FedEx Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FedEx Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, solving the need for accessible information.

Preview = Final Product

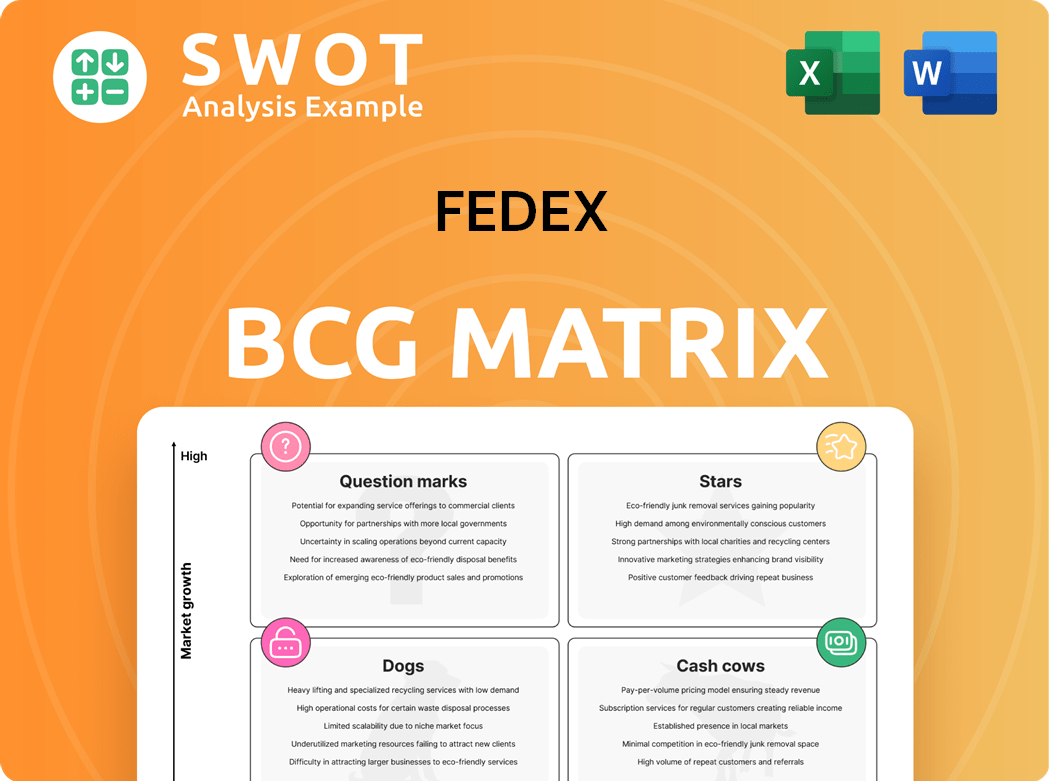

FedEx BCG Matrix

The BCG Matrix preview displays the identical report you receive upon purchase. Access the complete, strategic FedEx analysis—immediately downloadable and ready to inform your decision-making.

BCG Matrix Template

FedEx, a global logistics giant, uses a BCG Matrix to manage its diverse service offerings. This framework categorizes FedEx's business units based on market share and growth potential. This helps FedEx make smart investment choices and product decisions. Discover which areas are flourishing and which need strategic adjustments. Want to unlock the complete FedEx BCG Matrix and see how this company is strategically navigating the market? Purchase now for detailed analysis and actionable insights.

Stars

FedEx's fdx platform, launched in late 2024, targets e-commerce growth. It's designed to connect the entire customer journey. This includes boosting demand, improving conversions, and streamlining returns. FedEx aims to become a leader in providing end-to-end solutions.

FedEx's healthcare logistics is a rising star, with nearly $400 million in new annualized revenue anticipated. This expansion stems from tailored processes for essential deliveries and the FedEx Surround platform for real-time tracking. FedEx targets $9 billion in healthcare revenue by the fiscal year's end, reflecting its strong market position.

FedEx's "Stars" include sustainable logistics. The company plans carbon-neutral operations by 2040, investing over USD 2 billion. By 2030, they aim for electric vehicle purchases, with fleet conversion by 2040. This boosts FedEx's environmental leadership; in 2024, they expanded electric vehicle pilots.

DRIVE Program Initiatives

FedEx's DRIVE program, a "Stars" initiative, is a significant cost-reduction strategy. It successfully generated $1.8 billion in permanent savings in fiscal 2024. The program aims for an additional $2.2 billion in savings by fiscal 2025 through enhanced operational efficiency. This initiative highlights FedEx's ability to improve profitability during economic challenges.

- Fiscal 2024 Savings: $1.8 billion

- Fiscal 2025 Target: $2.2 billion in savings

- Focus: Enhancing operational efficiency and reducing expenses

- Impact: Improving profitability

Global Network Optimization

FedEx is strategically optimizing its global network, leveraging AI and robotics to boost efficiency. The consolidation into Federal Express Corporation unifies its air-ground express network. This enhances flexibility and responsiveness to customer needs. This effort is part of its ongoing transformation to maintain a competitive edge in the logistics sector.

- FedEx invested $2 billion in fiscal year 2024 in network enhancements.

- The company aims to achieve $4 billion in permanent cost reductions by the end of fiscal year 2025.

- FedEx Express reduced its operating expenses by $800 million in the fourth quarter of fiscal year 2024.

FedEx's Stars in the BCG Matrix include sustainable logistics and the DRIVE program, both critical for future growth.

The DRIVE program, a cost-cutting Star, achieved $1.8 billion in savings in fiscal 2024, with a $2.2 billion target for fiscal 2025.

Sustainable logistics, backed by a $2 billion investment, aims for carbon-neutral operations by 2040, boosting its environmental leadership.

| Initiative | Fiscal 2024 | Fiscal 2025 Target |

|---|---|---|

| DRIVE Savings | $1.8 billion | $2.2 billion |

| Network Investment | $2 billion | Ongoing |

| FedEx Express OpEx Reduction (Q4 FY24) | $800 million | N/A |

Cash Cows

FedEx Express (International Exports) is a cash cow, consistently generating substantial revenue. Despite domestic challenges, international exports thrive, with increased volume. This success stems from FedEx's strong global network. In fiscal year 2024, FedEx Express saw revenue of $45.6 billion, demonstrating its financial strength.

FedEx Ground is a cash cow, fueled by e-commerce growth. In fiscal year 2024, FedEx Ground achieved its highest adjusted operating income ever. This segment excels in efficiency, serving e-commerce vendors effectively. Its strong performance highlights its cash-generating capability.

FedEx benefits from a vast customer base, including many small and medium-sized enterprises (SMEs), ensuring consistent revenue. Their focus on SMEs through strategic actions boosts customer loyalty. This large base supports FedEx's financial health, generating significant cash flow. In 2024, FedEx reported serving millions of customers globally. This broad reach is key to its 'Cash Cow' status.

Strategic Partnerships

FedEx strategically partners with e-commerce and retail giants, broadening its service scope. These alliances improve FedEx's logistics solutions, keeping it competitive. Partnerships boost revenue and market share significantly. In 2024, FedEx's partnerships generated roughly $10 billion in revenue.

- Expanded Network: Partnerships extend FedEx's reach.

- Enhanced Services: Offering complete logistics solutions.

- Revenue Growth: Partnerships drive substantial revenue.

- Market Share: Alliances help maintain a competitive edge.

Cost-Saving Initiatives

FedEx's "Cash Cows" status is supported by cost-saving initiatives like the DRIVE program and Network 2.0. These programs boost efficiency by cutting operational redundancies and optimizing the network. For example, in fiscal year 2024, FedEx achieved $1.8 billion in cost savings. This financial discipline strengthens profitability and performance.

- DRIVE program and Network 2.0 initiatives boost efficiency.

- FedEx achieved $1.8 billion in cost savings in fiscal year 2024.

- Cost savings enhance profitability and overall financial performance.

Cash Cows like FedEx Express and Ground consistently generate strong revenue, exemplified by FedEx Express's $45.6B in FY2024. FedEx Ground's efficiency and e-commerce focus further cement its "Cash Cow" status. Strategic partnerships and cost-saving initiatives enhance profitability.

| Segment | FY2024 Revenue (USD Billions) | Key Characteristics |

|---|---|---|

| FedEx Express | 45.6 | International Exports, Global Network |

| FedEx Ground | Data Not Available | E-commerce Growth, Efficiency |

| Partnerships | ~10 | Logistics Solutions, Revenue Driver |

Dogs

FedEx's U.S. domestic package services struggle with weak demand and economic issues. Shipment volumes and weight per shipment have decreased, hurting revenue. Despite efforts to improve, the segment remains challenged. In Q2 2024, FedEx's U.S. domestic revenue fell, reflecting these difficulties. It's a "dog" in the BCG Matrix.

FedEx Freight, facing volume declines and yield pressures, is under strategic review. In fiscal year 2024, FedEx Freight's revenue decreased. A spin-off could let FedEx focus on parcels. This segment may be a "dog" due to its current performance.

FedEx's legacy air fleet, comprising older aircraft, represents a "dog" in the BCG matrix. These planes are less fuel-efficient, leading to increased operational expenses and environmental concerns. In 2024, the company's focus is on replacing them. In 2023, FedEx spent around $3.8 billion on aircraft, aiming to boost efficiency and cut emissions.

Traditional Retail Partnerships (Declining)

Traditional retail partnerships that fail to evolve with e-commerce trends can be categorized as dogs in the FedEx BCG matrix. These partnerships may struggle to contribute significantly to revenue or growth. FedEx's strategic shift towards bolstering its e-commerce solutions necessitates a reevaluation of these traditional partnerships. In 2024, FedEx's e-commerce volume showed a slight increase, while traditional retail shipments likely faced pressure. This divergence highlights the need for strategic adjustments.

- Focus on e-commerce solutions.

- Re-evaluate traditional retail partnerships.

- Address declining revenue and growth.

- Strategic adjustments needed.

Areas with High Operational Costs

Certain FedEx operational areas or processes might be categorized as "dogs" if they consistently show high costs and low returns. These areas may demand substantial investment for improvement, prompting a reevaluation of their sustainability. FedEx's cost-reduction focus could lead to divestiture or restructuring of these underperforming segments. For example, in 2024, FedEx aimed to cut $2.5 billion in structural costs.

- High operational costs can stem from inefficient routes or underutilized facilities.

- Low returns might be due to intense competition or decreased demand in particular regions.

- Divestiture or restructuring decisions could impact employee roles and operational focus.

- FedEx's strategy includes optimizing its network and adjusting its portfolio.

Various segments within FedEx are categorized as "dogs" in its BCG matrix due to poor performance. These include U.S. domestic package services, FedEx Freight, and parts of its air fleet. Their revenue is declining. FedEx aims to reduce costs and optimize its network, including potential restructuring.

| Segment | Performance | Strategy |

|---|---|---|

| U.S. Domestic Package Services | Revenue decline in Q2 2024 | Cost reduction, network optimization |

| FedEx Freight | Revenue decrease in FY2024 | Strategic review, potential spin-off |

| Legacy Air Fleet | Less fuel-efficient, higher costs | Fleet replacement, aiming for efficiency |

Question Marks

The FDX platform, though promising, faces early adoption challenges. It needs to attract merchants to show its e-commerce value. FedEx invested $2 billion in 2024 to enhance its digital capabilities, including FDX. Success hinges on growing market share through investment and marketing.

FedEx's EV fleet expansion is a question mark in its BCG Matrix. The tech is evolving, and infrastructure lags. Success hinges on battery tech, charging, and incentives. FedEx targets ambitious electrification, needing significant investment. In 2024, FedEx aimed for 50% electric vehicle pickup and delivery by 2025.

FedEx is actively growing in emerging markets, especially Southeast Asia, due to its high growth potential. However, this expansion faces hurdles like political instability and infrastructure issues. FedEx must adapt its strategies to local conditions to succeed. In 2024, FedEx increased its customer base in Southeast Asia by 15% and plans further investments.

New Technology Integration (AI, Blockchain)

New technology integration, including AI and blockchain, positions FedEx as a question mark in its BCG matrix. These technologies are still developing, and their full impact on logistics isn't clear. Success hinges on FedEx's ability to innovate and integrate these into its systems. FedEx is investing in AI and machine learning to streamline operations, with a $2 billion capital expenditure allocated for fiscal year 2024, showing a commitment to technological advancement.

- AI and Machine Learning: Streamlining operations.

- Blockchain: Enhancing tracking capabilities.

- Investment: $2 billion in capital expenditure.

- Uncertainty: Evolving technologies.

Sustainable Packaging Solutions

In the FedEx BCG Matrix, sustainable packaging solutions are a question mark. FedEx is pushing for eco-friendly packaging and urging customers to join in. However, these initiatives are still in their early phases, facing challenges. Success hinges on cost-effectiveness, availability, and customer interest, requiring big investments and teamwork.

- FedEx aims to make all packaging reusable, recyclable, or compostable by 2025.

- The company has invested in research for innovative materials.

- Customer adoption rates vary based on region and industry.

- Challenges include supply chain adjustments and cost comparisons.

FedEx's investments in tech, new markets, and sustainability are "question marks". These areas, like AI and EVs, require substantial investments before profitability. Success hinges on innovation and market acceptance.

| Initiative | Investment (2024) | Challenges |

|---|---|---|

| FDX Platform | $2 billion | Adoption by merchants. |

| EV Fleet | Significant, ongoing | Tech, infrastructure. |

| Emerging Markets | Increased 15% base | Political, infrastructure. |

BCG Matrix Data Sources

The FedEx BCG Matrix is data-driven, using sources such as financial filings, market reports, and industry analysis for actionable insights.