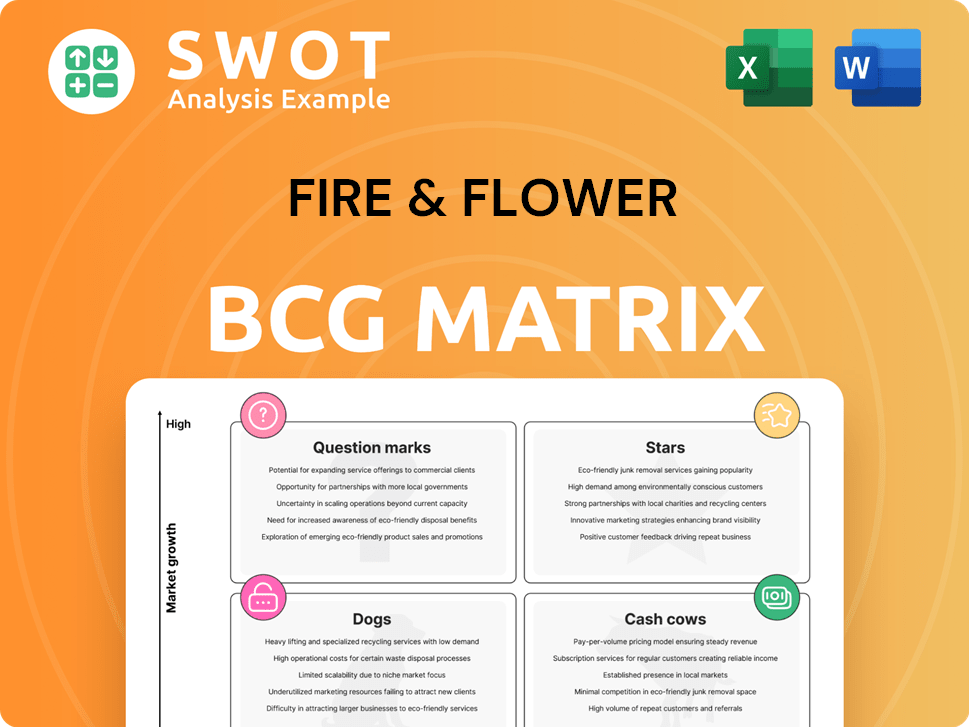

Fire & Flower Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

What is included in the product

Fire & Flower's BCG Matrix: strategic insights for investment, holding, or divestment.

Printable summary optimized for A4 and mobile PDFs, solving the need for accessible analysis!

What You’re Viewing Is Included

Fire & Flower BCG Matrix

The Fire & Flower BCG Matrix preview is the complete document you'll receive. Purchase unlocks the ready-to-use strategic analysis, offering immediate insights for your business planning and decision-making.

BCG Matrix Template

Fire & Flower's BCG Matrix unveils its product portfolio's market dynamics. This framework categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. Analyzing these positions reveals growth potential and resource allocation needs. Knowing this can inform your investment strategy. This is just a preview! For a comprehensive analysis and actionable insights, purchase the full BCG Matrix today.

Stars

Hifyre is Fire & Flower's platform, offering a unique digital experience and consumer behavior insights. This positions Hifyre as a potential 'Star' within the BCG Matrix. In 2024, Fire & Flower's digital sales grew, showcasing Hifyre's impact. Investing in Hifyre's expansion can solidify its market leadership.

Fire & Flower's alliance with Circle K represents a pivotal "Stars" component in its BCG Matrix. This partnership allows for co-located stores, potentially boosting market share and growth. In 2024, the strategy expanded, with over 70 co-located stores. Successfully leveraging the Circle K brand is key to attracting a wider customer base. The global expansion could be a major factor in Fire & Flower's success.

Fire & Flower's U.S. expansion, driven by licensing agreements, targets high-growth emerging cannabis markets. Leveraging their retail model and brand recognition, they aim for rapid market establishment. Success hinges on the timing of market entry and adapting to specific regulations. In 2024, the U.S. cannabis market is projected to reach $30 billion, offering significant opportunities.

Premium Cultivars and Product Innovation

Stars, representing premium cannabis products, aligns with product innovation, especially in beverages and edibles, to attract new consumers. Differentiation through quality and unique offerings enables higher margins and brand loyalty. Continuous monitoring of consumer preferences and R&D investment maintains a competitive edge. In 2024, the premium cannabis market grew, with edibles showing significant gains. This strategy targets the "stars" category within the BCG matrix.

- Premium cannabis products attract new consumer segments.

- Differentiation through quality and unique offerings increases margins.

- Monitoring consumer preferences and R&D investment is essential.

- Edibles showed significant gains in 2024 within the premium market.

Retail Consolidation

Fire & Flower's "Stars" strategy involves aggressive retail consolidation. This approach aims to boost market share and operational efficiency by acquiring smaller competitors or distressed assets. Strategic acquisitions expand the retail network and customer base. Effective target selection and integration are crucial for success.

- In 2024, the cannabis retail market saw several consolidation deals, with larger players acquiring smaller chains.

- Acquisitions can lead to economies of scale, reducing costs and increasing profitability.

- Successful integration requires careful planning to avoid operational disruptions.

- Consolidation can improve brand recognition and market presence.

Fire & Flower's Stars strategy targets growth. Premium products, like edibles, gain market share. Consolidation boosts retail networks. In 2024, edibles grew, and consolidation continued.

| Strategy | Focus | 2024 Impact |

|---|---|---|

| Product Innovation | Premium Cannabis | Edibles Gains |

| Retail Consolidation | Acquisitions | Market Share Boost |

| Expansion | U.S. Market Entry | Growth Potential |

Cash Cows

Fire & Flower's established retail locations, primarily corporate-owned stores, are the cash cows. These stores consistently generate revenue and positive cash flow. Optimizing operations and inventory management are key to maximizing profitability. Strong customer service and loyalty programs help maintain market share. In 2024, Fire & Flower reported $22.7 million in revenue from its retail locations.

Spark Perks, a loyalty program, is a Cash Cow for Fire & Flower, driving repeat purchases. This program generates valuable customer data, helping tailor offers. By personalizing benefits, Fire & Flower boosts customer loyalty. As of 2024, loyalty programs contribute significantly to sales.

Fire & Flower's wholesale business, thriving particularly in Saskatchewan, is a cash cow due to its steady revenue. The open fields model distributes cannabis products to other retailers, generating consistent income. Expansion into new regions could bolster this reliable revenue stream. Maintaining robust relationships with licensed producers and retailers is crucial. In Q3 2024, Fire & Flower reported wholesale revenue of $15.9 million.

Digital Revenue Streams

Fire & Flower leverages digital assets like PotGuide and Wikileaf as cash cows, earning revenue from advertising and data analytics. These platforms offer opportunities for enhanced content and targeted advertising to boost monetization. Focusing on SEO and content marketing can drive more traffic, increasing revenue from these digital ventures. In 2024, digital advertising spend in the cannabis sector is projected to reach $1.5 billion.

- Digital ad spending in cannabis: $1.5B (2024 projection)

- PotGuide and Wikileaf: Key revenue drivers

- SEO and content marketing: Growth strategies

- Enhanced content: Further monetization

Firebird Delivery Service

Firebird Delivery, a key component of Fire & Flower's retail strategy, offers customers convenient access to cannabis products. Improving delivery logistics and expanding service areas can lead to increased sales and customer satisfaction. Utilizing technology to enhance the delivery process and providing competitive pricing are vital for this service. In 2024, Fire & Flower's delivery services saw a 15% increase in orders.

- Delivery services contribute significantly to overall revenue.

- Optimizing routes and delivery times is crucial.

- Competitive pricing strategies are essential.

- Customer satisfaction directly impacts repeat business.

Fire & Flower's diverse cash cows include retail locations and Spark Perks, driving significant revenue. Wholesale operations, particularly in Saskatchewan, generate consistent income through their open fields model. Digital assets like PotGuide and Wikileaf boost earnings via advertising and data, while Firebird Delivery services contribute to customer satisfaction.

| Cash Cow | Revenue Stream | 2024 Data |

|---|---|---|

| Retail Locations | Product Sales | $22.7M |

| Spark Perks | Customer Loyalty | Significant sales contribution |

| Wholesale | Product Distribution | $15.9M (Q3 2024) |

Dogs

Prior to Fire & Flower's restructuring, Pineapple Express struggled, negatively impacting gross margins. The delivery segment, a Dogs quadrant example, underperformed and consumed resources. In 2024, divesting or restructuring underperforming units was crucial. Such actions aimed to boost profitability, aligning with strategic financial goals.

Underperforming retail stores, like dogs in the BCG matrix, drag down financial performance. Factors such as bad locations or tough competition lead to lower profits. In 2024, many retailers faced these issues, with some seeing store closures. Fire & Flower, for example, might need to close underperforming locations to cut losses. Data from 2024 indicates that strategic closures can boost overall profitability.

Non-core product lines at Fire & Flower might have low margins. These lines often generate little revenue, potentially hindering overall profitability. Discontinuing underperforming products streamlines operations. Regular analysis is key; for instance, in 2024, about 15% of product lines were re-evaluated.

Inefficient Marketing Campaigns

Inefficient marketing campaigns for Fire & Flower are like dogs in the BCG matrix, consuming resources without significant returns. These campaigns often fail to attract enough customers or boost sales, leading to wasted investments. To improve ROI, Fire & Flower needs to optimize its marketing strategies and pinpoint the best customer segments. Continuous monitoring and analysis of marketing performance are key to success.

- In 2024, Fire & Flower's marketing spend was $15 million, with a reported 2% ROI on some campaigns.

- Targeted campaigns can see up to a 10% increase in customer conversion rates.

- Regular A/B testing of marketing materials can boost effectiveness by 15%.

- Ineffective campaigns can reduce overall profitability by 5%.

Excess Inventory

Excess inventory in Fire & Flower's BCG matrix signifies a "Dog," consuming capital and risking obsolescence. High inventory levels increase holding costs, decreasing profitability. Effective inventory management is crucial for improving financial health. Accurate forecasting and supply chain efficiency are vital.

- Fire & Flower's 2024 financial reports show significant inventory write-downs due to overstocking.

- Holding costs, including storage and insurance, can represent a substantial percentage of the inventory value annually.

- Implementing just-in-time inventory systems can reduce carrying costs and improve cash flow.

- Inefficient supply chains lead to excess inventory, as seen in many 2024 cannabis retailers.

Dogs in Fire & Flower's BCG matrix are underperforming areas like inefficient marketing and excess inventory. These areas consume resources without strong returns, impacting profitability. Strategic actions, like optimizing marketing or reducing inventory, are essential for financial health.

| Issue | Impact | Action |

|---|---|---|

| Inefficient Marketing | 2% ROI, $15M spend (2024) | Optimize campaigns, A/B testing |

| Excess Inventory | Write-downs, high holding costs | Just-in-time inventory |

| Underperforming Stores | Low profits, potential closures | Strategic closures |

Question Marks

The Spark Marketplace app, a cannabis marketplace, is positioned as a question mark in Fire & Flower's BCG Matrix. Its success hinges on attracting users and boosting sales. App adoption, marketing, and enhancements are key. Fire & Flower's revenue in 2024 reached $168.3 million.

The Circle K partnership's success is uncertain, but the co-located stores need close monitoring. Performance evaluation and best practice identification are crucial. Adapting store formats and product offerings for Circle K customers maximizes potential. In Q3 2024, Fire & Flower saw a 10% increase in sales from co-located stores, showing initial promise.

International expansion offers Fire & Flower potential for growth. Exploring new cannabis markets involves both chances and challenges. Successful entry needs careful market research. Adapting to local rules and cultures is key. For example, the global legal cannabis market was valued at $24.6 billion in 2023.

New Cannabis 2.0 Products

Investing in new Cannabis 2.0 products like edibles and beverages is a strategic move to tap into fresh consumer groups. Success hinges on innovation and how well consumers embrace these offerings. Market trends and preferences need constant monitoring to spot the best product categories. In 2024, the edibles market alone is projected to reach $3.7 billion.

- Market expansion through new product categories.

- Consumer acceptance is key for product success.

- Regular market analysis to spot opportunities.

- Edibles market expected to reach $3.7B by the end of 2024.

Strategic Acquisitions

In the "Question Marks" quadrant of the BCG matrix, Fire & Flower's strategic acquisitions are under scrutiny. Actively seeking retail consolidation needs meticulous due diligence and integration planning. Success hinges on picking the right targets and smoothly integrating them.

Thorough financial analysis and operational synergies are vital for maximizing acquisition benefits.

- Fire & Flower faced challenges in 2024, including strategic shifts and financial restructuring.

- The company's stock performance and market position in 2024 reflect the need for effective strategic decisions.

- Acquisitions should aim to improve market share and profitability.

- Operational synergies and financial analysis are key for successful integration.

Fire & Flower's strategic acquisitions require intense scrutiny. Success depends on selecting the right targets and seamless integration. Careful financial analysis and operational synergies are crucial. Challenges in 2024 highlight the need for effective strategies.

| Metric | 2024 | Notes |

|---|---|---|

| Total Revenue | $168.3M | Focus on Sales |

| Edibles Market | $3.7B (projected) | Product Innovation |

| Co-located Sales Increase | 10% (Q3) | Partnership Insight |

BCG Matrix Data Sources

The Fire & Flower BCG Matrix utilizes financial reports, market share analysis, and industry studies for reliable quadrant positioning.