Etisalat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etisalat Bundle

What is included in the product

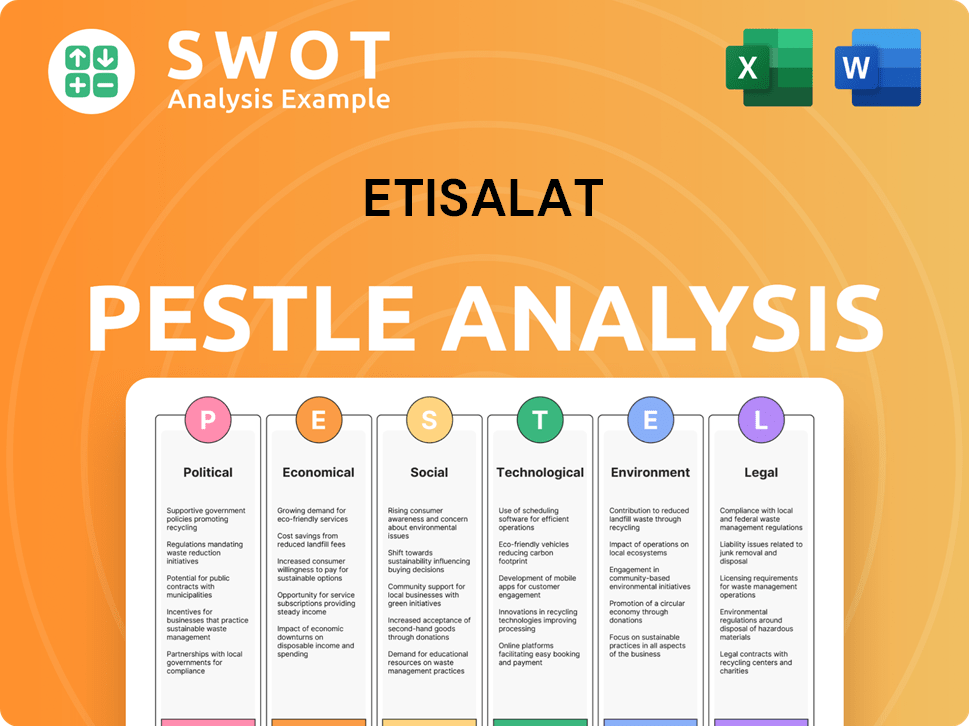

It examines how macro-environmental factors impact Etisalat using PESTLE across six areas.

Helps teams quickly identify and address key external factors impacting Etisalat's strategy.

Same Document Delivered

Etisalat PESTLE Analysis

Preview Etisalat's PESTLE analysis now! The displayed information, including formatting, is identical. You’ll download this fully complete document after purchase.

PESTLE Analysis Template

Discover how Etisalat is shaped by the outside world! This brief PESTLE glimpse reveals critical factors impacting its strategy, from political shifts to technological advancements. Uncover key insights into the economic landscape and social trends affecting the business. Understand legal & environmental considerations and how they influence Etisalat's operations. Don't miss out, purchase the full analysis and gain a strategic advantage today!

Political factors

e&, formerly Etisalat, navigates a regulatory landscape heavily influenced by the UAE government. The Telecommunications and Digital Government Regulatory Authority (TDRA) sets standards and oversees operations. The UAE's 5G Strategy (2020-2025) impacts e&'s strategies. In 2024, e&'s revenue reached AED 53.8 billion, reflecting the impact of government policies.

e& (formerly Etisalat) faces political risks due to its global presence in 38 countries. Political stability directly impacts market access and investment returns. For instance, in 2024, e&'s international revenue was $14.5 billion, highlighting the financial stakes. Unstable regions increase operational risks, potentially affecting profitability and expansion plans.

The UAE government prioritizes cybersecurity and data protection, significantly impacting e&. The Telecommunications and Digital Government Regulatory Authority (TDRA) enforces these policies. In 2024, the UAE’s cybersecurity market was valued at $2.5 billion, growing annually. E& must comply with stringent data governance to manage customer information and offer secure services.

Government Digital Transformation Initiatives

The UAE government's focus on digital transformation significantly impacts e&. This initiative, spanning smart cities and healthcare, boosts demand for e&'s services. Opportunities arise in 5G, AI, and IoT, crucial for these transformations. The UAE's digital economy is projected to reach $140 billion by 2031.

- e& is investing heavily in 5G infrastructure to support these initiatives.

- The smart city market in the UAE is expanding, creating new revenue streams.

- Partnerships with government entities are key for e&'s growth.

Telemarketing Regulations

Recent UAE cabinet resolutions focus on telemarketing regulations, aiming to streamline marketing and safeguard consumer privacy. These rules significantly impact e&'s marketing strategies, necessitating strict adherence to avoid potential penalties. For instance, in 2024, the UAE saw a 15% increase in consumer complaints related to unsolicited telemarketing calls. Non-compliance can lead to fines, potentially affecting e&'s financial performance and brand reputation.

- Consumer protection laws are becoming more stringent.

- E& must adapt its marketing strategies.

- Penalties may include financial fines.

- Brand reputation is at stake.

Political factors heavily shape e&'s business landscape. The UAE government's regulations and digital transformation strategies influence operations. Strict compliance with cybersecurity and telemarketing rules is crucial to avoid penalties.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Regulatory Oversight | Compliance with TDRA | 5G investment: $4 billion. |

| Market Stability | Risks from international presence | Intl. revenue share: 27%. |

| Digital Initiatives | Leverage digital growth | UAE digital economy: $140B by 2031 |

Economic factors

e&'s financial health is closely linked to economic growth in the UAE and its international markets. Inflation and currency volatility significantly influence its financial outcomes. For 2024, UAE's GDP growth is projected at 4.2%. Inflation rates and currency impacts remain key concerns. These factors directly affect e&'s revenue, profitability, and investment strategies.

Government investments in infrastructure and digital projects directly boost demand for e&'s services. The UAE's 2024 federal budget allocated significant funds to infrastructure and economic resources, impacting telecommunications. Specifically, the budget for 2024 is approximately AED 64 billion, with a considerable portion directed towards these sectors. This spending supports e&'s growth by creating opportunities in areas like smart city initiatives and digital transformation projects.

e& (formerly Etisalat) is broadening its revenue sources. They are expanding into fintech, IoT, and cloud services. This diversification aims to reduce reliance on core telecom. In Q1 2024, e& reported strong growth in its digital services, with a 20% increase in revenue. This shift helps capture new digital economy growth.

Competition and Market Dynamics

The UAE telecom market, primarily featuring e& and Du, experiences dynamic competition, influenced by regulatory changes and service innovations like VoIP. Such shifts can impact pricing strategies, potentially altering market share and profitability for both operators. For instance, in 2024, the UAE's telecom sector saw a 6% rise in overall revenue, demonstrating its responsiveness to market dynamics. Furthermore, the introduction of new technologies and services continuously reshapes the competitive environment.

- e&'s market capitalization reached approximately $50 billion in early 2024.

- Du's reported revenue grew by 8% in the last financial year.

- The VoIP market in the UAE is projected to expand by 10% annually.

Investment in Digital Infrastructure

e& (formerly Etisalat Group) is heavily investing in digital infrastructure to boost economic returns. These investments focus on 5G networks, data centers, and submarine cables to meet the rising demand for high-speed data and digital solutions. This strategic move aligns with forecasts predicting substantial growth in data consumption. The demand is driven by sectors such as e-commerce and cloud computing.

- e&'s capital expenditure reached AED 12.6 billion in 2023, with a focus on digital infrastructure.

- The UAE's digital economy is projected to contribute significantly to GDP by 2025.

e&'s fortunes hinge on UAE and international economic health, with inflation and currency shifts crucial. 2024's UAE GDP growth is pegged at 4.2%, yet inflation and currency pose risks. These impact revenue, profitability, and investment tactics for e&.

| Economic Factor | Impact on e& | Data/Stats (2024/2025) |

|---|---|---|

| GDP Growth | Influences service demand, revenue | UAE GDP: Projected 4.2% (2024) |

| Inflation | Affects costs, pricing, margins | UAE Inflation: ~2-3% (2024 est.) |

| Currency Volatility | Impacts international revenue, investments | USD/AED rate stability key; Monitor forex. |

Sociological factors

e& (formerly Etisalat) must adapt to rising digital adoption and changing consumer behaviors. Demand for digital services, online content, and mobile apps is surging. In 2024, mobile data usage grew significantly across the MENA region. This impacts e&'s service offerings, requiring enhanced customer experiences.

Population growth and demographic shifts in the UAE and international markets directly influence Etisalat's subscriber base. e&'s subscriber numbers reflect its market penetration and growth trajectory. The UAE's population in 2024 is approximately 10 million, with significant expatriate presence, impacting service demand. e&'s subscriber base is a crucial performance indicator.

e& (formerly Etisalat) actively promotes digital inclusion and education. In 2024, the company invested $50 million in digital literacy programs. These programs reached over 1 million individuals. e&'s efforts support societal progress by providing digital access and skills. They align with global initiatives aimed at bridging the digital divide.

Workforce and Emiratisation

As a major employer, e& (formerly Etisalat) faces workforce dynamics and Emiratisation pressures. The UAE government mandates and incentivizes the employment of UAE nationals. These policies directly impact e&'s HR strategies, including recruitment and training. The company must balance its workforce composition to meet Emiratisation targets and avoid penalties.

- Emiratisation targets are increasing across sectors.

- Penalties for non-compliance can include fines and restrictions.

- e& invests in training programs for UAE nationals.

- The telecom sector faces competition for skilled Emirati workers.

Community Engagement and Social Responsibility

e& (formerly Etisalat Group) actively participates in community engagement and social responsibility programs. This involvement boosts its social standing and operational approval within the areas it serves. The company’s efforts include supporting educational initiatives and promoting digital inclusion. In 2024, e& invested AED 1.2 billion in community programs globally. These projects enhance its brand image and strengthen ties with consumers.

- e&'s community programs include digital literacy initiatives.

- The company focuses on sustainable development goals.

- e& partners with various NGOs for social projects.

- These initiatives contribute to e&'s positive public perception.

Societal shifts such as increasing digital adoption heavily influence e&. Demographic changes, like the UAE’s population of 10 million in 2024, impact service demand and subscriber growth. e& invests significantly in digital literacy, with $50 million spent in 2024 to enhance societal access and skills.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Adoption | Growing demand | Mobile data use increased significantly |

| Demographics | Subscriber Base | UAE population: approx. 10M |

| Social Initiatives | Digital Literacy | $50M invested, reached 1M+ individuals |

Technological factors

e& (formerly Etisalat Group) is significantly investing in 5G and future network technologies. This involves infrastructure upgrades and spectrum licenses. In 2024, e& reported a 10% increase in network infrastructure investments. The company plans to spend over $2 billion on 5G expansion by 2025.

e& (formerly Etisalat Group) heavily invests in AI. In 2024, e&'s AI-driven services saw a 30% increase in adoption. They use AI to improve customer service and network efficiency. AI also drives new solutions in healthcare and finance. e& allocated $500 million for AI initiatives in 2024-2025.

e& is aggressively investing in IoT, fintech, and cloud. In 2024, e& invested $1.2 billion in digital infrastructure. These moves involve new platforms and partnerships. e& aims to boost digital revenue, which reached $6.5 billion in 2024.

Digital Transformation and Innovation

e& (formerly Etisalat Group) is actively transforming into a global technology group, emphasizing digital innovation. This strategic shift involves substantial investments in digital platforms and automation. The company aims to create new value through technology.

- e& reported a consolidated revenue of AED 53.8 billion in 2024.

- Digital services are a key growth area.

- Investments in 5G and fiber infrastructure are ongoing.

- e& aims to enhance customer experience through digital solutions.

Cybersecurity Technology

Cybersecurity is paramount given the digital landscape. e& invests in advanced cybersecurity to safeguard infrastructure, customers, and enterprise clients. In 2024, the global cybersecurity market was valued at $200 billion. e&'s cybersecurity arm likely saw revenue growth, mirroring the sector's expansion. It is essential for protecting sensitive data and ensuring business continuity.

- e&'s cybersecurity arm likely saw revenue growth.

- The global cybersecurity market was valued at $200 billion in 2024.

- Protecting sensitive data is critical.

e& is heavily focused on technology. Investments in 5G and digital infrastructure continue to grow, with $2B planned for 5G by 2025. AI initiatives also receive substantial funding, and digital revenue reached $6.5B in 2024. Cybersecurity is a priority in its digital transformation, securing customer data.

| Tech Focus | 2024 Data | 2025 Outlook |

|---|---|---|

| 5G Investment | $2B planned | Ongoing expansion |

| Digital Revenue | $6.5B | Projected Growth |

| Cybersecurity Market | $200B globally | Continued investment |

Legal factors

e&, formerly known as Etisalat, must adhere to telecommunications laws and licensing overseen by the TDRA in the UAE and similar bodies elsewhere. This includes adhering to rules on spectrum allocation, data privacy, and consumer protection. Failure to comply can result in significant penalties, including fines or the suspension of operations. For instance, in 2024, the TDRA imposed approximately $2 million in fines on various telecom providers for regulatory breaches. Furthermore, e& invests heavily in compliance, with an estimated $50 million allocated annually to ensure adherence to evolving legal standards.

Etisalat, now e&, must comply with the UAE's data protection law. This impacts how it handles user data. Non-compliance can lead to hefty fines. The UAE's telecom market was valued at $4.5 billion in 2024, highlighting the stakes.

Etisalat, now e&, must adhere to competition laws and anti-trust regulations. These laws impact market practices, acquisitions, and partnerships. Compliance is crucial for fair competition. In 2024, e& faced scrutiny in some markets regarding its dominant position, leading to adjustments in strategies. Regulatory fines can reach significant amounts.

International Regulations and Compliance

e& (formerly Etisalat Group) faces complex international regulations. These cover telecommunications, data privacy, and business practices across its global operations. Compliance costs are significant, impacting profitability and requiring dedicated legal teams. Non-compliance can lead to hefty fines and reputational damage.

- Data privacy regulations, like GDPR, affect e&'s global data handling.

- Telecommunications regulations vary by country, impacting service offerings.

- e& must navigate diverse legal landscapes in each market.

- Compliance is a continuous, resource-intensive process.

Contract Law and Consumer Protection

e&, formerly known as Etisalat, operates within a legal framework heavily influenced by contract law and consumer protection. This means all agreements with customers and business partners must comply with these laws. Non-compliance can lead to significant penalties and reputational damage. For instance, in 2024, consumer complaints related to telecom services in the UAE increased by 12%, highlighting the importance of stringent adherence to regulations.

- Contract law ensures that agreements are legally binding.

- Consumer protection laws safeguard customer rights.

- Non-compliance can result in fines and reputational harm.

- Adherence to regulations is crucial for sustainable business.

e& (Etisalat) navigates intricate legal landscapes globally, notably in data privacy, telecommunications, and international business practices.

Compliance requires major investments. Non-compliance leads to fines and reputational hits. The telecom sector saw over $2 million in fines in 2024.

Consumer protection and contract law adherence are also essential for the telco, with UAE complaints up by 12% in 2024.

| Legal Area | Impact on e& | 2024/2025 Data |

|---|---|---|

| Data Privacy | GDPR & local laws compliance | Estimated $50M annually for compliance |

| Telecom Regulations | Spectrum, licensing | UAE telecom market $4.5B value in 2024 |

| Consumer Protection | Contracts, consumer rights | UAE complaints +12% in 2024 |

Environmental factors

e& (formerly Etisalat Group) is actively addressing climate change. The company has set net-zero emissions targets. e& is focusing on reducing its carbon footprint. They are investing in energy efficiency. In 2024, e&'s sustainability efforts include specific emission reduction goals.

e& (Etisalat) actively addresses its network's energy use, a key environmental factor. They're investing in energy-efficient tech to cut consumption. In 2023, e& reported a 15% decrease in energy use intensity. Renewable energy sources are also explored. The aim is to reduce the carbon footprint.

Etisalat, now e&, focuses on environmental management, tackling waste from network equipment and devices. The company's commitment includes sustainable waste management practices. e&'s 2024 sustainability report highlights waste reduction strategies. For example, e& aims to recycle a significant portion of its electronic waste by 2025. This approach supports a circular economy.

Environmental Regulations and Compliance

e& (formerly Etisalat) faces environmental compliance challenges across its global operations. The UAE, where e& is headquartered, has stringent environmental standards. These regulations cover areas like carbon emissions from network infrastructure and waste management from electronic equipment. Failure to comply can lead to significant financial penalties and reputational damage.

- In 2024, the UAE government increased its focus on green initiatives, potentially impacting e&'s operational costs.

- Companies failing to meet environmental standards in the UAE face fines up to AED 1 million.

- e& must invest in sustainable practices like energy-efficient equipment to meet these regulations.

Development of Green Digital Solutions

e& (formerly Etisalat) is actively developing green digital solutions. They aim to help other industries decrease their environmental impact. This aligns with their sustainability strategy and climate action goals. For example, e& is investing in smart city technologies. These technologies can optimize resource use.

- e&'s 2024 Sustainability Report highlights investments in renewable energy.

- They are also focusing on energy-efficient network infrastructure.

- e& aims to reduce its carbon footprint by 25% by 2025.

e& prioritizes reducing its environmental footprint through net-zero targets. The company is focused on cutting emissions by investing in energy efficiency. They aim to reduce their carbon footprint, with a goal of 25% reduction by 2025.

| Environmental Factor | e& Initiative | 2024/2025 Data |

|---|---|---|

| Energy Use | Investing in efficient tech & renewables | 15% decrease in energy use intensity in 2023; 25% carbon footprint reduction target by 2025. |

| Waste Management | Sustainable practices, recycling | Aim to recycle a large portion of electronic waste by 2025. |

| Compliance | Meeting UAE environmental standards | Potential fines up to AED 1 million for non-compliance. |

PESTLE Analysis Data Sources

This Etisalat PESTLE leverages official reports from telecom regulators, market analysis from consulting firms, and economic forecasts.