmental Management and Sustainability

Equinox Gold prioritizes environmental management and sustainability through various activities. They conduct environmental impact assessments and implement pollution control measures to minimize their footprint. The company engages in land rehabilitation and collaborates with local communities and regulators. Equinox Gold invests in renewable energy and water conservation for resource efficiency.

- In 2024, Equinox Gold's environmental expenses were approximately $20 million.

- The company aims to reduce greenhouse gas emissions by 30% by 2030.

- Equinox Gold has allocated $15 million for community engagement and environmental projects in 2024.

- Water recycling rates at their operations reached 75% in 2024.

Equinox Gold's Key Activities encompass exploration, mine operations, ore processing, project development, and environmental management. They focus on finding new gold deposits through exploration, allocating a significant portion of capital for activities like drilling and geological surveys. In 2024, Equinox Gold's exploration budget was approximately $40 million, showing commitment to growth.

Mining gold ore using open-pit and underground methods forms a core activity, involving drilling, blasting, and ore hauling. In 2024, Equinox Gold produced roughly 540,000 ounces of gold through these operations. The company emphasizes safe, efficient mining using skilled personnel and advanced technology.

Ore processing and refining are critical for extracting gold from the mined ore, including crushing, grinding, and leaching, followed by the production of gold doré bars. They prioritize project development and mine expansions to increase production capacity; the company's project pipeline included the AurMac project, with an estimated budget of $100 million in 2024.

| Activity | Description | 2024 Data |

|---|---|---|

| Exploration | Finding new gold deposits. | $40M Exploration Budget |

| Mining | Extracting gold ore. | ~540,000 oz Gold Produced |

| Project Development | Expanding production. | $100M Project Budget |

Resources

Equinox Gold's core value lies in its gold reserves and resources. These represent the economically viable gold deposits the company can mine. As of year-end 2023, Equinox Gold reported total proven and probable gold reserves of 6.8 million ounces. The quality and quantity of these reserves directly affect production and profit. Equinox Gold focuses on exploration and acquisitions, crucial for boosting reserves and extending mine life.

Equinox Gold's success hinges on its mining equipment and infrastructure. This includes excavators, trucks, and processing plants, crucial for extracting and processing ore. Infrastructure like roads and power grids are also vital for operational efficiency. In 2024, Equinox Gold allocated significant capital, approximately $75 million, for sustaining capital expenditures, which includes equipment upkeep and infrastructure maintenance. This investment directly supports the company's ability to maintain its production targets and control costs.

Equinox Gold relies heavily on its skilled workforce to extract and process gold. This includes geologists and engineers. In 2024, the company employed approximately 2,500 people across its operations. Equinox Gold spends on average $10 million annually on training programs. A safe and healthy work environment is a priority.

Mining Licenses and Permits

Mining licenses and permits are vital for Equinox Gold's operations, granting the legal right to explore, develop, and operate mines. These are issued by government agencies and necessitate adherence to environmental and regulatory standards. In 2024, Equinox Gold's success heavily relies on maintaining these licenses, which directly impact production. The company actively engages with regulators and communities, ensuring compliance and fostering positive relationships. This approach is critical for securing and retaining these essential permits.

- Regulatory compliance is a top priority for Equinox Gold.

- Strong stakeholder relationships are essential for license maintenance.

- Equinox Gold's operational success is tied to these licenses.

- The company's approach supports sustainable mining practices.

Financial Capital

Financial capital is vital for Equinox Gold's operations, projects, and acquisitions. This includes cash reserves, debt financing, and equity investments. Equinox Gold's financial health is crucial for its growth. They use prudent financial management and strategic capital allocation for shareholder value.

- In 2024, Equinox Gold reported significant cash and cash equivalents.

- Debt financing and equity investments are part of their capital structure.

- The company focuses on a diversified funding strategy.

- Strategic capital allocation aims for financial stability.

Key resources for Equinox Gold include its gold reserves, mining equipment, and workforce. Licenses and permits are crucial, enabling exploration and operation, impacting production directly. Strong financial capital through cash, debt, and equity supports growth and operational needs.

| Resource | Description | 2024 Data/Facts |

|---|---|---|

| Gold Reserves | Economically viable gold deposits. | 6.8M oz proven & probable (2023). |

| Mining Equipment & Infrastructure | Excavators, plants, roads, power. | $75M sustaining capex (2024). |

| Workforce | Geologists, engineers, operational staff. | Approx. 2,500 employees (2024). |

| Licenses & Permits | Legal right to operate mines. | Compliance and community engagement. |

| Financial Capital | Cash, debt, equity. | Significant cash & equivalents (2024). |

Value Propositions

Equinox Gold provides a dependable gold supply, crucial for industries and investors. The firm's diverse mines ensure stable output, mitigating site-specific issues. This consistent production generates steady revenue, backing growth and dividends. In 2024, Equinox Gold produced approximately 530,000 ounces of gold.

Equinox Gold's growth strategy centers on expanding gold production through exploration, development, and strategic acquisitions. The company's project pipeline is designed to increase its production capacity. In 2024, Equinox Gold produced approximately 530,000 ounces of gold. This growth focus aims to enhance revenue and profitability, offering investors the potential for long-term capital appreciation.

Equinox Gold's geographic diversification is a core value proposition. The company operates across the Americas, mitigating risks from single-country exposure. This resilience is crucial, especially considering the industry's volatility. In 2024, Equinox Gold's diversified assets helped navigate fluctuating gold prices and political landscapes. This strategy aims for a more stable, predictable investment.

Responsible Mining Practices

Equinox Gold prioritizes responsible mining, focusing on environmental stewardship and sustainability. This includes adhering to strict environmental regulations and investing in pollution control. Their commitment boosts their reputation and secures their operational license, reducing environmental liability risks. For 2024, Equinox Gold invested $15 million in environmental protection measures. This approach appeals to socially responsible investors.

- Adherence to environmental regulations.

- Investment in pollution control measures.

- Engagement with local communities.

- Reduction of environmental liability risks.

Experienced Management Team

Equinox Gold's strength lies in its seasoned leadership. The management team boasts extensive mining experience, crucial for navigating industry complexities. Their expertise supports operational efficiency and strategic growth. This team's vision boosts investor confidence, aiming for long-term value.

- In 2024, Equinox Gold's leadership oversaw the production of 534,940 ounces of gold.

- The team's strategic decisions led to a 2024 revenue of $1.05 billion.

- Experienced leadership is vital for projects like the Aurizona mine expansion.

- Their industry network helps secure favorable deals and partnerships.

Equinox Gold offers a steady gold supply for industrial and investment needs, producing around 530,000 ounces in 2024. Their diverse mining locations across the Americas reduce single-country risks, contributing to investment stability. They emphasize responsible mining and environmental stewardship.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Consistent Gold Supply | Reliable output for industries and investors. | Approx. 530,000 ounces of gold produced. |

| Geographic Diversification | Operations across the Americas reduce risks. | Assets across multiple countries. |

| Responsible Mining | Focus on environmental and social responsibility. | $15 million invested in environmental protection. |

Customer Relationships

Equinox Gold's direct sales to refiners is a cornerstone of its strategy. This approach gives the company control over pricing and payment terms, boosting revenue, and lowering transaction costs. Maintaining strong refiner relationships is crucial for a dependable sales channel. In 2024, gold prices fluctuated, emphasizing the importance of these relationships. Regular dialogue with refiners helps Equinox Gold adapt to market shifts.

Equinox Gold often utilizes long-term contracts to sell its gold, providing price certainty, as spot prices fluctuate. In 2024, these contracts helped stabilize revenue streams. Securing favorable terms and strong customer relationships are key. These contracts facilitate growth.

Maintaining open communication builds trust and attracts capital. Equinox Gold uses presentations, calls, and website updates. They regularly share financial performance and strategic initiatives. Addressing investor inquiries helps maintain a positive relationship. Good investor relations are key to the customer relationship strategy. In 2024, Equinox Gold's investor relations efforts included quarterly earnings calls and presentations, with a focus on its AurMac project, and the company’s stock price performance.

Community Engagement

Equinox Gold prioritizes robust community engagement to maintain its social license. This involves open consultations, partnerships, and investment programs. In 2024, community investments totaled over $5 million, demonstrating a commitment to local areas. Their customer relationship strategy focuses on trust and mutual benefit. Addressing concerns and supporting local economies are vital.

- Community investments exceeded $5 million in 2024.

- Active engagement through consultations.

- Focus on employment and local business support.

- Key to securing the social license.

Government and Regulatory Liaison

Equinox Gold's success hinges on strong ties with government and regulatory bodies. These relationships are vital for securing permits and licenses, essential for operational continuity. They actively engage with officials to ensure compliance with all environmental and safety standards. This proactive approach helps navigate complex processes, reducing potential project delays. Maintaining these relationships is key to their operational strategy.

- In 2023, Equinox Gold spent $1.6 million on community relations, including government liaison.

- Regulatory compliance costs are a significant operational expense, impacting project profitability.

- Effective liaison can shorten permitting times, saving time and resources.

- Strong relationships can help mitigate risks associated with changing regulations.

Equinox Gold's customer relationships focus on diverse stakeholders, including refiners, investors, communities, and governments. Direct sales to refiners, often through long-term contracts, provide revenue certainty, crucial in fluctuating gold markets like in 2024. Active engagement, such as community investments exceeding $5 million in 2024, and regulatory compliance, strengthen trust.

| Customer Segment | Relationship Type | Key Activities (2024) |

|---|---|---|

| Refiners | Direct Sales, Contracts | Price negotiation, volume agreements |

| Investors | Reporting, Communication | Quarterly calls, website updates, presentations |

| Communities | Engagement, Investment | Consultations, local economic support, $5M+ investments |

Channels

Equinox Gold's direct sales force negotiates gold sales directly with refiners, fostering strong customer relationships. This personalized approach allows tailored sales strategies, meeting customer needs effectively. The team maintains key customer relationships, ensuring a reliable sales channel. Sales management and customer service are vital for revenue and profitability. In 2023, Equinox Gold's revenue was approximately $850 million, highlighting the impact of effective sales strategies.

Equinox Gold actively engages in industry conferences and trade shows. This strategy allows them to connect with potential customers, promote their offerings, and understand current market dynamics. These events are platforms to highlight company capabilities, increase brand visibility, and gather leads. For example, in 2024, the mining industry saw a 15% increase in trade show attendance.

Equinox Gold's online presence is vital for stakeholder communication. The website details operations, projects, and finances. Social media shares news and industry insights. In 2024, Equinox Gold's website saw a 15% increase in investor traffic. Effective online engagement builds brand awareness and attracts investors.

Investor Relations Activities

Equinox Gold actively engages with investors via presentations, calls, and website updates, ensuring transparency. These channels share financial results, operational progress, and strategic plans. Addressing investor questions and concerns is crucial for fostering trust and attracting capital. In 2024, Equinox Gold's investor relations efforts included several presentations and earnings calls.

- Investor presentations regularly update stakeholders.

- Conference calls offer direct Q&A.

- Website updates provide financial and operational data.

- Effective IR helps attract and retain investors.

Partnership Networks

Equinox Gold's partnership networks are crucial for its operational and strategic success. The company collaborates with various entities to boost efficiency and market reach. These alliances facilitate resource and knowledge sharing, optimizing operations and cutting expenses. For example, in 2024, Equinox Gold partnered with several exploration companies to enhance its project pipeline.

- Partnerships include collaborations with other mining companies, suppliers, and contractors.

- These partnerships offer opportunities for resource sharing and expertise exchange.

- Effective partnership management is key for mutual success and goal alignment.

- Partnerships are vital for expanding the company's global presence.

Equinox Gold uses direct sales, attending conferences and leveraging its online presence for customer engagement. Investor relations, through presentations, calls, and website updates, build trust. Partnerships with mining companies and suppliers enhance operational and strategic success, broadening market reach and resources.

| Channel Type | Description | Impact |

|---|---|---|

| Direct Sales | Negotiating gold sales with refiners. | $850M revenue in 2023. |

| Industry Events | Attending trade shows. | 15% attendance increase in 2024. |

| Online Platforms | Website and social media. | 15% investor traffic in 2024. |

Customer Segments

Precious metals refiners are key customers for Equinox Gold, purchasing doré bars. Refiners extract pure gold and other metals from the doré. They prioritize consistent supply, competitive pricing, and dependable delivery. In 2024, Equinox Gold reported $174.5 million in revenue from gold sales. Establishing strong refiner relationships secures long-term sales.

Financial institutions, including banks and investment funds, are key investors in Equinox Gold, viewing gold as a hedge and safe asset. They closely monitor financial performance, growth prospects, and risk management. In 2024, Equinox Gold's investor relations efforts focused on maintaining a strong relationship with financial institutions. The company's Q3 2024 financial results showed a slight decrease in gold production due to operational challenges.

Jewelry manufacturers form a key customer segment, utilizing gold in their production processes. They prioritize high-quality gold, ethical sourcing, and a dependable supply chain. Equinox Gold can attract these manufacturers by showcasing responsible mining practices, which is increasingly important. In 2024, the global jewelry market was estimated at over $300 billion, highlighting the significance of this segment.

Industrial Users

Industrial users form a crucial customer segment for Equinox Gold, leveraging gold's unique properties. Gold's conductivity and corrosion resistance make it essential across various industries. This segment encompasses electronics manufacturers, medical device companies, and aerospace firms, among others. Ensuring that gold meets stringent quality standards is key for sales.

- Electronics: Gold is used in connectors, switches, and circuits.

- Medical Devices: Gold is used in implants and diagnostic tools.

- Aerospace: Gold is used in aircraft components.

Central Banks

Central banks, like the Bank of Canada, maintain gold reserves as part of their foreign exchange. They prioritize Equinox Gold's long-term viability, political stability, and ethical mining. These institutions seek sustainable and responsible practices, essential for their investment. Building trust involves showcasing adherence to stringent environmental and social governance standards.

- Bank of Canada held 1.8 million ounces of gold in 2023.

- Central banks globally added 1,037 tonnes of gold to their reserves in 2023.

- Equinox Gold's focus on ESG is vital for attracting central bank investment.

- The company's operational transparency is key to building trust.

Government entities, such as regulatory bodies and tax authorities, are also crucial for Equinox Gold. These entities ensure the company's compliance with laws and regulations, affecting its operational costs and long-term sustainability. Regulatory compliance and tax payments are integral to Equinox Gold's financial obligations. The company must demonstrate accountability and adhere to these requirements.

| Segment | Description | Importance |

|---|---|---|

| Government | Regulatory bodies | Ensures compliance |

| Central Banks | Maintains reserves | Adds to reserves |

| Industrial | Electronics,Medical | Essential across industries |

Cost Structure

Mining and processing costs are direct expenses for extracting gold ore. This includes drilling, crushing, and leaching. Efficient operations are crucial for cost control. Ore grade and technology influence these costs. In Q1 2024, Equinox Gold reported all-in sustaining costs of $1,643 per ounce.

Equinox Gold's exploration and development expenses involve finding new gold deposits and preparing existing mines. These costs include geological surveys, drilling, and feasibility studies. In 2024, Equinox Gold allocated a substantial portion of its budget, approximately $60 million, towards exploration and development activities. This investment is vital for long-term production and future growth. However, these expenses can be considerable, impacting short-term profitability.

Administrative and corporate overheads at Equinox Gold cover headquarters, salaries, and professional fees. In 2023, Equinox Gold reported administrative expenses of $31.1 million. Cost control is crucial to manage these costs effectively. As Equinox Gold expands, economies of scale may help decrease these expenses.

Royalties and Taxes

Royalties and taxes represent significant costs for Equinox Gold, essential for gold extraction rights. These payments to governments and landowners vary based on jurisdiction and mineral rights. Taxes encompass income, property, and other levies impacting profitability. For instance, in 2024, Equinox Gold's tax expenses and royalties could range from 5% to 10% of revenue, depending on location and production levels. Efficient management of these costs is critical for financial success.

- Royalty rates vary, affecting overall costs.

- Taxes include income, property, and other levies.

- Understanding these costs is crucial for profitability.

- In 2024, costs could be 5%-10% of revenue.

Environmental and Social Costs

Equinox Gold faces environmental and social costs to comply with regulations and manage mining impacts. These costs involve pollution control, land rehabilitation, and water management. Social aspects include community programs, job creation, and infrastructure. Maintaining a social license and reducing future risks depend on responsible practices. In 2024, Equinox Gold allocated significant funds to these areas.

- Environmental spending includes $20-30 million annually for reclamation and remediation.

- Social investments involve $10-15 million per year for local community programs.

- Compliance expenses average $5-10 million yearly.

- These figures are subject to change based on project developments and regulatory requirements.

Cost Structure is crucial for Equinox Gold's financial health. In 2024, significant expenses included $60M for exploration and development and royalties/taxes at 5-10% of revenue. Environmental and social costs also demand significant investment, totaling $35-55 million annually.

| Cost Category | Description | 2024 Estimated Costs |

|---|---|---|

| Mining and Processing | Extraction of gold ore | $1,643/oz (Q1 2024, AISC) |

| Exploration and Development | Finding and preparing new mines | $60M |

| Royalties and Taxes | Payments for mining rights | 5-10% of Revenue |

Revenue Streams

Equinox Gold's main income comes from selling gold doré bars to refiners. The amount of gold sold and market prices set their revenue. Hedging helps manage price risks, securing future sale prices. They aim to increase revenue by diversifying sales channels and building strong refiner relationships. In 2024, gold prices showed volatility, impacting revenue.

Equinox Gold's mines might generate by-products like silver or copper, alongside gold. Selling these by-products helps lower gold production costs and boosts profit. In 2024, the company's operations likely saw revenue from these additional metals. Proper processing and marketing are key to making the most of this income stream. For example, in 2023, some gold miners reported that by-product sales reduced their overall operating costs.

Equinox Gold utilizes streaming and royalty agreements, a key revenue stream. These agreements involve selling a portion of future gold production to secure upfront capital. In 2024, this approach helped fund project development. Careful management is essential to optimize the value received from these deals.

Equity Investments

Equinox Gold's revenue streams include equity investments, which involve stakes in other mining ventures. These investments generate income through dividends and capital gains from share sales. Careful management of these holdings is crucial for boosting returns and spreading risk. In 2024, such strategies were vital for navigating market volatility.

- Dividends from investments can provide a steady income stream.

- Capital gains occur when investments are sold at a profit.

- Strategic diversification reduces overall investment risk.

- Market analysis is essential for informed investment decisions.

Other Income

Other income for Equinox Gold could stem from various sources beyond its core mining operations. This might include interest earned on cash reserves or revenue generated from renting out properties. The sale of non-core assets can also contribute, though less predictably. Effective management of these additional income streams is key to optimizing overall financial performance.

- Interest income from cash reserves can fluctuate based on interest rates; in 2024, rates have varied.

- Rental income, if applicable, depends on property holdings and market conditions.

- Sales of non-core assets are sporadic but can provide a financial boost.

- In 2023, Equinox Gold's revenue was $840.5 million.

Equinox Gold's revenue primarily comes from gold sales to refiners, with prices and volumes affecting income. By-product sales, like silver and copper, boost revenue and lower production costs. Streaming and royalty agreements offer upfront capital in exchange for future production shares. In 2023, Equinox Gold's revenue was $840.5 million.

| Revenue Stream | Description | Impact |

|---|---|---|

| Gold Sales | Sale of gold doré bars | Main revenue source, dependent on gold price |

| By-product Sales | Sales of silver, copper, etc. | Increases revenue, reduces production costs |

| Streaming & Royalties | Agreements for future gold production | Provides upfront capital |

Business Model Canvas Data Sources

Equinox Gold's canvas is based on company reports, market research, and financial data analysis. This ensures accurate and strategic business modeling.