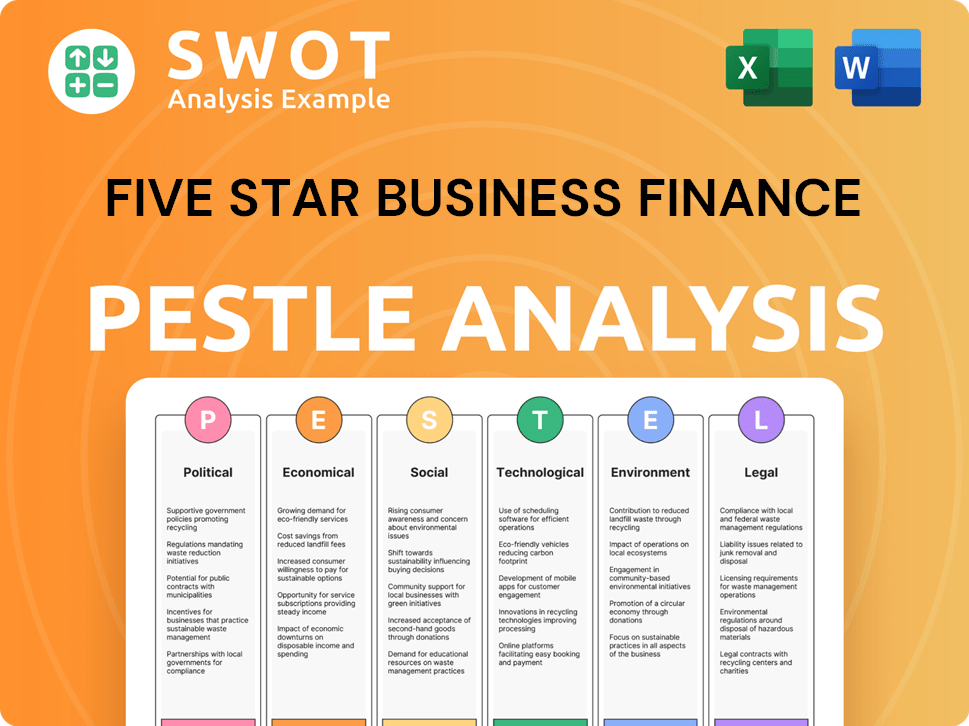

Five Star Business Finance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

What is included in the product

Analyzes macro-environmental forces impacting Five Star Business Finance through PESTLE lenses. Presents insightful, data-backed perspectives for strategic advantage.

Allows users to modify or add notes specific to their own context, region, or business line.

Full Version Awaits

Five Star Business Finance PESTLE Analysis

The Five Star Business Finance PESTLE Analysis you're previewing is the complete document. This file, including all analysis details and formatting, will be yours after purchase.

PESTLE Analysis Template

Explore the external forces shaping Five Star Business Finance with our PESTLE analysis. Understand how political factors, economic shifts, and social trends impact their business. Discover crucial legal and environmental influences impacting growth strategies. Uncover market opportunities and potential threats to stay ahead. Download the full analysis now for actionable insights.

Political factors

Government policies greatly affect Five Star Business Finance. Initiatives like credit access schemes directly benefit their MSME clients. The 2025 Union Budget's MSME focus boosts loan demand. This support can foster growth. Expect higher demand for MSME loans, based on 2024 data.

The political climate significantly shapes the regulatory landscape for NBFCs in India. The Reserve Bank of India (RBI) regularly updates regulations, impacting Five Star's operations and capital needs. The Scale-Based Regulation (SBR) framework places NBFCs into layers, each with specific compliance requirements. The RBI's policies, influenced by the government, directly affect Five Star's strategic planning. Recent data indicates that the RBI increased the risk weights for unsecured loans, affecting NBFCs' lending practices.

Political stability and economic policies in India have a significant impact on the business environment. A stable political climate usually boosts business confidence and supports economic growth. Government spending and fiscal policies influence market liquidity and credit availability, which is crucial. India's GDP growth is projected at 6.5% in 2024-25, indicating a generally positive environment.

Anti-Corruption Measures

Government initiatives to combat corruption significantly influence financial institutions like Five Star Business Finance. The company's commitment to ethical practices is evident in its anti-corruption policy. Five Star Business Finance must comply with anti-bribery laws, ensuring operational integrity. In 2024, India's Corruption Perception Index score was 39, indicating ongoing challenges.

- Compliance with anti-bribery laws is crucial.

- India's CPI score highlights the need for vigilance.

- Five Star Business Finance maintains its anti-corruption policy.

Regional Political Dynamics

Five Star Business Finance's operations are subject to regional political influences, which can cause localized business impacts across different states. Branch openings depend on detailed analysis of the area's economic and business potential, directly affected by regional political factors. Political stability is crucial for maintaining consistent business operations and expansion plans. Any policy shifts or regulatory changes at the state level can significantly influence the company's lending practices and customer base. Consider the impact of local elections in states where Five Star operates.

- State-level policy changes can affect interest rates and loan terms.

- Political stability influences investor confidence and market growth.

- Regional regulations may impact branch opening and operational costs.

Government policies like credit schemes and the 2025 Union Budget boost MSME loan demand, a key focus for Five Star.

RBI regulations, influenced by the government, directly impact operations and capital needs. The Scale-Based Regulation framework adds compliance layers, shaping strategic planning. For 2024-25, India’s GDP growth is forecast at 6.5%, reflecting a positive political climate for businesses.

Fighting corruption influences financial institutions; Five Star ensures ethical practices with its anti-corruption policy. Regional political factors impact branch openings, operations, and lending practices across different states, making localized impacts more obvious.

| Factor | Impact on Five Star | 2024-2025 Data |

|---|---|---|

| Government Policies | MSME Loan Demand | 2025 Union Budget focus |

| RBI Regulations | Operational Compliance | SBR Framework |

| Political Stability | Business Confidence | GDP growth at 6.5% |

Economic factors

India's economic growth and MSME performance are vital for Five Star. MSMEs significantly boost GDP and jobs, impacting loan demand. In 2024, MSMEs contributed about 30% to India's GDP. Projections show MSME's GDP contribution could reach 40% by 2029, expanding Five Star's market. This growth signals rising demand for secured loans.

The Reserve Bank of India (RBI) adjusts interest rates, influencing borrowing costs for NBFCs such as Five Star Business Finance. In 2024, the repo rate, a key benchmark, has been maintained at 6.5%. This directly impacts the company's lending rates and profitability. Changes affect loan affordability for customers, impacting demand.

Inflation significantly impacts micro-entrepreneurs and small business owners' purchasing power, affecting their loan repayment capabilities. In 2024, India's inflation rate fluctuated, influencing financial decisions. High inflation strains household budgets, potentially increasing loan delinquencies. For example, a 1% rise in inflation can correlate with a 0.5% increase in default rates.

Liquidity in the Financial System

Liquidity in the financial system is crucial for Five Star Business Finance to obtain funds for lending. The company's capacity to secure long-term funds at favorable rates directly impacts its growth and liquidity. In 2024, the Reserve Bank of India (RBI) maintained a focus on managing liquidity to support economic activity. Five Star's financial health depends on navigating these conditions effectively.

- RBI's liquidity management aims to balance inflation and growth.

- NBFCs like Five Star need to manage their borrowing costs carefully.

- Competitive rates are essential for profitability and expansion.

Credit Gap in the MSME Sector

A considerable credit gap persists for Indian MSMEs, creating opportunities for NBFCs like Five Star Business Finance. This gap indicates unmet demand for financial solutions. Data from 2024 shows a significant portion of MSMEs still struggle to access formal credit. This situation underscores the need for specialized financial services.

- MSME credit gap in India estimated at over $300 billion as of late 2024.

- Five Star Business Finance focuses on providing loans to MSMEs, particularly in South India.

- NBFCs are playing a crucial role in bridging this gap.

- Government initiatives aim to improve MSME access to finance.

India's robust economic expansion and MSME success are fundamental for Five Star. MSMEs are crucial contributors to GDP and employment, significantly influencing the demand for loans. By the close of 2024, MSMEs constituted approximately 30% of India's GDP, with forecasts predicting a rise to 40% by 2029, broadening Five Star's market scope and increasing the need for secured loans.

Interest rates are adjusted by the Reserve Bank of India (RBI), directly affecting borrowing costs for NBFCs such as Five Star. As of late 2024, the repo rate, which is a critical benchmark, was steady at 6.5%, thus affecting lending rates and overall profitability. Such changes affect the affordability of loans for customers, which in turn impacts overall demand.

Inflation greatly affects the purchasing power of small business owners and micro-entrepreneurs, which in turn impacts their capacity to repay loans. Fluctuations in the 2024 inflation rate have influenced critical financial decisions. Increased inflation levels stress household budgets and may elevate loan delinquencies. For instance, a 1% uptick in inflation can correspond to a 0.5% rise in default rates.

The Reserve Bank of India (RBI) plays a key role in managing financial liquidity, which is essential for entities like Five Star Business Finance to procure funds for lending. The capacity to secure long-term funding at advantageous rates significantly influences both growth and liquidity for the company. In 2024, the RBI has aimed at maintaining liquidity to bolster overall economic activities, impacting Five Star's capacity to function effectively within these changing circumstances.

| Economic Factor | Impact on Five Star | 2024/2025 Data |

|---|---|---|

| GDP Growth | Expands Market, Loan Demand | MSME contribution ~30% (2024), forecast 40% (2029) |

| Interest Rates | Affects Lending Rates, Profitability | Repo rate at 6.5% (Late 2024) |

| Inflation | Impacts Repayment, Affordability | Inflation fluctuated, 1% rise ~ 0.5% default increase |

| Liquidity | Impacts Funding Costs, Operations | RBI focused on managing liquidity in 2024 |

| Credit Gap | Creates lending opportunities | MSME credit gap > $300B (late 2024) |

Sociological factors

Five Star Business Finance boosts financial inclusion by offering loans to micro-entrepreneurs and the self-employed, groups often overlooked by mainstream banks. This approach is vital, particularly in regions with limited financial access. Data from 2024 indicates that 25% of Indian adults still lack access to formal credit. The company's success hinges on understanding the socio-economic backgrounds and financial literacy of its clientele.

A strong entrepreneurial culture and the expansion of small businesses fuel demand for Five Star's financial services. Five Star assesses potential branch locations based on retail and industrial activity, showing the significance of a vibrant local economy. Small businesses are key drivers, with approximately 33.3 million in the U.S. in 2024. This growth supports Five Star's lending. Specifically, small business loans hit $700 billion in 2024.

Demographic shifts, including urbanization and migration, shape where customers live and what businesses thrive. Five Star targets Tier 3-6 towns, aiming to capture growth in these areas. India's urbanization rate is about 35% as of 2024, and is expected to reach 40% by 2030, signaling expanding opportunities in smaller cities. The Reserve Bank of India data shows that the MSME sector, which Five Star serves, contributes significantly to these areas' economic growth.

Customer Behavior and Financial Literacy

Understanding customer repayment behavior and financial literacy is crucial for Five Star Business Finance. Their credit assessment and collection strategies depend on this. The company's model focuses on household cash flows and timely collections. For example, in 2024, approximately 35% of Indian adults lacked basic financial literacy. This impacts repayment behavior.

- Financial literacy in India is around 24% as of late 2024.

- Household debt in India rose to 40% of GDP by early 2024.

- Five Star's collection efficiency rate was approximately 96% in FY24.

Social Responsibility and Community Impact

Five Star Business Finance's commitment to social responsibility is vital. It enhances its reputation and operational license. The focus on micro-entrepreneurs' economic empowerment is a core business aspect. This approach attracts customers and investors.

- In 2024, Five Star disbursed ₹6,708 crore, supporting many entrepreneurs.

- The company focuses on financial inclusion, serving those often excluded.

- Their initiatives improve community well-being and economic growth.

Sociological factors significantly influence Five Star Business Finance's operations. Financial inclusion remains critical, especially where access to credit is limited, such as in 2024, where 25% of Indian adults lacked it. The company thrives by addressing socio-economic needs and understanding customer behavior. Initiatives like those supporting micro-entrepreneurs foster positive social impact.

| Factor | Impact | Data (2024) |

|---|---|---|

| Financial Literacy | Affects repayment and credit assessment. | ~24% of Indians are financially literate. |

| Entrepreneurial Culture | Drives demand for financial services. | Small business loans hit $700B in 2024 in the US. |

| Urbanization | Shapes customer base and business location. | India's urbanization rate is 35%. |

Technological factors

The rise of digital lending platforms and fintech is reshaping MSME financing. Five Star Business Finance can use tech to boost efficiency and reach more customers. Fintech lending in India grew to $30 billion in 2023, showing huge potential. Digital tools can also cut operational costs by up to 40%.

Data analytics and alternative data are crucial for credit assessment, especially for those with limited credit history. Five Star Business Finance leverages technology to enhance cash flow assessment. In 2024, the use of AI in credit scoring increased by 20% among financial institutions. This helps them make better lending decisions.

Cybersecurity and data privacy are paramount for Five Star Business Finance. Data breaches cost the financial sector billions; in 2024, the average cost was $4.5 million. Robust security measures are vital to protect customer data and comply with data protection laws. Investments in cybersecurity and data privacy are crucial for maintaining customer trust. In 2025, it is expected that cybersecurity spending will continue to increase.

Operational Efficiency and Branch Network Management

Technology plays a vital role in enhancing operational efficiency for Five Star Business Finance, especially in managing its extensive branch network. Technological advancements streamline loan origination, servicing, and collections, leading to significant improvements. These investments in technology are designed to boost overall productivity within the company. For instance, in 2024, the company allocated approximately ₹50 crore towards digital transformation initiatives, including upgrading its core banking system and implementing advanced analytics platforms to optimize operational workflows and reduce processing times by up to 20%.

- Automated loan processing systems can reduce manual errors and speed up approvals.

- Digital platforms for customer service enhance accessibility and responsiveness.

- Data analytics tools provide insights for better risk management and decision-making.

- Mobile applications allow customers to manage their accounts and make payments easily.

Product Innovation through Technology

Technology helps Five Star innovate financial products for micro-entrepreneurs, staying competitive. This focus addresses their market's evolving needs. Digital platforms enable tailored services and efficient loan processing. In 2024, fintech adoption in India surged, with digital lending platforms disbursing ₹6.7 trillion. This trend supports Five Star's tech-driven strategy.

- Digital lending platforms disbursed ₹6.7 trillion in India in 2024.

- Fintech adoption is rapidly increasing.

Technology dramatically shapes Five Star's operations and market position, from lending platforms to risk management. Digital tools streamline processes and cut costs; digital transformation initiatives by firms saw up to a 20% reduction in processing times in 2024. Innovation includes digital financial products for micro-entrepreneurs.

| Aspect | Impact | 2024 Data/Trends |

|---|---|---|

| Fintech Adoption | Enhanced efficiency | Digital lending disbursed ₹6.7T |

| Operational Tech | Streamlined processes | ₹50Cr allocated for digital initiatives. |

| Cybersecurity | Data Protection | Average breach cost: $4.5M |

Legal factors

Five Star Business Finance, as an NBFC, is governed by the RBI. They must adhere to RBI regulations. These include capital adequacy, asset classification, and provisioning rules. For 2024, NBFCs need a higher capital-to-risk weighted assets ratio. The RBI often updates these rules, impacting operations.

As a listed entity, Five Star Business Finance adheres to SEBI regulations. These rules govern corporate governance, ensuring transparency and accountability. Compliance includes detailed disclosures about financial performance and key business activities. In 2024, SEBI enhanced disclosure norms to boost investor protection.

Five Star Business Finance's secured lending model is significantly impacted by laws concerning property rights and mortgages. The Recovery of Debts and Bankruptcy Act of 1993 and the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act of 2002 are crucial. These laws govern the enforcement of security interests and debt recovery, impacting Five Star's ability to recover assets. Any legal changes can directly affect the company's operational efficiency and risk profile. For 2024, the Indian government has been actively reviewing and updating these acts to streamline processes.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Five Star Business Finance faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are crucial to prevent illegal financial activities. The company must verify customer identities and monitor transactions, impacting operational costs. Non-compliance can lead to hefty penalties; for example, in 2024, financial institutions globally faced over $10 billion in AML fines.

- Compliance requires robust systems.

- Regular audits and training are essential.

- These measures protect both the company and the public.

Labor Laws and Employment Regulations

Five Star Business Finance operates with a substantial branch network, requiring strict adherence to India's labor laws and employment regulations. These regulations cover various aspects, including minimum wage, working hours, and employee benefits. Non-compliance can lead to penalties, legal disputes, and reputational damage, affecting operational costs and stakeholder trust. Recent amendments to labor codes in India, such as those impacting wage structures and social security, necessitate continuous adaptation.

- Minimum wages have been revised in several states, requiring adjustments to employee compensation.

- The implementation of the new labor codes is ongoing, with potential impacts on compliance requirements.

- Employee benefits, including health insurance and retirement plans, must align with current regulations.

- There are ongoing legal cases related to labor disputes in the financial sector.

Legal factors significantly affect Five Star's operations. RBI and SEBI regulations govern capital, disclosure, and governance. Property, debt recovery, and bankruptcy laws impact secured lending. AML and KYC rules fight financial crimes, requiring strong compliance.

| Area | Impact | Data |

|---|---|---|

| AML Fines (2024) | Compliance costs | Global fines exceeded $10B. |

| SARFAESI Act | Debt recovery | Impacts asset recovery rates. |

| Labor Law | Operational costs | Wage revisions in several states. |

Environmental factors

Five Star Business Finance faces physical risks tied to property collateral. Natural disasters, like the 2023 Turkey-Syria earthquakes, can severely devalue property. In 2024, insured losses from natural disasters are projected to reach $100 billion. This directly impacts the collateral's worth.

Climate change poses indirect risks for Five Star Business Finance. Borrowers in agriculture and weather-sensitive small businesses face increased risks from extreme weather. This could lead to lower repayment capacity. For example, 2024 saw a 10% drop in agricultural yields in some regions due to erratic rainfall.

Environmental regulations are key for Five Star's borrowers. Stricter rules might mean higher operational costs. This affects profitability and loan repayment abilities. For example, the EPA's 2024-2025 focus on emissions could hit manufacturing businesses hard. Compliance costs can range from 5% to 15% of operational budgets.

Five Star's Internal Environmental Sustainability Practices

Five Star Business Finance might implement internal environmental practices. This could involve energy-saving measures in its offices. These practices may include waste reduction programs. Such initiatives reflect a growing trend.

- Energy-efficient lighting upgrades can reduce energy consumption by up to 50%.

- Recycling programs in offices can divert up to 70% of waste from landfills.

- Implementing paperless systems can save costs and reduce paper waste.

Investor and Stakeholder Focus on ESG

Investors and stakeholders are increasingly focused on Environmental, Social, and Governance (ESG) factors. Although Five Star Business Finance's direct environmental impact might be limited, acknowledging and addressing environmental considerations is important. This approach can enhance investor relations and corporate responsibility. In 2024, ESG-focused funds saw substantial inflows, with assets under management reaching trillions globally.

- ESG investments have grown significantly, reflecting investor priorities.

- Awareness of environmental issues can boost a company's image.

- Demonstrating ESG commitment is key for stakeholders.

Five Star Business Finance must assess environmental risks to its operations. Physical risks, such as property devaluation from natural disasters, require evaluation. Climate change and related regulatory impacts on borrowers should also be considered.

ESG factors increasingly influence stakeholders and investors. Addressing these environmental concerns will improve investor relations. By focusing on ESG practices, it is possible to enhance the company’s corporate responsibility.

| Aspect | Details | Data (2024-2025) |

|---|---|---|

| Physical Risks | Impact from property damage due to natural disasters. | Insured losses: $100B projected (2024). |

| Climate Change | Borrowers' challenges from extreme weather. | Agri yield drop (10% in some areas in 2024). |

| Environmental Regulations | Impacts on borrowers through operational costs. | Compliance costs 5%-15% of budget. |

PESTLE Analysis Data Sources

Five Star Business Finance PESTLE reports are data-driven. We leverage governmental reports, financial data, market research, and industry publications for accurate insights.