Equitable Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equitable Bundle

What is included in the product

Equitable's BCG Matrix analysis: strategic investment recommendations, considering competitive landscapes.

Export-ready design enables fast BCG Matrix insertion into executive presentations.

What You’re Viewing Is Included

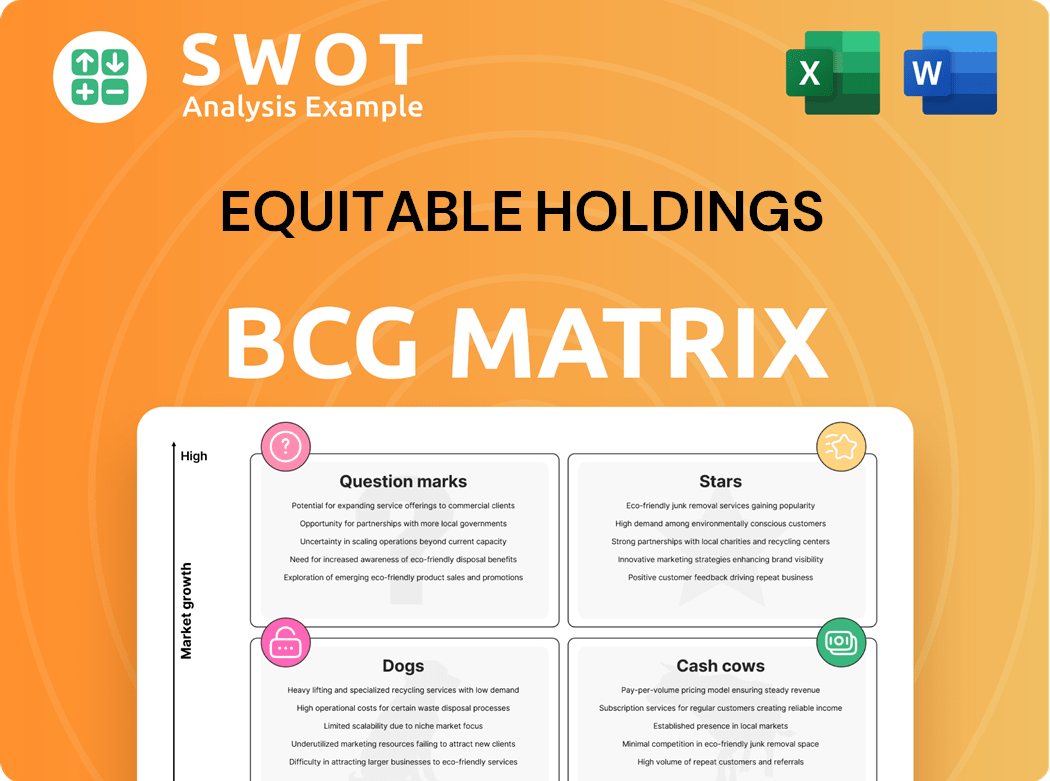

Equitable Holdings BCG Matrix

The preview displays the complete Equitable Holdings BCG Matrix you'll obtain upon purchase. Receive the fully formatted report, tailored for immediate strategic application within your business. No edits are needed; this is the final product, ready to download and utilize.

BCG Matrix Template

Equitable Holdings' BCG Matrix offers a glimpse into its product portfolio, highlighting strengths and weaknesses. This analysis categorizes products into Stars, Cash Cows, Dogs, and Question Marks, revealing their market position. Understand which offerings drive growth and where investments are best placed. Explore the strategic implications of each quadrant and how Equitable navigates its competitive landscape. This is just a snippet of the full picture. Purchase the full BCG Matrix for a comprehensive strategic advantage.

Stars

Equitable Holdings saw significant inflows in its Retirement business. The full-year 2024 net inflows hit a record $7.1 billion, with $1.6 billion in Q4. This performance positions the Retirement segment as a 'Star' in the BCG Matrix. Continued investment is crucial to sustain this positive trend. The goal is to evolve into a 'Cash Cow'.

Equitable Holdings' Wealth Management advisory net inflows reached $4.0 billion in 2024, demonstrating robust growth. Advisor productivity surged by 10% year-over-year, indicating efficiency gains. This positions Wealth Management as a 'Star' within the BCG Matrix, reflecting its competitive edge. Further investments in technology can sustain this positive trajectory.

AllianceBernstein, a key part of Equitable Holdings, showed strong performance in 2024. It achieved $4.3 billion in active net inflows. This reflects the appeal of their investment strategies. The consistent inflows highlight their potential for future expansion.

RILA Market Leadership

Equitable Holdings shines as a leader in the RILA market, a 'Star' in their BCG Matrix. RILAs are the fastest-growing segment in variable annuities. This market position stems from strong product offerings. Strategic focus on R&D will further solidify their dominance.

- Equitable's RILA sales reached $5.5 billion in 2023, up from $4.2 billion in 2022.

- RILA market growth is projected to continue, with an estimated 15-20% annual growth rate.

- Equitable holds a significant market share, estimated at over 20% in the RILA sector.

- The company's innovation in product design and distribution channels is key.

Strategic Reinsurance and Capital Deployment

Equitable Holdings' strategic reinsurance deal with RGA, valued at over $2 billion, is a key move. This capital will be used to boost its stake in AllianceBernstein and buy back shares. Such actions are typical of a 'Star' in the BCG Matrix, indicating strong growth. This strategy aims to improve financial health and drive future expansion.

- Reinsurance deal with RGA valued over $2 billion.

- Planned capital redeployment: increased stake in AllianceBernstein and share repurchases.

- Aims to enhance financial health and growth.

Equitable Holdings showcases multiple 'Stars' in its BCG Matrix. These segments, including Retirement and Wealth Management, are experiencing robust growth. RILA market dominance and strategic capital moves further cement their 'Star' status. Ongoing investments are vital to sustain this momentum.

| Segment | 2024 Performance | Strategic Actions |

|---|---|---|

| Retirement | $7.1B net inflows | Continued investment |

| Wealth Mgmt | $4.0B net inflows | Tech investment |

| RILA | Market leader | R&D focus |

Cash Cows

Even after reinsuring 75% of its individual life insurance, the remaining block is a Cash Cow. This segment offers steady revenue. The focus is efficient administration. Customer service maximizes profitability. In 2024, Equitable's net income was $2.2 billion.

The Legacy segment, a Cash Cow in Equitable Holdings' BCG Matrix, mainly involves the fixed-rate GMxB business. This established business generates consistent cash flow, vital for financial stability. Equitable focuses on efficient management to maximize value from this segment. In 2024, the company's focus remains on optimizing these legacy products.

Equitable's established annuity products, with a large customer base, are cash cows. They produce steady revenue with lower marketing costs. In 2023, Equitable's annuity sales reached $30.6 billion, showing strong, consistent performance. Focus is on keeping customers happy and managing the portfolio well for profit.

Group Retirement Services

Equitable Holdings' Group Retirement Services, offering tax-deferred investment plans, exemplifies a Cash Cow within the BCG matrix, generating steady, predictable revenue. This segment benefits from a large, established base of employer-sponsored plans, reducing the need for significant new customer acquisition investments. The focus is on maintaining and improving service quality to retain existing clients and ensure continued profitability. In 2024, the retirement services market is estimated to be worth over $7.5 trillion.

- Stable Revenue: Consistent income from existing retirement plans.

- Low Investment: Reduced need for aggressive customer acquisition.

- Focus: High service quality for client retention.

- Market Value: Over $7.5T in 2024.

Portion of Wealth Management Business

A segment of Equitable's Wealth Management, particularly the established, less risky areas, fits the Cash Cow profile. This includes services for clients with long-term investment plans. The goal is to keep client relationships strong and generate steady returns. These mature segments provide predictable revenue streams. In 2024, Equitable's Wealth Management saw a steady flow of assets.

- Focus is on stable, long-term client relationships.

- Provides consistent returns.

- Generates predictable revenue streams.

- In 2024, Equitable's Wealth Management showed stable asset growth.

Equitable's Cash Cows generate dependable revenue with minimal new investment. These segments include established products like annuities and retirement services, focusing on client retention. They are crucial for financial stability. In 2024, Equitable's annuity sales continued to be strong.

| Segment | Focus | 2024 Performance |

|---|---|---|

| Annuities | Client retention | Strong sales |

| Retirement Services | Service quality | $7.5T Market |

| Wealth Management | Client relationships | Stable asset growth |

Dogs

Traditional life insurance, lacking unique features, often lands in the "Dogs" quadrant. These products face slow growth and market share struggles. In 2024, overall life insurance sales slightly decreased, reflecting this trend. Equitable might consider divesting or phasing out these underperforming products. The goal is resource allocation for better returns.

Certain run-off products, as highlighted in Equitable Holdings' financial reports, fall into the Dogs category of the BCG Matrix. These are products that the company is actively phasing out, leading to declining revenue streams. In 2024, Equitable reported a decrease in revenue from these legacy products. The focus remains on efficient management of the run-off process to mitigate any potential losses. Specifically, the company aims to minimize the impact on its overall profitability by carefully overseeing these declining assets.

Underperforming investment strategies within AllianceBernstein, a subsidiary of Equitable Holdings, might be categorized as Dogs in the BCG Matrix. These strategies, failing to meet benchmarks, could include specific actively managed funds. For example, a 2024 report showed some of AB's strategies lagged peers. Restructuring or closure could be necessary to boost overall portfolio performance. The company needs to make informed decisions based on these assessments.

Products with High Capital Requirements and Low Returns

Products with high capital needs and low returns are typically "Dogs." These products consume considerable resources without offering substantial profits. In 2024, a study showed that firms with a high percentage of Dogs often underperform. Companies might consider selling these assets or reducing investment. Reallocating capital to more profitable areas is crucial.

- Significant capital investment with poor returns characterizes Dogs.

- These products drain resources.

- Divestment or re-evaluation is often the strategy.

- Focus on more profitable areas is essential.

Segments with Negative Net Flows

In the Equitable Holdings BCG Matrix, segments consistently facing negative net flows are classified as Dogs. This signifies customer loss and asset decline, signaling potential market appeal issues or competitive disadvantages. For example, in 2024, a hypothetical segment might see a 5% annual decline in assets under management due to outflows. The company must address the root causes, such as poor performance or changing market dynamics, and consider corrective actions or exit strategies.

- Negative net flows indicate customer attrition.

- Dogs often lack market appeal.

- Corrective actions or exiting the segment is needed.

- Hypothetical segment: 5% annual asset decline in 2024.

Dogs in the BCG Matrix for Equitable Holdings are products or segments with low growth and market share. These underperformers often require significant capital but yield poor returns. The company might consider exiting or restructuring these areas to improve overall profitability.

| Characteristic | Implication | 2024 Data Example |

|---|---|---|

| Slow Growth | Struggling Market Share | Life insurance sales slightly decreased. |

| Low Returns | Resource Drain | Run-off products with declining revenue. |

| Negative Net Flows | Customer Attrition | Hypothetical 5% asset decline in one segment. |

Question Marks

A new digital advisory platform can be a Question Mark in Equitable Holdings' BCG Matrix. It targets a niche market, offering high growth potential but low current market share. Achieving traction requires substantial investments in marketing and technology. For example, in 2024, digital advisory assets grew by 15% overall, indicating market interest.

Equitable's sustainable and ESG-focused investments represent a Question Mark in its BCG Matrix. Demand is rising, but market share might be small. In 2024, ESG assets hit $40 trillion globally. Strategic partnerships and investments are key for growth in this area.

Innovative retirement income solutions at Equitable Holdings are classified as Question Marks, focusing on longevity risk and decumulation. These products face market growth but need strong marketing. Success relies on proving value and building trust. In 2024, the retirement market is estimated at $34.9 trillion, with innovative solutions aiming for a slice.

Partnerships with Fintech Companies

Collaborations with fintech companies are crucial for Equitable Holdings to enhance customer experience and streamline operations. These partnerships offer the potential for innovation and efficiency gains, but they also come with execution risks. Proper management and integration are necessary to fully realize the benefits. For example, in 2024, many insurance companies are partnering with fintechs to improve claims processing times.

- Partnerships can lead to faster claims processing.

- Fintech collaborations may increase customer satisfaction.

- Integration challenges can lead to delays.

- Careful planning minimizes execution risks.

New product development in Wealth Management

In the context of Equitable Holdings' BCG Matrix, new product development in Wealth Management would be categorized as a "Question Mark." These are offerings with unproven demand but high growth potential. They require significant investment to capture market share, as seen with the rising interest in digital wealth management tools. For example, assets under management (AUM) in digital wealth platforms grew to approximately $1.2 trillion by the end of 2023.

- High growth potential, but unproven demand.

- Requires significant investment.

- Examples include digital wealth management tools.

- Digital wealth platforms AUM was around $1.2 trillion by the end of 2023.

Digital advisory platforms, ESG investments, innovative retirement solutions, fintech collaborations, and new wealth management products represent "Question Marks" for Equitable Holdings.

They all have high growth potential but uncertain market share, demanding significant investment. Success hinges on strategic execution and building trust to capture market opportunities. For instance, ESG assets surged to $40 trillion globally in 2024, and digital wealth AUM reached $1.2 trillion by the close of 2023.

| Category | Characteristics | Strategic Considerations |

|---|---|---|

| Digital Advisory | Niche market, high growth potential, low share. | Marketing, technology investment; aim for a 15% growth (2024). |

| ESG Investments | Rising demand, potentially small share. | Strategic partnerships, significant investments; $40T global market (2024). |

| Retirement Solutions | Focus on longevity risk; market growth. | Strong marketing, prove value; $34.9T retirement market (2024). |

BCG Matrix Data Sources

Equitable's BCG Matrix uses financial statements, market analysis, and industry benchmarks for a data-driven overview.