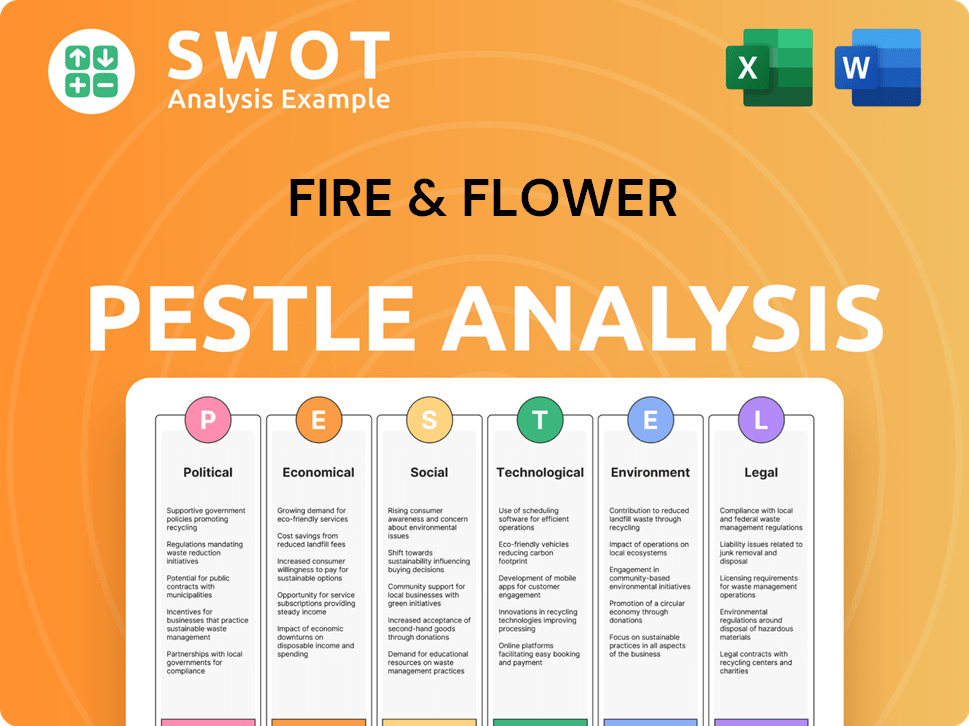

Fire & Flower PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

What is included in the product

This Fire & Flower PESTLE analysis investigates macro-environmental influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Full Version Awaits

Fire & Flower PESTLE Analysis

Everything displayed here is part of the final product. What you see is what you’ll be working with. This PESTLE analysis for Fire & Flower is fully formatted and ready to download. You'll get the same professional insights instantly. Review the detailed overview!

PESTLE Analysis Template

Explore the intricate world of Fire & Flower through our exclusive PESTLE Analysis. We dissect the crucial external factors affecting its performance, from regulations to consumer behaviors.

Gain an in-depth understanding of the opportunities and threats shaping Fire & Flower's market position.

Our ready-made analysis offers valuable insights for investors and analysts alike.

Identify emerging trends and develop well-informed strategies for growth. Download the full analysis now and empower your decision-making process!

Political factors

The cannabis industry faces stringent government regulations. Licensing requirements and store density limits are crucial. Product regulations also play a significant role. These factors directly affect Fire & Flower's operations and growth. In 2024, regulatory changes in Ontario impacted store openings.

Government taxation and excise duties on cannabis products significantly impact Fire & Flower's profitability. In Canada, excise duties are calculated as the higher of a per-unit amount or a percentage of the sale price. Recent data indicates that these taxes can represent a substantial portion of the final retail price, affecting consumer affordability. For example, in 2024, excise duties contributed to approximately 20-30% of the final cannabis product cost, influencing Fire & Flower's pricing strategies.

Political stances on cannabis vary widely, creating market uncertainty. Legalization progress affects public perception and Fire & Flower's operations. In Canada, the legal cannabis market reached CAD 5.6 billion in 2023, showing growth despite regulatory hurdles. Changing government policies can boost or hinder business prospects.

International Cannabis Policy

Fire & Flower's international expansion hinges on global cannabis policies. Regulatory frameworks vary widely, impacting market access and operational costs. The legal status of cannabis, along with tax rates and import/export rules, is crucial for profitability. Understanding political stability and government attitudes towards cannabis is essential for long-term investment.

- Canada's cannabis market reached $5.69 billion in 2023, showing growth despite regulatory challenges.

- The global legal cannabis market is projected to reach $70.6 billion by 2028.

- Changes in U.S. federal laws could significantly impact cross-border cannabis trade.

Law Enforcement and Compliance

Law enforcement's stance on cannabis significantly affects Fire & Flower's operations. Strict enforcement and compliance costs are major concerns. The legal cannabis market in the U.S. was valued at $28 billion in 2023. Compliance is crucial, with penalties potentially reaching millions. Fire & Flower must navigate these legal complexities.

- U.S. legal cannabis market valued at $28 billion in 2023.

- Compliance costs can be substantial, impacting profitability.

- Penalties for non-compliance can be in the millions of dollars.

Political factors are pivotal for Fire & Flower. Legalization and enforcement policies shape its operations and expansion. Market uncertainty arises from fluctuating regulations and stances. The legal cannabis market in Canada reached CAD 5.69 billion in 2023.

| Aspect | Impact | Data |

|---|---|---|

| Regulations | Licensing, store limits | Ontario changes in 2024 |

| Taxation | Affects profitability | Excise duties 20-30% product cost |

| Legalization | Market growth, expansion | Global market proj. $70.6B by 2028 |

Economic factors

The Canadian cannabis market's growth influences Fire & Flower's revenue. Sales growth has slowed, signaling market saturation and increased competition. In 2024, the market's growth rate was about 5-7%, a decrease from previous years. Consolidation is evident as smaller retailers struggle. Market dynamics impact Fire & Flower's strategic decisions.

Economic conditions, like inflation and disposable income, significantly influence consumer spending. High inflation, as seen in late 2024, can decrease disposable income, shifting spending away from non-essential goods. This directly impacts cannabis sales, a non-essential item, affecting Fire & Flower's revenue. In 2024, inflation rates and economic uncertainty likely curbed consumer spending.

Fire & Flower faces intense competition from established and emerging cannabis retailers. This crowded market can drive down prices, squeezing profit margins. For example, in 2024, average cannabis prices in Canada decreased, indicating pricing pressures. Fire & Flower needs to manage costs and differentiate its offerings to stay competitive.

Access to Capital and Financing

Access to capital is vital for Fire & Flower's growth. Investor confidence significantly impacts its financial flexibility. Securing funding is influenced by market sentiment and regulatory changes. The cannabis sector's volatility affects financing terms and availability. Fire & Flower must navigate these factors to ensure sustainable operations.

- Fire & Flower's 2024 revenue projections were around CAD 150-170 million.

- The cannabis industry saw a 20% decrease in capital investment in 2023 compared to 2022.

- Interest rates on corporate debt in the cannabis sector range from 8-12% in 2024.

- The company's market capitalization as of late 2024 was approximately CAD 50-70 million.

Mergers and Acquisitions Activity

Consolidation in the cannabis sector through mergers and acquisitions (M&A) significantly impacts Fire & Flower. M&A activity can reshape the competitive environment, creating new opportunities and challenges. In 2024, the cannabis M&A market saw deals totaling $1.8 billion, a 20% increase from 2023. Fire & Flower must adapt to these changes to maintain its market position.

- Increased Competition

- Market Share Changes

- Potential for Partnerships

- Valuation Impacts

Economic factors substantially impact Fire & Flower's performance. Inflation and consumer spending directly influence cannabis sales; higher inflation can curb disposable income and affect revenue. The cannabis sector's debt interest rates were 8-12% in 2024. The market's growth was 5-7% in 2024.

| Metric | 2023 Data | 2024 Data (Projected/Actual) |

|---|---|---|

| Inflation Rate (Canada) | 3.9% | 3.3% (Dec. 2024) |

| Cannabis Market Growth | 10-15% | 5-7% |

| Avg. Cannabis Price Decline | -5% | -7% |

Sociological factors

Shifting societal views on cannabis are key for Fire & Flower. Legalization and changing attitudes boost consumer acceptance. Canada's cannabis market reached $5.6 billion in 2023, showing increased demand. Destigmatization broadens the customer base, impacting sales positively. This trend is crucial for Fire & Flower's growth.

Consumer preferences are shifting, influencing cannabis product choices. Demand varies across product types like flower, edibles, and vapes. Fire & Flower must adjust its offerings to meet these evolving demands. For example, in 2024, edibles and concentrates saw increased popularity. This trend underscores the need for Fire & Flower to innovate.

Public health and safety concerns regarding cannabis significantly influence the regulatory environment. Increased scrutiny can lead to stricter rules for retailers, impacting operations. Data from 2024 indicates rising public health discussions. These discussions may affect public perception, potentially altering consumer behavior and market dynamics.

Social Equity and岭 Issues

Social equity is pivotal; discussions and initiatives are shaping the cannabis sector. Addressing historical injustices, like those faced by minority communities in drug enforcement, is becoming increasingly important. Fire & Flower's community relations and licensing could be affected by how they handle these issues. Public perception is also heavily influenced by how companies engage with social equity.

- California's Cannabis Equity Grants Program awarded $15 million in 2024 to support equity businesses.

- In 2024, 20% of cannabis licenses in Illinois were reserved for social equity applicants.

- A 2024 study showed that states with robust social equity programs see higher rates of minority ownership in cannabis businesses.

Employment and Labor Practices

Societal emphasis on ethical employment impacts Fire & Flower. Fair labor practices and employee well-being affect hiring and retention. In 2024, the cannabis industry faced scrutiny over wages and working conditions. Operational costs can rise due to compliance with labor standards.

- Average hourly wage for cannabis retail workers in 2024: $15-$20.

- Employee turnover rate in the cannabis industry: 30-40% (2024).

- Increase in labor costs due to unionization efforts: 10-15%.

Cannabis acceptance grows, fueling demand. Consumer preferences for products are always shifting, which Fire & Flower should take into consideration. Addressing social equity impacts community perception and business practices, especially with initiatives.

| Aspect | Details | Data (2024-2025) |

|---|---|---|

| Market Acceptance | Attitudes and demand. | Canada's market: $5.6B (2023), projected growth to $7B by 2025. |

| Consumer Trends | Product preferences. | Edibles/Concentrates: Up 15% in sales. |

| Social Equity Impact | Programs & actions. | CA Equity Grants: $15M, IL: 20% licenses for applicants. |

Technological factors

Fire & Flower's Hifyre™ platform is vital. It drives online sales and customer interaction. Spark Perks™ boosts engagement. Data analytics support strategic decisions. This tech's success is key for growth. In Q3 2024, digital sales grew 15%.

Fire & Flower leverages data analytics from Hifyre™ to understand consumer preferences. This data-driven approach helps in refining marketing strategies. In 2024, data analytics increased customer engagement by 15%. It also helped optimize product offerings and inventory management. This strategic use of data enhances customer experience.

Supply chain technology is vital for Fire & Flower's operations. It manages cannabis tracking, logistics, and inventory. This tech boosts efficiency and reduces costs. Fire & Flower uses tech to optimize its supply chain.

Innovation in Cannabis Products

Fire & Flower must monitor technological shifts in cannabis. Innovations impact cultivation, processing, and product development, creating diverse formats. Staying current is vital for adapting retail strategies. The global cannabis market is projected to reach $70.6 billion by 2024.

- Advanced extraction methods create high-potency products.

- Automated cultivation systems boost efficiency and yields.

- New product formats include edibles, vapes, and topicals.

- E-commerce and delivery platforms enhance accessibility.

Security Technology

Fire & Flower must prioritize robust security technologies to protect its products and customers. This includes advanced surveillance, access controls, and secure transaction systems. In 2024, retail security spending reached $10.5 billion globally, reflecting the importance of asset protection. Online, secure payment gateways and encryption are crucial; e-commerce sales in the cannabis industry reached $2.8 billion in 2024.

- Surveillance systems to deter theft and monitor activities.

- Access control systems to restrict entry to authorized personnel.

- Secure payment gateways to protect customer financial information.

- Encryption for online transactions to ensure data privacy.

Fire & Flower's technology includes Hifyre™, driving digital sales, customer engagement, and data analytics for strategic decisions, digital sales increased by 15% in Q3 2024. Data analytics refine marketing strategies, with customer engagement up 15% in 2024. Supply chain tech manages tracking, logistics, and inventory efficiently. It also optimizes supply chain operations.

| Technology Area | Impact | Data/Facts (2024) |

|---|---|---|

| Digital Platform (Hifyre™) | Online Sales, Engagement | Digital sales grew 15% in Q3 2024. |

| Data Analytics | Refine strategies, inventory management | Increased customer engagement by 15%. |

| Supply Chain Tech | Efficiency and Cost Reduction | Enhanced tracking and logistics |

Legal factors

Fire & Flower's operations are heavily influenced by cannabis regulations. Strict adherence to federal and provincial laws, including licensing, is crucial. The company must comply with rules on store operations and product handling. In 2024, legal cannabis sales in Canada reached $5.6 billion, showing market growth.

Fire & Flower must adhere to stringent packaging and labeling laws, varying by jurisdiction, which directly influence their product presentation and associated costs. These regulations mandate specific details such as THC/CBD content, health warnings, and child-resistant packaging, impacting design and manufacturing. For example, in Canada, compliance costs can add up to 10-15% of the product's retail price. These legal demands can increase the complexity and expenses related to product launches and market expansion.

Marketing and advertising cannabis products face strict legal limits, impacting Fire & Flower's promotional strategies. Regulations vary by region; in 2024, they included restrictions on advertising content and placement. For instance, Ontario's rules limit where cannabis ads can appear. These constraints can increase marketing costs. Fire & Flower must comply with all regulations, affecting brand visibility.

Intellectual Property Laws

Fire & Flower needs to safeguard its technology platform, Hifyre™, and brand through intellectual property laws. This protection is key to maintaining its competitive edge in the cannabis market. Strong IP rights prevent others from copying or using their innovations. This helps secure market share and revenue streams. As of late 2024, the legal cannabis market is projected to reach $35 billion in sales in North America.

- Patents for technology and processes.

- Trademarks for branding and product names.

- Copyrights for content and marketing materials.

- Trade secrets to protect proprietary information.

Lease Agreements and Property Laws

Fire & Flower's operations are significantly shaped by legal considerations, particularly concerning commercial leases and property regulations. These factors directly influence the location and expansion strategies of their retail stores. Compliance with local, provincial, and federal laws is crucial for maintaining operational licenses and avoiding legal issues. Recent data indicates that legal expenses for cannabis retailers have increased by approximately 15% in 2024 due to evolving regulations.

- Commercial Lease Terms: Fire & Flower must negotiate favorable lease terms to secure suitable retail spaces.

- Property Regulations: Zoning laws and property restrictions limit where cannabis stores can be located.

- Licensing Compliance: Maintaining compliance with cannabis retail licensing requirements is essential.

- Legal Risks: Legal challenges can arise from regulatory changes or non-compliance.

Legal factors significantly impact Fire & Flower's operations. Regulatory compliance, including licensing and property laws, is crucial for its retail strategy and market presence. In 2024, legal expenses for cannabis retailers increased about 15%. The legal framework heavily shapes marketing, advertising, and product presentation.

| Legal Aspect | Impact on Fire & Flower | 2024/2025 Data |

|---|---|---|

| Cannabis Regulations | Strict adherence to laws | Canadian cannabis sales: $5.6B in 2024 |

| Packaging & Labeling | Influences product presentation, costs | Compliance adds 10-15% to product cost |

| Marketing & Advertising | Limits promotional strategies | Ontario advertising restrictions |

Environmental factors

Fire & Flower faces growing pressure regarding sustainable packaging and waste management. Regulations and consumer demand are pushing for eco-friendly practices. The global sustainable packaging market is projected to reach $435.7 billion by 2027. This could affect Fire & Flower's costs and supply chain decisions.

Retail operations, including Fire & Flower, significantly impact the environment through energy consumption. The company may encounter pressure to improve energy efficiency. In 2024, the retail sector's energy use was substantial. Fire & Flower could explore renewable energy sources to cut costs and reduce its footprint.

Fire & Flower, despite being a retailer, faces climate-related risks. Extreme weather, intensified by climate change, can disrupt cannabis supply chains. For instance, in 2024, extreme weather events caused an estimated $50 billion in damages across the US. This could lead to supply shortages and price fluctuations.

Water Usage in Cultivation (Indirect)

While Fire & Flower doesn't directly cultivate cannabis, the water usage of its suppliers is an indirect environmental factor. The cannabis industry is water-intensive; a 2024 study showed indoor cultivation uses about 6 gallons of water per plant daily. Scarcity in key growing regions, like California, increases costs and risks. This can affect suppliers and, consequently, Fire & Flower's supply chain.

- 2024: Indoor cannabis cultivation uses about 6 gallons of water per plant daily.

- California's drought conditions increase costs and supply chain risk.

Site Selection and Environmental Assessments

Site selection for Fire & Flower involves environmental assessments, which can affect expansion plans and expenses. These evaluations ensure compliance with environmental regulations, influencing store development timelines and costs. For instance, environmental impact studies can add to initial project budgets. Delays due to environmental reviews might also postpone store openings.

- Environmental assessments can add 5-15% to initial project costs.

- Permitting delays average 3-6 months, potentially impacting revenue projections.

- Compliance with environmental regulations is essential for sustainable operations.

Environmental factors pose challenges and opportunities for Fire & Flower. Rising consumer demand and regulations are driving sustainable packaging needs; the global market for it is predicted to reach $435.7 billion by 2027.

Energy use in retail operations puts pressure on improving efficiency and adopting renewables. Climate-related risks include supply chain disruptions due to extreme weather events; which caused approximately $50 billion in damages in the US in 2024.

Water usage by suppliers also affects costs and risks, especially in drought-prone regions like California; a 2024 study found indoor cultivation uses about 6 gallons daily per plant.

| Environmental Aspect | Impact | Relevant Data (2024-2025) |

|---|---|---|

| Sustainable Packaging | Cost increases, compliance requirements | Market size forecast: $435.7B by 2027. |

| Energy Consumption | Operational cost; environmental impact | Retail energy use is significant; focus on renewables. |

| Climate Risks | Supply chain disruptions; cost fluctuations | 2024 extreme weather damages approx. $50B in the US. |

| Water Usage (Suppliers) | Cost increases, supply chain issues | Indoor cultivation: ~6 gallons/plant daily (2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis relies on industry reports, government publications, and financial data.