Five Star Business Finance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, making sharing Five Star Finance's business strategy easy.

Preview = Final Product

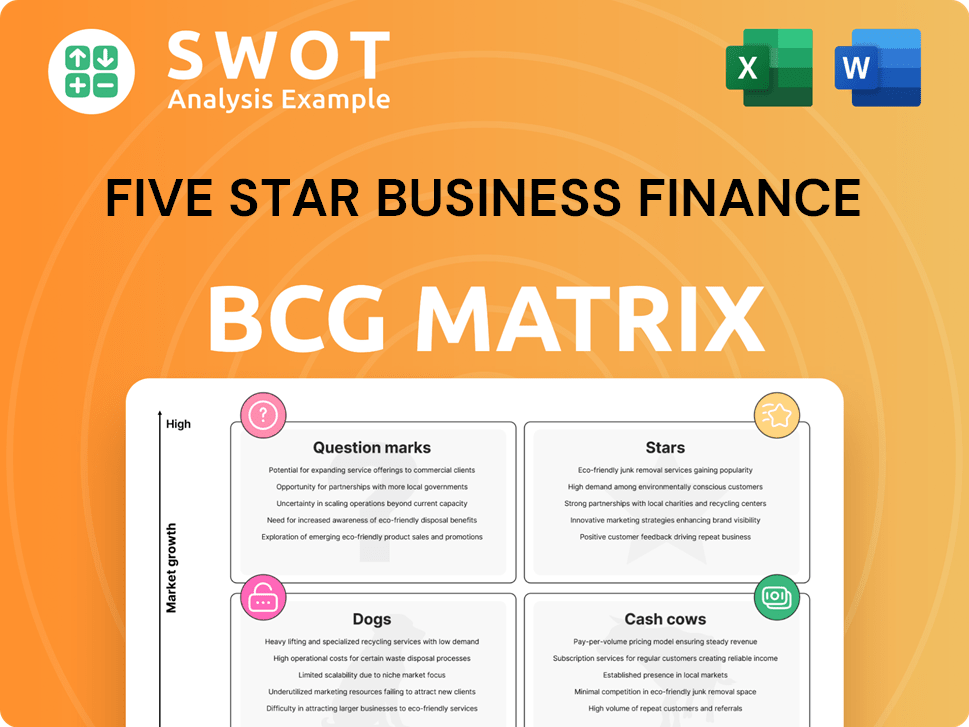

Five Star Business Finance BCG Matrix

This preview mirrors the Five Star Business Finance BCG Matrix you'll receive. It's the complete, ready-to-use strategic tool, fully formatted and prepared for immediate implementation.

BCG Matrix Template

Our Five Star Business Finance BCG Matrix highlights key product areas: Stars, Cash Cows, Dogs, and Question Marks. This snapshot reveals initial strategic positioning for informed decisions. Understanding these quadrants is crucial for resource allocation and growth. This analysis offers a glimpse into the company's potential and challenges. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Five-Star Business Finance is a Star in the BCG Matrix due to its impressive AUM growth. As of December 31, 2024, AUM hit ₹11,178 crore. This represents a 25% year-on-year increase. This growth signals strong market penetration and efficient customer acquisition.

Strong Financial Performance: Five Star Business Finance showcases strong financial performance. They have a 26% year-on-year increase in net profit for Q3 FY25, reaching ₹274 crore. This growth is driven by higher net interest income. The company's financial health is supported by a stable net interest margin and a diversified funding profile. In 2024, the company's assets under management (AUM) grew to ₹10,800 crore.

Five-Star Business Finance boasts a seasoned management team. Chairman and MD D. Lakshmipathy leads, bringing stability. This team's expertise aids market navigation and asset quality. Such experience is vital for continued, sustainable growth, as seen in the company's ₹1,215.57 Cr revenue in FY24.

Prudent Underwriting Practices

Five-Star Business Finance's prudent underwriting is key to its success. They prioritize secured lending, mainly against self-occupied residential properties. This strategy helps keep asset quality strong, even when the economy struggles. In 2024, their gross NPA was low at 0.8%.

- Secured lending focus.

- Low loan-to-value ratios.

- Stable asset quality.

- Gross NPA of 0.8% in 2024.

Diversified Funding Profile

Five-Star's diversified funding profile is a key strength. By December 2024, it included bank and financial institution loans, NCDs, securitization, and external commercial borrowings. This mix reduces reliance on any single source. Diversification enhances financial stability.

- Funding mix includes: bank term loans, financial institution term loans, NCDs, securitization, and external commercial borrowings.

- Reduced reliance on bank funding.

- Enhances financial stability.

- Provides access to a wider range of funding sources.

Five-Star Business Finance excels as a Star, driven by strong AUM growth, reaching ₹11,178 crore by December 2024. It demonstrated significant financial performance, with a 26% increase in net profit for Q3 FY25, at ₹274 crore. This growth is supported by a robust management team and diversified funding.

| Metric | Value (FY24) | Value (Q3 FY25) |

|---|---|---|

| AUM (₹ Crore) | ₹10,800 | - |

| Net Profit (₹ Crore) | - | ₹274 |

| Gross NPA | 0.8% | - |

Cash Cows

Five Star Business Finance's secured lending, especially against self-occupied residential property, generates steady income. Over 95% of their loans are secured, lowering risk. A low loan-to-value ratio further protects the portfolio. This approach yields consistent cash flow, positioning it as a cash cow.

Five-Star Business Finance's strong foothold in Southern India, especially Tamil Nadu, Andhra Pradesh, and Telangana, exemplifies a cash cow. This regional focus enables efficient operations and deep customer relationships. Their established presence generates a stable income stream; in 2024, they disbursed ₹6,000+ crore.

Five Star Business Finance showcases high collection efficiency, hitting 98% in Q3 FY25. This efficiency minimizes losses, ensuring consistent revenue streams. Such strong collection practices boost profitability and financial stability. The firm's robust collection methods are key to its success.

Effective Risk Management Practices

Five-Star Business Finance's robust risk management, honed over two decades, is key to its cash cow status. This expertise is evident in its tightly controlled gross non-performing asset (GNPA) levels, which stood at 2.6% in FY24, showcasing effective asset quality maintenance. These practices, reflecting a deep understanding of vulnerable borrower classes, ensure consistent profitability. This focus on risk management supports the company's steady cash flow.

- GNPA levels at 2.6% in FY24.

- Over two decades of experience.

- Focus on vulnerable borrower classes.

Strong Capitalization Levels

Five-Star Business Finance's cash cow status is reinforced by strong capitalization. They sustain adequate levels through consistent internal accruals, with low gearing. This strong base allows for absorbing potential losses and operational sustainability. Robust capitalization, crucial for cash cows, offers financial resilience.

- Capital Adequacy Ratio: 28.8% as of March 2024.

- Gearing Ratio: 0.7x, indicating low debt relative to equity.

- Net Worth: Increased to ₹5,888 crore in FY24.

- CRAR: Well above regulatory requirements.

Five Star Business Finance is a cash cow due to its reliable income from secured lending, especially in South India, and efficient operations.

High collection efficiency, hitting 98% in Q3 FY25, and robust risk management, including GNPA at 2.6% in FY24, are key.

Strong capitalization, with a Capital Adequacy Ratio of 28.8% as of March 2024, further reinforces its financial stability, making it a profitable and resilient business.

| Metric | Value | Year |

|---|---|---|

| GNPA | 2.6% | FY24 |

| CAR | 28.8% | March 2024 |

| Disbursements | ₹6,000+ crore | 2024 |

Dogs

Five-Star Business Finance's "Dogs" category highlights geographic concentration risks. A large part of their loan portfolio is in Tamil Nadu, Andhra Pradesh, and Telangana. This over-reliance makes them vulnerable to regional economic issues. As of 2024, these states comprised over 70% of their assets, signaling a need for market diversification.

Five-Star's portfolio shows moderate seasoning. A large part of its loans are recent, with a short vintage. This means many loans are less than a year old, as of December 2024. These loans haven't faced various economic ups and downs yet, indicating some risk.

Five-Star's customer base is vulnerable to overleveraging, with many also using unsecured microfinance loans. This increases the risk of defaults and credit losses. In 2024, the company reported a 4.5% increase in non-performing assets. Managing overleveraging is key to maintaining asset quality.

Potential Regulatory Headwinds

The NBFC sector, including Five-Star Business Finance, is under increasing regulatory scrutiny. This heightened oversight can affect operations and profitability. Adapting to changes in regulations is vital for sustained success. In 2024, the RBI introduced stricter NPA classification norms, impacting many NBFCs.

- RBI's stricter NPA norms in 2024.

- Increased compliance costs for NBFCs.

- Potential impact on loan growth.

- Need for proactive regulatory adaptation.

Competition from Other Lenders

The financial services landscape is fiercely competitive, with numerous lenders, including NBFCs and banks, targeting similar customer segments. This intense competition can squeeze profit margins and affect market share. To stay ahead, Five Star Business Finance must excel in customer service and offer innovative products. For example, in 2024, the NBFC sector saw over 100 new entrants, highlighting the competition.

- Competition from various NBFCs and banks puts pressure on margins.

- Differentiation through service and products is key.

- The NBFC sector experienced over 100 new entrants in 2024.

- Strong customer relationships are crucial for success.

Five-Star Business Finance's "Dogs" category spotlights its vulnerabilities, particularly geographic concentration and recent loan seasoning. A major portion of its assets is concentrated in specific states, with over 70% in Tamil Nadu, Andhra Pradesh, and Telangana as of 2024. This heavy reliance on a few regions exposes the company to economic fluctuations.

| Risk Factor | Impact | 2024 Data |

|---|---|---|

| Geographic Concentration | Regional economic downturns | 70%+ assets in 3 states |

| Loan Seasoning | Higher default risk | Many loans < 1 year old |

| Customer Overleveraging | Increased defaults | 4.5% NPA increase |

Question Marks

Five-Star Business Finance's foray into affordable housing and used vehicles is a strategic move toward expansion. These segments are new, implying higher initial investment and risk. Considering the company's focus on secured lending, these initiatives could become future stars if managed well. In 2024, the used car market is valued at approximately $800 billion.

Five-Star Business Finance's expansion into new geographic markets presents both opportunities and challenges. While strong in Southern India, venturing elsewhere demands significant upfront investments. Market viability assessments and adaptation to local conditions are crucial. In 2024, they secured ₹1,977 crore in funding, supporting expansion efforts. Success hinges on strategic market entry and operational adjustments.

Embracing tech and digital lending boosts efficiency and reach. This demands tech infrastructure investment. Effective tech use can turn initiatives into stars, improving customer experience. Digital lending grew, with fintechs disbursing $109 billion in 2024. This is a key area for growth.

Green Finance Initiatives

Five-Star Business Finance can capitalize on the growing green finance trend. This involves providing loans for electric vehicles and eco-friendly projects. Green finance boosts the company's image and attracts investors focused on sustainability. Successfully entering this market demands specialized products and expertise.

- In 2024, the global green bond market reached over $600 billion.

- India's green finance market is expanding, with significant government support.

- Five-Star can partner with NGOs to enhance green project validation.

- Developing green finance products could diversify Five-Star's portfolio.

Partnerships with Fintech Companies

Partnering with fintech firms can boost innovation and broaden Five Star Business Finance's reach. Careful selection and integration are essential for successful partnerships. Fintech collaborations can become "stars" by improving digital capabilities. In 2024, fintech investments hit $34.2 billion, signaling growth potential.

- Fintech partnerships can enhance customer acquisition strategies.

- Successful collaborations drive digital transformation.

- Strategic alliances can lead to market expansion.

- Proper integration is crucial for mutual success.

Question Marks in the BCG Matrix represent high-growth potential but also high uncertainty. Five-Star Business Finance's new ventures, like affordable housing and geographic expansions, fall into this category. These initiatives require significant investment and careful management to transform into Stars. Success depends on strategic execution and market adaptation.

| Aspect | Consideration | Data |

|---|---|---|

| Investment | High upfront costs | Expansion funding in 2024: ₹1,977 crore |

| Market Risk | Uncertainty in new markets | Used car market in 2024: ~$800 billion |

| Strategy | Strategic market entry and tech | Fintech investment in 2024: $34.2 billion |

BCG Matrix Data Sources

The BCG Matrix is built on multiple sources like financial filings, market reports, and analyst assessments to ensure insightful market positions.