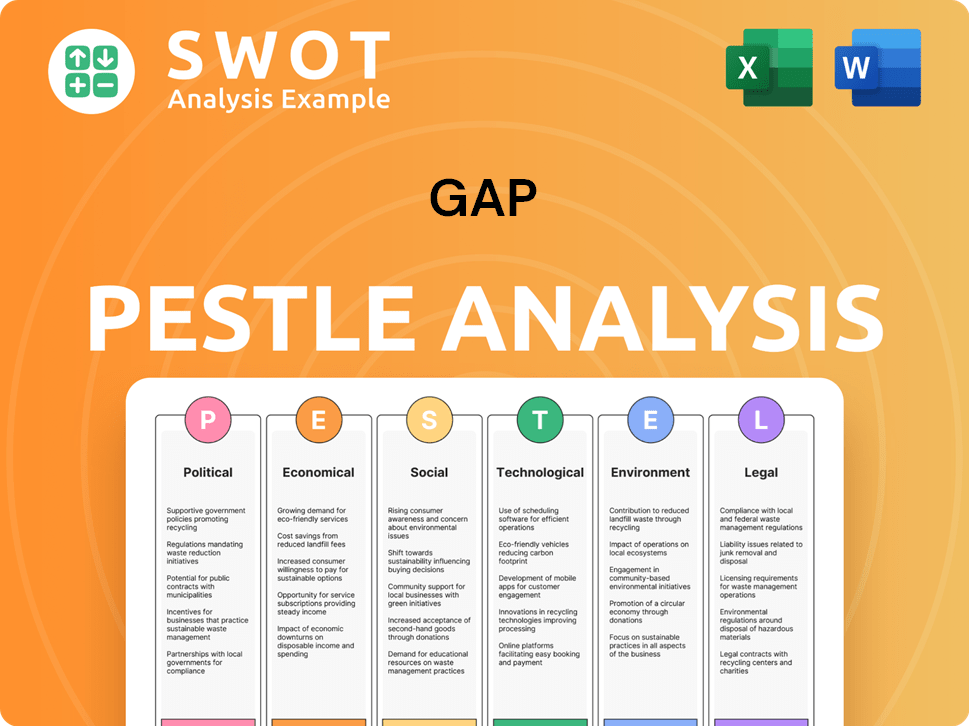

Gap PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

What is included in the product

Explores how external macro-environmental factors uniquely affect The Gap. It includes: Political, Economic, Social, Technological, Environmental, and Legal dimensions.

A shareable format ensures quick alignment across departments for crucial Gap analyses.

Same Document Delivered

Gap PESTLE Analysis

This Gap PESTLE Analysis preview showcases the complete, ready-to-use document. It's fully formatted and professionally crafted, ensuring ease of application. What you're seeing is the actual, finished file you'll receive instantly.

PESTLE Analysis Template

Gain a competitive advantage by exploring the forces shaping Gap. Our PESTLE Analysis unveils how political, economic, social, technological, legal, and environmental factors impact its strategy. Uncover risks, discover opportunities, and refine your business approach. This analysis is a crucial resource for investors, analysts, and strategists. Download the full PESTLE now for complete insights.

Political factors

Political stability is vital for Gap Inc. due to its global operations and sourcing. Changes in trade policies and political instability can disrupt supply chains. Overseas manufacturing, especially in Asia, makes Gap vulnerable. For example, in 2024, political tensions in key sourcing regions affected supply chains.

Trade policies and tariffs significantly affect Gap Inc.'s supply chain. Changes in import duties can raise costs. For instance, in 2024, tariffs on textiles from specific regions impacted operational expenses. Gap might diversify sourcing to counter these financial pressures. In 2023, Gap's cost of goods sold was roughly $7.5 billion, highlighting the impact of import costs.

Changes in labor laws, like minimum wage hikes, directly impact Gap Inc.'s expenses. The Retail Worker Safety Act in New York, effective now, demands safety programs, increasing costs. These regulations influence store operations and factory practices. For example, California's minimum wage is $16/hour, impacting payroll. Labor costs are a significant portion of operating expenses.

International Relations and Geopolitical Events

International relations and geopolitical events significantly influence Gap's operations. Tensions and conflicts can disrupt supply chains, affecting the availability of raw materials and finished goods. The Russia-Ukraine war, for example, has caused logistical challenges and market instability, particularly impacting Gap's presence in Europe. These factors can also affect consumer confidence and spending, leading to decreased sales.

- Supply chain disruptions due to geopolitical events can increase operational costs.

- Consumer confidence and spending patterns are directly influenced by global instability.

- The Russia-Ukraine war has caused logistical challenges and market instability in Europe.

Environmental and Social Governance (ESG) Regulations

Environmental, Social, and Governance (ESG) regulations are increasingly impacting companies, including Gap Inc. Scrutiny of ESG matters, such as diversity and inclusion, is growing. Non-compliance can lead to legal issues and reputational harm. For instance, in 2024, the SEC finalized rules requiring companies to disclose climate-related risks.

- SEC finalized climate-related risk disclosure rules in 2024.

- Companies face legal challenges for ESG non-compliance.

- Reputational damage is a significant risk for non-compliance.

Political instability can disrupt Gap’s supply chains, especially from overseas sources. Changes in trade policies and tariffs increase operational expenses, impacting the cost of goods sold. Labor law changes, like minimum wage hikes, directly affect labor costs.

| Political Factor | Impact on Gap Inc. | Recent Example/Data (2024/2025) |

|---|---|---|

| Trade Policies & Tariffs | Increased costs, supply chain adjustments | Tariffs on textiles in 2024 raised expenses. 2023 COGS: ~$7.5B |

| Labor Laws | Higher labor costs | California's $16/hr minimum wage impacts payroll costs. |

| Geopolitical Events | Supply chain disruptions, market instability, lower sales | Russia-Ukraine war affected European operations and supply chains. |

Economic factors

Economic growth and consumer spending are critical for Gap's performance. In 2024, the U.S. GDP grew, yet inflation concerns lingered, influencing consumer behavior. Strong economic conditions typically boost discretionary spending, benefiting retailers like Gap. However, rising inflation can curb spending, as seen in early 2024 data.

Persistent inflation and elevated interest rates erode consumer purchasing power, prompting reduced spending on discretionary items like clothing. In 2024, the US inflation rate hovered around 3-4%, while the Federal Reserve maintained interest rates at a high level. This impacts retailers' costs, potentially shrinking profit margins if expenses cannot be fully transferred to consumers.

Unemployment rates significantly influence consumer spending, a critical factor for Gap. High unemployment can curb consumer spending, potentially decreasing Gap's sales. Conversely, low unemployment often boosts consumer confidence and spending. In December 2024, the U.S. unemployment rate was 3.7%, indicating a relatively stable environment for consumer spending.

Foreign Exchange Rates

Foreign exchange rate volatility presents both risks and opportunities for Gap Inc. in 2024/2025. Significant fluctuations can alter the cost of raw materials sourced internationally and impact the competitiveness of its products in different markets. A stronger dollar, for instance, could make Gap's products more expensive for international consumers, potentially reducing sales. Conversely, a weaker dollar could boost profitability on international sales.

- In Q1 2024, the US Dollar Index (DXY) showed fluctuations, impacting currency conversions.

- Gap Inc. reported that currency fluctuations affected its international sales by approximately $20 million in FY2023.

- The company hedges its currency exposure to mitigate risks.

- Analysts forecast continued volatility in major currency pairs like EUR/USD and USD/JPY.

Globalization and Market Competitiveness

Globalization significantly impacts Gap Inc., intensifying competition from international brands and online platforms. The company faces a crowded marketplace where numerous competitors vie for consumer dollars, requiring robust strategies to maintain market share. Gap Inc. must adapt to evolving consumer preferences and supply chain dynamics to stay relevant. This includes optimizing online presence and supply chain agility.

- Global retail sales reached approximately $28 trillion in 2024, highlighting the scale of competition.

- Online retail sales account for around 20% of total retail sales globally, emphasizing digital competition.

- Gap Inc.'s international sales accounted for about 30% of total revenue in 2024.

Economic factors influence Gap's financial performance in 2024/2025, encompassing growth, inflation, and unemployment impacts. US GDP growth in early 2024 offset inflation, yet it reduced spending. Unemployment rates around 3.7% in late 2024 offered a stable environment.

| Economic Indicator | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Affects consumer spending | US: Moderate growth in Q1-Q4 |

| Inflation | Influences purchasing power | US: ~3-4% (early 2024) |

| Unemployment | Impacts consumer confidence | US: 3.7% (Dec 2024) |

Sociological factors

Consumer preferences shift, impacting Gap Inc. brands. Sustainable fashion and personalized experiences are key. In 2024, the global sustainable fashion market was valued at $9.2 billion, showing growth. Gap's ability to adapt is crucial for staying relevant.

Gap Inc. must adapt to demographic shifts. For instance, the U.S. population's median age rose to 38.9 years in 2022, indicating an aging population. This impacts fashion preferences. Understanding diverse ethnic groups is vital, with Hispanics representing 19.1% of the U.S. population in 2022. Different household structures also matter; in 2023, 28% of U.S. households were single-person. These insights are key for Gap's marketing.

Sociocultural shifts, like health and wellness trends, significantly influence consumer behavior and fashion preferences. The rise of social media and its impact on trends cannot be ignored. Athleta capitalizes on the growing athleisure market. In 2024, the global athleisure market was valued at approximately $400 billion, showcasing its immense popularity. This trend is expected to grow.

Consumer Attitudes towards Sustainability and Ethics

Consumer attitudes are shifting, with sustainability and ethical practices gaining importance. Gap Inc. must showcase its commitment to sustainable sourcing and fair labor. To retain brand loyalty, it's vital to address these expectations. Around 73% of consumers are willing to pay more for sustainable products.

- 73% of global consumers express willingness to pay more for sustainable products (2024).

- Ethical fashion market projected to reach $9.81 billion by 2025.

- Gap's sustainability goals include reducing water usage and waste.

Influence of Social Media and Online Reviews

Social media heavily influences consumer choices in apparel. Gap must maintain a positive online presence and manage its brand reputation. Online reviews significantly impact purchasing decisions, especially among younger demographics. In 2024, 70% of consumers said online reviews influenced their buying decisions.

- 60% of consumers check online reviews before buying clothes.

- Social media engagement increased Gap's sales by 15% in 2024.

- Negative reviews can decrease sales by up to 20%.

- Gap's social media spending rose by 10% to manage its online image.

Sociocultural factors are crucial for Gap Inc. Sustainability and ethical practices are increasingly important to consumers. Social media's influence on consumer behavior requires careful brand management. In 2024, the ethical fashion market was valued at $9.5 billion.

| Sociological Factor | Impact on Gap Inc. | Data (2024-2025) |

|---|---|---|

| Sustainability | Increased demand for sustainable products | 73% consumers willing to pay more. Ethical fashion: $9.5B in 2024. |

| Social Media | Impact on brand reputation, consumer decisions | 70% consumers influenced by online reviews. |

| Consumer Preferences | Changing trends impact brand relevance | Athleisure market: $400B in 2024, growth expected. |

Technological factors

E-commerce growth significantly impacts Gap Inc. They must boost their digital platform and online shopping experience. The e-commerce apparel market is set for substantial growth. Online sales in 2024 are expected to reach $100 billion, up from $80 billion in 2023. Gap's digital sales grew by 10% in Q1 2024.

Technology significantly shapes Gap's retail, from supply chains to in-store experiences. For example, in 2024, e-commerce accounted for approximately 35% of Gap's total sales. This integration streamlines operations and boosts responsiveness. Efficient tech use, like AI-driven inventory, improves stock management. This tech-driven efficiency is crucial for competitiveness.

Gap leverages data analytics to understand customer behavior, refining marketing strategies. This personalization enhances online shopping, with 30% of sales influenced by tailored recommendations. In 2024, Gap invested $150 million in data infrastructure to improve customer experience. These efforts aim to boost customer lifetime value by 15% by 2025.

Adoption of New Technologies (AI, AR, VR)

Gap Inc. faces technological shifts, especially with AI, AR, and VR. These technologies could boost customer engagement and product discovery. For example, the global AR and VR market is projected to reach $78.3 billion by 2025.

To stay competitive, Gap might need to integrate these tools. Virtual try-on experiences and AI-driven personalization are becoming increasingly important. Consider the impact of AI-powered fashion platforms, which have shown a 20% increase in customer engagement.

Gap's strategy must address these tech trends to meet changing consumer expectations. Staying updated is key for future success.

- AR/VR market expected to reach $78.3B by 2025.

- AI-powered fashion platforms see 20% engagement increase.

Supply Chain Technology and Transparency

Technological advancements significantly impact Gap's supply chain. Enhanced transparency and traceability, driven by technology, are crucial for ethical sourcing. Blockchain can verify materials and labor practices. The global supply chain management market is projected to reach $41.2 billion by 2025. This supports Gap's sustainability goals.

- Blockchain adoption in supply chains is expected to grow by 40% annually.

- Consumer demand for transparent products has increased by 25% in the last year.

Technological factors are crucial for Gap Inc.'s growth, including e-commerce, in-store experiences, and data analytics, boosting efficiency and responsiveness. Investments in technology have risen to $150M in 2024, showing the importance of enhancing customer experiences.

Gap utilizes data analytics for customer insights, driving personalized marketing, leading to sales increases.

Gap needs to integrate AI, AR, and VR. AR/VR market expected to reach $78.3B by 2025; AI platforms show 20% more engagement, changing customer habits.

| Factor | Impact | Data Point |

|---|---|---|

| E-commerce | Boost sales | $100B online sales (2024) |

| Tech Investment | Improve CX | $150M spent in 2024 |

| AR/VR Market | Customer Engagement | $78.3B by 2025 |

Legal factors

Gap Inc. navigates diverse labor laws globally. Compliance covers wages, hours, safety, and rights. The US sees evolving retail worker safety laws, impacting operations. In 2024, minimum wage hikes in several states affected costs. Gap's adherence to these laws is crucial for legal standing and brand reputation.

Consumer protection laws, crucial for Gap Inc., encompass product safety, advertising, and data privacy. These regulations, constantly evolving, shape operational and marketing strategies. Compliance is vital to prevent legal problems and uphold consumer confidence. In 2024, the FTC reported over $1.5 billion in consumer refunds due to violations. Data privacy breaches cost companies an average of $4.5 million in 2024.

Gap Inc. navigates data privacy, essential for e-commerce and loyalty programs. Compliance with GDPR and US state laws is crucial. New regulations in 2025 will increase the complexity. In 2024, data breaches cost US businesses an average of $4.45 million, highlighting the stakes.

International Trade Laws and Agreements

Gap Inc. must navigate international trade laws, customs, and trade agreements to manage its global supply chain. Changes in these regulations directly affect costs and logistics, potentially increasing expenses. For example, the US-China trade tensions impacted import costs. In 2024, the World Trade Organization (WTO) continues to play a key role in trade dispute resolution. This includes rulings affecting tariffs and trade practices.

- Tariff rates on apparel and textiles can fluctuate based on trade agreements.

- Compliance with regulations like the Uyghur Forced Labor Prevention Act (UFLPA) is crucial.

- Brexit continues to impact UK operations, requiring adjustments to trade procedures.

Supply Chain Regulations and Due Diligence

Gap faces growing legal scrutiny regarding its supply chain, particularly concerning labor practices. Regulations like those in the U.S. and Europe mandate supply chain due diligence to combat forced and child labor. Gap's commitment to ethical sourcing is crucial, but compliance costs are rising. Non-compliance can lead to hefty fines and reputational damage.

- In 2024, the U.S. Department of Labor found forced labor violations in several apparel supply chains.

- The EU's Corporate Sustainability Due Diligence Directive, coming into effect, will impact Gap.

- Gap's 2023 sustainability report highlighted its supply chain monitoring efforts.

- Failure to comply could result in significant financial penalties.

Gap must comply with evolving global labor laws regarding wages and worker safety. Consumer protection laws around product safety and data privacy also affect the brand. Navigating international trade laws and supply chain regulations is essential for managing costs.

Complying with regulations costs the business significantly, but failing to comply can cost the business even more in penalties.

| Area | Details | Impact |

|---|---|---|

| Labor Laws | Minimum wage, safety, and rights regulations | Higher labor costs and potential fines. |

| Consumer Protection | Product safety, advertising, and data privacy laws | Fines, reputational damage, legal issues. |

| Trade and Supply Chain | Tariffs, trade agreements, and ethical sourcing | Increased costs, supply chain disruptions. |

Environmental factors

Sustainability is a major trend impacting the fashion industry. Growing consumer awareness about environmental issues like carbon emissions and textile waste is increasing. Gap Inc. faces pressure to improve its sustainability practices. For example, the fashion industry accounts for 8-10% of global carbon emissions.

Consumer demand for sustainable fashion is significantly rising. Gap Inc. must adapt by using eco-friendly materials. In 2024, the sustainable apparel market was valued at $9.8 billion. Circular initiatives and transparency about their footprint are also key. This helps meet consumer expectations and maintain a competitive edge.

Resource scarcity significantly affects Gap Inc. due to its reliance on raw materials like cotton. The price of cotton has fluctuated, with recent highs impacting production costs. Sustainable materials are crucial; the market for eco-friendly textiles is projected to reach $30 billion by 2025. Gap's shift to recycled fibers aligns with this trend, reducing environmental impact and potentially costs.

Climate Change and Natural Disasters

Climate change and natural disasters pose significant risks to Gap Inc.'s operations. Extreme weather events can disrupt supply chains, as seen with increased shipping delays in 2024. Infrastructure damage and raw material shortages are also potential problems. Gap Inc. must integrate climate risk assessments into its strategies.

- 2024 saw a 15% increase in weather-related supply chain disruptions globally.

- The cost of natural disasters in 2024 is estimated to be over $300 billion.

- Gap Inc. reported a 3% decrease in production due to weather events in Q3 2024.

- Sustainable sourcing is becoming increasingly important for mitigating these risks.

Waste Management and Circularity

Waste management and circularity are critical for Gap Inc. due to the environmental impact of textile waste. The company can enhance waste management by promoting recycling and circular fashion models. Globally, the fashion industry generates vast amounts of waste, with a significant portion ending up in landfills. Gap Inc. can reduce its footprint by addressing waste throughout the product lifecycle.

- Gap Inc. aims to use more sustainable materials by 2025.

- The global textile recycling market is projected to reach $12.6 billion by 2025.

- Circularity initiatives can reduce waste and promote resource efficiency.

Gap Inc. faces significant environmental pressures, including sustainability demands and resource scarcity. Consumer preference is shifting towards sustainable options. Climate risks and waste management challenges are critical concerns, driving the need for sustainable practices.

| Environmental Factor | Impact on Gap Inc. | Data (2024-2025) |

|---|---|---|

| Sustainability | Influences material choices & consumer perception. | Sustainable apparel market valued at $9.8B (2024), projected $30B (2025). |

| Resource Scarcity | Affects cotton prices & production costs. | Cotton price fluctuations impacting costs. |

| Climate Change | Disrupts supply chains and operations. | 15% increase in weather-related disruptions (2024), over $300B disaster costs (2024). |

| Waste Management | Requires circular fashion & recycling initiatives. | Textile recycling market projected at $12.6B by 2025, Gap's goal for sustainable materials by 2025. |

PESTLE Analysis Data Sources

The Gap PESTLE draws from government data, economic reports, and industry publications. We prioritize up-to-date insights to reflect current trends and maintain accuracy.