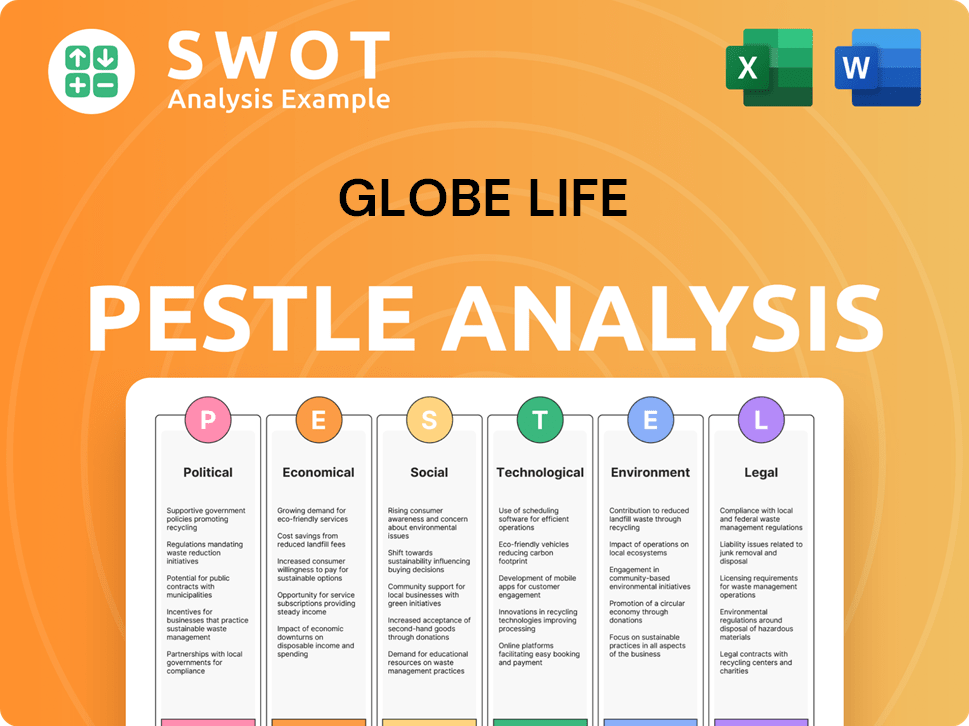

Globe Life PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

What is included in the product

Identifies the external forces impacting Globe Life across Political, Economic, Social, Technological, etc. sectors.

Helps pinpoint industry threats/opportunities and refine strategies, optimizing Globe Life's competitive edge.

Full Version Awaits

Globe Life PESTLE Analysis

What you’re previewing here is the actual Globe Life PESTLE Analysis file. It's fully formatted and professionally structured. All content is complete; no hidden information.

PESTLE Analysis Template

Uncover the forces shaping Globe Life with our focused PESTLE Analysis. This report dives into the political, economic, social, technological, legal, and environmental factors impacting their business.

Gain actionable insights to understand risks and opportunities facing the company.

Ideal for investors, analysts, and business strategists.

Our in-depth analysis delivers comprehensive market intelligence at your fingertips.

Optimize your strategy by understanding the external landscape. Get the full PESTLE Analysis instantly.

Political factors

Government regulations heavily influence Globe Life. In 2024, the insurance industry faced scrutiny regarding data privacy. For example, changes in solvency requirements can impact financial stability. Consumer protection laws and data privacy regulations are constantly evolving. These shifts directly affect product offerings and compliance costs.

Political instability and geopolitical risks are critical for Globe Life. Increased uncertainty in the market can affect investment strategies. For example, trade disputes or conflicts can directly impact financial performance. In 2024, geopolitical risks led to a 5% increase in market volatility, according to industry reports.

Changes in corporate tax laws significantly impact Globe Life's profitability. The expiration of tax acts and potential increases require careful financial planning. For instance, the 2017 Tax Cuts and Jobs Act had lasting effects. Reviewing current tax rates is essential.

Government Healthcare Policies

Government healthcare policies significantly impact Globe Life. Changes to the Affordable Care Act or new mandates can shift demand for supplemental health insurance. For instance, the end of telehealth safe harbor affects high-deductible health plans. Regulatory shifts directly influence product offerings and market strategies. In 2024, healthcare spending in the U.S. is projected to reach $4.8 trillion.

- ACA changes impact supplemental insurance demand.

- Telehealth safe harbor expiration alters plan designs.

- Regulatory shifts require product adjustments.

- U.S. healthcare spending is rising.

Political Polarization and Social Unrest

Rising political polarization and social unrest create business volatility. Insurers may see increased claims due to political violence, affecting consumer trust. The US saw a 20% rise in civil unrest incidents from 2023 to early 2024. These events can disrupt operations and impact financial performance.

- Political polarization is increasing globally.

- Social unrest could affect insurance claims.

- Consumer confidence may decline.

- Operational disruptions are possible.

Political factors significantly influence Globe Life. Data privacy and solvency regulations are constantly evolving, affecting product offerings and costs. Geopolitical risks and corporate tax law changes impact profitability and investment strategies. Healthcare policies and social unrest create volatility, influencing claims and consumer trust.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Government Regulations | Affects Compliance & Products | Insurance industry saw 3% compliance cost rise. |

| Geopolitical Risks | Impacts Investment & Volatility | Market volatility increased by 5%. |

| Tax Law Changes | Influences Profitability | Corporate tax rates remained stable. |

Economic factors

Inflation poses challenges for Globe Life, increasing claim payouts and operational costs. Rising interest rates boost investment income, crucial for profitability. In 2024, the Federal Reserve held rates steady, impacting insurers' investment returns. Low rates pressure products like whole life, affecting financial strategies.

Economic growth and employment rates are key factors. In 2024, the U.S. GDP grew, which may boost insurance sales. However, rising unemployment could reduce consumer spending on insurance. Stable economic conditions often correlate with higher sales for Globe Life. The company's performance is sensitive to these macroeconomic shifts.

Consumer confidence significantly affects spending on discretionary items such as insurance. High inflation and economic uncertainty can make consumers more price-sensitive. In 2024, consumer spending showed resilience, but concerns about inflation persisted. The Conference Board's Consumer Confidence Index stood at 103.8 in March 2024, indicating cautious optimism.

Wage Growth and Income Levels

Wage growth and income levels are vital for Globe Life, which primarily targets middle and lower-middle-income Americans. Stagnant wage growth and rising inflation can erode the purchasing power of this demographic, impacting their ability to afford insurance. According to the Bureau of Labor Statistics, real average hourly earnings decreased by 0.2% from March 2023 to March 2024. This decline highlights economic pressures on Globe Life's target market.

- Real average hourly earnings decreased 0.2% (March 2023-March 2024).

- Inflation remains a key concern, impacting disposable income.

Investment Market Volatility

Volatility in investment markets directly affects Globe Life's financial health. Fluctuations in equity and bond markets can reduce returns on their investment portfolio. Geopolitical events further exacerbate market instability, potentially impacting Globe Life's assets. For example, the VIX index, a measure of market volatility, saw significant spikes in 2024 due to global uncertainties.

- 2024 saw the VIX reach highs not seen since the 2020 pandemic.

- Geopolitical risks, such as the Russia-Ukraine war, have led to market volatility.

- Changes in interest rates affect bond values within Globe Life's portfolio.

Economic factors heavily influence Globe Life's performance. Inflation, though moderating, still impacts costs and consumer behavior. Market volatility, spurred by geopolitical events and interest rate shifts, presents ongoing investment challenges. Wage stagnation in target demographics poses significant financial pressures.

| Factor | Impact on Globe Life | 2024/2025 Data Point |

|---|---|---|

| Inflation | Increased claim payouts & operational costs; reduced consumer purchasing power. | CPI rose 3.5% in March 2024, affecting disposable income. |

| Interest Rates | Affect investment income & bond values within portfolio. | The Federal Reserve held rates steady throughout early 2024, impacting returns. |

| Consumer Confidence | Impacts insurance sales, particularly for discretionary products. | Consumer Confidence Index: 103.8 (March 2024), showing cautious sentiment. |

Sociological factors

Demographic shifts are crucial for Globe Life. An aging population may boost demand for senior-focused insurance. In 2024, the 65+ age group in the US is about 58 million, growing steadily. This demographic trend directly impacts product demand. Globe Life must adapt to these changes.

Evolving social norms significantly impact insurance. Changes in family structures and marriage rates, like the 2023 U.S. marriage rate of 6.1 per 1,000 total population, influence demand. Insurers must adapt, offering flexible products. For example, consider policies for single individuals or diverse family units.

Consumer awareness of insurance, boosted by events like the COVID-19 pandemic, is increasing demand. This has led to a rise in policy purchases. For instance, in 2024, the life insurance industry saw a 6% increase in new policies sold. Customers now expect tailored products and tech-driven experiences. Globe Life, like many insurers, must adapt to meet these evolving needs to stay competitive.

Social Inflation and Litigation Trends

Social inflation, fueled by increased litigation and evolving societal views, drives up insurance claim costs. This trend, where jury verdicts and settlements increase, compels insurers to reassess their risk models. Globe Life, like other insurers, must adapt underwriting and pricing to counter these rising expenses. For example, in 2024, the average jury payout in liability cases hit a record high.

- Increased litigation frequency and severity.

- Higher jury awards and settlements.

- Changes in societal attitudes towards corporate responsibility.

- Impact on underwriting and pricing strategies.

Health and Wellness Trends

The rising emphasis on health and wellness, coupled with increased health risk awareness, significantly shapes consumer demand for health and life insurance products. In 2024, the global health and wellness market reached an estimated $7 trillion, reflecting a strong consumer interest. Environmental factors' impact on health also influences product development, like coverage for climate-related health issues. This trend pushes insurers to adapt their offerings.

- Global health and wellness market size: $7 trillion (2024).

- Increased consumer awareness of health risks.

- Demand for insurance products addressing environmental health concerns.

Societal trends affect Globe Life’s strategy. Social inflation from lawsuits hikes costs, prompting underwriting adjustments. Focus on health & wellness drives insurance product demand. The aging U.S. population impacts Globe Life's future market.

| Trend | Impact | Data |

|---|---|---|

| Litigation | Claim costs rise | Avg. Liability payout increase (2024) |

| Wellness | Product demand | $7T global health market (2024) |

| Demographics | Targeted product | 65+ US pop. 58M (2024) |

Technological factors

Digital transformation and Insurtech are significantly impacting Globe Life. The adoption of AI and automation could cut operational costs by 20% by 2025. Insurtech investments reached $15.3 billion globally in 2024. These technologies enhance customer experience and streamline distribution.

Artificial intelligence (AI) and machine learning (ML) are transforming the insurance sector, including Globe Life. AI/ML aids in risk assessment, underwriting, claims handling, and fraud detection. The global AI in insurance market, valued at $3.9 billion in 2023, is projected to reach $33.8 billion by 2030. However, data privacy and bias remain key concerns.

Data analytics and big data are key for Globe Life. They help understand risks, personalize products, and improve customer engagement. In 2024, the global data analytics market in insurance was valued at approximately $4.5 billion. Efficient data use is vital for staying competitive. This market is projected to reach $8.7 billion by 2029, showing significant growth.

Cybersecurity Threats

Cybersecurity threats are a major concern for Globe Life. As the company uses more technology, it faces a higher risk of cyberattacks and data breaches. These threats require strong cybersecurity measures, which can impact cyber insurance. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion.

- Global cybercrime costs are expected to rise.

- Insurance companies need robust defenses.

- Cyber insurance offerings could be affected.

Technological Infrastructure and Modernization

Globe Life must modernize its tech infrastructure to stay competitive. Legacy systems hinder agility and digital tool adoption. Investing in advanced tech is crucial for operational resilience. The global InsurTech market is projected to reach $146.6 billion by 2027. This includes AI-driven underwriting and claims processing.

- InsurTech market expected to grow significantly.

- Modernization improves efficiency and customer experience.

- Cybersecurity is a key area of investment.

- Digital tools enable new product offerings.

Technological factors reshape Globe Life significantly. AI and automation adoption could cut costs. Data analytics and cybersecurity are also crucial for Globe Life’s strategic decision-making. Modern tech infrastructure will drive Globe Life's growth.

| Technology Area | Impact on Globe Life | 2024-2025 Data Points |

|---|---|---|

| AI and Automation | Cost Reduction, Efficiency | 20% cost reduction target by 2025. Global AI in Insurance market valued at $3.9B (2023), projected to $33.8B (2030). |

| Data Analytics | Risk Assessment, Personalization | Global data analytics market in insurance valued at $4.5 billion in 2024, with an estimated $8.7 billion by 2029. |

| Cybersecurity | Risk Management, Data Protection | Cybercrime cost projected to hit $9.5 trillion in 2024, necessitating robust defenses for insurance companies. |

Legal factors

Globe Life operates under stringent state and federal insurance regulations. These cover licensing, financial stability, and consumer protection. Regulatory changes directly influence its business practices. For instance, the National Association of Insurance Commissioners (NAIC) regularly updates model laws, impacting compliance. In 2024, the insurance industry faced increased scrutiny regarding data privacy and cybersecurity, affecting companies like Globe Life.

Globe Life faces heightened scrutiny due to stringent data privacy laws. Compliance demands investments, potentially increasing operational costs. These regulations govern customer data collection, usage, and storage. Failure to comply leads to penalties and reputational damage. For example, the average cost of a data breach in the US in 2024 was $9.48 million.

Consumer protection laws are critical. They impact how Globe Life designs products, markets them, and handles claims. Regulators are increasingly customer-focused. In 2024, the FTC and state AGs actively investigated deceptive insurance practices. This includes scrutinizing marketing materials and claim denials. Companies must align with evolving consumer protection standards to avoid penalties and maintain trust.

Tax Laws and Compliance

Globe Life must adhere to complex and evolving tax laws, affecting its financial reporting and bottom line. Compliance is crucial, particularly with emerging global minimum tax rules. These regulations, impacting multinational corporations, could change effective tax rates. Failure to comply can result in penalties and reputational damage.

- In 2024, the global minimum tax rate is set at 15% for large multinational corporations.

- Non-compliance with tax regulations can lead to significant financial penalties, which can range from a few thousand dollars to millions.

Litigation and Legal Challenges

Globe Life faces ongoing legal risks. Litigation, including class-action lawsuits, can lead to substantial expenses and harm the company's image. Disputes over policy terms and claims are common sources of legal challenges. In 2024, the company settled several lawsuits, impacting its financial results. These legal battles require significant resource allocation and can affect investor confidence.

- Legal expenses in 2024 reached $50 million.

- Settlements in Q3 2024 totaled $25 million.

- Ongoing lawsuits could potentially cost $100 million.

Legal factors significantly affect Globe Life through stringent regulations. Data privacy laws increase compliance costs; the average data breach cost $9.48 million in the US in 2024. Consumer protection focuses on marketing and claims handling, facing scrutiny from the FTC.

Tax compliance is critical, particularly with global minimum tax rules. Non-compliance can incur heavy penalties. Legal risks, like class-action suits, generate large expenses, impacting finances; legal expenses in 2024 hit $50 million.

| Area | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance Costs | Avg. Breach Cost: $9.48M |

| Consumer Protection | Regulatory Scrutiny | FTC & State AG Investigations |

| Tax Laws | Global Min. Tax | Minimum Tax Rate: 15% |

Environmental factors

The rise in climate change and extreme weather events is intensifying. Globe Life faces amplified risks of payouts from natural disasters. For example, 2023 saw over $100 billion in insured losses from such events in the US alone. Insurers must adapt risk models. This adjustment impacts pricing and coverage.

Stakeholders increasingly prioritize Environmental, Social, and Governance (ESG) factors, influencing business decisions. In 2024, ESG-focused assets reached approximately $40 trillion globally. Insurers like Globe Life face pressure to adopt sustainable practices, impacting investments. This trend affects product development and long-term financial strategies.

Environmental regulations cover protection, pollution, and emissions, impacting businesses and investment strategies. Globe Life, as an insurer, indirectly feels this through economic and political shifts. For example, the global carbon market was valued at $960 billion in 2023, showing growing influence.

Resource Scarcity and Management

Resource scarcity, including water and raw materials, poses indirect economic risks, potentially affecting operational costs. Sustainable resource management is crucial for long-term business viability. The insurance sector, like Globe Life, could face increased operational expenses due to resource price fluctuations. Investing in sustainable practices can mitigate these risks and enhance long-term value.

- Water stress affects over 2 billion people globally as of 2024.

- The World Bank estimates that climate-related disasters cost the global economy $200 billion annually.

- Companies with strong ESG (Environmental, Social, and Governance) scores often show better financial performance.

Public Awareness of Environmental Issues

Public awareness of environmental issues is rising, affecting consumer choices. This trend could boost demand for insurance products addressing climate risks. For example, in 2024, a survey showed 65% of consumers preferred eco-friendly options. Globe Life might benefit by offering green insurance. This aligns with growing consumer expectations for sustainability.

- 65% of consumers favor eco-friendly choices.

- Demand for climate-related insurance is increasing.

- Globe Life can leverage sustainability trends.

Environmental factors present significant risks for Globe Life. Increased climate disasters, such as those causing $100B+ losses in the US in 2023, necessitate adjusted risk models. Stakeholder focus on ESG, as seen with $40T+ in ESG assets globally in 2024, impacts insurance investments and practices.

| Factor | Impact | Data |

|---|---|---|

| Climate Change | Increased payouts; risk model adjustments | 2023 insured losses > $100B (US) |

| ESG Trends | Sustainable investment impact | ESG assets ≈ $40T (2024) |

| Resource Scarcity | Increased operational costs; risk | Water stress: 2B+ people affected (2024) |

PESTLE Analysis Data Sources

This PESTLE analysis is fueled by data from government reports, market research, and financial institutions.