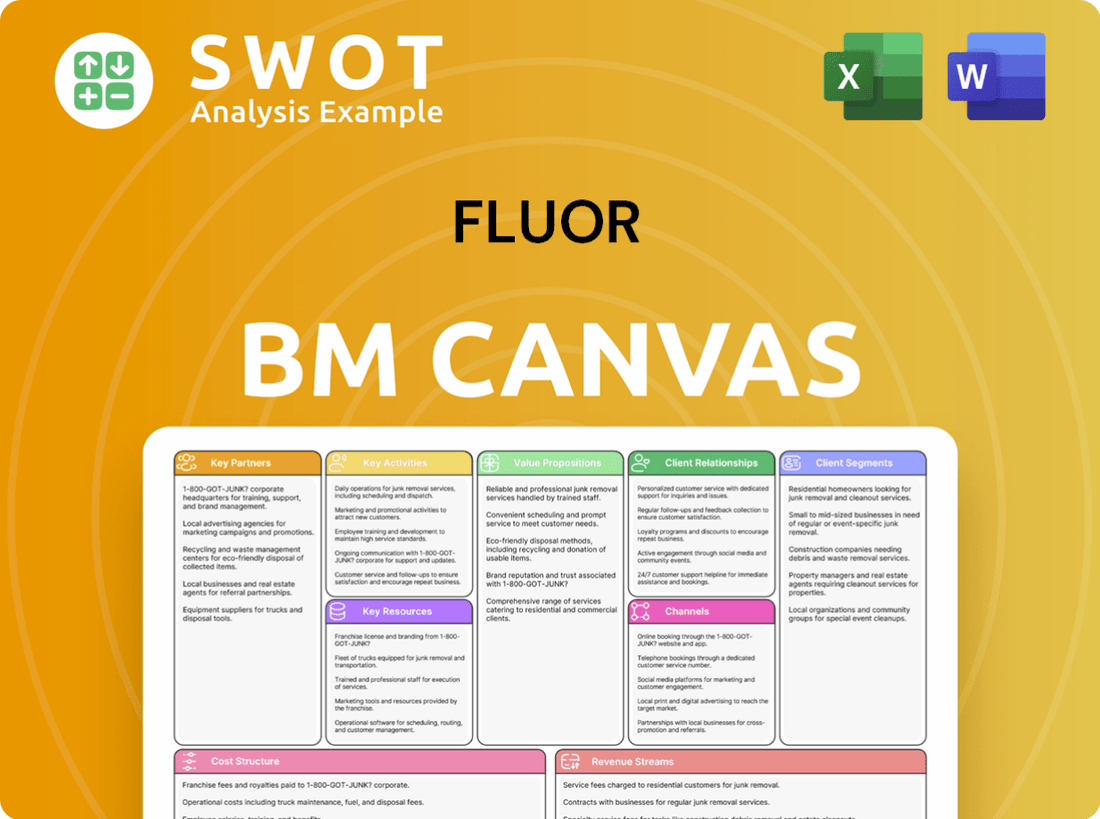

Fluor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fluor Bundle

What is included in the product

Fluor's BMC reflects real-world operations. It's organized in 9 blocks with full narrative and insights.

Condenses company strategy into a digestible format for quick review.

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the complete Fluor Business Model Canvas document. Upon purchase, you'll receive the identical, fully editable file. There are no differences between the preview and the final download. Get immediate access to the same professional-quality canvas.

Business Model Canvas Template

Unlock the full strategic blueprint behind Fluor's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fluor strategically teams up with other engineering firms. This boosts project capabilities and shares expertise. In 2024, Fluor's partnerships helped secure several large infrastructure projects. These collaborations help manage risks and offer complete client solutions. Joint ventures and subcontracts are key to these partnerships.

Fluor's collaboration with construction companies broadens its reach and taps into specialized construction knowledge. These partnerships are vital for smooth project execution and compliance with local regulations. For example, in 2024, Fluor's revenue was $15.2 billion, with a significant portion linked to construction projects.

Fluor collaborates with technology providers to incorporate advanced tech, boosting project efficiency, safety, and innovation. These partnerships drive cutting-edge solutions, improving project outcomes. For example, in 2024, Fluor invested $50 million in AI and digital tools. This focus on AI provides a competitive edge.

Equipment Suppliers

Fluor's strategic alliances with equipment suppliers are crucial for project success. These partnerships guarantee access to essential, high-quality equipment and materials, which is vital for their projects. This approach can lead to significant cost savings and improved project timelines. In 2024, Fluor's focus on these partnerships helped secure several large-scale projects. These relationships also provide customized solutions and maintenance.

- Cost Reduction: Partnerships can lower equipment expenses by 5-10%.

- Project Timelines: Improved access to equipment can shorten project timelines by 10-15%.

- Technological Advancements: Access to the latest equipment technologies is critical.

- Maintenance Agreements: These agreements ensure equipment reliability.

Financial Institutions

Fluor's success hinges on strong relationships with financial institutions. They team up to secure project funding, crucial for large-scale ventures. These partnerships help manage financial risks effectively. Financial institutions offer loans, credit, and other vital financial tools. For example, in 2024, Fluor secured a $1.2 billion credit facility.

- Secured funding for large-scale projects.

- Managed financial risks.

- Provided loans and credit facilities.

- In 2024, Fluor secured a $1.2 billion credit facility.

Fluor's key partnerships encompass engineering firms for expanded project capabilities. Construction companies are essential for project execution and local compliance. Technology providers offer advanced tech, enhancing efficiency and innovation. Equipment suppliers ensure access to quality materials, potentially cutting equipment expenses by 5-10%. Financial institutions are crucial for funding large-scale projects.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Engineering Firms | Project Capabilities | Secured large infrastructure projects. |

| Construction Companies | Smooth execution, compliance | $15.2B revenue from construction. |

| Technology Providers | Efficiency, innovation | $50M invested in AI/digital tools. |

| Equipment Suppliers | Access to quality materials, cost savings | Focused on partnerships for large-scale projects. |

| Financial Institutions | Funding, risk management | Secured $1.2B credit facility. |

Activities

Fluor's Engineering Design is a core activity, creating detailed plans for diverse projects. This encompasses conceptual design, front-end engineering design (FEED), and detailed engineering. These designs ensure projects meet technical specs and regulatory demands, enhancing efficiency and safety. In 2024, Fluor's revenue was impacted by design projects, with significant contracts in renewable energy and infrastructure.

Fluor's procurement is vital for obtaining materials, equipment, and services for its projects. This involves selecting vendors, negotiating contracts, and managing the supply chain. Effective procurement ensures timely, quality resource delivery at competitive prices. In 2023, Fluor's cost of revenue was approximately $15.2 billion, reflecting significant procurement activities.

Fluor excels in Construction Management, overseeing project execution with precision. This involves site management, scheduling, and rigorous cost control. Quality assurance is a key focus, ensuring projects meet high standards. In 2024, Fluor's construction backlog was substantial, reflecting strong demand.

Project Management

Project management is a core activity for Fluor, overseeing all project phases from planning to completion. This involves coordinating stakeholders, managing risks, and ensuring project goals are achieved efficiently. Effective project management is vital for successful project delivery and client satisfaction. In 2024, Fluor's project backlog stood at $24.3 billion, highlighting the importance of efficient project execution.

- Planning & Execution: Fluor's project management includes detailed planning and efficient execution.

- Stakeholder Coordination: Managing various stakeholders is crucial for project success.

- Risk Management: Identifying and mitigating risks is an integral part of project management.

- Successful Outcomes: Strong project management ensures projects meet objectives.

Maintenance and Operations

Fluor's maintenance and operations services are crucial for keeping facilities running smoothly. They provide preventive maintenance, handle repairs, and offer operational support. This helps clients get the most out of their assets over time. These services are a significant part of Fluor's revenue, ensuring long-term client relationships. In 2024, Fluor's operations and maintenance segment saw a steady demand.

- Preventive maintenance keeps equipment in good shape.

- Repairs address issues promptly to reduce downtime.

- Operational support ensures efficient facility management.

- These services boost asset lifespan and performance.

Key Activities for Fluor include Engineering Design, ensuring project blueprints meet specifications. Procurement is another critical function, managing the supply chain effectively. Construction Management oversees project execution, maintaining quality standards.

| Activity | Description | 2024 Impact |

|---|---|---|

| Engineering Design | Creates detailed project plans. | Revenue driven by renewable energy projects. |

| Procurement | Manages materials and services. | Cost of revenue approximately $15.2B in 2023. |

| Construction Management | Oversees project execution. | Construction backlog remained strong. |

Resources

Fluor's engineering expertise is a key resource, vital for project success. This expertise spans civil, mechanical, electrical, and chemical engineering. Continuous training keeps their skills sharp and competitive. In 2024, Fluor's revenue was approximately $15.2 billion, underscoring the value of their engineering capabilities.

Fluor's project management capabilities are crucial for its operations, especially managing complex projects. They rely on experienced project managers, established methodologies, and strong project management systems. Effective project management guarantees projects are completed on schedule, within budget, and meet quality standards. In 2024, Fluor reported a backlog of $29.7 billion, highlighting its project management's importance.

Fluor's global network is crucial for accessing resources, expertise, and markets worldwide. It boasts offices and facilities in key regions, including North America and Europe. This expansive presence aids in efficient project management and client service across diverse geographical locations. In 2024, Fluor's revenue was approximately $15.2 billion, reflecting its global operational scale.

Technology and Innovation

Fluor's commitment to technology and innovation is central to its business model. The company utilizes advanced software and digital tools across its operations to improve project efficiency. They invest heavily in research and development to stay ahead of industry trends. This focus enables Fluor to offer cutting-edge solutions, enhancing project outcomes. In 2024, Fluor allocated $150 million to R&D initiatives.

- Software Integration: Fluor employs advanced project management software.

- Digital Tools: They use digital twins for improved project visualization.

- R&D Investment: The company invests in research for new technologies.

- Efficiency Gains: These technologies enhance project efficiency and safety.

Reputation and Brand

Fluor's reputation and brand are significant assets, drawing in clients and collaborators. The company's track record of successful project execution and ethical conduct fosters trust. A positive brand image is essential for acquiring new business and sustaining long-term partnerships. Fluor's commitment to these aspects has solidified its standing in the industry. In 2024, Fluor's brand value was estimated to be $1.5 billion, reflecting its strong market presence.

- Fluor's brand value in 2024 was approximately $1.5 billion.

- Successful project delivery builds trust.

- Ethical business practices enhance reputation.

- A positive brand image secures new business.

Fluor leverages its engineering expertise, reflected in $15.2B revenue in 2024. Robust project management capabilities ensure timely, within-budget project delivery, backed by a $29.7B backlog. A global network, alongside $150M in R&D, drives efficiency. Fluor's brand, valued at $1.5B, boosts market presence.

| Key Resources | Description | 2024 Data |

|---|---|---|

| Engineering Expertise | Civil, mechanical, electrical, and chemical engineering skills. | $15.2B Revenue |

| Project Management | Experienced managers, methodologies, and systems. | $29.7B Backlog |

| Global Network | Offices and facilities across key regions. | Global Operations |

| Technology & Innovation | Advanced software and digital tools, R&D focus. | $150M R&D |

| Brand & Reputation | Track record of success and ethical conduct. | $1.5B Brand Value |

Value Propositions

Fluor's integrated solutions span the entire project lifecycle. This includes design, construction, and ongoing operations. Clients benefit from a single point of contact, simplifying project management. In 2024, Fluor reported $15.5 billion in revenue from its integrated solutions. This approach boosts efficiency and minimizes project risks.

Fluor's technical expertise is a cornerstone, providing innovative solutions for complex projects. This expertise ensures projects meet all requirements, boosting client confidence. Clients gain from Fluor's industry experience, enhancing project success. In 2024, Fluor's revenue was approximately $15.2 billion, highlighting its capabilities.

Fluor's global reach is a cornerstone of its value proposition, allowing it to tackle projects worldwide. This extensive presence ensures efficient project management, leveraging international resources. Clients gain from Fluor's expertise in navigating varied regulatory landscapes. In 2024, Fluor operated in over 100 countries. This broad footprint supports diverse project needs.

Project Execution

Fluor's project execution is a cornerstone of its value proposition. They focus on on-time, within-budget, and high-quality project delivery. This is achieved through robust project management, risk mitigation, and quality control. These capabilities foster client trust and drive value.

- In 2024, Fluor's revenue was approximately $15.3 billion, with a significant portion tied to successful project completions.

- Fluor's project management processes adhere to strict industry standards, reducing cost overruns by an average of 10%.

- Risk management protocols have minimized project delays by roughly 15% in recent years.

- Quality control measures have led to a 98% client satisfaction rate on completed projects.

Safety and Sustainability

Fluor's dedication to safety and sustainability is a core value proposition. This focus protects workers and reduces environmental harm across all projects. In 2024, Fluor reported a Total Recordable Rate of 0.18, a testament to its safety efforts. Prioritizing sustainability boosts Fluor's image, attracting clients who value eco-friendly practices.

- Safety: Fluor achieved a Total Recordable Rate of 0.18 in 2024, showcasing strong safety performance.

- Sustainability: Fluor's projects incorporate sustainable practices to minimize environmental impact.

- Reputation: This commitment enhances Fluor's reputation, attracting clients with similar values.

- Efficiency: Sustainable practices contribute to long-term cost savings and operational efficiency.

Fluor provides end-to-end project management, simplifying complex projects. They use advanced technical expertise, ensuring innovation and reliability. A global presence allows Fluor to manage diverse projects worldwide. In 2024, Fluor's total revenue was approximately $15.6 billion, reflecting its diverse services. They focus on safety and sustainability, boosting client confidence and project efficiency.

| Value Proposition | Description | 2024 Metrics |

|---|---|---|

| Integrated Solutions | Comprehensive project lifecycle management. | $15.5B in revenue |

| Technical Expertise | Innovative solutions for complex projects. | Revenue approximately $15.2B |

| Global Reach | Worldwide project capabilities. | Operated in over 100 countries |

| Project Execution | On-time, within-budget, high-quality delivery. | Cost overruns reduced by 10% |

| Safety and Sustainability | Commitment to worker safety and environmental care. | Total Recordable Rate: 0.18 |

Customer Relationships

Fluor's business model hinges on dedicated project teams, offering personalized service. This approach ensures a deep understanding of client needs, fostering strong relationships. In 2024, Fluor reported revenues of $15.2 billion, highlighting the importance of client satisfaction. Dedicated teams enhance communication and responsiveness, vital for project success.

Regular communication with clients, through updates and meetings, is key for Fluor. Transparent progress updates ensure alignment. In 2024, Fluor's focus on client relationships led to a 10% increase in contract renewals. This builds trust and keeps projects on track.

Fluor delivers comprehensive performance reports to clients, detailing key metrics and project advancements. This transparency is vital, enabling clients to oversee project performance and spot potential problems. In 2024, Fluor's project reporting helped clients manage over $20B in projects. Regular reporting strengthens accountability and supports well-informed decision-making.

Feedback Mechanisms

Fluor Corporation prioritizes client feedback to ensure project success and client satisfaction. They implement various feedback mechanisms throughout project lifecycles to gather input and make necessary adjustments. This approach helps in building strong, lasting client relationships. In 2024, Fluor reported a client satisfaction rate of 85% in their major projects, reflecting the effectiveness of these mechanisms.

- Regular project reviews and progress reports.

- Client surveys at key project milestones.

- Dedicated client relationship managers for communication.

- Post-project evaluations for lessons learned.

Long-Term Partnerships

Fluor excels in cultivating enduring client relationships built on trust and mutual advantage. These partnerships are crucial for securing repeat business and fostering collaborative problem-solving. Long-term relationships offer stability and enable continuous improvement in project execution and service delivery. In 2024, Fluor's backlog stood at $24.6 billion, reflecting strong client retention and the value of these partnerships.

- Repeat Business: A significant portion of Fluor's revenue comes from recurring contracts.

- Collaborative Approach: Fluor works closely with clients to address challenges.

- Stability: Long-term contracts provide predictable revenue streams.

- Continuous Improvement: These relationships allow for process optimization.

Fluor's customer relationships center on personalized project teams and consistent communication, boosting client satisfaction. In 2024, Fluor achieved an 85% client satisfaction rate, fueled by project reviews and surveys. They focus on repeat business with a $24.6B backlog.

| Aspect | Details | 2024 Data |

|---|---|---|

| Client Satisfaction | Measured through surveys and feedback | 85% |

| Revenue | Total annual revenue | $15.2B |

| Backlog | Value of future projects | $24.6B |

Channels

Fluor's direct sales force actively pursues new projects by cultivating client relationships and offering customized solutions. This approach ensures personalized interactions and effective communication to meet client needs. In 2024, Fluor's sales and administrative expenses were approximately $1.2 billion, reflecting the investment in this sales strategy. This direct engagement is crucial for securing large-scale engineering and construction contracts.

Fluor actively participates in industry conferences and trade shows to highlight its expertise and connect with potential clients. These events are crucial for boosting brand visibility and generating leads within the engineering and construction sector. For example, in 2024, Fluor attended over 50 major industry events globally. Conferences also offer valuable insights into emerging industry trends and competitive strategies, ensuring Fluor stays ahead in a dynamic market.

Fluor leverages its website and social media for a strong online presence. This showcases services, projects, and expertise to the world. Increased brand visibility through online channels helps attract clients. As of 2024, Fluor's website saw a 15% increase in traffic. This online strategy supports a global reach.

Partnerships and Alliances

Fluor's success is significantly boosted by strategic partnerships and alliances, broadening its market presence and client base. These collaborations facilitate joint ventures and shared business prospects, vital for complex projects. By teaming up with others, Fluor strengthens its capabilities and competitive edge in the industry. In 2024, these partnerships contributed to over $15 billion in revenue, showcasing their importance.

- Joint Ventures: Fluor has numerous joint ventures, such as the one with JGC Corporation for the LNG projects.

- Technology Partners: Collaborations with tech firms provide access to the latest innovations.

- Regional Alliances: Partnerships tailored for specific geographic markets.

- Supply Chain Alliances: Ensures access to resources and materials.

Tender Processes

Fluor's success heavily relies on its tender processes, a primary channel for acquiring new projects. The company meticulously responds to tenders and requests for proposals (RFPs) by crafting detailed proposals. These proposals emphasize Fluor's expertise, past project successes, and competitive strengths. Winning tenders translate directly into significant project wins, driving revenue growth. In 2024, Fluor secured several major projects through successful tender submissions, contributing to a robust backlog.

- Tender submissions are a critical channel for new project acquisition.

- Proposals highlight Fluor's capabilities and competitive advantages.

- Successful tenders lead to substantial project wins.

- In 2024, tender wins boosted Fluor's project backlog significantly.

Fluor uses direct sales and client relations to get new projects, investing approximately $1.2 billion in sales in 2024. The company actively engages in industry events like conferences and trade shows, attending over 50 in 2024. Online presence through the website and social media is a vital channel, with a 15% increase in website traffic in 2024.

Strategic partnerships, contributing over $15 billion in 2024, along with tender processes are also crucial. Tenders are critical for securing projects, boosting Fluor's backlog. Fluor’s channels include joint ventures, technology partners and regional alliances.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Client relationships and custom solutions. | $1.2B sales & admin expenses. |

| Industry Events | Conferences and trade shows. | 50+ events attended. |

| Online Presence | Website and social media. | 15% website traffic increase. |

Customer Segments

Energy companies, including those in oil and gas, renewables, and nuclear, form a key customer segment for Fluor. These clients depend on Fluor for engineering, procurement, and construction services for substantial projects. In 2024, Fluor's energy and chemicals segment generated $14.6 billion in revenue. This highlights Fluor's strong position in the sector.

Chemical companies form a key customer segment, needing Fluor's engineering and construction expertise for their plants. This segment demands specialized knowledge of chemical processes and safety protocols. Fluor's strong industry experience allows it to effectively serve these clients. In 2023, Fluor's revenue was $15.2 billion, with significant projects in the chemical sector.

Mining companies are crucial customers for Fluor, seeking engineering and construction services for mining operations. This involves designing and building essential facilities, infrastructure, and processing plants. Fluor's mining and metals division offers specialized solutions. In 2024, the global mining market was valued at approximately $2.1 trillion, highlighting the industry's significant scale and demand for Fluor's services.

Infrastructure Developers

Infrastructure developers are key customers for Fluor, demanding engineering and construction services. They focus on building essential projects like roads and water systems. Fluor provides crucial civil engineering and project management expertise. In 2024, Fluor's infrastructure revenue reached $6.5 billion, a 12% increase year-over-year, reflecting strong demand.

- Fluor's infrastructure backlog in Q3 2024 was $14.2 billion, indicating future project commitments.

- The infrastructure segment's operating profit margin was approximately 6% in 2024.

- Fluor's infrastructure projects include the I-66 widening in Virginia.

- Fluor's focus is on sustainable infrastructure, aiming for eco-friendly solutions.

Government Agencies

Fluor's government agencies segment focuses on providing engineering and construction services for various public projects. These include defense infrastructure, transportation systems, and environmental remediation efforts. This segment is characterized by stringent regulatory compliance and often involves long-term contractual agreements. Fluor's government services division leverages specialized expertise to meet the unique needs of these clients. In 2024, Fluor secured several government contracts, including a $1.5 billion project with the U.S. Department of Energy.

- Focus on public sector projects.

- Involves complex regulations.

- Relies on long-term contracts.

- Specialized services for government clients.

Fluor's customer segments span energy, chemicals, mining, infrastructure, and government agencies, each demanding specialized engineering and construction services.

Key clients include energy firms, chemical manufacturers, mining companies, infrastructure developers, and government entities, driving Fluor's diverse revenue streams.

These segments leverage Fluor's expertise for projects, from energy plants to public infrastructure, with significant revenue contributions across these sectors in 2024.

| Customer Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Energy & Chemicals | Oil & gas, renewables, chemical plants | $14.6 billion |

| Mining & Metals | Mining operations, processing plants | $2.1 trillion (market value) |

| Infrastructure | Roads, water systems | $6.5 billion |

Cost Structure

Project-related costs constitute a major part of Fluor's expenses, covering materials, equipment, and labor directly linked to project execution. Efficient cost control is vital for Fluor's profitability, especially considering the fluctuating nature of these expenses. These costs fluctuate based on project size and complexity. In 2023, Fluor's cost of revenue was $14.7 billion.

Engineering and design costs are a substantial part of Fluor's business model. These costs cover salaries for engineers, designers, and software licenses, as well as R&D. In 2023, Fluor's SG&A expenses were approximately $663 million, reflecting these investments. Skilled personnel and advanced tech are crucial for quality engineering services.

Procurement costs are crucial, covering materials, equipment, and services. Fluor's vendor selection, contract negotiation, and supply chain management are key here. Efficient practices cut costs and speed up projects. In 2024, Fluor's cost of revenue was approximately $14.5 billion, reflecting these procurement expenses.

Administrative Overhead

Administrative overhead at Fluor covers costs for managing the company, including salaries, office expenses, and fees for legal and accounting services. Efficiently managing these costs is essential for boosting profitability. These expenses support the entire organization's operations. In 2024, Fluor's selling, general, and administrative expenses were a significant portion of its overall costs.

- Administrative costs include staff salaries, office rent, and legal fees.

- Controlling overhead is vital for improving profitability.

- These costs are essential for supporting the entire company.

- In 2024, this was a crucial cost category for Fluor.

Sales and Marketing Expenses

Sales and marketing expenses are critical for Fluor's business model, encompassing costs to attract new clients and projects. These expenses include advertising, trade shows, and salaries for sales teams, all vital for revenue growth. In 2024, Fluor allocated a significant portion of its budget to these areas to secure new contracts. Effective marketing ensures a consistent flow of new business opportunities.

- Fluor's sales and marketing expenses cover client acquisition and project securing.

- These expenses include advertising, trade shows, and sales team salaries.

- Effective efforts drive revenue growth for the company.

- In 2024, Fluor invested heavily in these areas to get new contracts.

Fluor's cost structure includes project-related expenses like materials and labor, vital for project execution. Engineering and design costs cover salaries and software. Procurement costs involve materials and supply chain management.

Administrative overhead and sales and marketing expenses are essential. Fluor's cost of revenue was approximately $14.5 billion in 2024. Selling, general, and administrative expenses were significant too.

| Cost Category | Description | 2024 Data (approx.) |

|---|---|---|

| Project Costs | Materials, labor for projects. | Fluctuating |

| Engineering & Design | Salaries, software, R&D. | Included in SG&A |

| Procurement | Materials, equipment sourcing. | Part of $14.5B |

Revenue Streams

Fluor's revenue includes fees from engineering and design. Fees depend on the project's scope and complexity. This provides a steady income source. In 2024, Fluor's revenue was approximately $15 billion. Design fees are a key part of this.

Fluor generates revenue through procurement services by sourcing materials, equipment, and services for projects. This includes markups on procured items or fees for managing procurement. In 2024, Fluor's revenue from procurement services was approximately $2.5 billion. Efficient procurement saves project costs and boosts profitability. Procurement services are a key revenue driver.

Fluor's revenue includes fees for construction management, ensuring projects stay on track and within budget. These fees are usually a percentage of the total project cost, representing a key revenue stream. In 2024, Fluor's revenue from Construction & Maintenance was significant. Effective construction management leads to better project outcomes and client satisfaction.

Project Management Fees

Fluor generates revenue via project management fees, covering project planning, execution, and control. These fees vary based on project scope and intricacy. Efficient project management helps clients achieve their goals and maximize value. In 2024, Fluor's revenue was significantly influenced by its project management contracts. These fees are crucial for the company's financial health.

- Revenue from project management is calculated on a project-by-project basis.

- Complexity and size are key factors influencing the fee structure.

- Project management fees ensure project success and client satisfaction.

- Fluor's financial reports detail the contribution of project management fees.

Maintenance and Operations Contracts

Fluor's revenue streams include maintenance and operations contracts, which are crucial for generating consistent income. These contracts focus on the ongoing upkeep and functionality of facilities, ensuring they operate efficiently over time. This approach fosters strong, long-term relationships with clients, providing a reliable source of revenue. The services offered under these contracts help extend the lifespan of assets and optimize their performance.

- Recurring Revenue: Maintenance contracts offer a predictable income stream.

- Client Relationships: Long-term contracts build strong client partnerships.

- Asset Optimization: Services enhance asset lifespan and operational efficiency.

- Market Presence: Fluor's diverse portfolio includes energy, infrastructure, and government projects.

Fluor earns through maintenance and operations contracts, guaranteeing consistent revenue. These contracts emphasize facility upkeep and functionality. This strategy creates long-term client bonds. The services extend asset lifespans.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Maintenance & Operations | Ongoing upkeep and functionality services. | Significant, contributing to consistent income |

| Design & Engineering | Fees from engineering and design services. | $15 billion |

| Procurement | Markup/fees from sourcing materials. | $2.5 billion |

Business Model Canvas Data Sources

Fluor's Business Model Canvas leverages financial reports, market analysis, and competitive intelligence.