Fair Isaac Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fair Isaac Bundle

What is included in the product

Fair Isaac's product strategy using the BCG Matrix to assess investment and divestment.

Instantly build a BCG matrix for your Fair Isaac data.

Preview = Final Product

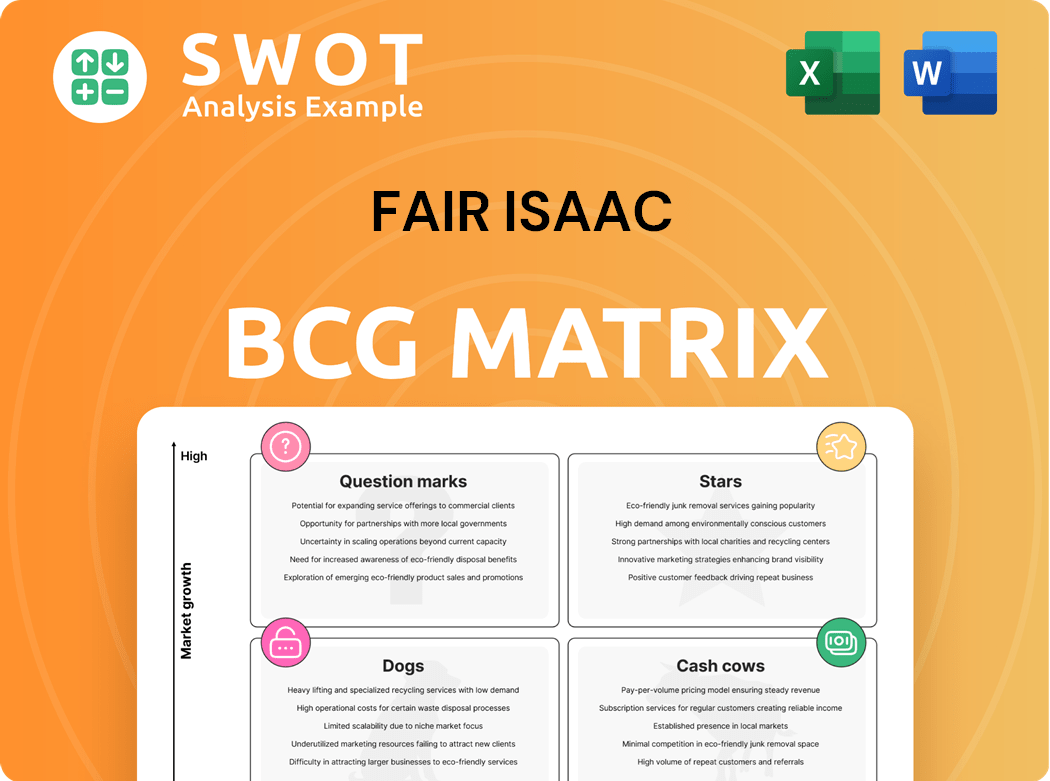

Fair Isaac BCG Matrix

The preview you see showcases the complete Fair Isaac BCG Matrix you'll receive after purchase. It’s the fully functional document—no hidden sections or altered formatting, ensuring your strategic analysis is on point. You will download and use the complete document

BCG Matrix Template

The Fair Isaac BCG Matrix categorizes products by market share and growth rate, revealing strategic investment needs. This glimpse shows how products stack up as Stars, Cash Cows, Dogs, or Question Marks. Analyze which are market leaders and which need strategic attention.

This preview is just a taste of the insights available. Get the full BCG Matrix for detailed quadrant placements, data-driven recommendations, and a roadmap to superior decision-making.

Stars

FICO Score 10 T, Fair Isaac's latest model, is gaining traction, especially in mortgages. MCT analyzes transaction data to assess its impact on loan sales and servicing. This real-time data aids pricing and secondary marketing. Precise credit risk assessment is a core function. In 2024, FICO Score 10 T adoption grew by 15%.

The FICO Platform, a "Star" within Fair Isaac's BCG Matrix, uses analytics and AI for improved business decisions. As of September 30, 2024, FICO Platform-based products generated $227.0 million in annual recurring revenue (ARR). This revenue constituted 31% of the total software ARR, highlighting its importance. The platform supports digital transformation and decision-making enhancements.

Falcon X, a cutting-edge AI-powered fraud detection platform, is FICO's recent venture aimed at financial institutions. Cognizant and FICO's collaboration resulted in a cloud-based solution that uses ML and AI for real-time fraud prevention. Falcon X is designed to enhance predictive analytics, thereby improving fraud detection across various payment channels. In 2024, fraud losses in the US are projected to reach $30 billion, making solutions like Falcon X crucial.

AI-Driven AML Solutions

FICO's AI-driven AML solutions, a star in the Fair Isaac BCG Matrix, leverage machine learning and data insights for comprehensive fraud prevention. The FICO Falcon Intelligence Network, a key component, offers a 360-degree customer view, enhanced by AI. These solutions are crucial for mitigating identity and payment fraud, alongside money laundering risks. In 2024, global AML spending is projected to reach $40 billion.

- FICO's AI solutions offer advanced fraud detection.

- The Falcon Intelligence Network enhances customer insights.

- These solutions help reduce financial crime.

- Global AML spending is on the rise.

Partnerships for Market Expansion

FICO strategically forms partnerships to expand its market presence and tailor its offerings to specific regions. For instance, FICO and Fujitsu are collaborating to introduce FICO solutions in Japan, with plans to extend into other financial markets, and Fujitsu will provide FICO® platform's Omni-Channel Engagement Capabilities to Japanese financial institutions from July 2025. This partnership aims to tap into the Japanese market, which had a consumer credit market of approximately $1.3 trillion in 2024. Collaborations like the one between TransUnion and FICO to introduce risk solutions in Kenya are also critical for expanding credit access.

- Fujitsu will provide FICO® platform's Omni-Channel Engagement Capabilities to Japanese financial institutions from July 2025.

- Japan had a consumer credit market of approximately $1.3 trillion in 2024.

- These partnerships are vital for broadening the reach of FICO's services.

Fair Isaac's "Stars" include AI-driven AML and fraud detection solutions. These areas are seeing significant investment, with global AML spending reaching $40B in 2024. Falcon X and the Falcon Intelligence Network are key offerings. These platforms drive revenue and improve fraud prevention.

| Feature | Description | 2024 Data |

|---|---|---|

| Key Products | AI-driven AML, Falcon X, Intelligence Network | $40B AML spending |

| Focus | Fraud detection, enhanced customer insights | 30B projected US fraud losses |

| Strategic Importance | Revenue generation, market expansion | $227M platform ARR (as of Sept 2024) |

Cash Cows

The classic FICO score is a cash cow. It's used in over 90% of U.S. lending decisions. This model generates significant revenue due to its widespread use. Despite newer models, the classic score's stability ensures its reliability. Its dominance makes it a dependable benchmark.

FICO's B2B scoring solutions are a key revenue source, with revenues increasing. For the full year, revenues were up 27% as of the latest reports. The mortgage market's recovery is crucial. Strong pricing power, especially in mortgage scores, boosts revenue.

In 2024, the BFSI sector led the fraud detection and prevention market. Digitalization increased fraudulent activities, boosting demand for security solutions. FICO's offerings profit from the growing need to combat payment fraud. These solutions ensure continuous revenue, vital for financial transaction security.

Credit Risk Management Solutions

FICO offers credit risk management solutions, vital for financial institutions managing credit portfolios and boosting operational efficiency. Regulatory demands are increasing, focusing on transparency and capital adequacy. In 2024, the global credit risk management market was valued at $33.6 billion. Institutions increasingly use advanced analytics, including AI and ML, to improve risk modeling and automate tasks.

- FICO's solutions support compliance with evolving regulations.

- Financial institutions are adopting AI and ML to enhance risk management.

- The credit risk management market is substantial and growing.

- These solutions are crucial for financial stability.

Licensing and IP

FICO's licensing and intellectual property (IP) are key cash cows. They have over 200 patents globally, fueling revenue. These patents protect FICO's market position and ensure a steady income stream. FICO's responsible AI model development standard further strengthens its IP value.

- In 2024, FICO's revenue from licensing and related services was a significant portion of its total revenue.

- FICO's commitment to responsible AI helps maintain client trust and protects its IP.

- The company's AI model development standard includes specific requirements, testing, and approvals.

- FICO continues to invest in new patents to protect its market advantage.

FICO's cash cows generate consistent revenue, as evidenced by significant growth in 2024. The classic FICO score remains dominant, used in most lending decisions, ensuring stability. B2B scoring solutions and licensing of IP are major income sources. These factors reinforce FICO's strong financial position and market leadership.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue Growth | B2B Solutions | Up 27% |

| Market Value | Credit Risk Management | $33.6 Billion |

| Patents | Global Portfolio | Over 200 |

Dogs

Non-platform software, or legacy systems, are like the Dogs in FICO's BCG Matrix, not growing as fast as the FICO Platform. Despite revenue, investment and support are likely declining. In 2024, FICO's strategy focuses sales teams on platform clients.

In the Fair Isaac BCG Matrix, B2C scores represent the "Dogs" quadrant. Direct sales and volumes of FICO's B2C scores, especially via myFICO.com, have declined. This downturn might stem from greater competition or shifting consumer habits. FICO's emphasis on B2B scores signals a potentially lower priority for B2C, possibly leading to slower growth. The B2C segment saw a decrease in revenue in 2024.

Traditional on-premise solutions, while offering dependable services, particularly in government and education, are not the primary growth focus. The cloud segment, driven by AI and data analytics, led the market in 2024. On-premise solutions are expected to grow at a slower rate compared to the cloud segment. The cloud segment is projected to have the highest CAGR during the forecast period. Data from 2024 shows a clear shift towards cloud-based deployments.

Older Fraud Detection Systems

Older fraud detection systems, without advanced AI and machine learning, are increasingly vulnerable. These systems struggle to adapt to evolving fraud tactics. This can lead to a decline in market share and revenue. Staying current with fraud detection innovations is essential to avoid obsolescence. In 2024, the global fraud detection and prevention market was valued at $37.1 billion, highlighting the stakes.

- Outdated systems face a rising threat from sophisticated cyberattacks.

- Failure to update can result in significant financial losses.

- Innovation is crucial for maintaining a competitive edge.

- Market share erosion is a direct consequence of lagging technology.

Geographically Limited Products

Products or services confined to specific geographic areas, without expansion strategies, often fit the "Dog" category in the Fair Isaac BCG Matrix. FICO's proactive moves into markets like Japan and Kenya, which represent significant growth opportunities, underscore the necessity of a global presence. Those products or services that do not align with this worldwide expansion face constrained growth. For example, in 2024, FICO's international revenue grew by 15%, outpacing domestic growth.

- Geographic limitations hinder growth.

- Global expansion is a key strategic focus for FICO.

- Products lacking global reach face limited potential.

- International revenue growth highlights global strategy success.

Dogs in the Fair Isaac BCG Matrix include legacy systems, B2C scores, on-premise solutions, outdated fraud detection, and geographically limited products. These areas show slower growth or declining revenue compared to other segments. In 2024, these segments required less investment, shifting focus to higher-growth opportunities.

| Category | Characteristics | 2024 Status |

|---|---|---|

| Legacy Systems | Declining investment, slower growth | Revenue decline |

| B2C Scores | Declining direct sales | Revenue decrease |

| On-Premise | Slower growth than cloud | Below cloud CAGR |

| Fraud Systems | Outdated tech, vulnerable | Market share erosion |

| Geography Limited | Lack global presence | Slower growth |

Question Marks

FICO's inclusion of Buy Now, Pay Later (BNPL) data in its scoring model targets a high-growth yet uncertain market. The goal is to encourage market adoption of these products. BNPL's increasing use necessitates FICO's refinement of credit risk assessments. According to a 2024 report, BNPL usage grew by 30% in the last year, highlighting the need for such integration.

AI-driven personalization is key, as 88% of bank customers value customer experience. FICO's AI capabilities offer personalization, but it's a developing area. The marketing strategy focuses on product adoption. Effective execution of these investments could lead to significant growth.

The healthcare sector offers a significant growth opportunity for Fraud Detection and Prevention (FDP) solutions, with a projected high Compound Annual Growth Rate (CAGR) in the forecast period. FICO's current presence in fraud detection positions it well, but specializing in healthcare fraud is a strategic question mark. Market adoption of these products is driven by marketing initiatives. Collaborations and partnerships are crucial growth strategies for the next five years. The global healthcare fraud detection market was valued at $2.7 billion in 2023.

Solutions for SMEs

The Small and Medium Enterprise (SME) segment is projected to experience the most significant Compound Annual Growth Rate (CAGR) in the coming years. The focus is on encouraging market adoption of fraud detection and prevention solutions within this sector. SMEs are increasingly aware of the need for these solutions, driven by intricate regulatory environments and operational risks. For example, the global fraud detection and prevention market was valued at $28.8 billion in 2023.

- SME growth is the highest in the forecast period.

- Marketing focuses on adoption of these products.

- SMEs need fraud detection to navigate regulations.

- The fraud detection market was $28.8 billion in 2023.

Blockchain for AI Governance

FICO's AI Innovation and Development team has patented an immutable blockchain ledger to enhance AI governance. This technology tracks the entire lifecycle of machine learning models, from creation to deployment and monitoring. The goal is to promote market adoption of these blockchain-based products, ensuring transparency and accountability. By leveraging blockchain, FICO aims to improve trust and reliability in AI systems across various industries.

- FICO's patent covers an immutable blockchain ledger.

- The technology tracks the development, operation, and monitoring of machine learning models.

- The marketing strategy focuses on encouraging market adoption of these products.

- This approach aims to increase transparency and trust in AI.

Question marks in the BCG Matrix represent high-growth, low-market-share products. FICO strategically evaluates opportunities like healthcare FDP and AI solutions within this category. These areas require significant investment to potentially become stars. The success hinges on effective marketing and product adoption, with the global healthcare fraud detection market valued at $2.7 billion in 2023.

| Category | Description | Example |

|---|---|---|

| Characteristics | High market growth, low market share; uncertain future. | Healthcare fraud detection market |

| Strategic Focus | Invest, or divest, based on growth potential. | AI innovation, BNPL |

| Marketing Goal | Drive market adoption to increase share. | Targeting SMEs |

BCG Matrix Data Sources

Fair Isaac's BCG Matrix uses financial reports, market research, and competitor analysis for reliable strategic insights.