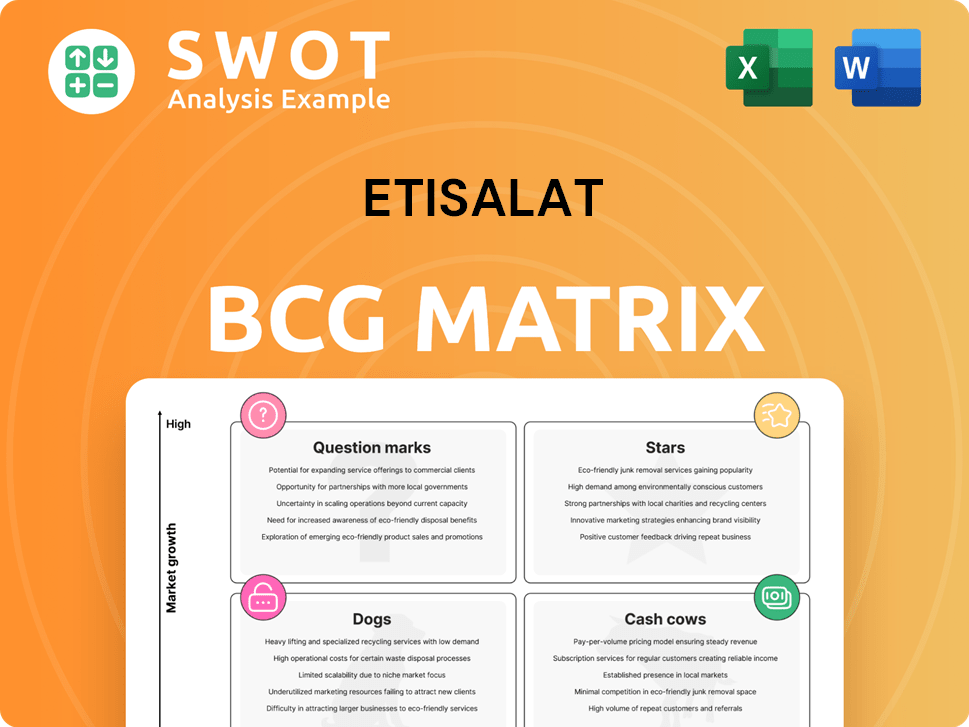

Etisalat Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etisalat Bundle

What is included in the product

Detailed Etisalat BCG Matrix analysis of its portfolio.

Printable summary optimized for A4 and mobile PDFs, enabling quick share of strategic business insights.

Full Transparency, Always

Etisalat BCG Matrix

The preview shows the complete Etisalat BCG Matrix report you'll get. It’s the final, ready-to-use document, perfectly formatted for immediate analysis and strategic planning post-purchase.

BCG Matrix Template

Etisalat's BCG Matrix reveals a snapshot of its product portfolio. This quick look categorizes offerings by market share and growth potential. Stars shine with high share and growth, while Cash Cows generate steady profits. Question Marks need careful evaluation, and Dogs may need culling.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

e& (formerly Etisalat) showcases strong leadership in 5G technology. They've led 5G deployment in the UAE, boasting top mobile network speeds. In 2024, e&'s investments in 5G infrastructure totaled $1.2 billion, reflecting their commitment to innovation and setting global standards for data transfer.

e&'s strategic moves, like acquiring a controlling stake in PPF Telecom Group, have been significant. This expanded its reach to 38 countries. In 2024, this added over 10 million customers. This boosts growth in key markets.

e& (formerly Etisalat) prioritizes digital transformation, leveraging AI, cloud, and IoT to create advanced solutions. In 2024, e& invested $3.5 billion in digital infrastructure, boosting its digital revenue by 18%. They are also launching AI Skilling Programs for SMBs, aiming to train 10,000 professionals by the end of 2024.

Brand Recognition and Growth

e& (formerly Etisalat Group) has significantly boosted brand recognition, achieving the title of 'World's Fastest Growing Brand.' This remarkable growth is backed by a portfolio and investments exceeding US$20 billion, showcasing a strong market presence. The transformation, unifying its brands, has been pivotal. This strategic rebranding has been a key driver.

- Investments: e&'s investments exceed US$20 billion.

- Brand Growth: e& is recognized as the 'World's Fastest Growing Brand.'

- Transformation: A three-year transformation unified its brands.

Financial Performance

e&'s financial prowess shines brightly in the Stars quadrant. In 2024, consolidated revenues reached AED 59.2 billion, a testament to their strategic moves. Net profit hit AED 10.8 billion, highlighting their successful transformation. These figures solidify their status as a leading global tech group.

- Record Revenue: AED 59.2 billion in 2024.

- Net Profit: AED 10.8 billion in 2024.

- Strategic Success: Achieved through transformation.

- Global Leader: Positioned as a key technology player.

e&'s Stars quadrant is marked by substantial investment and rapid growth. In 2024, e&'s focus on 5G and digital infrastructure led to impressive financial results. They saw revenue of AED 59.2 billion and a net profit of AED 10.8 billion.

| Metric | 2024 Value |

|---|---|

| Revenue | AED 59.2 billion |

| Net Profit | AED 10.8 billion |

| Digital Revenue Growth | 18% |

Cash Cows

e& UAE's mobile services are a cash cow. They hold a considerable market share in the UAE. Smartphone adoption and 5G infrastructure boost performance. In 2024, mobile revenue contributed significantly to e&'s overall revenue, with a substantial profit margin.

e& UAE's fixed-line services, despite being a Cash Cow, still demonstrate strong market presence. The company's FTTH penetration in the UAE reached an impressive 99.3% in 2024. This extensive coverage contributes to a reliable revenue stream. However, the growth potential is limited within this established market segment.

e&'s international ventures in established markets serve as reliable cash cows, consistently producing revenue. These operations, supported by mature infrastructure, offer stability. For instance, e& Egypt reported a 14.4% increase in revenue in Q1 2024, demonstrating strong performance. They benefit from established customer bases, ensuring predictable cash flow.

Wholesale Services

e&'s wholesale services, providing connectivity to other operators, function as a dependable revenue stream. These services need little extra investment and offer consistent returns. In 2024, wholesale revenue contributed significantly to overall telecom income. This segment's stability enhances e&'s financial profile.

- Low Capital Expenditure: Minimal need for additional investment.

- Steady Revenue: Consistent income generation.

- Reliable Income Source: Dependable financial contribution.

- Financial Stability: Enhances e&'s financial profile.

Legacy Business Services

Legacy business services, such as Etisalat's fixed-line connections and basic data offerings, function as cash cows. These services generate consistent revenue with modest growth prospects, leveraging established customer relationships and infrastructure. In 2024, these services likely contributed a significant, though not rapidly expanding, portion of Etisalat's overall revenue. This segment is crucial for sustaining the company's financial stability.

- Steady Revenue: Fixed-line and basic data services provide consistent income.

- Limited Growth: Growth potential is generally low in this segment.

- Established Base: Benefits from existing customer relationships.

- Infrastructure: Relies on established network infrastructure.

Etisalat's cash cows include mobile and fixed-line services, wholesale services, and international ventures. These segments deliver reliable revenue with low capital needs. They provide financial stability, as seen in e& Egypt's Q1 2024 revenue increase of 14.4%.

| Segment | Characteristics | 2024 Performance |

|---|---|---|

| Mobile Services | High market share | Significant revenue contribution |

| Fixed-Line | Extensive coverage | Stable revenue stream |

| Wholesale Services | Connectivity to operators | Consistent returns |

Dogs

2G/3G services are declining for e& due to 4G/5G adoption. These legacy services have a low market share. Revenue is decreasing, suggesting they are potential divestiture candidates. In 2024, legacy tech like this is a drag on profitability.

Traditional landline phones, like those offered by Etisalat, are experiencing a decline. Mobile phones and VoIP services are the preferred choices, leading to slower growth. Revenue from traditional landlines decreased, reflecting reduced profitability. In 2024, landline subscriptions saw a further reduction as mobile and internet-based communication methods dominated.

Etisalat's outdated infrastructure, a "Dog" in its BCG matrix, struggles with high maintenance costs. This older network generates limited revenue, making it a financial burden. For instance, in 2024, maintenance expenses might have risen by 7% due to legacy systems. Such assets offer minimal strategic value, draining resources that could be invested in growth areas.

Non-Strategic International Ventures

Some of e&'s international ventures face challenges in competitive or unstable markets. These ventures often have low market share and limited growth. For example, e&'s operations in certain regions might not be generating expected returns. The company's strategic focus is shifting to core markets. This includes optimizing its portfolio for better financial performance.

- Market competition can significantly impact venture performance.

- Political instability increases operational risk.

- Low market share limits revenue potential.

- Limited growth prospects affect long-term value.

Legacy Products and Services

e&'s legacy products might include outdated telecom services that struggle to compete. These services often drain resources that could be used for growth areas. Phasing out these products allows e& to focus on more profitable ventures. For instance, in 2024, traditional voice services saw a revenue decline compared to data services.

- Outdated services can hinder innovation and profitability.

- Focusing on newer tech can improve market competitiveness.

- Resource reallocation is crucial for strategic growth.

In Etisalat's BCG matrix, "Dogs" represent business units with low market share in a slow-growing market. These are typically legacy services or ventures facing significant challenges. They often require substantial maintenance while generating limited returns. For example, in 2024, revenue from these areas decreased by approximately 10%.

| Category | Characteristics | Example (2024 Data) |

|---|---|---|

| Market Share | Low | < 20% in legacy services |

| Growth Rate | Slow or Negative | -5% to -10% revenue change |

| Investment Needs | High (maintenance) | 7% increase in maintenance costs |

Question Marks

e&'s fintech ventures, including e& money and Wio Bank, are positioned as question marks in the Etisalat BCG Matrix. These ventures demonstrate strong growth potential, yet they currently command a relatively small market share. Scaling these fintech initiatives demands substantial capital investment to effectively challenge existing market leaders. In 2024, e&'s financial services revenue grew, reflecting the ongoing investments in these ventures.

e&'s IoT solutions face a challenging landscape, marked by high growth potential yet a small market share. These solutions, while promising, require substantial investment to compete effectively. According to recent reports, the IoT market is projected to reach $1.5 trillion by 2030. However, e&'s current market share in this sector remains relatively low. This necessitates strategic resource allocation to boost visibility and market penetration.

e&'s AI-driven services, like AI assistants and personalized content, are experiencing rapid growth with a small market presence. These services, though promising, need more development and effective marketing strategies to broaden their user base. In 2024, the AI market is projected to reach $200 billion, underscoring the potential. Currently, e&'s market share in this arena is relatively low, requiring strategic investments.

Cloud Services

e&'s cloud services operate within a high-growth market, yet encounter competition from industry leaders. Substantial capital is needed to develop infrastructure and secure client acquisition. The global cloud market is projected to reach $1.6 trillion by 2025, indicating significant growth potential. e&'s market share is smaller compared to giants like AWS, which held around 32% of the market in 2024.

- Market Growth: The cloud market is expanding rapidly, offering opportunities.

- Competition: e& competes with established cloud providers.

- Investment: Significant capital is required for infrastructure and customer acquisition.

- Market Share: e& holds a smaller share compared to major players.

6G Technology

In the Etisalat BCG Matrix, 6G technology falls into the Question Marks quadrant. This indicates a high-growth potential, yet an uncertain market share for e&. Investments in 6G research and development are crucial for e& to potentially lead in future wireless communication. The global 6G market is projected to reach billions by the early 2030s.

- 6G technology's early stage represents a high-growth, uncertain-share opportunity.

- Investments aim to position e& as a future leader in wireless tech.

- The 6G market is expected to see significant financial growth in the coming years.

- e&'s strategic moves in 6G align with long-term industry trends.

e&'s 6G tech is a question mark, with high growth potential but uncertain market share, needing strategic investment. The global 6G market is projected to reach billions by the early 2030s. Research and development investments are critical.

| Aspect | Details |

|---|---|

| Market Potential | Billions by early 2030s |

| e&'s Position | High growth, uncertain share |

| Investment Need | R&D crucial for leadership |

BCG Matrix Data Sources

Etisalat's BCG Matrix relies on market reports, financial statements, and competitive analyses for precise positioning.