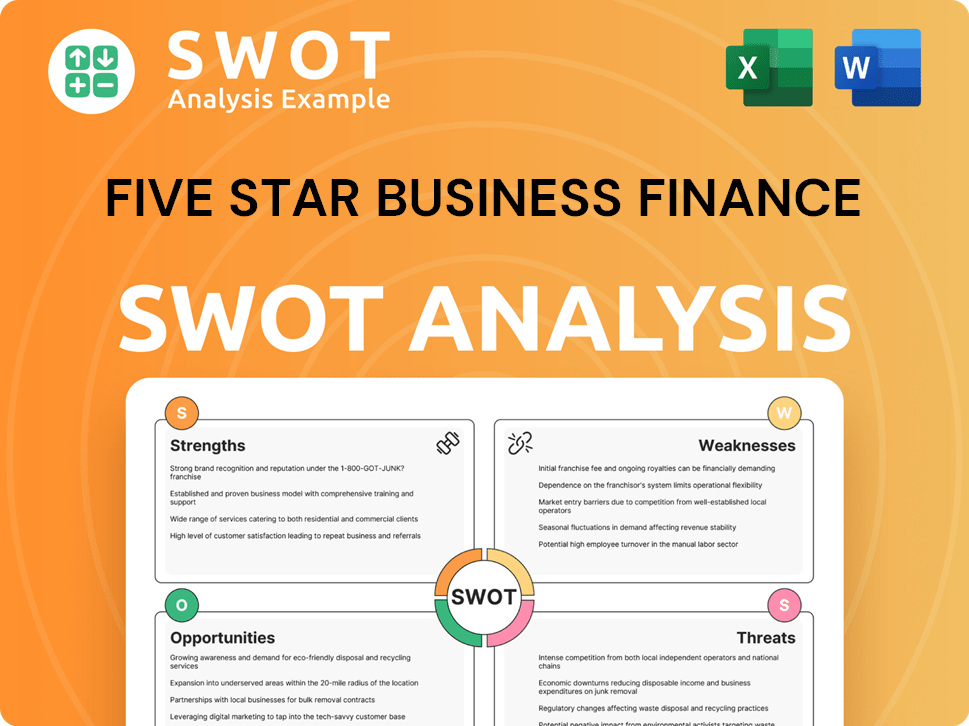

Five Star Business Finance SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

What is included in the product

Analyzes Five Star's competitive position through key internal & external factors.

Gives a high-level overview for quick stakeholder presentations.

What You See Is What You Get

Five Star Business Finance SWOT Analysis

The preview you see here is exactly what you'll receive! The full Five Star Business Finance SWOT analysis, professionally crafted and complete, will be available instantly after purchase.

SWOT Analysis Template

Five Star Business Finance faces a dynamic lending landscape. Our brief SWOT highlights key areas—strengths, weaknesses, opportunities, and threats. Analyzing these aspects gives a starting view. Gain comprehensive insights into their market strategy with our detailed SWOT analysis.

Want the full story behind Five Star's strategic position? Purchase the complete SWOT analysis to unlock expert-written insights, offering an actionable, editable report for planning.

Strengths

Five Star Business Finance benefits from a long operational history, honing credit assessments. This experience, especially within their niche, is a key strength. Management's deep NBFC industry expertise further bolsters their foundation. Their AUM reached ₹8,518 crore by March 31, 2024. This indicates successful operations.

Five Star Business Finance boasts robust financial health. Strong capitalization comes from consistent internal accruals and equity raises. The firm's loan portfolio has expanded, reflecting healthy profitability. Their return on assets and equity are either improving or already healthy. For example, in 2024, the company's net profit was ₹667.3 crore.

Five Star Business Finance excels by targeting micro-entrepreneurs and small businesses, a market segment often underserved by mainstream lenders. Their specialized underwriting model evaluates cash flows and accepts informal documentation, enabling them to reach a broader customer base. This approach, coupled with property-backed loans, reduces risk, as evidenced by their 2024-2025 data showing a default rate of under 2%.

Extensive Branch Network and Local Presence

Five Star Business Finance's extensive branch network is a key strength. They have a significant presence in semi-urban and rural areas. This network enables effective customer reach and relationship building, crucial for their business model. On-ground presence supports loan verification, assessment, and collection.

- Over 350 branches across India.

- Focus on Tier 2 and Tier 3 cities.

- High customer touchpoints.

Secured Lending with Low LTVs

Five Star Business Finance's secured lending model, primarily backed by self-occupied residential properties, is a key strength. The company's conservative approach to loan-to-value (LTV) ratios, often staying below 50%, acts as a solid safeguard. This strategy significantly reduces the risk of defaults and potential losses. It allows the company to navigate market fluctuations with greater resilience.

- LTV Ratios: Typically below 50%

- Loan Security: Primarily self-occupied residential property

Five Star Business Finance showcases robust operational experience and industry expertise, reflected in their increasing AUM and substantial profitability. Their financial health, supported by solid capitalization and healthy returns, highlights a strong market position. A focused approach to underserved micro-entrepreneurs, combined with a secure lending model and widespread branch network, contributes to reduced risk. By March 2024, AUM was ₹8,518 crore, with a net profit of ₹667.3 crore, underscoring their operational efficiency.

| Key Strength | Details | Financial Impact (2024) |

|---|---|---|

| Experienced Management | Deep NBFC Industry Experience | Consistent profitable growth |

| Financial Health | Strong Capitalization & Profitability | Net Profit: ₹667.3 crore |

| Target Market | Micro-entrepreneurs & Small Businesses | Low Default Rate: Under 2% |

| Branch Network | Over 350 branches, Tier 2/3 focus | Enhanced Customer Reach |

| Secured Lending Model | LTV ratios below 50% | Reduced Risk & Resilience |

Weaknesses

Five Star Business Finance's loan portfolio is primarily concentrated in southern Indian states. This geographical focus, although familiar, leaves them vulnerable to regional economic downturns or natural disasters. Data from 2024 shows over 70% of their assets are in these areas. Expansion into new regions is ongoing, but the current concentration poses a key risk.

Five Star Business Finance's portfolio, while having a history, has a significant portion with a short vintage due to recent expansion. This means the portfolio's resilience hasn't been thoroughly tested across various economic conditions. For instance, data from 2023 and early 2024 shows a rapid increase in new loan originations. This rapid growth could expose the portfolio to higher default rates in an economic downturn, as recent data from the financial sector highlights a potential increase in credit risk.

Five Star Business Finance faces challenges with its target customer segment. Micro-entrepreneurs and self-employed individuals, who make up a significant portion of their borrowers, often have marginal credit profiles. This necessitates robust underwriting processes to mitigate the risks associated with limited formal income documentation. In 2024, the non-performing assets (NPA) ratio for microfinance institutions in India was around 4.5%, highlighting the risk.

Dependence on External Funding

Five Star Business Finance's reliance on external funding presents a significant weakness. The company's operations and expansion are heavily dependent on external sources, particularly term loans from banks and NBFCs. The timely availability and the cost of these funds directly influence the company's financial performance and growth trajectory. This dependence can make the company vulnerable to fluctuations in interest rates and credit market conditions.

- External funding dependency can increase financial risk.

- The cost of funds impacts profitability.

- Availability of funds is crucial for growth.

Labor-Dependent Business Model

Five Star Business Finance's model is labor-intensive, especially in underwriting and collections. They depend on on-ground staff for essential tasks. This reliance can increase operational costs. This is because of the customers' income documentation. The business model is less tech-driven compared to competitors.

- Staff costs consume a significant portion of operational expenses.

- The model's scalability could be limited by staffing constraints.

- Labor-intensive processes may slow down loan processing times.

Five Star Business Finance faces significant geographical concentration, with over 70% of assets in southern India, risking regional downturns. Rapid portfolio expansion exposes it to higher default risks, especially for micro-entrepreneurs with marginal credit profiles; the 2024 NPA ratio for microfinance was 4.5%. Reliance on external funding also poses vulnerabilities.

| Weakness | Details | Impact |

|---|---|---|

| Geographical Concentration | Over 70% of assets in southern India. | Vulnerable to regional economic downturns; Potential credit risk. |

| Portfolio with Short Vintage | Rapid expansion in recent years | Untested across varied economic cycles, increased default risk. |

| Customer Segment Challenges | Micro-entrepreneurs with marginal credit profiles | Necessitates robust underwriting, risk associated with income. |

Opportunities

India's MSME sector presents a huge, largely unserved market for financial services. Five Star Business Finance can capitalize on this by expanding its reach in semi-urban and rural areas. In 2024, the MSME sector's credit gap was estimated at over $300 billion, showing significant growth opportunities. This untapped market offers substantial potential for Five Star's secured small business loans.

Five Star Business Finance can substantially grow by expanding into new regions. They can replicate their successful model in new states and boost their portfolio. In 2024, they increased their footprint by 15% with plans for more. This expansion strategy aims to capture underserved markets. It should boost their loan book by an estimated 20% by 2025.

Five Star Business Finance could boost its average loan size. Inflation and customer business growth allow for larger loans. In FY24, the company disbursed ₹6,308 crore in loans. This trend suggests room for increased ticket sizes in 2025. This could lead to revenue and profit growth.

Diversification of Funding Profile

Five Star Business Finance can tap into diverse funding avenues to strengthen its financial position. Expanding beyond bank loans to include non-convertible debentures, securitization, and external commercial borrowings can lower the cost of funds. In 2024, the NBFC sector saw increased diversification efforts, with securitization volumes rising by 15%. This strategy reduces dependency on a few sources, mitigating risks. The company's access to various markets, as demonstrated by the success of similar NBFCs in securing competitive rates, supports this approach.

- Securitization volumes in the NBFC sector increased by 15% in 2024.

- Non-convertible debentures offer an alternative funding route.

- External commercial borrowings can provide access to cheaper funds.

Leveraging Technology

Five Star Business Finance can boost efficiency by using technology strategically. This includes using data analysis, credit risk models, and compliance tools. However, they must keep their human touch in customer interactions. For example, Fintech lending grew by 20% in 2024.

- Data analytics can improve loan decisions.

- Automation can speed up processes.

- Compliance software reduces risks.

- Technology enhances customer service.

Five Star can tap the vast MSME market, with a $300B+ credit gap in 2024. They can expand geographically, boosting their loan book. Furthermore, they can increase loan sizes and use diverse funding options like securitization. Using tech to enhance operations is also key, considering that the Fintech lending rose by 20% in 2024.

| Opportunity | Description | 2024 Data/Trend |

|---|---|---|

| MSME Expansion | Target unserved MSME market | $300B+ credit gap |

| Geographic Growth | Expand into new regions | Footprint increased by 15% |

| Loan Enhancement | Increase loan sizes | ₹6,308 crore in loans disbursed |

| Funding Diversification | Explore diverse funding sources | Securitization volumes +15% |

| Technological Advancements | Use data analysis, etc. | Fintech lending +20% |

Threats

The financial services sector is intensely competitive, with traditional banks, NBFCs, and fintech firms vying for market share. This competition can squeeze Five Star Business Finance's yields and profit margins. In 2024, the Indian NBFC sector saw a 15% increase in assets, intensifying competition.

Deterioration in asset quality poses a significant threat. Increased NPAs directly hit profits and strain finances. Five Star Business Finance faces this risk due to its borrower profile. As of December 2023, gross NPAs were at 3.5%. This highlights the need for robust risk management. Watch for Q1 2024 numbers.

Five Star Business Finance's core clientele, micro-entrepreneurs, face heightened risks during economic downturns. Their capacity to repay loans is directly affected by economic instability. Consider the COVID-19 pandemic, which severely impacted small businesses. According to a 2024 report, over 30% of micro-enterprises faced significant financial distress during economic shocks.

Regulatory Changes

Regulatory changes pose a significant threat to Five Star Business Finance. New rules from the RBI or other bodies can increase compliance costs and operational hurdles. Adapting quickly is essential to avoid penalties or disruptions. For example, NBFCs face stricter capital adequacy norms.

- RBI's revised guidelines on asset classification and provisioning could impact Five Star's profitability in 2024-2025.

- Increased scrutiny on digital lending practices might affect their loan disbursement processes.

- Changes in interest rate regulations could limit their pricing flexibility.

Execution Risk in Expansion

Five Star Business Finance faces execution risk as it ventures into new areas, potentially struggling to replicate its proven model. Maintaining the quality of assets and operational efficiency in these new markets poses a challenge. Expansion could lead to increased operational complexities and costs. The company's ability to manage these risks will directly impact its growth and profitability.

Intense competition from banks, NBFCs, and fintechs can squeeze Five Star’s yields and profit margins. Deterioration in asset quality, such as increased NPAs, poses a financial risk; gross NPAs were 3.5% as of December 2023. Micro-entrepreneurs, their core clients, face heightened economic downturn risks, impacting loan repayments. Regulatory changes, especially from RBI, also add to operational challenges.

| Threat | Impact | Mitigation |

|---|---|---|

| Intense Competition | Reduced yields, lower profits. | Product innovation, strong customer service. |

| Asset Quality | Increased NPAs, financial strain. | Enhanced risk management, stricter credit assessments. |

| Economic Downturn | Borrower defaults. | Diversified portfolio, focus on resilient sectors. |

SWOT Analysis Data Sources

This SWOT analysis uses financial statements, market data, and expert insights for a robust and accurate evaluation.