Fire & Flower SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

What is included in the product

Analyzes Fire & Flower’s competitive position through key internal and external factors. It helps define strategic positioning.

Offers quick identification of key strengths, weaknesses, opportunities, & threats.

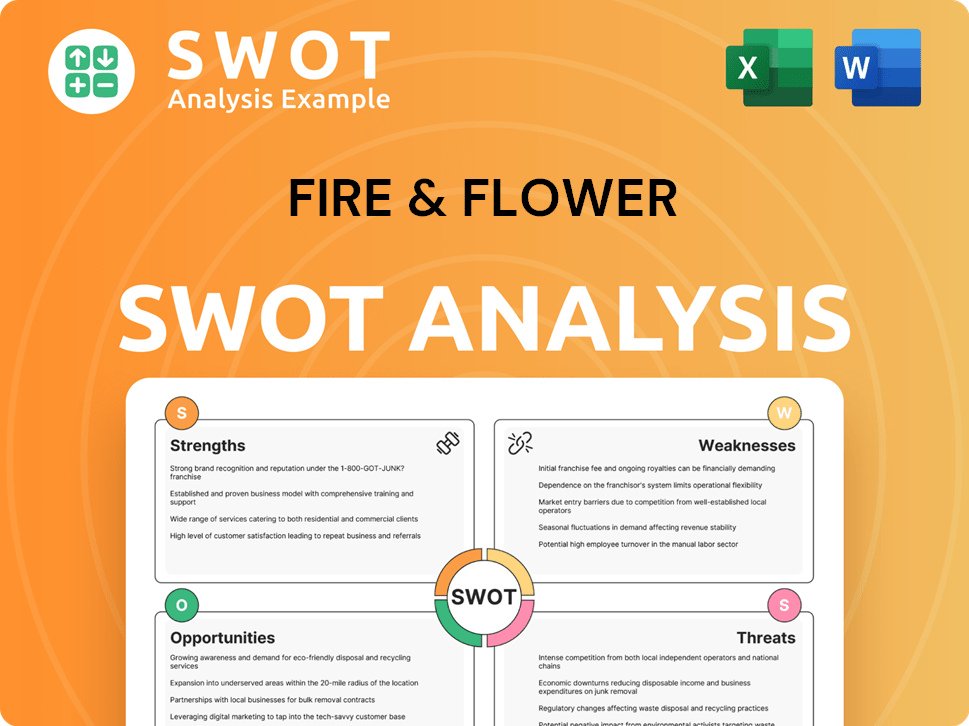

Preview Before You Purchase

Fire & Flower SWOT Analysis

The preview reveals the actual Fire & Flower SWOT analysis. This is the same comprehensive document you will receive upon purchase.

SWOT Analysis Template

The Fire & Flower SWOT analysis reveals key insights into its market standing, touching upon strengths like its brand presence and weaknesses like competition. We've assessed opportunities such as market expansion and identified threats like regulatory changes. Ready to take your insights further? Unlock the full SWOT report for deep, research-backed details and actionable strategic tools. Purchase now!

Strengths

Fire & Flower boasts a robust retail network, primarily in Canada, with a substantial number of corporately-owned stores. This extensive physical presence allows them to effectively reach consumers and establish strong brand recognition. Recent acquisitions have further amplified their retail footprint, contributing to market dominance. As of late 2024, they operated over 85 stores across Canada.

Fire & Flower's Hifyre platform is a significant strength. It offers digital retail solutions and data analytics, boosting operational efficiency. In Q3 2024, Hifyre's data insights drove a 15% increase in customer loyalty program engagement. This technology also supports e-commerce, which contributed to a 10% revenue increase in the same quarter.

Fire & Flower's strategic partnership with Alimentation Couche-Tard (ACT) is a major strength. ACT's investment and support offer Fire & Flower access to prime retail locations, operational know-how, and financial backing. This collaboration can lead to co-located stores, boosting visibility and convenience for consumers. Furthermore, this partnership supports potential expansion plans, leveraging ACT's extensive network.

Focus on Data and Analytics

Fire & Flower's strength lies in its data and analytics capabilities, particularly through its Hifyre platform. This platform enables the collection and analysis of vast amounts of consumer purchasing data and market trends. This data-driven approach facilitates personalized customer experiences and optimizes product offerings. In 2024, Fire & Flower's Hifyre platform tracked over $1 billion in cannabis sales.

- Personalized customer experiences.

- Optimized product offerings.

- Informed business decisions.

Experienced Leadership Team

Fire & Flower's leadership team brings a wealth of experience from tech, cannabis, and retail sectors. This diverse background is crucial for tackling the cannabis market's unique challenges and steering strategic expansion. Their combined expertise could lead to innovative solutions and a competitive edge. The team's ability to adapt and leverage these skills is vital for Fire & Flower's success.

- Experienced leadership can drive strategic decisions.

- Diverse industry backgrounds offer varied perspectives.

- Adaptability is key in the evolving cannabis market.

- This should lead to better market navigation.

Fire & Flower's strengths include its extensive retail network with over 85 stores by late 2024, ensuring robust market reach. The Hifyre platform enhances efficiency, boosting customer engagement by 15% in Q3 2024. Their partnership with Alimentation Couche-Tard offers access to prime retail locations.

| Strength | Description | Impact |

|---|---|---|

| Retail Network | Over 85 stores as of late 2024. | Market reach & brand recognition. |

| Hifyre Platform | Digital retail solutions and data analytics. | 15% increase in customer engagement. |

| ACT Partnership | Strategic alliance with Alimentation Couche-Tard. | Access to prime retail locations. |

Weaknesses

Fire & Flower has struggled with financial performance. The company reported an impairment loss on investment. Restructuring efforts aimed to improve its financial standing. In 2023, the company's net loss widened. This reflects ongoing challenges in achieving profitability.

Fire & Flower faces intense competition in Canada's cannabis retail sector. The market is fragmented, with numerous retailers vying for market share. This competition leads to price wars, squeezing profit margins. In 2024, the Canadian cannabis retail market saw over 3,000 licensed stores.

Fire & Flower faces regulatory hurdles, particularly with the cannabis industry's evolving restrictions. Delays in securing licenses and adhering to regulatory frameworks can slow expansion. This impacts operations, as seen with past delays in specific Canadian provinces. For example, in 2024, regulatory changes in Ontario affected store openings.

Potential for Oversupply and Price Compression

The Canadian cannabis market faces potential oversupply issues, impacting Fire & Flower. Overproduction across Canada has resulted in wholesale price declines. This can squeeze the profit margins for retailers like Fire & Flower. The latest data from 2024 shows a 15% drop in wholesale cannabis prices.

- Oversupply can lead to reduced profitability.

- Price compression affects retail margins.

- Market dynamics can shift rapidly.

Reliance on the Canadian Market

Fire & Flower's heavy reliance on the Canadian market presents a notable weakness. The company's performance is significantly influenced by the Canadian cannabis market's dynamics. This dependence makes Fire & Flower vulnerable to regulatory changes and market saturation within Canada. While the company is expanding internationally, a large portion of its revenue still comes from Canada.

- In 2024, the Canadian cannabis market's growth slowed to around 5-7%.

- Fire & Flower's international expansion is still in its early stages, with limited revenue contribution.

- Regulatory challenges continue to affect the Canadian cannabis market.

Fire & Flower struggles financially, with widened net losses in 2023 reflecting persistent profitability challenges. Intense competition and price wars in Canada's fragmented cannabis market squeeze margins; over 3,000 licensed stores operated in 2024. Oversupply and declining wholesale prices, down 15% in 2024, further hinder financial performance.

| Weakness | Details |

|---|---|

| Financial Instability | Net loss widened in 2023. |

| Market Competition | Over 3,000 stores in 2024, driving price wars. |

| Oversupply | Wholesale prices dropped 15% in 2024. |

Opportunities

Fire & Flower could grow significantly by entering the U.S. market. As cannabis regulations in the U.S. shift, more opportunities arise. Leveraging licensing deals and the Hifyre platform in the U.S. could be a major boost. In 2024, the U.S. cannabis market is projected to reach $30 billion, presenting a lucrative chance.

Fire & Flower can boost revenue by licensing its Hifyre platform to other retailers. Expanding e-commerce and direct-to-consumer sales via Hifyre also presents opportunities. Data insights from Hifyre are a valuable asset for strategic decision-making. In Q3 2023, Hifyre generated $1.3 million in revenue, showcasing its potential.

Market consolidation in the Canadian cannabis retail sector offers Fire & Flower opportunities. Fire & Flower could acquire smaller competitors, potentially increasing its market share. Recent data shows that the top 10 cannabis retailers control over 50% of the market. This presents a chance for strategic acquisitions.

Development of New Product Categories

The cannabis market is expanding beyond traditional dried flower, with pre-rolls, edibles, and vapes gaining popularity. Fire & Flower can leverage these trends by diversifying its product range. The global legal cannabis market is projected to reach $70.6 billion by 2024. Fire & Flower can boost sales by optimizing its offerings to match consumer preferences.

International Expansion Beyond the U.S.

Fire & Flower has an opportunity to expand internationally, especially with the evolving cannabis markets in Europe. This could involve leveraging its retail and technology platforms to gain a foothold in these new markets. According to a 2024 report, the European cannabis market is projected to reach $3.2 billion by the end of 2025. This expansion could diversify revenue streams and reduce reliance on the U.S. market.

- European cannabis market projected to hit $3.2B by 2025.

- Expansion diversifies revenue.

Fire & Flower's U.S. expansion via licensing and Hifyre is promising given the $30B 2024 market. Licensing Hifyre to other retailers could boost revenue. Acquisitions in the consolidating Canadian market present growth opportunities.

| Opportunity | Details | Data |

|---|---|---|

| U.S. Market Entry | Leverage Hifyre & licensing agreements | $30B U.S. market (2024 projection) |

| Hifyre Platform | License and expand e-commerce | Hifyre generated $1.3M revenue (Q3 2023) |

| Market Consolidation | Acquire competitors | Top 10 retailers control over 50% of the Canadian market. |

Threats

Fire & Flower faces heightened competition from larger retail chains, possibly including Couche-Tard, which acquired it in 2023. These chains could leverage their resources for aggressive price strategies. For example, Couche-Tard's 2023 revenue was over $80 billion, which indicates their financial capacity. This could force Fire & Flower to lower prices or face market share erosion.

Regulatory shifts pose a threat. Changes in cannabis laws, like excise tax adjustments, could hurt Fire & Flower. In 2024, compliance costs in the cannabis industry were substantial, with some firms spending up to 15% of revenue on regulatory adherence. Further, any negative regulatory changes could impact Fire & Flower's profitability.

Economic uncertainties pose a threat, potentially reducing consumer spending on non-essential items like cannabis. Inflation and rising interest rates in 2024/2025 could decrease disposable income. Cannabis sales growth slowed in 2024, with some markets experiencing declines. This trend highlights the sensitivity of cannabis demand to economic downturns. A recession could further exacerbate these challenges.

Slowdown in Canadian Market Growth

A slowdown in the Canadian cannabis market's growth poses a threat to Fire & Flower. Recent reports indicate a cooling in the market's expansion, potentially restricting Fire & Flower's growth opportunities within Canada. This deceleration could impact revenue projections and investment returns. The slowing market growth may lead to increased competition among existing retailers.

- Cannabis sales in Canada increased by only 2.8% in December 2023, the slowest pace of growth in over a year.

- Ontario's cannabis sales growth slowed to 1.9% in December 2023, a significant drop.

- The slower growth is partly due to market saturation and economic challenges.

Inability to Access Capital and Funding

Fire & Flower faces the threat of limited access to capital, which is a significant hurdle in the cannabis sector. Securing funding is vital for operational needs, acquisitions, and growth initiatives. The company must compete for capital in a market where financing options can be constrained, impacting its ability to expand and consolidate its market position. Limited access to capital could hinder Fire & Flower's strategic plans and overall competitiveness.

- Cannabis companies often struggle to secure traditional financing due to federal regulations.

- Fire & Flower's ability to secure funding affects its capacity to execute its business strategy.

- Access to capital is crucial for staying competitive within the evolving cannabis market.

Fire & Flower’s financial success faces obstacles like intense retail competition, particularly from major chains such as Couche-Tard, now the owner. Regulatory changes and adjustments to excise taxes are possible; some cannabis companies dedicate up to 15% of revenue to regulatory compliance. Economic instability is another threat; inflation and rate hikes could hurt consumer spending. Slowing Canadian market growth also impedes progress.

| Threat | Description | Impact |

|---|---|---|

| Competition | Strong retail chains and pricing | Erosion of market share and reduced margins |

| Regulations | Changes in excise taxes & compliance costs | Profitability reduction |

| Economic | Inflation & decreased consumer spending | Diminished disposable income, and lower demand |

| Market | Slowing cannabis market expansion | Hindered revenue growth; investment returns impact |

SWOT Analysis Data Sources

This SWOT analysis leverages dependable data, including financial statements, market trends, and expert reports for accuracy.