Equitable PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equitable Bundle

What is included in the product

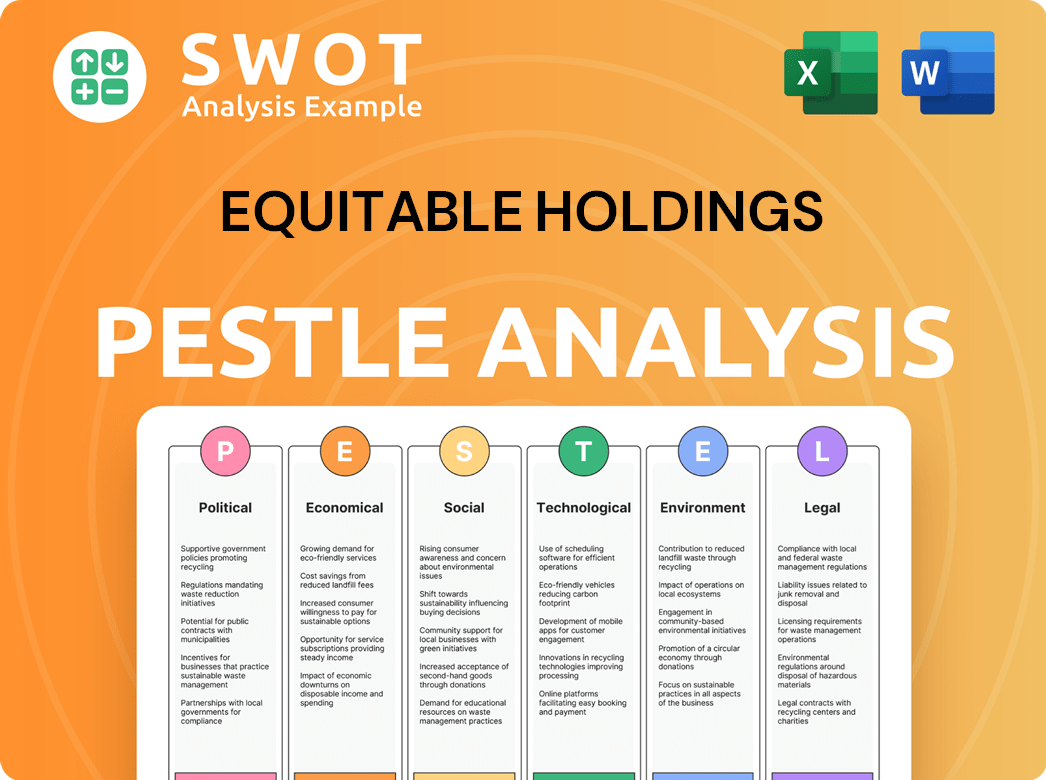

It assesses Equitable Holdings through Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Equitable Holdings PESTLE Analysis

This Equitable Holdings PESTLE analysis preview is the complete document you will receive. It includes all the information shown, organized for easy understanding. You'll get the same in-depth insights immediately after purchase. There are no changes; download the same finished file.

PESTLE Analysis Template

Explore how Equitable Holdings faces external forces in our PESTLE Analysis.

We break down Political, Economic, Social, Technological, Legal, and Environmental factors.

Understand market shifts, competitive risks, and growth opportunities.

This ready-made analysis offers deep insights for strategic decisions.

Enhance your business planning with comprehensive intelligence.

Download the complete PESTLE Analysis now for immediate access and actionable strategies!

Political factors

Changes in financial regulations and government oversight are critical for Equitable Holdings. The company must navigate evolving rules on insurance and retirement products. For example, the SEC proposed changes to the definition of "accredited investor" in 2024. These shifts influence compliance costs and product availability. Furthermore, increased scrutiny from bodies like the NAIC impacts strategic decisions.

Changes in tax policies significantly affect financial services. For instance, adjustments to retirement savings incentives could alter demand for products like annuities. Corporate tax rate modifications directly impact Equitable's profitability. In 2024, discussions around tax reforms continue, potentially impacting investment strategies. These changes can influence both consumer behavior and the company's financial performance.

Political stability in major markets and shifts in trade policies significantly influence the global economy, impacting investor sentiment and Equitable's financial outcomes. For instance, changes in US-China trade relations could affect market volatility. As of early 2024, geopolitical tensions continue to introduce uncertainty.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly influence Equitable Holdings. These policies directly affect interest rates, inflation, and economic growth, impacting investment returns and client financial security. For example, the U.S. federal budget for 2024 projects trillions in spending, which can lead to higher interest rates. Inflation, a key concern, stood at 3.5% in March 2024, influencing investment strategies.

- High government spending can increase inflation.

- Changes in tax policies affect corporate profitability.

- Fiscal policies impact the availability of credit.

- Economic growth is influenced by government investments.

Geopolitical Events

Geopolitical events significantly affect financial markets. The Russia-Ukraine war, for example, has increased market volatility. These events impact investment choices and demand for insurance products. Equitable Holdings must monitor global tensions carefully. This helps them manage risks and seize opportunities.

- Increased market volatility due to geopolitical events.

- Impact on investment decisions and product demand.

- Need for careful monitoring of global tensions.

- Risk management and opportunity identification.

Equitable Holdings faces scrutiny from evolving regulations, such as the SEC's proposals in 2024. Tax policy shifts, like adjustments to retirement incentives, also have an impact. Furthermore, government spending, including the U.S. federal budget in 2024, affects interest rates. Finally, geopolitical events cause market volatility.

| Factor | Impact | Example (2024) |

|---|---|---|

| Regulations | Compliance costs & product availability | SEC proposed changes to accredited investor definition |

| Tax Policies | Affects consumer behavior & profit | Discussions on retirement savings & corporate tax |

| Government Spending | Influences interest rates & growth | U.S. federal budget impacting rates & investment |

| Geopolitical Events | Market volatility & investment | Russia-Ukraine war affecting markets & products |

Economic factors

Interest rate fluctuations significantly affect Equitable Holdings. Changes in rates directly influence investment income, annuity and life insurance profitability, and borrowing costs. Rising rates can boost certain products, yet raise the cost of capital. The Federal Reserve's recent decisions, like maintaining rates, impact Equitable's financial strategies. For example, in Q1 2024, the company saw how rising rates affected its investment portfolio.

Market volatility significantly impacts Equitable Holdings. Fluctuations in equity and bond markets directly influence asset values. For instance, in Q1 2024, the VIX, a measure of market volatility, saw notable spikes. This affects investment returns and client account values. The company's wealth management products are particularly sensitive to these market swings.

Inflation significantly impacts Equitable Holdings. High inflation erodes purchasing power, potentially decreasing client savings. In 2024, the U.S. inflation rate was around 3.1%, influencing investment decisions. Demand for inflation-protected products, like TIPS, may rise in response to inflation concerns.

Economic Growth and Recession Risks

Economic growth and recession risks are critical for Equitable Holdings. The overall economic health significantly impacts consumer spending, employment, and client investment capabilities. In 2024, the U.S. GDP growth is projected around 2.1%, with potential slowdowns. Recession risks remain a concern due to inflation and interest rate hikes.

- U.S. GDP growth projected at 2.1% for 2024.

- Inflation rates and interest rate hikes pose recession risks.

Employment Levels and Wage Growth

High employment and wage growth are vital for Equitable Holdings, as they boost consumer spending on financial products. Rising wages, supported by a strong job market, increase disposable income, which in turn fuels demand for retirement plans and investment services. According to the Bureau of Labor Statistics, the unemployment rate in March 2024 was 3.8%, indicating a healthy labor market. This positive trend directly benefits financial services providers like Equitable.

- Unemployment Rate (March 2024): 3.8%

- Average Hourly Earnings Growth (March 2024): 4.1% year-over-year

- Increased demand for retirement planning and investment products

- Higher disposable income leads to greater investment potential

Equitable Holdings faces significant economic influences, particularly from interest rates affecting investment income and borrowing costs. Market volatility, as reflected by metrics like the VIX, directly impacts investment returns. Inflation, at 3.1% in 2024, influences client savings. Economic growth, projected at 2.1% GDP in 2024, and employment levels also play crucial roles in shaping financial product demand.

| Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Erodes purchasing power, savings | 3.1% |

| Unemployment | Affects spending | 3.8% (March) |

| GDP Growth | Impacts investment | 2.1% (projected) |

Sociological factors

Aging populations and increased life expectancy are key. The 'Peak 65' trend, with Baby Boomers retiring, boosts demand. This fuels needs for retirement solutions and wealth services. By 2024, the 65+ population reached 58 million in the US.

Consumer preferences are shifting. Clients now prioritize digital financial services and ESG factors. In 2024, digital banking adoption grew by 15%. ESG-focused investments saw a 10% rise in popularity. This impacts product development and service delivery at Equitable Holdings.

Financial literacy levels greatly influence demand for financial advice and product complexity. A 2024 study found only 34% of U.S. adults are financially literate. This impacts Equitable's product design and client education efforts. Increased financial literacy can lead to more informed investment decisions.

Wealth Transfer Trends

The ongoing generational wealth transfer, a key sociological factor, is reshaping financial landscapes. This shift, driven by the aging of the Baby Boomer generation, creates significant prospects for firms specializing in wealth management and estate planning. According to Cerulli Associates, over $70 trillion is expected to be transferred in the U.S. through 2045. This trend demands tailored financial products and services.

- $70+ Trillion: Projected wealth transfer in the U.S. by 2045.

- Increased demand for estate planning services.

- Opportunities for financial advisors to engage new clients.

- Need for innovative wealth management solutions.

Social Attitudes Towards Risk and Security

Social attitudes significantly shape the demand for Equitable's offerings. Risk aversion and the need for financial security drive the market for insurance and retirement products. The rising interest in long-term care and retirement planning reflects these societal shifts. For example, in 2024, the U.S. retirement market was valued at approximately $34.8 trillion.

- Increased demand for financial planning services.

- Growing interest in retirement income solutions.

- Demand for protection products, such as life insurance.

- Focus on wealth management and legacy planning.

Sociological factors, such as aging populations and generational wealth shifts, are critical for Equitable. Digital finance and ESG preferences are transforming consumer behavior, influencing product demands. Financial literacy's impact necessitates targeted client education efforts to meet diverse client needs.

| Sociological Factor | Impact on Equitable | 2024/2025 Data |

|---|---|---|

| Aging Population | Increased demand for retirement and wealth services | US 65+ population: 58M in 2024. Retirement market valued at ~$34.8T. |

| Consumer Preferences | Demand for digital services, ESG investments | Digital banking adoption grew by 15% in 2024. ESG investments grew by 10%. |

| Wealth Transfer | Demand for wealth management, estate planning | $70T+ expected transfer by 2045. |

Technological factors

Equitable Holdings must enhance its digital presence to meet rising demands. This includes investments in online platforms, mobile apps, and digital tools. In 2024, digital adoption in financial services grew by 15%, reflecting this shift. Equitable's digital initiatives aim to improve client interaction and account management. They are also working on digital advice tools.

Equitable Holdings must navigate the evolving landscape of cybersecurity. In 2024, financial institutions faced an average of 1,500 cyberattacks weekly, a 13% rise. Breaches can lead to hefty fines; the average cost of a data breach hit $4.45 million globally in 2023. Strong cybersecurity is vital for Equitable to protect client data and maintain operational integrity.

Equitable Holdings can utilize data analytics and AI to refine risk assessments, potentially reducing financial losses. For example, AI-driven fraud detection systems could have prevented an estimated $40 billion in losses in 2024. This technology also personalizes product offerings, increasing customer satisfaction and loyalty. Moreover, AI boosts operational efficiency, as evidenced by a 2024 study showing a 15% reduction in operational costs for companies using AI. Lastly, this empowers more tailored financial advice, which aligns with the increasing demand for personalized financial planning.

Development of Fintech

The rise of Fintech presents both challenges and chances for Equitable Holdings. Fintech firms could disrupt traditional services such as payment processing and wealth management. In 2024, the global Fintech market was valued at around $150 billion. Partnerships or acquisitions offer chances for innovation. The digital wealth management market is predicted to reach $12 trillion by 2025.

- Fintech market: $150 billion (2024)

- Digital wealth market: $12 trillion (2025 forecast)

Automation and Operational Efficiency

Equitable Holdings leverages automation to boost efficiency. This includes using technology for administrative tasks, underwriting, and claims processing. In 2024, automation initiatives helped reduce operational costs by approximately 7%. The company aims to further automate key processes by 2025. This leads to a streamlined workflow and better customer service.

- Reduced operational costs by 7% in 2024.

- Targeting further automation improvements by 2025.

Equitable Holdings must adapt to digital trends, focusing on online platforms, apps, and tools, with digital adoption in financial services growing. Cybersecurity remains crucial; in 2024, institutions faced an average of 1,500 weekly cyberattacks. The Fintech market in 2024 was valued at $150 billion.

| Area | Impact | Data |

|---|---|---|

| Digital Adoption | Client Interaction | 15% growth in financial services adoption (2024) |

| Cybersecurity | Data Protection | Average 1,500 weekly cyberattacks on institutions (2024) |

| Fintech Market | Disruption & Opportunity | $150 billion market valuation (2024) |

Legal factors

Equitable Holdings must adhere to intricate state and federal laws. These laws oversee insurance products, securities, and financial advice, impacting the company's operations. Compliance is crucial, as non-compliance can lead to significant penalties. In 2024, the insurance industry faced increased regulatory scrutiny regarding product suitability and sales practices. The SEC continues to enforce regulations, as seen with recent enforcement actions.

Data privacy regulations, like GDPR and CCPA, are critical. They affect how Equitable handles client data. This necessitates investments in security and compliance. In 2024, data breaches cost companies an average of $4.45 million. Staying compliant is crucial for avoiding penalties and maintaining client trust.

Consumer protection laws are crucial for Equitable. These laws dictate how financial products are designed and marketed. In 2024, regulations like the Dodd-Frank Act continue to shape disclosure practices. Equitable must ensure compliance to avoid penalties. The company's legal team constantly monitors changes in these laws.

Labor Laws and Employment Regulations

Equitable Holdings must adhere to labor laws that influence its operational costs and workforce. This includes regulations on employee benefits and the classification of independent contractors, especially pertinent to financial advisors. For instance, in 2024, the U.S. Department of Labor reported that misclassification of employees as independent contractors led to significant penalties for various companies. Compliance is crucial for managing expenses and maintaining legal standards.

- Employee misclassification can result in substantial fines and legal challenges.

- Compliance with benefits regulations directly impacts the company's financial planning.

- Changes in labor laws, such as those related to minimum wage or overtime, require constant adaptation.

Contract Law and Litigation Risks

Equitable Holdings faces legal challenges due to its financial products involving contractual agreements. This exposes the company to litigation risks stemming from product terms, sales practices, and claim disputes. In 2024, the financial services sector saw a 15% increase in lawsuits related to contract disputes. Equitable's legal expenses in 2024 were approximately $120 million, reflecting the costs of managing these risks.

- Contractual disputes can arise from policy interpretations.

- Sales practices are under scrutiny, potentially leading to mis-selling claims.

- Claims processing errors can result in litigation.

- Regulatory changes may introduce new compliance challenges.

Equitable Holdings confronts a complex web of legal mandates across its operations, especially regarding insurance and data privacy. Regulatory scrutiny in 2024 focused on product suitability, impacting sales strategies and requiring rigorous compliance to avoid penalties. Contractual disputes led to rising legal costs, approximately $120 million in 2024, as reflected in sector-wide litigation trends.

| Legal Aspect | Impact | 2024 Data |

|---|---|---|

| Data Privacy | GDPR/CCPA Compliance | Average data breach cost: $4.45M |

| Labor Laws | Employee Classification | Misclassification penalties, DOL reports |

| Contractual Disputes | Product terms, claims | 15% rise in financial services litigation |

Environmental factors

Climate change is a significant environmental factor. Extreme weather events, like hurricanes and floods, are increasing, potentially leading to higher insurance claims for Equitable. These events can also decrease the value of real estate investments. For instance, in 2024, insured losses from weather events totaled over $100 billion. Projections indicate these costs will continue to rise in 2025.

Equitable Holdings must comply with environmental regulations, affecting real estate and infrastructure investments. For instance, the EPA's 2024 regulations on emissions standards could influence property values. Companies face costs for environmental compliance, potentially impacting profitability. These regulations can also create opportunities, like investing in sustainable projects. Failure to comply can lead to fines or reputational damage.

ESG investment is booming. Investors are increasingly focused on environmental, social, and governance factors. This trend drives demand for sustainable products. Equitable must adapt its strategies and reporting. In 2024, ESG assets reached $40 trillion globally.

Reputational Risk Related to Environmental Issues

Equitable Holdings faces reputational risks tied to environmental issues. Public perception of its environmental stewardship directly affects its brand and appeal to stakeholders. Poor environmental practices can lead to negative publicity and loss of investor confidence. This can harm financial performance.

- In 2024, ESG-focused funds saw inflows of $22.8 billion, highlighting investor sensitivity.

- Companies with high ESG ratings often experience a lower cost of capital.

- Equitable has a specific ESG report published in 2024.

Resource Scarcity and Cost

Resource scarcity, such as rising energy costs, indirectly affects Equitable Holdings. Increased energy prices can elevate operational expenses, impacting profitability. The financial services sector, including Equitable, is sensitive to these indirect cost pressures. For instance, in 2024, energy costs rose by approximately 5%, influencing operating budgets.

- Energy price volatility impacts operational expenses.

- Rising costs can squeeze profit margins.

- Efficiency measures may become necessary.

- Indirect impact on overall financial performance.

Equitable faces climate risks from weather events, potentially increasing insurance payouts and decreasing real estate values. Stricter environmental regulations and resource scarcity, such as rising energy costs, indirectly impact profitability, as observed by a 5% rise in energy costs in 2024. The increasing demand for ESG investments, which hit $40 trillion globally in 2024, requires Equitable to adapt.

| Environmental Factor | Impact on Equitable | 2024 Data |

|---|---|---|

| Climate Change | Increased insurance claims; Decreased real estate value | Insured losses from weather events: $100B+ |

| Environmental Regulations | Compliance costs; Opportunities in sustainable projects | EPA emission standards influenced property values |

| ESG Investment Trends | Need to adapt strategies, reporting | ESG assets reached $40T globally; ESG funds saw $22.8B inflows. |

PESTLE Analysis Data Sources

The PESTLE Analysis relies on reputable sources: government databases, industry reports, economic forecasts, and news outlets.