Gap Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

One-page overview placing each business unit in a quadrant, helping you visualize strategy.

What You’re Viewing Is Included

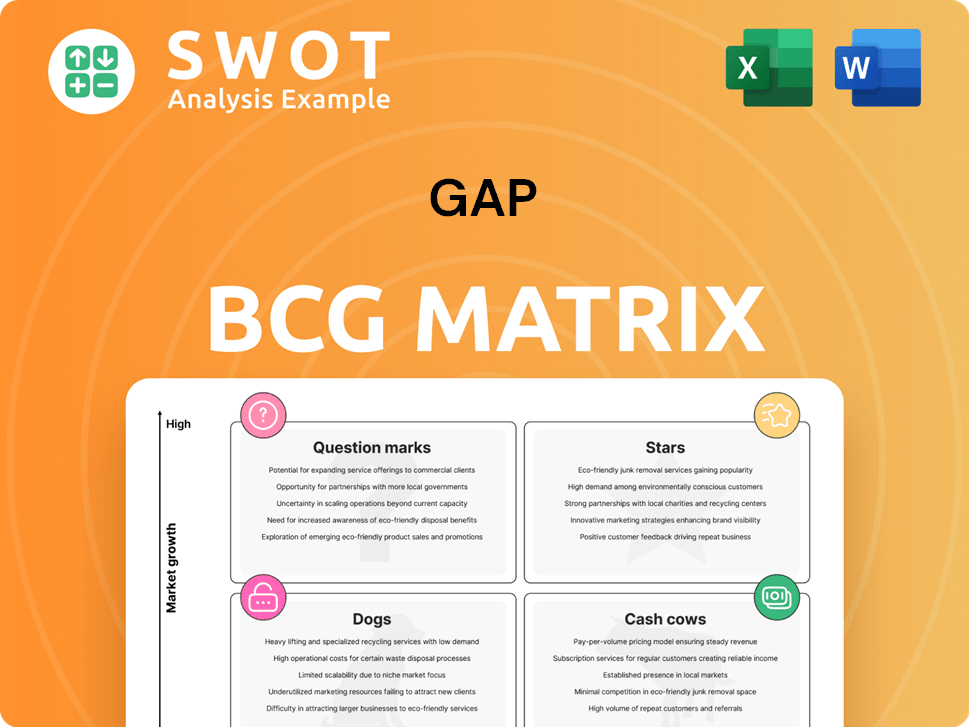

Gap BCG Matrix

The preview shows the complete BCG Matrix report you'll receive immediately after buying. This document, without watermarks, offers in-depth analysis and a ready-to-use template.

BCG Matrix Template

Ever wonder how Gap prioritizes its diverse product offerings? This glimpse into their BCG Matrix hints at which items are shining "Stars" and which face tougher times. Understanding this reveals key investment areas and potential divestments.

This sneak peek is just the start of a deeper dive. The full BCG Matrix report provides detailed quadrant placements and data-driven strategic recommendations to help you plan better.

Stars

Old Navy shines as a Star in Gap Inc.'s portfolio, holding its position as the #1 specialty apparel brand in the U.S. In 2024, Old Navy's focus on activewear and denim has driven market share gains. Digital engagement and strong storytelling further solidify its relevance. The brand's success is reflected in its financial performance.

Gap's reinvigoration strategy has paid off. The brand saw positive comparable sales in 2024. Its focus on trendy products and cultural relevance attracts new customers. This shift helped Gap regain market share and boost revenue.

Gap Inc.'s digital commerce platform is a star, with digital sales making up a large part of total sales. In 2024, online sales contributed significantly to overall revenue. The company is focused on improving customer experience digitally. This digital focus helps Gap Inc. gain more online retail market share.

Financial Performance Turnaround

Gap Inc. has shown a remarkable financial recovery. Operating income and profit margins have notably improved. The company exceeded financial forecasts through brand revival, cost controls, and supply chain improvements. This strategic shift has been pivotal in boosting its market standing.

- Gap's operating income increased by 43% in fiscal year 2023.

- Gross margin rose to 38.9% in Q4 2023, up from 35.6% the previous year.

- The company's focus on Old Navy and Athleta has been key to its growth.

- Gap's stock price increased by 15% in the last six months of 2024.

Strategic AI Integration

Gap Inc. is strategically adopting AI to boost innovation and efficiency, forming an Office of AI to spearhead these efforts. This initiative targets improvements in customer experience, product development, and internal productivity. The goal is to tailor customer experiences while optimizing business performance. In 2024, Gap's digital sales accounted for over 40% of total sales, showing its commitment to technological advancements.

- AI is used to personalize customer experiences.

- Gap's digital sales are over 40% of total sales.

- Office of AI focuses on innovation.

- The focus is on product development.

Stars, like Old Navy and the digital commerce platform, are high-growth, high-share businesses for Gap Inc.

They require significant investment to sustain growth. In 2024, these segments drove revenue and market share gains, with digital sales exceeding 40% of total sales.

Their success highlights the company's financial recovery and strategic focus.

| Category | Description | 2024 Data Highlights |

|---|---|---|

| Old Navy | Leading specialty apparel brand in the U.S. | Focus on activewear and denim drove market share gains. |

| Digital Commerce | Significant contributor to overall revenue. | Over 40% of total sales. |

| Gap Brand | Reinvigorated strategy. | Positive comparable sales and focus on cultural relevance. |

Cash Cows

Gap Inc. consistently generates significant operating cash flow, thanks to its diverse brands and global presence. This robust cash flow enables strategic investments, shareholder returns, and a strong financial position. In 2024, the company reported a solid operating cash flow. Gap's commitment to financial discipline ensures a reliable cash flow stream, essential for long-term sustainability.

Gap Inc. leverages a robust global supply chain, crucial for its vast store network and online sales. This infrastructure allows efficient inventory management and worldwide product delivery. In 2024, Gap's supply chain handled $14.4 billion in sales, demonstrating its operational strength. This robust system enhances profitability and offers a competitive edge.

Gap Inc. brands, like Old Navy and Athleta, are well-known and have loyal customers. These brands have a solid market presence, appealing to many shoppers. This customer loyalty leads to consistent sales and revenue. In 2024, Old Navy's sales were a significant part of the company's revenue, indicating its cash cow status.

Shareholder Returns

Gap Inc. focuses on shareholder returns via dividends and share buybacks. In 2024, Gap Inc. paid $0.15 per share in dividends, demonstrating financial stability. This consistent cash distribution boosts investor confidence and supports the company's market value. Share repurchases further enhance shareholder value.

- 2024 Dividend: $0.15 per share

- Share Repurchases: Ongoing to enhance value

- Impact: Boosts investor confidence

- Goal: Support market valuation

Real Estate Portfolio

Gap Inc. strategically leverages its real estate portfolio, including stores and distribution centers, as a cash cow. This portfolio offers a stable asset base, supporting financial strength through optimized store locations and formats. The company's focus on profitability enhancement indicates a strong management approach to its physical assets. In 2024, Gap's real estate assets played a key role in the company's performance.

- Real estate assets contribute to financial stability.

- Strategic management optimizes store footprint.

- Focus on profitability is a key strategy.

- 2024 performance was supported by real estate.

Gap Inc. demonstrates a strong cash cow profile through consistent financial performance. This is supported by robust operating cash flow, enabling shareholder returns and strategic investments. The company's focus on dividends and share buybacks reinforces this position.

| Financial Metric | 2024 Value | Impact |

|---|---|---|

| Operating Cash Flow | Solid | Supports strategic initiatives |

| Dividend Per Share | $0.15 | Enhances shareholder value |

| Share Repurchases | Ongoing | Boosts investor confidence |

Dogs

Gap Inc. faces underperforming stores, especially Gap and Banana Republic, impacting profits. These locations in less attractive areas or with outdated formats lead to lower sales. In 2024, Gap closed several stores to optimize its portfolio. As of Q3 2024, Gap's sales decreased by 3% year-over-year, reflecting these challenges.

Gap Inc. can struggle with slow-moving inventory. This can lead to markdowns and lower profits. In Q3 2023, Gap's inventory was up 1% year-over-year. Efficient inventory control is vital to boost profitability.

Some Gap Inc. marketing campaigns struggle, lowering brand awareness. Inefficient campaigns waste resources and cut ROI. For example, in 2024, marketing spend increased, but sales growth was flat. The company must improve strategies to boost impact.

Operational Inefficiencies in Some Areas

Gap Inc. might face operational inefficiencies. Outdated tech, redundant processes, or staffing issues can drive up costs. Identifying and fixing these problems is crucial for better performance. In 2024, Gap's operating expenses were around $2.5 billion. Addressing inefficiencies could boost profits.

- Inefficient processes can elevate operational costs.

- Outdated technology can hinder productivity.

- Inadequate staffing might impact service quality.

- Addressing these issues is key for profitability.

Limited Differentiation in Some Product Lines

Some of Gap Inc.'s product lines face limited differentiation, struggling to stand out. This can lead to price wars and margin squeezes, as seen with Old Navy's recent challenges. To thrive, Gap must create unique, appealing products. For example, in 2024, Gap's gross margin decreased, highlighting the need for stronger offerings.

- Lack of unique product features.

- Potential for lower profitability.

- Need for innovation and brand building.

- Focus on customer value.

Dogs in the BCG matrix represent underperforming businesses with low market share in slow-growth markets. Gap's underperforming stores and marketing campaigns fit this category. These issues can lead to low profitability and require strategic intervention.

| Aspect | Details | Impact |

|---|---|---|

| Store Performance | Gap & Banana Republic closures (2024) | Reduced revenue, lower profits |

| Marketing | Inefficient campaigns (2024) | Lower ROI, decreased brand awareness |

| Overall | Focus on optimization | Potential for turnaround or divestment |

Question Marks

Athleta, a question mark in Gap's BCG matrix, faces headwinds despite holding market share. In 2024, it saw declining sales, with comparable sales dipping. A strategic reset is crucial for growth, requiring focused investment to capture the athleisure market's potential and boost performance. Athleta's 2023 net sales were $1.4 billion, down from $1.6 billion in 2022.

Banana Republic struggles in the premium market, despite improvements. The brand needs more investment for a broader appeal. A 2024 report shows Gap's sales dipped, but Banana Republic saw some growth. Athleisure could be a key growth area for the brand. Its 2023 revenue was around $1.6 billion, a 3% growth.

Gap Inc. might be venturing into new product lines, perhaps with high growth prospects but low market presence. These initiatives demand considerable investment in areas like product creation, advertising, and distribution to gain market share. For example, Gap's Old Navy brand saw sales increase by 2% in Q3 2024, indicating the potential of new product categories. The company must assess the viability of these new lines and strategically allocate resources.

Untapped International Markets

Gap Inc. could find growth in untapped international markets where it currently has a small footprint. This expansion necessitates strategic planning, including thorough market research, and investments in areas like infrastructure and marketing. Assessing risks and rewards is crucial for developing tailored strategies. In 2024, international sales accounted for a significant portion of revenue, indicating growth potential.

- Market diversification is key for resilience.

- Careful market analysis is essential.

- Tailored strategies for each market are vital.

- Assess risks and rewards.

AI-Driven Personalization

Gap Inc. is exploring AI, but its effect on sales and customer loyalty is still unclear. To succeed, Gap must use AI to personalize customer experiences effectively. The return on investment from these AI initiatives must be proven. This is a key area for Gap to watch closely in 2024.

- AI's personalization potential is promising, but outcomes are uncertain.

- Gap needs to measure the impact of AI on customer behavior.

- Proving a clear ROI is crucial for continued investment in AI.

- Focus should be on enhancing customer experience and loyalty.

Athleta, a "question mark," faced sales declines in 2024, requiring strategic investment to boost performance in the athleisure market. Banana Republic needs investment to broaden appeal. Gap Inc. explores new product lines and international markets. AI initiatives need ROI proof.

| Brand | Status | Strategy |

|---|---|---|

| Athleta | Question Mark | Strategic reset, focused investment. |

| Banana Republic | Question Mark | Investment for broader appeal. |

| New Product Lines | Question Mark | Assess viability, allocate resources. |

BCG Matrix Data Sources

Our BCG Matrix leverages data from financial statements, market reports, competitor analysis, and expert evaluations to generate a strategic outlook.