Fluor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

What is included in the product

Tailored analysis for Fluor's product portfolio.

Clear data visualization: easily identifies investment opportunities and risks.

Full Transparency, Always

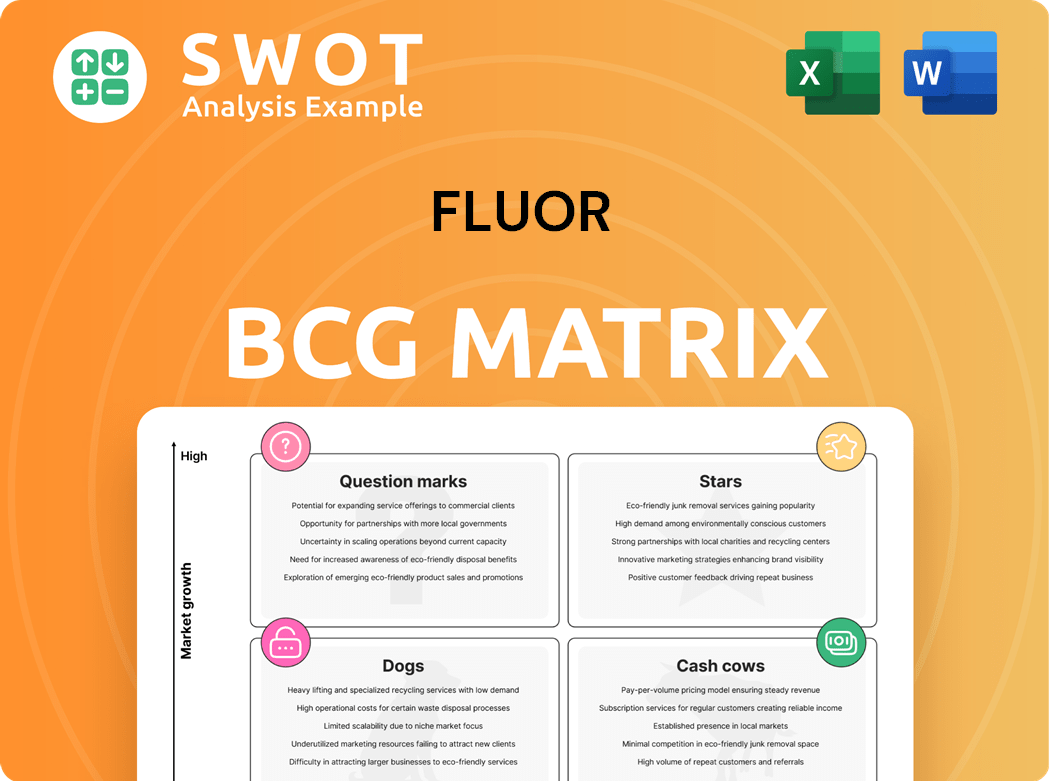

Fluor BCG Matrix

The Fluor BCG Matrix preview mirrors the document you'll receive post-purchase. This comprehensive report, without any alterations, is immediately accessible for strategic planning and analysis.

BCG Matrix Template

The Fluor BCG Matrix offers a glimpse into its diverse portfolio, categorizing products into Stars, Cash Cows, Dogs, and Question Marks. This simplified view helps understand market share versus growth rate.

It's a powerful framework for strategic planning and resource allocation. The basic matrix can help evaluate overall portfolio health, however, It is just the tip of the iceberg.

Get the full BCG Matrix to get deeper analysis, including data-driven recommendations for each product quadrant.

Unlock insights, competitive clarity, and a roadmap for smart business decisions. Purchase the full version now!

Stars

Fluor's Urban Solutions, including tech, manufacturing, and infrastructure, is a star in the BCG matrix. This segment's 2024 revenue hit $7.2 billion, fueled by new projects. Its robust pipeline and reimbursable contracts ensure ongoing growth. Urban Solutions is set for continued success in 2024.

Fluor is focusing on energy transition projects like nuclear power and renewable fuels. This strategic move aligns with the global shift towards sustainable energy. In 2023, nearly 40% of Fluor's new awards were energy transition-related. This positioning allows Fluor to tap into significant growth opportunities.

Fluor is actively pursuing opportunities in the data center market, collaborating with major tech firms, anticipating significant expansion by 2025. They're innovating cooling methods and using offsite modular designs. The global data center market was valued at $228.8 billion in 2023 and is projected to reach $709.8 billion by 2030. Fluor's project management skills position it well.

Mining and Metals Projects

Fluor's Mining & Metals division is a "Star" in its BCG Matrix, fueled by significant project wins. A key example is its joint venture on BHP's Olympic Dam expansion. Fluor's ability to manage large, complex projects and handle multiple mine constructions simultaneously is a major advantage. The firm's strong position in the mining sector is set to benefit from ongoing demand.

- In 2024, the global mining market was valued at approximately $2.3 trillion.

- Fluor's backlog in the Mining & Metals sector in 2023 was over $2 billion.

- BHP's Olympic Dam expansion is valued at several billion dollars.

- The demand for critical minerals is projected to grow significantly through 2030.

Government Services

Fluor's Government Services, a Star in its BCG Matrix, offers technical solutions to the U.S. and other governments, primarily in nuclear and environmental areas. This segment saw a profit of $153 million in 2024, indicating strong performance. Government contracts provide a stable revenue stream and potential for sustained long-term expansion. Fluor's involvement in decommissioning a former uranium enrichment facility further highlights its expertise.

- Mission Solutions segment reported $153 million profit in 2024.

- Government contracts provide stable revenue.

- Focus on nuclear and environmental solutions.

- Selected for uranium enrichment facility decommissioning.

Stars like Urban Solutions, Energy Transition, Mining & Metals, and Government Services drive Fluor's growth.

These segments show high market share and growth potential in the BCG matrix.

They contribute significantly to Fluor's revenue and profitability, ensuring future success.

| Segment | 2024 Revenue/Profit | Key Projects/Focus |

|---|---|---|

| Urban Solutions | $7.2B Revenue | Tech, Manufacturing, Infrastructure |

| Energy Transition | Significant growth | Nuclear, Renewables (40% of 2023 new awards) |

| Mining & Metals | $2B+ Backlog (2023) | Olympic Dam, critical minerals |

| Government Services | $153M Profit (2024) | Nuclear, Environmental, U.S. Govt. |

Cash Cows

Fluor's established oil and gas operations are a cash cow, providing significant financial stability. In 2024, these projects contributed a substantial portion of the company's revenue. Fluor's robust engineering and construction services for oil and gas ensure consistent cash flow. Despite the energy transition focus, this segment remains a reliable income source, with an estimated $4.5 billion in revenue.

Fluor's long-term maintenance contracts span diverse industries, securing a steady revenue flow. These contracts bolster the company's financial stability by providing recurring income. The necessity of infrastructure upkeep ensures these contracts remain a reliable cash source. In 2024, Fluor's Maintenance, Modification, and Asset Integrity segment generated significant revenue, highlighting their importance.

Fluor's move to reimbursable contracts has lowered its risk. In 2024, 79% of Fluor's backlog was reimbursable, protecting against cost issues. This boosts cash flow predictability. These contracts are a key part of Fluor's strategy.

Strong Backlog Execution

Fluor's robust backlog execution is key to its cash flow generation. The company's focus is on project delivery and efficient resource allocation, ensuring timely revenue recognition. This execution strategy directly impacts Fluor's profitability and financial stability. Efficient project management is critical for maintaining a strong financial position. In 2024, Fluor reported significant progress in this area, with several projects reaching key milestones.

- Backlog execution is a priority.

- Focus on timely revenue recognition.

- Improved profitability due to efficient execution.

- Project milestones reached in 2024.

Global Presence

Fluor's global presence is key to its success, enabling it to undertake projects across various markets and sectors. With an extensive network of offices and a skilled workforce, it effectively manages projects worldwide. This wide reach gives Fluor a strong competitive edge, ensuring a consistent stream of opportunities. For instance, Fluor has a presence in over 100 countries, with a workforce of approximately 40,000 employees worldwide as of 2024. This broad footprint supports its ability to secure and execute projects globally.

- Operations in over 100 countries.

- Approximately 40,000 employees globally.

- Diverse project portfolio across various sectors.

- Strong competitive advantage in global markets.

Fluor's oil and gas and maintenance segments are cash cows, providing stable revenue. Reimbursable contracts further enhance cash flow predictability. Strong backlog execution and a global presence ensure consistent project opportunities and financial stability.

| Key Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Sources | Oil & Gas, Maintenance | Oil & Gas: $4.5B est. |

| Contract Type | Reimbursable | 79% of Backlog |

| Global Presence | Operations Worldwide | 100+ countries, 40,000 employees |

Dogs

Fluor's legacy projects, some facing cost overruns, pose financial challenges. These projects demand continued funding and management focus. In 2024, $81 million was allocated to these projects. Management anticipates up to $200 million more in 2025 to address these issues.

Fluor's refinery projects in Mexico have faced hurdles, impacting its Energy Solutions segment revenue. These projects' reduced contributions have affected the company's financial outcomes. In Q3 2024, Fluor reported a decrease in revenue, partially due to these challenges. Improving performance in Mexico is critical for Fluor's future growth. The company's Energy Solutions segment saw a revenue decline of 10% in 2024, reflecting these issues.

Fluor divested Stork's continental European operations, a strategic move. This suggests these units weren't core or underperformed. In 2024, such divestitures often boost focus and efficiency. Fluor likely aimed to concentrate on its key sectors, potentially boosting its stock value. This decision aligns with broader industry trends in portfolio optimization.

Lump-Sum Contracts

Fluor's "Dogs" segment, encompassing lump-sum contracts, presents significant challenges. These contracts expose Fluor to greater financial risk due to potential project delays and cost overruns. The company's profitability can be negatively affected if these contracts are not managed efficiently. In 2024, Fluor reported that its lump-sum projects experienced an average cost overrun of 8%. Effective management is critical.

- Higher Risk Profile

- Potential for Delays

- Impact on Profitability

- Need for Effective Management

NuScale Investment

Fluor deconsolidated its NuScale investment in 2024, leading to a pre-tax gain, though exact figures vary. This strategic shift removed Fluor's direct operational control. NuScale's future hinges on new project wins and revenue generation, crucial for its long-term viability. The market is watching NuScale's ability to secure contracts, especially following Fluor's exit.

- Fluor's 2024 pre-tax gain from NuScale's deconsolidation reflects strategic financial maneuvering.

- Without Fluor's direct control, NuScale's performance is now solely market-driven.

- NuScale needs to secure new projects to prove its business model's effectiveness.

- Investors are assessing NuScale's ability to generate sustainable revenue post-deconsolidation.

Dogs, in Fluor's BCG matrix, include lump-sum contracts, exposing the company to higher financial risks due to cost overruns and project delays. Managing these projects effectively is crucial for Fluor’s profitability. In 2024, lump-sum projects averaged an 8% cost overrun, highlighting the critical need for careful oversight.

| Aspect | Details | Impact |

|---|---|---|

| Contract Type | Lump-sum | High risk, cost overruns |

| Financial Risk | Project delays and cost increases | Negative impact on profitability |

| 2024 Performance | 8% average cost overrun | Requires effective management |

Question Marks

Fluor's investment in NuScale SMR technology is a question mark in the BCG matrix. SMRs are in early stages, but could revolutionize nuclear power. In 2024, NuScale faced project setbacks, impacting its market position. Strategic partnerships and further investment are crucial to shift this to a Star. The global SMR market is projected to reach $60 billion by 2030.

Fluor is targeting advanced tech sectors. This includes semiconductors, life sciences, and infrastructure. These areas are experiencing growth. In 2024, the semiconductor industry saw a 13.2% revenue increase. Fluor's success relies on strategic investments and strong execution.

Fluor secured a front-end engineering and design contract for a cement plant CCS project in Germany, signaling growing interest in CCS. This technology helps reduce carbon emissions from industrial sites. In 2024, the global CCS market was valued at approximately $3.5 billion. Winning more CCS projects could boost Fluor's growth significantly.

Renewable Fuels and Chemicals

Fluor's involvement in renewable fuels and chemicals aligns with the growing demand for sustainable products. This segment is a developing market, offering Fluor opportunities to expand its expertise and revenue. The global biofuels market was valued at $101.3 billion in 2023. Continued investment and innovation could lead to significant growth.

- Market growth is projected to reach $180.6 billion by 2030.

- Fluor's expertise can be leveraged in biofuel production facilities.

- Focus on sustainable chemicals presents further opportunities.

- The market for sustainable aviation fuel is expanding.

Lithium-Ion Battery Manufacturing Facilities

Fluor's involvement in lithium-ion battery manufacturing, exemplified by its contract for Northvolt's facility in Germany, positions it in a high-growth sector. The demand for lithium-ion batteries is surging, driven by the expansion of electric vehicles (EVs) and energy storage systems. Securing more contracts in this area could significantly boost Fluor's growth trajectory. The lithium-ion battery market is expected to reach $193 billion by 2028.

- Fluor secured a contract for phase one of Northvolt's large-scale lithium-ion battery manufacturing facility in Germany.

- The demand for lithium-ion batteries is increasing due to the growth of electric vehicles and energy storage systems.

- Securing additional contracts in this sector could be a significant growth driver for Fluor.

- The lithium-ion battery market is projected to reach $193 billion by 2028.

Fluor's NuScale SMR investment is a question mark. SMRs have potential but face challenges. Strategic moves are crucial to boost their market position. The global SMR market could hit $60 billion by 2030.

| Category | Details | 2024 Data |

|---|---|---|

| SMR Market | Early-stage tech, high potential | NuScale project setbacks |

| Market Growth | Projected to rise | $60B by 2030 |

| Strategic Need | Partnerships & investments vital | Market position impact |

BCG Matrix Data Sources

The Fluor BCG Matrix utilizes financial data, market analysis, and project performance reviews to determine market positioning.