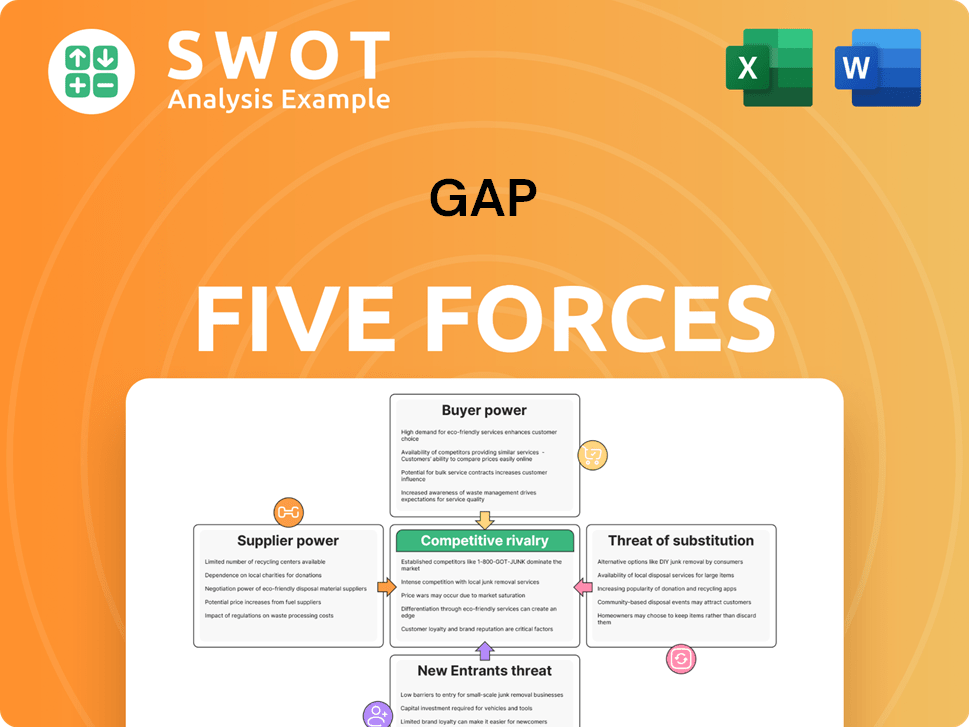

Gap Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gap Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview Before You Purchase

Gap Porter's Five Forces Analysis

This is the full Gap Porter's Five Forces analysis. You're viewing the complete document, professionally written and ready. Once purchased, you'll download the *exact* analysis you see now—no changes. Enjoy immediate access to this fully formatted file. It's ready for your review.

Porter's Five Forces Analysis Template

Gap's Porter's Five Forces analysis assesses its competitive landscape. Bargaining power of suppliers and buyers influence profitability. The threat of new entrants and substitutes impacts market share. Competitive rivalry shapes Gap's strategic positioning. Understanding these forces is crucial for Gap's success.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Gap.

Suppliers Bargaining Power

Gap Inc. encounters moderate supplier power, benefiting from a broad supplier network globally. This distribution helps to prevent dependence on individual suppliers, lessening the impact of disruptions and price hikes. In 2024, Gap's cost of goods sold (COGS) was $7.7 billion, reflecting supplier negotiations. Specialized material suppliers may have increased influence.

Gap Inc. benefits from global sourcing, enhancing supplier negotiations. Their vast supply chain offers sourcing flexibility, enabling supplier switches. This bolsters their position, especially for commoditized goods.

Supplier power, a key factor in Gap's Five Forces analysis, hinges on concentration. In 2024, the apparel industry saw varied supplier leverage; some, like those supplying specialty fabrics, have more power. Gap must strategically manage supplier relations. Gap Inc. reported a gross margin of 44.5% in Q1 2024.

Supplier Power 4

Gap's supplier power is shaped by ethical and sustainability standards. Their focus on ethical labor and sustainable materials narrows the supplier base. Suppliers meeting these standards may have more pricing power. In 2024, Gap aims to increase the use of sustainable materials. This impacts sourcing and supplier negotiations.

- Ethical sourcing influences supplier selection.

- Commitment to ethical labor practices narrows supplier options.

- Sustainable materials affect supplier pricing and terms.

- Gap's 2024 goals emphasize sustainable sourcing.

Supplier Power 5

Supplier power assesses how easily suppliers can drive up prices. Strong relationships, like those with Apple's display suppliers, offer stability but create dependencies. Collaborative ties can lead to benefits, such as better pricing and innovation access. However, this can also leave a company vulnerable if a supplier faces issues. In 2024, supply chain disruptions caused a 10% increase in costs for many businesses.

- Long-term relationships offer stability.

- Strong relationships can lead to mutual benefits.

- This also creates some level of dependence.

- Supply chain disruptions impact costs.

Gap Inc. manages supplier power through global sourcing and a diverse network, mitigating risks. The apparel industry saw varied supplier leverage in 2024, impacting Gap. Ethical and sustainability standards influence supplier selection, impacting negotiations. Supply chain issues caused cost increases in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Network | Reduces dependence, controls costs | COGS $7.7B |

| Ethical Sourcing | Narrows options, affects pricing | Emphasis on sustainable materials |

| Supply Chain Disruptions | Increase in costs | 10% cost increase for many businesses |

Customers Bargaining Power

Buyer power at Gap Inc. is high, mainly because switching costs are low for customers. Shoppers can easily choose between Gap's brands and competitors, like H&M or Zara, influencing pricing. This power requires Gap to focus on customer loyalty. In 2024, Gap's loyalty program saw a 10% increase in member spending, showing the importance of this strategy.

Buyer power at Gap Inc. hinges on price sensitivity, varying across its brands. Old Navy's customers are highly price-conscious, unlike those at Banana Republic or Athleta. In 2024, Old Navy's sales saw fluctuations influenced by promotional activities. Gap Inc. must adjust pricing to resonate with each segment.

E-commerce significantly boosts buyer power. Online platforms give customers access to more information and choices, strengthening their position. Gap Inc. must ensure its online shopping experience is smooth and competitive to keep customers. In 2024, online sales made up a significant portion of total retail sales, emphasizing the importance of a strong digital presence. This gives buyers more control.

Buyer Power 4

Buyer power assesses customer influence on pricing and terms. Brand loyalty significantly affects buyer behavior; strong loyalty reduces price sensitivity. For example, Athleta's loyal customer base supports premium pricing. Building brand equity and enhancing customer engagement are key. This strategy lessens buyer power's impact.

- Athleta saw a 10% increase in sales in 2024, due to strong brand loyalty.

- Customer retention rates for brands with high loyalty average 75%.

- Investment in brand building increased by 15% across the apparel industry in 2024.

- Price sensitivity is reduced by up to 20% for highly loyal customers.

Buyer Power 5

Customers wield considerable power, especially with the rise of social media and online reviews. These platforms heavily influence purchasing decisions, creating a dynamic where consumer feedback shapes brand perception. Gap Inc. must actively monitor and respond to customer feedback to maintain a positive brand image. A negative review can significantly impact sales.

- In 2024, over 80% of consumers research products online before buying.

- Negative online reviews can decrease sales by up to 22%.

- Social media engagement directly affects brand loyalty and purchase intent.

Customer power at Gap is strong, amplified by low switching costs and online access. Pricing sensitivity varies; Old Navy customers are more price-driven. Strong brand loyalty, especially at Athleta, reduces buyer power, supporting premium pricing.

| Metric | Data |

|---|---|

| Online Research Before Purchase (2024) | 80% |

| Athleta Sales Increase (2024) | 10% |

| Loyal Customer Retention Rate | 75% |

Rivalry Among Competitors

Competitive rivalry within the apparel industry is fierce, with many retailers battling for consumer dollars. Gap Inc. contends with fast-fashion giants, department stores, and online platforms. In 2024, the apparel market demonstrated its competitiveness, with significant shifts in market share among the top players.

Competitive rivalry at Gap Inc. involves price wars and promotions. Intense competition pressures profit margins, as seen in 2024 with fluctuating apparel prices. Gap Inc. faces the challenge of balancing pricing to preserve brand value amid rivals. For example, their gross margin was 38.7% in Q3 2024, reflecting this pressure.

Competitive rivalry within the apparel industry is intense. Gap Inc. must differentiate to compete effectively. This involves unique designs and enhanced customer experiences. The company's focus on value propositions is also crucial. In 2024, the global apparel market reached approximately $1.7 trillion.

Competitive Rivalry 4

Competitive rivalry in the apparel industry, including Gap Inc., is fierce. E-commerce significantly intensifies this rivalry by broadening market reach. Gap Inc. faces increased competition from online retailers, demanding robust online investments. In 2024, Gap's online sales grew, showing the importance of digital strategy.

- E-commerce growth fuels competition among apparel brands.

- Gap Inc. must enhance its digital presence to maintain competitiveness.

- Online sales are a key performance indicator for the company.

Competitive Rivalry 5

The retail industry is highly competitive, with Gap Inc. facing significant rivalry. Consolidation continues, with larger companies absorbing smaller ones. This intensifies competitive pressure and impacts Gap's market position. Increased scale offers advantages, but also heightens the stakes.

- In 2024, the retail market saw significant M&A activity, with deals totaling billions.

- Amazon and Walmart continue to dominate market share, increasing pressure on specialty retailers.

- Gap Inc.'s sales in 2024 reflect the ongoing challenges of this competitive environment.

- Competitive strategies include product innovation, and supply chain optimization.

Competitive rivalry significantly shapes Gap Inc.'s market position, especially within the apparel sector. In 2024, the apparel market's competitive dynamics intensified with e-commerce growth and consolidation.

Gap Inc. confronts these challenges through strategic differentiation, including product innovation and digital enhancements. Market data highlights this fierce competition, with changing consumer preferences and retailer strategies impacting performance.

The company's ability to navigate this rivalry hinges on its brand value and digital strategy effectiveness, as evidenced by its financial results in a challenging retail climate.

| Metric | 2024 Data | Impact |

|---|---|---|

| Global Apparel Market Size | $1.7 Trillion | High Competition |

| Gap Inc. Gross Margin (Q3 2024) | 38.7% | Pricing Pressure |

| E-commerce Growth Rate | Significant | Increased Rivalry |

SSubstitutes Threaten

The threat of substitutes for Gap Inc. is notably high. Consumers have numerous apparel choices, intensifying competition. In 2024, the fast-fashion market was valued at over $35 billion, highlighting the availability of alternatives. This includes options like thrift stores and direct-to-consumer brands, impacting Gap's market share.

Changing consumer preferences are a significant threat, especially in fashion. Consumers increasingly favor sustainable and ethical brands. These shifts can lead to substitution away from traditional apparel like Gap. In 2024, the sustainable fashion market is projected to reach $9.81 billion. Gap must adapt to these trends or risk losing market share.

Rental and subscription services pose a significant threat to Gap Inc. as they offer alternatives to buying clothes. The apparel rental market is growing; in 2024, it's estimated to reach $2.8 billion globally. Gap Inc. should consider these models to stay competitive. This includes exploring partnerships or launching its own subscription options to offset potential losses from substitution.

Threat of Substitution 4

The threat of substitutes for Gap Inc. is growing due to shifts in consumer behavior. DIY and upcycling trends are gaining traction, with consumers making their own clothes or repurposing existing ones. This reduces demand for new apparel from traditional retailers. Gap Inc. might consider collaborations or programs to address this shift.

- DIY fashion and upcycling are gaining popularity among consumers, potentially impacting Gap Inc.'s sales.

- In 2024, online searches for "upcycling" increased by 20%, indicating growing interest.

- Gap Inc. could explore partnerships with DIY platforms or offer upcycling workshops to adapt.

- Developing sustainable and adaptable products can help counter the threat.

Threat of Substitution 5

The threat of substitutes for Gap Inc. is significant. Limited brand loyalty makes substitution easier. Customers often switch to alternatives. Gap must build loyalty through unique offerings and engaging customers.

- Competitors like H&M and Zara offer similar products at competitive prices, increasing the substitution threat.

- In 2024, Gap's net sales were $14.4 billion, reflecting the impact of competition and substitution.

- To combat this, Gap is investing in its online presence and loyalty programs.

- Gap's ability to innovate and offer distinctive products is crucial for reducing the substitution threat.

The threat of substitutes significantly impacts Gap Inc. due to abundant apparel choices. Consumers easily switch to competitors like H&M and Zara. In 2024, fast-fashion sales reached $35 billion, highlighting the ease of substitution. Gap needs strong branding and unique offerings to counter this threat.

| Substitute Type | Impact | 2024 Data |

|---|---|---|

| Fast Fashion | High Competition | $35B market |

| Rental Services | Reduced Purchases | $2.8B market |

| DIY & Upcycling | Lower Demand | 20% search increase |

Entrants Threaten

The threat of new entrants to Gap is moderate. High capital needs and brand recognition create barriers. New apparel retail entrants face hurdles, but online retail eases entry. In 2024, Gap's market share was around 2%, indicating some vulnerability.

E-commerce significantly lowers barriers to entry in the apparel industry, increasing competition for Gap Inc. The rise of online platforms allows new retailers to reach a global customer base without substantial upfront investment in physical stores. This shift intensifies the threat of new entrants, potentially eroding Gap's market share.

The threat of new entrants is significant for Gap Inc. due to the rise of direct-to-consumer (DTC) brands. These brands can bypass traditional retail, building direct customer relationships. In 2024, DTC apparel sales are projected to reach $175 billion, representing a growing market share. Gap Inc. must adapt to this evolving landscape to remain competitive.

Threat of New Entrants 4

The threat of new entrants in the apparel industry, including Gap Inc., is a key consideration. Niche markets present opportunities for new players to enter. These entrants often target segments like sustainable fashion, which is a growing market. Gap needs to watch these trends and adjust its strategies.

- Sustainable fashion market is projected to reach $9.81B in 2024.

- Gap's net sales for fiscal year 2023 were $14.8B.

- New entrants can disrupt the market by focusing on specific consumer needs.

- Adaptation is crucial for established companies to stay competitive.

Threat of New Entrants 5

The threat of new entrants to Gap Inc. is moderate. Established brands like Gap, Old Navy, Banana Republic, and Athleta have advantages. These include brand recognition, customer loyalty, and economies of scale, which can be difficult for new competitors to overcome. Maintaining these advantages is crucial for Gap's market position.

- Gap Inc. reported net sales of $3.99 billion in Q1 2024.

- Old Navy's net sales were $1.78 billion in Q1 2024.

- Banana Republic's net sales were $489 million in Q1 2024.

- Athleta's net sales were $536 million in Q1 2024.

The threat from new entrants to Gap Inc. is moderate, balanced by established brand recognition and high capital needs. E-commerce and DTC models increase competition, influencing market dynamics. In Q1 2024, Old Navy’s net sales were $1.78B, illustrating the competitive landscape.

| Factor | Impact | Data (2024) |

|---|---|---|

| E-commerce | Lowers barriers to entry | DTC apparel sales projected at $175B |

| Brand Recognition | Provides a competitive advantage | Gap's Q1 2024 net sales $3.99B |

| Niche Markets | Offer entry points for new firms | Sustainable fashion market $9.81B |

Porter's Five Forces Analysis Data Sources

Our Gap analysis uses SEC filings, industry reports, and financial news for buyer power, and competitive rivalry assessments.