Equitable SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equitable Bundle

What is included in the product

Analyzes Equitable Holdings’s competitive position through key internal and external factors.

Streamlines SWOT communication with visual, clean formatting.

What You See Is What You Get

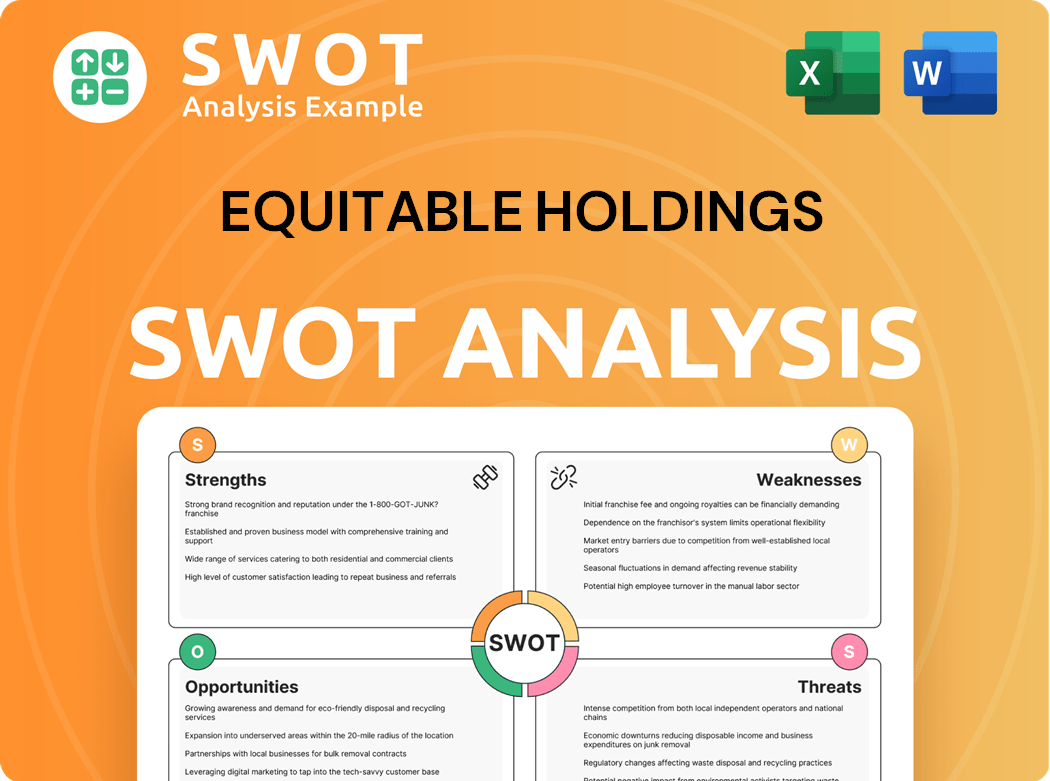

Equitable Holdings SWOT Analysis

See a live preview of the actual Equitable Holdings SWOT analysis here. The preview showcases the same professional content you'll receive. Purchasing grants instant access to the entire detailed report.

SWOT Analysis Template

The brief glimpse shows Equitable Holdings' core strengths: its financial stability, brand reputation and expansive distribution network. However, understand that this view just scratches the surface; uncovering vulnerabilities, opportunities, and risks is key to making smart choices. Discover the full SWOT report to gain detailed strategic insights, editable tools, and a high-level summary in Excel. Perfect for smart, fast decision-making.

Strengths

Equitable Holdings holds a strong market position in Registered Index-Linked Annuities (RILAs), having pioneered the product in 2010. This early entry has fostered significant brand recognition and customer loyalty. In 2024, RILA sales continue to be a key driver for Equitable, with approximately $7.5 billion in sales for Q3 2024. Their expertise allows for consistent innovation and optimization of RILA products.

Equitable's robust capital position is a key strength. In 2024, its RBC ratios remained well above internal targets. This financial strength supports strategic moves like acquisitions. It also boosts investor confidence, potentially increasing valuations. In Q4 2024, the company reported a significant increase in shareholder equity.

Equitable Holdings boasts a diversified business model spanning retirement, wealth management, and asset management. This integrated model lets them capture value across the financial services spectrum. It reduces dependence on any single area, boosting stability. In 2024, they reported $1.3 billion in net income. This diversification strategy fuels growth opportunities.

Strong Cash Flow Generation

Equitable Holdings' strong cash flow is bolstered by its leadership in the Registered Index-Linked Annuity (RILA) market, a product they pioneered in 2010. This first-mover status has cultivated strong brand recognition and customer loyalty, driving significant market share. Their expertise in RILA product development and management allows for continuous innovation. In 2024, RILA sales remained strong.

- RILA sales in 2024 are robust, contributing to solid cash flow.

- Equitable's early entry in the RILA market provided a competitive edge.

- Customer loyalty supports consistent cash flow generation.

Strategic Reinsurance Agreements

Equitable's strategic reinsurance agreements bolster its financial strength, with risk transfer to reinsurers improving capital efficiency. These agreements protect against large losses, supporting financial stability and allowing for strategic investments. In 2024, Equitable's risk-based capital (RBC) ratio remained strong, exceeding regulatory requirements, showcasing the effectiveness of these agreements. This strength supports dividend payments and share buybacks.

- Enhanced Capital Position: Reinsurance boosts capital adequacy.

- Risk Mitigation: Protects against significant financial shocks.

- Strategic Flexibility: Supports growth initiatives.

- Investor Confidence: Strengthens market perception.

Equitable's dominant RILA market position and strong sales, approximately $7.5 billion in Q3 2024, drive its financial success.

Robust capital levels, exceeding internal targets, provide financial stability and support strategic initiatives.

A diversified business model, encompassing retirement, wealth, and asset management, fosters stability and growth; the company's net income was $1.3 billion in 2024.

| Strength | Description | 2024 Data |

|---|---|---|

| RILA Leadership | First-mover advantage with RILAs, building brand loyalty. | $7.5B Sales (Q3) |

| Capital Strength | RBC ratios above targets, supporting strategic moves. | Strong RBC ratio |

| Diversified Model | Integrated business across financial sectors. | $1.3B Net Income |

Weaknesses

Equitable's financial health is vulnerable to market swings, especially concerning its RILA offerings. During times of market instability, demand for equity-linked products might decrease, affecting both sales and customer retention. Market volatility can also influence the performance of Equitable's investments, potentially jeopardizing its ability to fulfill guaranteed returns. In 2024, the company's net income decreased due to market volatility.

Equitable's profitability is sensitive to interest rate changes. Higher rates can boost investment returns, but also increase borrowing costs, potentially affecting product sales. In 2024, the Federal Reserve's actions significantly impacted financial institutions. Managing these fluctuations is vital for customer retention. Equitable must adapt its strategies to maintain profitability.

Equitable faces internal control weaknesses, potentially impacting its stability amidst global capital market challenges. Continuous monitoring and enhancement of internal controls are crucial for accurate financial reporting. This is especially important given the $7.9 billion net income reported in 2023. Addressing these weaknesses boosts investor confidence and ensures regulatory compliance.

Underperformance in Specific Segments

Equitable's financial performance faces vulnerabilities, notably in its RILA products, due to market volatility. Heightened market uncertainty can decrease demand for equity-linked products, influencing sales and retention. Volatile markets also affect the investment portfolio's performance, potentially impacting guaranteed returns. For instance, in 2024, RILA sales might see a downturn if market conditions become unfavorable. This can lead to lower profits and reduced customer satisfaction.

- RILA sales are sensitive to market volatility.

- Market uncertainty can reduce demand for equity-linked products.

- Investment portfolio performance is vulnerable to market fluctuations.

- Guaranteed returns might be at risk during volatile periods.

Complex Regulatory Landscape

Equitable Holdings faces a complex regulatory landscape, particularly in the insurance and annuity sectors. These regulations vary by state and can be costly to comply with, affecting operational efficiency. The company must navigate evolving rules regarding product sales, capital requirements, and consumer protection. Compliance efforts demand significant resources, potentially impacting profitability and strategic flexibility.

- Regulatory changes in 2024, like those from the SEC or state insurance departments, can necessitate product adjustments.

- Equitable's legal and compliance expenses totaled $190 million in 2023, reflecting the cost of adherence to regulations.

Equitable's weaknesses include sensitivity to market volatility, affecting sales and investment performance. They are challenged by profitability tied to interest rate shifts, which can impact sales. Internal control weaknesses and regulatory compliance also pose financial burdens, impacting operational efficiency and requiring significant resources.

| Weakness | Impact | Financial Data (2024) |

|---|---|---|

| Market Volatility | Decreased RILA sales, investment risks | Net income impacted, with RILA sales potential decline. |

| Interest Rate Sensitivity | Profitability risks | Affected investment returns, impacting borrowing costs. |

| Internal Control Weaknesses | Impact on reporting accuracy and regulatory compliance | Cost of compliance, as seen in 2023's $190M legal expenses. |

Opportunities

Equitable can tap into the growing US retirement market. Favorable demographics and the need for financial advice fuel this expansion. The company can broaden its retirement solutions, using its distribution network. This strategy targets both individual and group retirement segments. In 2024, the retirement market is estimated at $36 trillion.

Equitable's strategic move to increase ownership in AllianceBernstein (AB) is a key opportunity. This allows them to capture synergies between insurance and asset management businesses. The combination leads to enhanced product offerings and more cross-selling. In 2024, AB's assets under management (AUM) were approximately $750 billion. This move boosts cash flow and shareholder value.

Equitable can capitalize on the digital revolution, especially fintech and AI, to boost its services. This strategic move can significantly improve customer experience, making interactions smoother and more personalized. In 2024, AI-driven tools are projected to save financial institutions up to 20% in operational costs. Leveraging AI for personalized advice and fraud prevention is a smart move.

Strategic Partnerships

Equitable Holdings can forge strategic partnerships to boost growth in the US retirement market, which is experiencing favorable demographic shifts and rising demand for financial advice. This presents a prime opportunity to broaden its retirement solutions and customer reach through its robust distribution channels. The individual and group retirement segments offer avenues for expansion, with the US retirement market projected to reach $46.9 trillion by 2024.

- Projected US retirement market size: $46.9 trillion by 2024.

- Focus on expanding retirement solutions.

- Leverage existing distribution networks.

- Target both individual and group retirement segments.

Focus on Sustainable and Impact Investing

Equitable's increased stake in AllianceBernstein (AB) is a strategic move for sustainable and impact investing. This integration aims to capitalize on synergies between insurance and asset management. The combined entity can offer better products and increase cross-selling, boosting shareholder value. In 2024, AB's assets under management (AUM) were approximately $770 billion, showing significant growth potential.

- Synergies between Insurance and Asset Management

- Enhanced Product Offerings

- Increased Cross-Selling Opportunities

- Increased Cash Flow

Equitable can use the expanding retirement market, valued at $46.9 trillion in 2024, to its advantage. It aims to broaden retirement solutions and use current networks to boost profits, targeting both individual and group segments for financial gain. This includes strategic partnerships for enhanced reach. They’re also using fintech and AI.

| Opportunity | Description | 2024 Data |

|---|---|---|

| Retirement Market Expansion | Capitalizing on the growing retirement market. | US Retirement Market: $46.9T |

| Strategic Partnerships | Boosting growth with alliances. | Targeting growth in both Individual & Group retirement plans |

| Tech Integration | Leveraging Fintech/AI for service boost. | AI savings in Fin. Institutions: up to 20% |

Threats

Equitable faces fierce competition in financial services. This includes established firms and innovative fintech companies. Increased competition may squeeze pricing and profit margins. To stay competitive, Equitable must innovate and stand out. The potential sale of Brighthouse Financial adds to the competitive landscape.

Economic downturns and market volatility present a major threat to Equitable's financial health. Economic uncertainty can decrease financial product sales and increase claims. Lower investment returns can also occur. In 2024, the S&P 500 saw fluctuations, illustrating market volatility. Equitable must ensure a strong capital base and use risk management.

Equitable faces regulatory threats. The insurance sector has strict, evolving rules. New regulations, like higher capital needs, hit profits. Adapting to changes and managing compliance costs is key. In 2024, compliance expenses are expected to be around $300 million.

Cybersecurity Risks

Equitable Holdings faces significant cybersecurity threats, especially given its reliance on digital platforms for financial transactions. These risks include data breaches, ransomware attacks, and fraudulent activities, which could lead to financial losses and reputational damage. The financial sector saw a 13% increase in cyberattacks in 2024, highlighting the industry's vulnerability. Breaches can result in costly regulatory penalties and remediation expenses.

- The financial sector experienced a 13% increase in cyberattacks in 2024.

- Data breaches can lead to significant financial losses and reputational damage.

- Regulatory penalties and remediation costs are a consequence of security breaches.

Demographic Shifts

Economic downturns and market volatility are major threats to Equitable's financial health. Uncertainty can decrease financial product sales, increase claims, and lower investment returns. Equitable must maintain a strong capital position and use robust risk management. In 2024, the company faced market volatility affecting its investment portfolio.

- Market volatility can lead to decreased sales.

- Increased claims is a major risk.

- Lower investment returns is a threat.

- Risk management strategies are essential.

Equitable faces substantial cybersecurity threats like data breaches and fraudulent activities. These risks could cause financial harm and hurt its reputation. Regulatory penalties and recovery costs can arise from breaches; the financial sector saw a 13% rise in cyberattacks in 2024.

Economic downturns and market volatility are critical threats, potentially cutting sales and investment returns. Higher claims may result, making a strong capital base vital. In 2024, volatility negatively impacted their investment portfolio. Risk management strategies are vital to address these challenges.

Strict regulations and changes also pose significant threats to Equitable's profitability and operations. Adapting to evolving rules, particularly around capital requirements, impacts the company's financial health. Compliance costs are also expected to be significant. In 2024, about $300 million has been spent on compliance.

| Threat | Description | Impact |

|---|---|---|

| Cybersecurity Risks | Data breaches, ransomware, fraud | Financial losses, reputational damage, penalties |

| Market Volatility | Economic downturns, sales decline | Lower sales, increased claims, lower investment returns |

| Regulatory Changes | New rules, higher capital needs | Reduced profitability, compliance costs (approx. $300M in 2024) |

SWOT Analysis Data Sources

The Equitable Holdings SWOT analysis utilizes credible sources such as financial filings, market analysis, and industry reports.