Globe Life Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

What is included in the product

Tailored analysis for Globe Life's insurance product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs. Concise overview for quick reference.

Full Transparency, Always

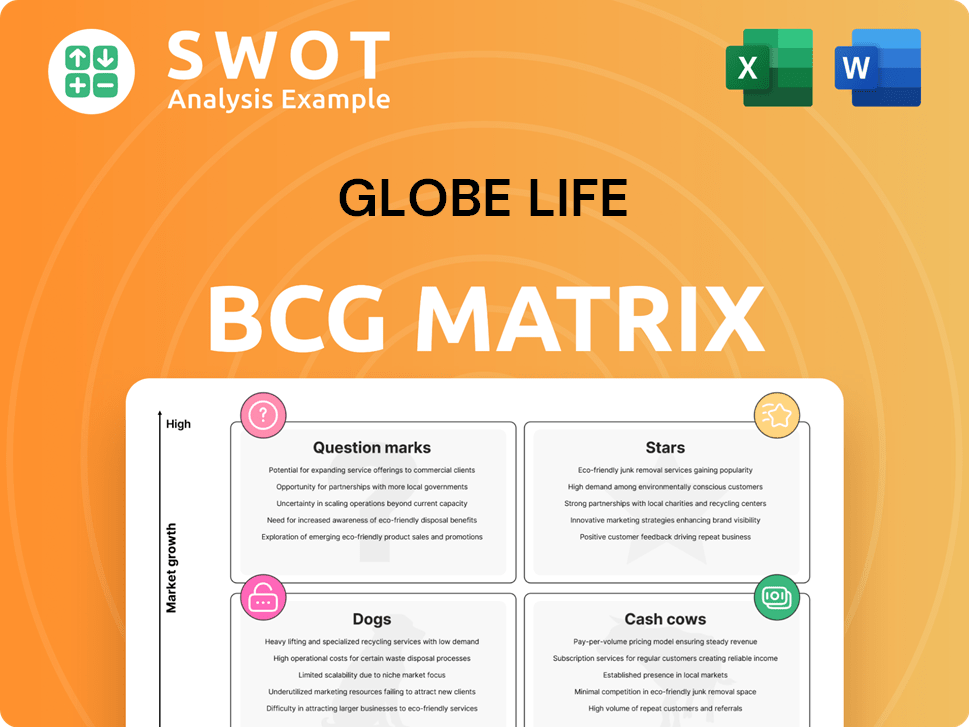

Globe Life BCG Matrix

The displayed BCG Matrix preview is the identical document you'll receive post-purchase. This means the complete, professionally designed matrix—ready for immediate strategic application—awaits your download.

BCG Matrix Template

Globe Life's BCG Matrix reveals its product portfolio's strategic landscape. Uncover how its products are classified as Stars, Cash Cows, Dogs, or Question Marks. This snapshot offers a glimpse into Globe Life's market positioning. It helps understand resource allocation and growth potential. The full report provides in-depth quadrant analysis and strategic insights.

Stars

The American Income Life (AIL) division within Globe Life is a star, showing impressive growth. In the most recent quarter, AIL's life net sales surged by 22%, with life premiums up 7% compared to the same period last year. This strong performance is further supported by a 7% increase in the average producing agent count, reflecting successful sales strategies.

Medicare Supplement Insurance, a star in Globe Life's BCG matrix, is fueled by United American's success. Net sales surged 11%, with Medicare Supplement leading the charge.

Increased Medicare Advantage enrollment and policy shifts boost growth. Globe Life can customize plans for specific care requirements. In 2024, Medicare Supplement sales are a key driver for the company.

Globe Life is leveraging technology to enhance operations and customer satisfaction. The company is investing in AI-driven solutions and product enhancements. This includes digital tools aimed at simplifying insurance processes. In 2024, Globe Life's tech investments increased by 15%, reflecting its commitment to innovation.

Agent Expansion

Globe Life's agent expansion strategy is a core driver of its success, especially in 2024. The company has focused on growing its sales force organically. This approach has yielded positive results, with agent numbers and sales volumes increasing. The American Income Life Division is a key focus for this strategy.

- In Q1 2024, Globe Life's total revenues increased.

- Agent expansion, particularly in American Income Life, is a key growth area.

- The company is focused on middle-management growth and new office openings.

- This expansion strategy is expected to drive sustainable growth.

Shareholder Returns

Globe Life's shareholder returns are a key strength. The company actively boosts shareholder value. In Q4 2024, they repurchased $36 million in shares. Globe Life returned $1 billion to shareholders in 2024. They increased the quarterly dividend to $0.27 per share in 2025.

- Share Repurchases: $36 million in Q4 2024.

- Total Shareholder Return: $1 billion in 2024.

- Dividend Increase: $0.27 per share in 2025.

Stars in Globe Life's BCG matrix include American Income Life (AIL) and Medicare Supplement Insurance. AIL's net sales increased by 22% in the last quarter, with life premiums up 7%. Medicare Supplement sales rose significantly in 2024, driven by United American. Both segments benefit from agent expansion and tech investments.

| Segment | Performance | Key Driver (2024) |

|---|---|---|

| AIL | Net Sales +22% | Agent Growth |

| Medicare Supp. | Sales Growth | United American |

| Tech Investments | Increased by 15% | AI Solutions |

Cash Cows

Life insurance is a major revenue source for Globe Life. In the most recent quarter, it contributed 79% of the insurance underwriting margin. Moreover, life insurance products generated 70% of total premium revenue. This dependable income stream firmly positions it as a cash cow for the company.

Globe Life's direct-to-consumer channel is a reliable cash cow. This channel consistently delivers revenue, reaching a wide audience. Globe Life's focus on the middle-income market ensures a steady flow of premiums. In 2023, Globe Life reported over $5.5 billion in total revenues. The direct-to-consumer channel contributed significantly to this figure.

Supplemental health insurance is a key revenue source for Globe Life. In the latest quarter, it made up 21% of their insurance underwriting margin. It also represented 30% of the total premium revenue. These products offer a stable income stream. Globe Life focuses on improving efficiency here.

Strong Financial Health

Globe Life is considered a 'Cash Cow' due to its robust financial health. InvestingPro gives it a 'GOOD' score of 3.0 out of 5, reflecting stability. This strength comes from a solid capital structure and liquidity. Globe Life aims for a 300% to 320% consolidated Company Action Level RBC ratio by 2025, supporting its financial ratings.

- InvestingPro gives Globe Life a financial health score of 3.0 out of 5.

- Globe Life targets a 300% to 320% consolidated Company Action Level RBC ratio by 2025.

Strategic Investments

Globe Life strategically invests in its core operations, focusing on efficiency to maintain strong profitability. The company carefully manages its investment portfolio to match long-term policy liabilities, mostly investing in investment-grade fixed maturities. These investments are crucial for supporting long-term financial stability and consistent cash flow. In 2023, Globe Life reported a net investment income of $770.4 million.

- Net investment income of $770.4 million in 2023.

- Focus on investment-grade fixed maturities.

- Strategic investments for efficiency.

- Alignment with long-term policy liabilities.

Globe Life's life insurance, direct-to-consumer channels, and supplemental health insurance act as its cash cows. These segments provide steady revenue streams and high profit margins. The company’s strong financial health, with a 'GOOD' InvestingPro score, supports this. They prioritize investment-grade assets and efficient operations, contributing to financial stability.

| Feature | Details | Financial Impact (2023) |

|---|---|---|

| Revenue Contribution | Life insurance, direct-to-consumer, supplemental health. | Life insurance underwriting margin 79%, premium revenue 70%. |

| Financial Health | InvestingPro Score. | 3.0 out of 5, RBC ratio target of 300%-320% by 2025. |

| Investment Strategy | Investment-grade fixed maturities. | Net investment income of $770.4 million. |

Dogs

The Direct to Consumer Division saw a 9% decrease in net sales, reaching $106 million in 2024, influenced by reduced spending on direct mail and online ads. This downturn could indicate that this division is a "Dog" in the BCG matrix, requiring strategic reassessment. The division's performance lags behind other segments, potentially affecting overall profitability. Further analysis and restructuring could be vital for improvement.

Viceroy Research highlighted Globe Life's expanded risk disclosures due to IT vulnerabilities. Legacy systems can impede growth and elevate operational expenses. In 2024, companies with outdated IT saw a 15% productivity dip. Addressing weaknesses boosts efficiency and competitiveness. Globe Life's market cap was $9.6 billion as of late 2024.

Globe Life might have insurance products with shrinking underwriting margins. Regular monitoring of each product's profitability is crucial to spot problems. For example, in 2024, the company's net premiums earned were around $4.8 billion. Low-margin products may need changes or could be sold off.

High Policy Acquisition Costs

Viceroy Research's concerns highlight rising policy acquisition costs at Globe Life. This means Globe Life spends more to get new policies than the revenue they bring in. This trend could harm the company's profits if not addressed. Streamlining acquisition processes can help improve financial performance.

- Policy acquisition costs have been outpacing premium growth.

- This could erode profitability if not managed.

- Streamlining processes is a key strategy.

- Financial performance depends on cost control.

Increased Lapse Rates

Viceroy Research highlights rising lapse rates at Globe Life, signaling more policy cancellations. This trend could pressure the company's financial results by reducing premium revenue. Addressing this issue is critical to maintaining financial health and stability. Strategies focusing on customer retention are needed to mitigate these challenges.

- Lapse rates are key metric impacting profitability.

- High lapse rates reduce revenue and profits.

- Customer retention strategies are essential.

In the BCG matrix, "Dogs" represent business units with low market share and low growth potential. The Direct to Consumer Division's 9% sales decrease to $106 million in 2024 suggests it's a "Dog". Products with shrinking margins and rising acquisition costs also fit this profile. Addressing these issues is crucial.

| Metric | 2024 | Impact |

|---|---|---|

| Direct Sales Decline | 9% | Negative |

| IT Vulnerabilities | Increased Risk | Negative |

| Policy Lapses | Rising | Negative |

Question Marks

Globe Life actively launches new health insurance products to meet evolving market demands. These offerings show promise for substantial growth, yet currently hold a modest market share. Boosting awareness and accessibility through strategic marketing and distribution is key. In 2024, the health insurance sector saw a 7% increase in new product adoption.

AI-driven customer service streamlines responsiveness and boosts satisfaction. Integrating AI requires careful planning and risk management. Investments in AI tech could drive growth, though uncertainty exists. In 2024, AI in customer service saw a 25% adoption rate within the insurance sector. This is projected to reach 40% by 2026.

Expanding into new geographic markets is a growth opportunity. It demands investment and has initial market share risks. Globe Life's 2024 revenue was about $5.6 billion. Successful expansion needs research and planning.

Partnerships and Acquisitions

Globe Life, as a "Question Mark" in the BCG matrix, might explore partnerships and acquisitions to boost its market position. These actions could open doors to new markets and technologies, driving expansion. However, such moves come with integration hurdles and financial risks that need careful management. For example, in 2024, the insurance sector saw 1,200+ M&A deals. Thorough due diligence is essential to mitigate these risks and ensure success.

- Partnerships can offer quicker market entry and access to specialized expertise.

- Acquisitions can provide economies of scale and eliminate competition.

- Integration challenges include merging cultures, systems, and operations.

- Financial risks involve debt, overpayment, and integration costs.

Customized Insurance Products

Customized insurance products represent a question mark in the Globe Life BCG Matrix. Developing specialized insurance options tailored to specific customer needs could unlock new market segments, potentially leading to high growth. This approach necessitates a deep understanding of customer preferences and market dynamics, requiring significant investment in market research and product development. For instance, the insurance industry saw a 6.3% increase in premiums in 2023, indicating growth potential.

- Market research is key to understanding customer needs and preferences.

- Product development requires significant investment.

- Customized products have the potential for high growth.

Globe Life's "Question Marks" strategy emphasizes growth via partnerships, acquisitions, and product customization. These initiatives aim to boost market share and tap into new opportunities. The company must carefully manage integration challenges and financial risks to succeed. In 2024, the insurance industry's M&A activity totaled over $1.2 trillion.

| Initiative | Impact | Risk |

|---|---|---|

| Partnerships/Acquisitions | Market expansion, scale | Integration, financial |

| Customized Products | New market segments, growth | Investment, research |

| Strategic Focus | Growth potential | Requires adaptation |

BCG Matrix Data Sources

Globe Life's BCG Matrix leverages financial data, industry analysis, and market reports for robust strategic positioning.