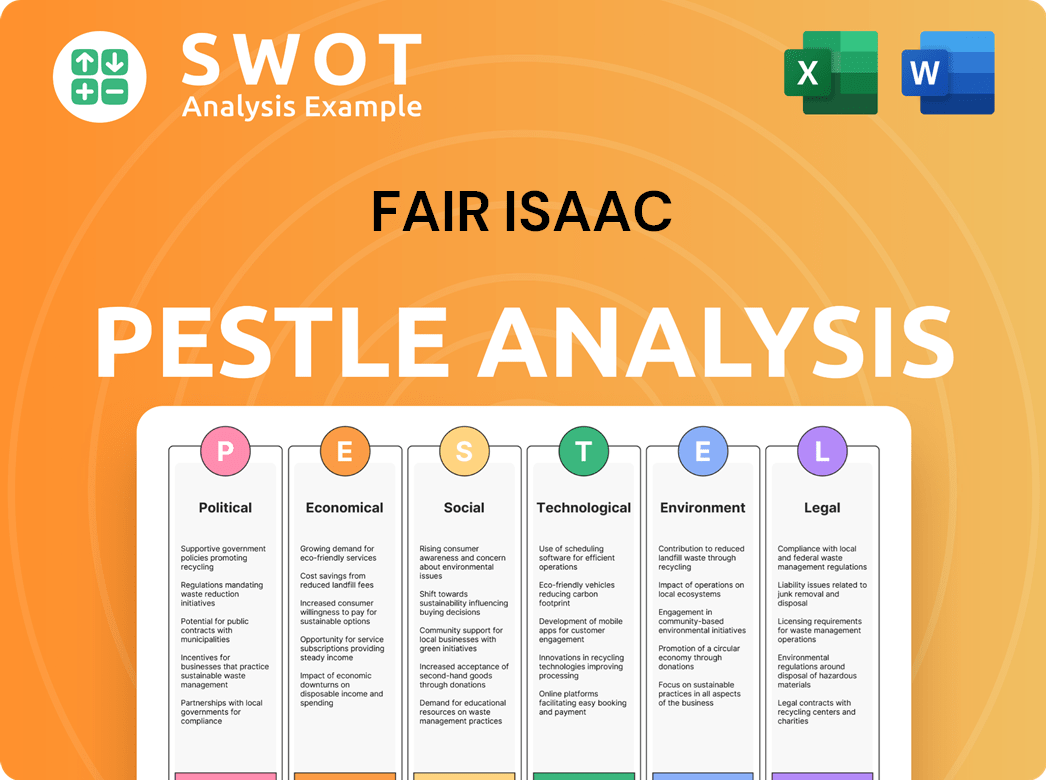

Fair Isaac PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fair Isaac Bundle

What is included in the product

Analyzes external factors impacting Fair Isaac across political, economic, social, technological, environmental, and legal areas.

Offers editable fields for brainstorming diverse viewpoints during strategy sessions.

Full Version Awaits

Fair Isaac PESTLE Analysis

What you're previewing is the real, complete Fair Isaac PESTLE analysis. This document you see showcases the structure and analysis provided. It's a ready-to-use resource for strategic planning. You'll download this exact, fully formed file instantly after purchase.

PESTLE Analysis Template

Gain a crucial understanding of Fair Isaac's external environment with our concise PESTLE Analysis. We break down the political, economic, social, technological, legal, and environmental factors impacting their business. See how industry trends shape their strategy and market positioning. Don't miss out—download the full report and empower your strategic planning immediately!

Political factors

Governments, including the CFPB, are intensifying scrutiny of credit reporting. This focuses on fairness and transparency in scoring models, especially those using AI. Regulatory changes could affect FICO's operations and model development. The CFPB has proposed rules impacting credit reporting accuracy. Compliance costs for FICO could rise due to these changes.

Increasing global data privacy regulations, like GDPR and U.S. state laws, impact FICO's data handling. Compliance demands investment and can change credit scoring data usage. For instance, in 2024, FICO spent $50 million on GDPR compliance and related legal fees. These regulations also affect how they develop and deploy new scoring models.

Geopolitical instability and trade policies significantly affect FICO. Trade restrictions can disrupt operations and reduce revenue, especially in key international markets. FICO's global footprint requires navigating diverse political environments and potential trade barriers. For example, in 2024, changes in trade agreements impacted 5% of FICO's international revenue.

Government Use of Credit Scoring

Government use of credit scoring significantly affects FICO's business. Federal agencies' adoption of FICO scores, like in mortgage lending, influences its market share. Policy changes regarding credit scoring models can shift FICO's dominance. For example, the U.S. government's role in housing finance, including agencies like Fannie Mae and Freddie Mac, directly impacts FICO.

- Fannie Mae and Freddie Mac use FICO scores.

- Policy changes can mandate or limit specific scoring models.

- Government actions influence consumer lending standards.

- Regulatory shifts affect FICO's revenue streams.

Political Stance on Financial Inclusion

Government policies significantly shape financial inclusion, affecting credit scoring. Initiatives aimed at reaching the unbanked boost demand for alternative scoring methods. This creates opportunities and challenges for FICO. For example, in 2024, the U.S. government continued efforts to expand financial access, impacting credit markets.

- Policy shifts can alter credit risk assessments.

- Increased financial inclusion may drive demand for FICO's products.

- Regulatory changes can create new market opportunities.

- Political stability impacts investor confidence.

Political factors present considerable risks and opportunities for FICO's future. Government regulations regarding credit scoring models and data privacy continue to evolve, significantly influencing operational costs. The U.S. government’s influence, particularly through agencies like Fannie Mae, shapes market dynamics.

These agencies' use of FICO scores directly affects the company's market share and revenue streams. Policy shifts focusing on financial inclusion impact the demand for alternative scoring methods, which opens new challenges.

Navigating geopolitical instability and trade policies is essential for FICO's global operations, influencing international revenue and market access.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Compliance costs and model changes | $50M spent on GDPR in 2024 |

| Government Use | Market share and revenue shifts | Fannie Mae & Freddie Mac's influence |

| Trade Policies | Operational and revenue disruptions | 5% international revenue impacted in 2024 |

Economic factors

Economic slowdowns pose a risk to FICO. Reduced borrowing, especially in mortgages, lowers demand for FICO's services. US mortgage originations fell to $1.45 trillion in 2023, impacting FICO. The expectation for 2024 is a slow recovery.

Interest rate changes affect borrowing costs and consumer credit demand. Rising rates may reduce credit applications, impacting FICO's revenue. The Federal Reserve held rates steady in early 2024, impacting consumer spending. As of May 2024, the prime rate is around 8.50%, influencing credit card and loan rates.

Consumer debt and delinquency trends significantly affect credit scoring. Resumed student loan reporting has led to higher delinquencies. In Q4 2023, credit card debt hit $1.13 trillion, with delinquencies rising. These trends can lower credit scores, impacting lending in 2024/2025.

Inflationary Pressures

Inflationary pressures are a significant factor for Fair Isaac (FICO). Rising inflation can reduce consumer spending and increase debt management challenges, directly impacting credit risk. High inflation often erodes consumer confidence, leading to shifts in financial behavior. This affects the demand for FICO's credit scoring and risk management products. In March 2024, the U.S. inflation rate was 3.5%, indicating persistent cost increases.

- Consumer Price Index (CPI) rose 0.3% in March 2024.

- Federal Reserve aims for 2% inflation.

- Increased interest rates to combat inflation.

- Higher prices affect loan repayment.

Pricing Power and Market Demand

FICO's pricing power is a key economic driver. It can raise prices for its scoring services, especially in mortgage scoring, boosting revenue. This power stems from strong market demand and its leading market position. For example, in 2024, FICO's revenue increased, partly due to pricing adjustments. This pricing strategy is crucial for its financial performance.

- Pricing adjustments boosted FICO's revenue in 2024.

- Market demand and dominance support FICO's pricing power.

Economic factors like inflation impact FICO's operations. Rising inflation of 3.5% (March 2024) affects consumer spending, influencing credit risk. Increased interest rates to fight inflation can reduce consumer credit demand. FICO's pricing power is critical; it raised prices, boosting 2024 revenue.

| Metric | Value | Year |

|---|---|---|

| Inflation Rate (U.S.) | 3.5% | March 2024 |

| Prime Rate | 8.50% (approx.) | May 2024 |

| Credit Card Debt | $1.13 trillion | Q4 2023 |

Sociological factors

Consumer financial literacy significantly impacts credit scoring and financial product adoption. Studies in 2024 revealed that only 40% of U.S. adults could correctly answer basic financial literacy questions. Changes in consumer behavior, such as increased reliance on buy-now-pay-later services, are also shaping credit risk profiles. FICO and similar firms must adapt their scoring models to reflect these evolving trends and the effectiveness of financial education initiatives.

Demographic shifts, including aging populations and increased migration, influence credit needs. Financial inclusion efforts, especially targeting underserved groups, are rising. In 2024, the unbanked rate in the U.S. was around 4.5%, indicating a significant market. This drives the need for models using alternative data for broader access.

Public trust in credit scoring is vital. Data privacy concerns and fairness perceptions are key. In 2024, 60% of consumers worried about data misuse. Transparency influences consumer attitudes towards credit. Negative perceptions can impact financial service providers.

Social Responsibility and Ethical Considerations

Societal demands for corporate social responsibility and ethical data handling are rising, affecting FICO. This includes tackling potential biases in algorithms and ensuring responsible AI use in financial decisions. FICO must adapt to these expectations to maintain its reputation and relevance. In 2024, a study showed that 70% of consumers prioritize ethical business practices.

- 70% of consumers prioritize ethical business practices.

- FICO is actively working on bias mitigation in its algorithms.

- Regulatory scrutiny of AI in finance is increasing.

- Stakeholders demand greater transparency in data usage.

Workforce Diversity and Talent Acquisition

For a tech firm like FICO, workforce diversity and talent acquisition are crucial sociological factors. Attracting and keeping a skilled, diverse team directly impacts innovation and operational efficiency. Fostering an inclusive environment is key to competing for top talent. In 2024, the tech industry saw a 30% increase in demand for AI and data science professionals, highlighting the need for FICO to attract these specialists.

- FICO's 2024 revenue: $1.4 billion, reflecting operational efficiency.

- Tech industry average for diversity: 28% women in tech roles (2024).

- Companies with diverse teams have a 19% higher innovation revenue (2023).

- Employee retention rate is a key measure.

Consumer expectations and behaviors shift, impacting credit. Public trust in data and AI influences acceptance, with 60% of consumers concerned about data misuse in 2024. Ethical practices and diversity, seen in the tech sector, also matter. FICO must address these to maintain its position in 2025.

| Factor | Impact | Data (2024) |

|---|---|---|

| Trust & Ethics | Consumer confidence, AI acceptance | 70% prioritize ethical firms |

| Diversity | Innovation & talent attraction | Tech diversity: 28% women |

| Data Privacy | Credit product adoption | 60% worried about data misuse |

Technological factors

AI and machine learning are revolutionizing credit scoring and risk assessment. FICO utilizes these technologies, yet faces challenges regarding fairness and bias. In 2024, the global AI in fintech market was valued at $12.9 billion, expected to reach $43.2 billion by 2029. FICO's adoption must navigate these ethical considerations.

Big data and analytics are central to FICO's operations. They leverage advanced data processing to refine credit scoring. In 2024, FICO processed approximately 12 billion credit scores annually. Enhanced analytical capabilities allow for more accurate risk assessments. The company invests heavily in AI and machine learning to improve its predictive models.

Fair Isaac (FICO) must prioritize cybersecurity. The company faces constant threats of data breaches, demanding substantial investment in security infrastructure. According to a 2024 report, the average cost of a data breach is $4.45 million. FICO's ability to protect sensitive financial data is crucial for its reputation and operations.

Cloud Computing and Digital Transformation

Cloud computing and digital transformation are reshaping how FICO operates. FICO is adapting its platform strategy to align with these tech advancements. The financial services industry's shift to cloud-based solutions influences FICO's offerings. This affects how FICO provides its services and engages with customers. FICO's investments in cloud infrastructure reflect these changes.

- In 2023, the global cloud computing market was valued at $545.8 billion.

- Digital transformation spending in financial services is projected to reach $1.1 trillion by 2026.

- FICO's cloud revenue grew by 24% in fiscal year 2024.

- Over 80% of financial institutions are using or planning to use cloud services.

Development of Alternative Data Sources

The evolution of technology has led to the development of alternative data sources, creating new opportunities and challenges for FICO. These sources, which go beyond traditional credit data, include things like utility payments and rental history. FICO is actively exploring how to use this data to broaden financial inclusion, potentially reaching underserved populations. However, the use of alternative data brings significant regulatory and ethical considerations that FICO must address.

- According to a 2024 Experian report, the use of alternative data can increase credit access by up to 20% for "thin-file" consumers.

- FICO's 2024 initiatives include pilot programs to integrate telco and utility payment data into credit scoring models.

- The Consumer Financial Protection Bureau (CFPB) has increased scrutiny on the fairness and transparency of alternative data use in 2024 and 2025.

FICO leverages AI and machine learning for credit scoring and risk assessment, navigating ethical considerations in the $12.9 billion fintech AI market of 2024. Big data analytics refines credit scoring, processing around 12 billion scores annually, with investments in AI for predictive models.

Cybersecurity is paramount, as FICO faces data breach threats; the average cost per breach was $4.45 million in 2024. Cloud computing and digital transformation reshape operations, reflected in 24% growth in FICO’s cloud revenue during fiscal year 2024.

Alternative data sources offer opportunities and challenges; incorporating utility and rental payment data can increase credit access. Regulatory scrutiny intensifies as FICO adapts to these technological shifts, balancing innovation with data security and fairness.

| Technological Factor | Impact on FICO | Data/Statistics (2024-2025) |

|---|---|---|

| AI & Machine Learning | Improved scoring, bias challenges | Fintech AI market: $12.9B (2024) |

| Big Data & Analytics | More accurate risk assessment | 12B credit scores processed annually |

| Cybersecurity | Protection of sensitive data | Average data breach cost: $4.45M |

| Cloud Computing | Platform adaptation | Cloud revenue: +24% (fiscal 2024) |

| Alternative Data | Expand financial inclusion | Increase credit access up to 20% |

Legal factors

FICO operates within a legal framework shaped by credit reporting laws. The Fair Credit Reporting Act (FCRA) in the U.S. is a key regulation. The FCRA ensures the accuracy and fairness of consumer credit information. In 2024, the CFPB continued to scrutinize credit reporting practices. Regulatory changes can affect FICO's scoring methods and data usage.

Data privacy laws, such as GDPR and CCPA, are crucial legal factors for FICO. These laws govern how FICO manages personal data. The company must adapt its data handling practices and algorithms to comply. Failure to comply can result in substantial penalties; for example, GDPR fines can reach up to 4% of annual global turnover. In 2024, data privacy compliance costs are projected to rise by 15% for financial institutions.

Fair lending regulations, like the Equal Credit Opportunity Act (ECOA), are crucial for FICO. These rules ensure fair practices in lending. Regulators are actively reviewing credit scoring models to eliminate biases. For example, in 2024, the CFPB fined a lender $4.5 million for discriminatory practices. The push is on for less discriminatory alternatives.

Consumer Protection Laws

FICO, as a major player in credit scoring, must adhere to consumer protection laws. These laws dictate how businesses interact with consumers, especially regarding transparency, disclosure, and complaint handling. Compliance is crucial to avoid legal issues and maintain consumer trust. The Consumer Financial Protection Bureau (CFPB) handles many consumer complaints related to credit reporting. In 2024, the CFPB received approximately 400,000 complaints related to credit and consumer reporting.

- FICO must comply with the Fair Credit Reporting Act (FCRA).

- Transparency in credit scoring models is essential.

- Proper handling of consumer disputes is a legal requirement.

- Non-compliance can lead to significant fines and reputational damage.

International Regulations and Compliance

Fair Isaac (FICO) faces intricate international regulations. Operating globally demands navigating diverse legal landscapes concerning credit reporting, data privacy, and operational standards. Compliance is crucial, with requirements differing significantly across regions, impacting FICO's strategies. For example, the EU's GDPR has a global impact.

- GDPR compliance costs businesses an average of $550,000 to $1.1 million.

- FICO's international revenue in 2024 was approximately $400 million.

- Data privacy regulations are becoming stricter in many countries.

FICO's operations are heavily influenced by legal and regulatory factors. Key laws like FCRA and GDPR demand compliance, especially regarding data accuracy and privacy. Violations can lead to significant penalties. Fair lending regulations and consumer protection laws also require strict adherence.

| Aspect | Details |

|---|---|

| FCRA Compliance | Ensures accuracy of consumer credit data. |

| GDPR Impact | High compliance costs; fines up to 4% of global turnover. |

| Consumer Protection | Adherence to rules on transparency, disclosure, and complaint handling. |

Environmental factors

FICO's data centers, crucial for its analytics, are energy-intensive. They face growing scrutiny regarding energy efficiency and environmental impact. In 2024, data centers globally consumed about 2% of the world's electricity. This drives FICO to seek sustainable solutions. The push includes renewable energy adoption and efficiency upgrades.

FICO faces environmental considerations in waste management, especially electronic waste from IT equipment. Responsible waste management policies are key for corporate sustainability. In 2024, the global e-waste generated was around 62 million metric tons. Proper disposal minimizes environmental impact. FICO's actions here impact its ESG profile.

Climate change indirectly impacts financial risk for companies like Fair Isaac (FICO). Extreme weather events can disrupt industries, affecting loan repayment abilities. For example, in 2023, insured losses from natural disasters reached $93 billion globally. This can lead to increased defaults and credit risk.

Customer and Investor Expectations for Sustainability

Customers and investors increasingly demand environmental sustainability from companies, especially among younger demographics. This shift impacts business relationships and investment choices. A 2024 study by Morgan Stanley found that 80% of millennials and Gen Z consider a company's environmental impact when making purchasing decisions. Companies failing to meet these expectations risk losing both customers and capital. The rise in ESG (Environmental, Social, and Governance) investing, which reached over $40 trillion globally by early 2024, underscores this trend.

- Millennials and Gen Z are more likely to support businesses with strong environmental practices.

- ESG investments are becoming mainstream, influencing market valuations.

- Companies must adapt to meet sustainability expectations to maintain competitiveness.

Regulatory Focus on Environmental, Social, and Governance (ESG)

Regulatory and investor scrutiny of Environmental, Social, and Governance (ESG) is intensifying. Companies must now report their environmental impact and sustainability efforts. Although FICO's direct environmental footprint might be less substantial, demonstrating commitment is key. Investors are increasingly using ESG metrics to assess risk and value.

- In 2024, ESG-linked assets reached $40.5 trillion globally.

- The SEC's climate disclosure rule (March 2024) mandates environmental impact reporting.

- FICO's ESG rating improved to B in 2024, reflecting its initiatives.

FICO's data centers and waste practices face environmental scrutiny. Growing demand from younger customers and investors for sustainability is increasing. Regulatory demands like the SEC's climate disclosure rule and the expansion of ESG investments globally drive the need to address the environmental factors.

| Environmental Factor | Impact on FICO | 2024/2025 Data |

|---|---|---|

| Data Center Energy Use | Operational cost, reputation risk | Data centers used 2% of global electricity in 2024; projected to grow. |

| Waste Management (E-waste) | Compliance, brand image, disposal costs | Global e-waste: ~62M metric tons in 2024; Increasing costs and regulations. |

| Climate Change Risks | Financial, credit risks, Insurance premiums | 2023 insured losses: $93B; Rising natural disasters cause credit issues. |

PESTLE Analysis Data Sources

Fair Isaac's PESTLE analysis draws from government data, financial reports, and technology forecasts. These credible sources provide robust, data-backed insights.