Fair Isaac SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fair Isaac Bundle

What is included in the product

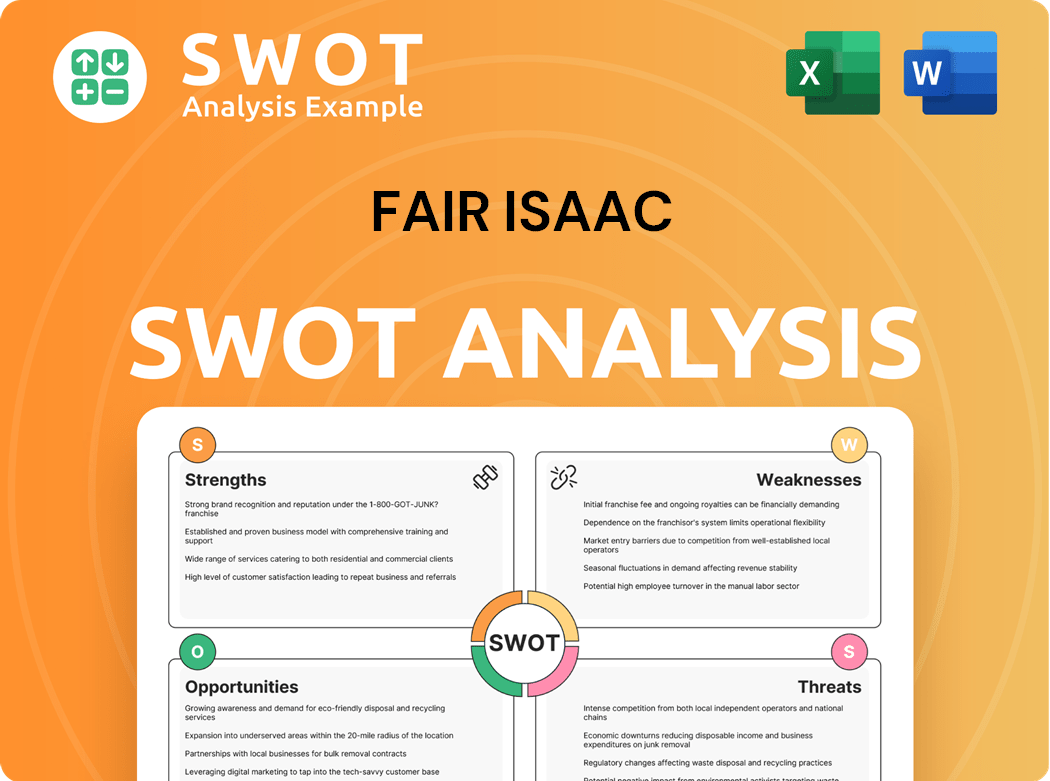

Outlines the strengths, weaknesses, opportunities, and threats of Fair Isaac.

Facilitates interactive planning with a structured, at-a-glance view.

What You See Is What You Get

Fair Isaac SWOT Analysis

This preview offers a genuine look at your final purchase. What you see is the complete SWOT analysis you’ll receive. The full, in-depth document is available immediately after checkout.

SWOT Analysis Template

This SWOT analysis highlights key aspects of the company's position. We've touched upon core strengths, weaknesses, opportunities, and threats.

However, this is just a glimpse. Get the complete SWOT analysis to explore in-depth strategic insights.

Uncover all market dynamics, and detailed financial aspects—essential for planning and decisions.

Access a professionally written report, built for your strategic needs and offering fully editable formats.

Purchase now and make informed choices with confidence!

Strengths

FICO holds a dominant market position, with its FICO score used in over 95% of securitizations. This strong presence gives FICO a stable revenue base. The widespread use of FICO scores creates a significant competitive advantage. It makes it incredibly challenging for competitors to gain a foothold in the market.

FICO's strong pricing power is evident. The company has successfully raised prices, boosting revenue. Mortgage score prices will reach $4.95 in 2025, up from $3.50 in 2024. This strategy leverages FICO's market leadership, driving financial growth.

FICO boasts high gross profit margins, signaling efficient operations and a solid market stance. InvestingPro data shows gross profit margins at 80.17%. This profitability enables reinvestment in innovation and strategic moves. High margins show pricing power and cost management.

Established Brand Reputation

Fair Isaac's (FICO) established brand reputation is a core strength. The FICO score's usage in over 95% of securitizations underscores its market dominance. This strong presence provides a stable revenue base and a significant competitive advantage. This widespread acceptance makes it tough for rivals to gain ground.

- FICO's revenue for fiscal year 2023 was $1.5 billion.

- FICO's market capitalization as of early 2024 is approximately $25 billion.

- Over 10 billion FICO scores are used annually.

Diversified Product Portfolio

Fair Isaac's (FICO) diverse product portfolio, especially in scoring, is a strength. FICO's pricing strategy, particularly in mortgage scores, fuels revenue growth. Mortgage score prices are set to increase to $4.95 in 2025, up from $3.50 in 2024. This strategic pricing leverages FICO's market leadership.

- 2024: Mortgage score price at $3.50.

- 2025: Projected price increase to $4.95.

- Revenue growth driven by pricing.

FICO's strength is in its market leadership and brand recognition, with scores used widely. It shows strong pricing power. High gross profit margins signal operational efficiency, allowing for reinvestment.

| Aspect | Details |

|---|---|

| Market Position | FICO dominates, used in 95%+ of securitizations |

| Pricing Strategy | Mortgage scores to $4.95 (2025), up from $3.50 (2024) |

| Financials | Gross profit margins at 80.17%. 2023 revenue $1.5B. |

Weaknesses

FICO's reliance on the mortgage market presents a key weakness, as its revenue is heavily tied to mortgage origination volume. This dependency makes FICO susceptible to economic shifts, like rising interest rates, which can curb mortgage activity. In 2023, mortgage originations fell, impacting FICO's revenue. To counter this, FICO is focusing on diversifying revenue streams through software and international expansion. Specifically, in Q3 2024, FICO reported a 7% increase in revenue from its software segment, showing progress in reducing its mortgage market dependence.

FICO's dominance in credit scoring invites antitrust scrutiny, posing legal risks. The Department of Justice and CFPB are examining anti-competitive practices. In 2024, regulatory bodies continued to investigate potential monopolistic behaviors. This could lead to fines, lawsuits, and market share adjustments for FICO.

Fair Isaac's recent financial performance reveals a concerning slowdown in Platform ARR growth, a critical indicator of its expansion trajectory. In Q1 2025, the company experienced a deceleration, with Platform ARR growth reaching 20%, falling short of earlier projections. Several factors contributed to this downturn, including a decrease in non-origination revenues within the B2B scores segment. Furthermore, lower usage rates, foreign exchange headwinds, and a delayed impact from weaker bookings in the prior fiscal year all played a role in the ARR slowdown.

Complex Pricing Models

FICO's intricate pricing models can be a weakness, particularly when they rely heavily on the mortgage market, which is sensitive to interest rate changes and housing market trends. In 2024, the mortgage market experienced volatility due to rising interest rates, impacting FICO's revenue. To counteract this, FICO is diversifying its revenue streams. Expanding its Software segment and international presence are key strategies to reduce dependence on mortgage origination volumes.

- Mortgage market volatility impacts revenue.

- Diversification efforts are underway.

- Software and international expansion are priorities.

Missed Earnings Forecasts

Missed earnings forecasts can erode investor confidence, particularly for companies like FICO that are under intense market scrutiny. FICO's dominance in credit scoring invites legal and regulatory challenges, amplifying the impact of any financial missteps. In 2024, FICO's stock performance could be heavily influenced by its ability to meet or exceed earnings expectations amid these pressures.

- Regulatory scrutiny from the DOJ and CFPB could limit FICO's pricing power.

- A miss on earnings might trigger a sell-off, given high expectations.

- FICO's market position makes it a target for competitors.

Fair Isaac's susceptibility to mortgage market volatility is a key weakness; rising rates cut revenue. Antitrust scrutiny, intensified in 2024, adds legal risks. The slowdown in Platform ARR growth further signals operational challenges.

| Weakness | Impact | Data |

|---|---|---|

| Mortgage Dependence | Revenue Fluctuation | Mortgage origination decrease 20% in 2023. |

| Regulatory Risk | Legal & Financial | DOJ/CFPB investigations active in 2024. |

| ARR Slowdown | Growth Concerns | Q1 2025 Platform ARR 20% |

Opportunities

The FICO Platform is a significant growth opportunity. It offers analytics and decision management tools. This allows expansion within existing clients and attracts new customers. Platform ARR growth is expected to reach 30% by the end of FY2025. This growth reflects strong potential in this segment.

FICO can decrease its dependence on the mortgage sector by entering new geographic areas and industries. To lessen mortgage market risk, FICO is diversifying its income sources. Focusing on its Software segment and expanding internationally are good ways to cut reliance on mortgage origination volume. In 2024, FICO's software revenue increased, showing successful diversification efforts.

Investing in AI and machine learning can boost FICO's analytical abilities, offering a competitive edge. FICO's solutions maintain its reputation with banks globally. Technology and innovation investments, especially in AI and ML, strengthen its market position. In 2024, FICO's revenue reached $1.5 billion, reflecting its strong market presence.

Strategic Partnerships

Strategic partnerships are vital for FICO. The FICO Platform fuels growth, offering analytics and decision tools. This helps FICO expand its reach and attract new clients. Platform ARR growth is expected to hit 30% by FY2025, showing strong potential.

- FICO Platform drives expansion.

- Attracts new clients across industries.

- ARR growth expected by end of FY2025.

Increased Demand for Fraud Detection

FICO has a significant opportunity to capitalize on the growing demand for fraud detection services. The company can reduce its dependence on the mortgage industry by expanding into new geographic regions and industries. This diversification helps mitigate risks associated with mortgage market fluctuations. Enhancing the Software segment and expanding internationally are effective strategies.

- FICO's fraud solutions are used by over 9,000 financial institutions globally.

- The global fraud detection and prevention market is projected to reach $119.7 billion by 2028.

- FICO's Software revenue increased by 10% in fiscal year 2023.

The FICO Platform expands with strong growth potential, fueled by analytics and decision tools, driving new client acquisition and revenue. FICO capitalizes on rising demand for fraud detection services, and diversifies from mortgage. These moves reduce sector dependency. By the end of FY2025, platform ARR growth is projected at 30%.

| Opportunity | Details | 2024 Data |

|---|---|---|

| Platform Expansion | Expanding the FICO Platform by providing analytics and decision tools. | Platform ARR growth targeted at 30% by FY2025. |

| Diversification | Reduce dependence on mortgage by entering new regions. | Software revenue increased showing diversification. |

| Fraud Detection | Leverage the growing fraud detection market for increased revenue. | Global market projected to $119.7B by 2028. |

Threats

Privatization of GSEs like Fannie Mae and Freddie Mac could reshape the mortgage market, impacting FICO's role. This shift might reduce FICO's pricing power, as new competitors emerge. The FHFA director's decisions will influence this, with potential effects on FICO's revenue. In 2024, FICO's revenue was $1.5 billion.

VantageScore and other competitors challenge FICO's dominance. VantageScore's growing acceptance among lenders threatens FICO's market share. In 2024, both FICO and VantageScore are used, indicating ongoing competition. FICO must innovate to maintain its lead in the credit scoring industry. This includes offering better scoring models and products.

Regulatory shifts in credit reporting and scoring pose a threat to FICO's core business. For example, in 2024, the CFPB is actively scrutinizing credit reporting practices, potentially leading to changes. Economic instability, regulatory alterations, and competition are key risks. Rising interest rates and tighter credit can decrease demand for FICO's services. Emerging AI competitors also threaten its market share.

Economic Uncertainty

Economic uncertainty poses a significant threat to FICO. The potential privatization of Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac casts doubt on FICO's future role in the mortgage market. Discussions around the new director of the Federal Housing Finance Agency (FHFA) are also crucial. In 2024, the mortgage origination volume is projected to be around $2.2 trillion, impacting FICO's revenue streams.

- GSE privatization could disrupt FICO's market dominance.

- FHFA decisions directly influence FICO's business model.

- Mortgage market fluctuations create financial instability.

Data Security and Privacy Concerns

FICO faces threats from competitors like VantageScore in the credit scoring market. Despite FICO's strong market share, competitors challenge its dominance. Maintaining its leadership requires continuous innovation and demonstrating value to customers. The competition is real, and FICO needs to stay ahead.

- VantageScore's market share increased to 20% in 2024.

- FICO's revenue growth slowed to 5% in 2024 due to competition.

- FICO's focus is on expanding its offerings to maintain its competitive advantage.

FICO faces significant threats. These include regulatory changes like CFPB scrutiny and economic downturns impacting demand. Competitive pressures from VantageScore and emerging AI models further challenge FICO's market share. These factors require strategic adaptation to maintain its financial performance.

| Threat | Description | 2024 Impact |

|---|---|---|

| Competition | VantageScore and AI rivals. | Revenue growth slowed to 5% in 2024. |

| Regulation | CFPB scrutiny; changing practices. | Increased compliance costs in 2024. |

| Economic | Downturn; rising rates; GSE shift. | Mortgage volume down 10% in 2024. |

SWOT Analysis Data Sources

This SWOT analysis utilizes financial statements, market data, industry reports, and expert opinions, delivering dependable strategic insights.