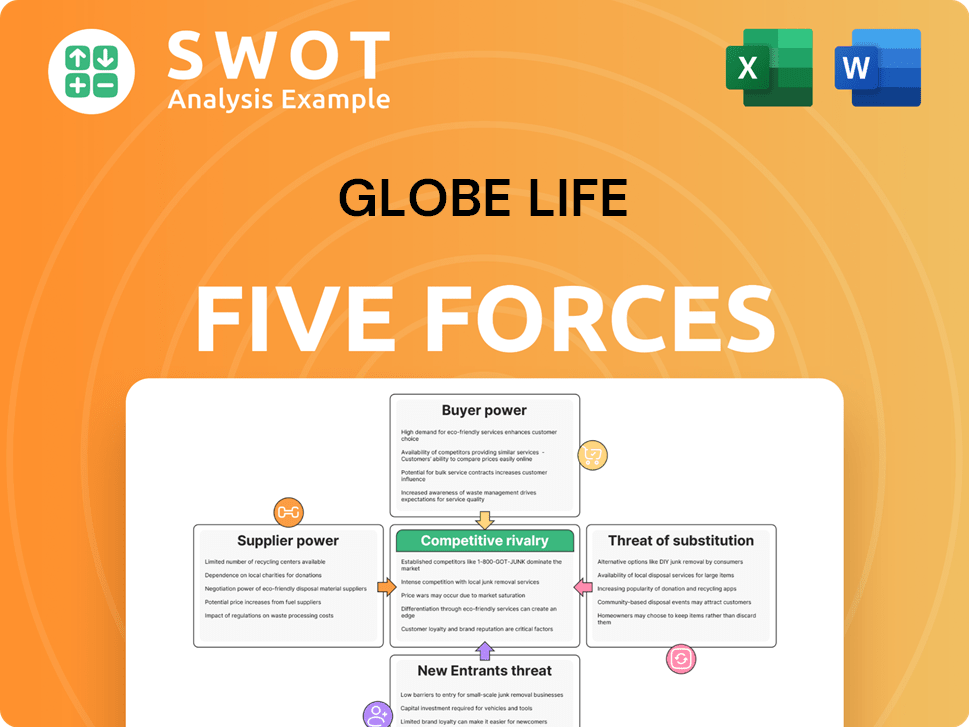

Globe Life Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Quickly identify market threats and opportunities with a single, dynamic view of all forces.

Preview Before You Purchase

Globe Life Porter's Five Forces Analysis

This preview details Globe Life's Porter's Five Forces analysis, showcasing competitive dynamics.

It assesses industry rivalry, supplier power, buyer power, and threats of new entrants/substitutes.

The document provides insights into Globe Life's market position, influencing its strategic decisions.

You are viewing the complete analysis; the same document is available instantly after purchase.

It's ready for your review and strategic planning—no extra steps needed.

Porter's Five Forces Analysis Template

Globe Life operates within a competitive insurance market. Analyzing Porter's Five Forces reveals key pressures affecting its strategic position. Buyer power is moderate, influenced by consumer choice and switching costs. Competitive rivalry is intense, shaped by numerous insurance providers. The threat of new entrants is relatively low, due to high capital requirements.

Substitute products, like self-insurance, pose a limited threat. Supplier power, mainly from healthcare providers, is also moderate. This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Globe Life.

Suppliers Bargaining Power

The insurance industry typically faces low supplier power. Its main resource is capital, easily accessible in financial markets. Reinsurance firms could have leverage, yet competition among them is fierce. In 2024, the global reinsurance market was estimated at $450 billion. Globe Life’s diverse structure lessens dependence on any specific supplier.

Actuarial expertise is crucial for Globe Life's operations. Access to skilled actuaries is vital for assessing risk and pricing policies correctly. While actuarial talent is specialized, the supply is generally adequate, preventing excessive supplier bargaining power. Globe Life likely invests in internal actuarial capabilities and may outsource specific tasks. In 2024, the insurance industry saw a 3% increase in actuarial positions.

Globe Life depends on tech vendors for software and infrastructure. The bargaining power of these vendors differs based on their specialization and market share. In 2024, the IT services market is valued at over $1.4 trillion globally. Globe Life can lessen vendor power by using multiple vendors or developing in-house solutions for vital processes.

Data providers are essential

Data providers are crucial for Globe Life's underwriting and risk management processes. These providers possess moderate bargaining power, particularly if they offer unique or specialized data. Globe Life can mitigate this by using multiple data sources and enhancing its data analytics. This approach helps in negotiating better terms and reducing dependency on any single provider. In 2024, the insurance industry spent approximately $12 billion on data analytics and related services.

- Data analytics spending in the insurance sector reached $12 billion in 2024.

- Reliance on unique data increases supplier bargaining power.

- Diversification of data sources is a key strategy.

- Investing in data analytics capabilities reduces dependency.

Regulatory compliance costs

Regulatory compliance significantly impacts Globe Life, demanding specialized expertise and resources. The costs associated with adhering to insurance regulations are substantial, affecting operational expenses. Although regulatory bodies lack traditional bargaining power, the financial implications are considerable. Globe Life's established infrastructure offers a degree of cost management.

- Compliance costs for insurance companies can range from 5% to 10% of operational expenses.

- Globe Life reported $1.3 billion in operating expenses in 2023, a portion of which is allocated to regulatory compliance.

- The regulatory landscape is continually evolving, necessitating ongoing investment in compliance.

Globe Life faces varying supplier power across resources. Capital suppliers have low power due to market accessibility, with the reinsurance market valued at $450 billion in 2024. Tech vendors and data providers hold moderate influence, especially with unique offerings. Diversifying resources and investing in internal capabilities are crucial strategies.

| Supplier | Bargaining Power | Mitigation Strategy |

|---|---|---|

| Capital | Low | Access to financial markets |

| Actuaries | Moderate | Invest in internal capabilities |

| Tech Vendors | Moderate | Use multiple vendors |

| Data Providers | Moderate | Diversify data sources |

Customers Bargaining Power

Customers, especially those with lower incomes, are very price-conscious, pushing Globe Life to keep premiums competitive. With many insurance choices, customers have strong bargaining power. In 2024, the average annual premium for term life insurance was about $600, showing price sensitivity. This forces Globe Life to balance affordability and profitability. The market's competitive nature further amplifies this customer influence.

Switching insurance providers is generally easy, particularly for term life policies. This ease of switching gives customers significant power to seek better prices. In 2024, term life insurance saw high churn rates, with policyholders frequently comparing options. Globe Life combats this by emphasizing customer service and providing strong value, a strategy that is crucial in a competitive market.

Customers now have vast information and comparison tools online, increasing their power to choose insurance providers. This easy access allows for quick evaluation of insurance products. Globe Life must maintain a robust online presence and transparent pricing to stay competitive. In 2024, the insurance industry saw a 15% increase in online policy comparisons.

Group policies offer advantages

Customers in group insurance plans, often employer-sponsored, wield significant bargaining power. Securing and keeping these group contracts is vital for Globe Life. These plans typically have negotiated rates and benefits, affecting profitability. In 2024, group insurance accounted for a substantial portion of the insurance market.

- Group plans offer negotiated rates.

- Maintaining group contracts is crucial.

- Group insurance impacts profitability.

- Group plans represent a large market share.

Demographic shifts affect demand

Demographic shifts and economic conditions significantly influence the demand for insurance products like those offered by Globe Life. For example, an aging population might increase demand for certain life insurance policies. Globe Life needs to adjust its product offerings to align with these evolving customer needs and preferences to stay competitive. Analyzing these changes is essential for Globe Life's strategic planning.

- In 2024, the U.S. population aged 65+ is approximately 58 million.

- Economic downturns can impact consumer spending on discretionary items like certain insurance products.

- Globe Life's ability to offer tailored products is crucial.

- Understanding these shifts helps in strategic decision-making.

Customers strongly influence pricing, especially those with many insurance options.

Switching providers is easy, enhancing customer power to seek better deals.

Online comparison tools increase customer choice and market competition.

Group plans have negotiated rates.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Term life average premium: ~$600 |

| Switching Costs | Low | High churn rates |

| Online Comparisons | Increased Power | 15% rise in online comparisons |

Rivalry Among Competitors

The life insurance market is intensely competitive, featuring many national and regional companies. This fierce rivalry significantly impacts pricing strategies and profitability. Globe Life competes with industry leaders like New York Life and Prudential, alongside smaller, specialized firms. In 2024, the industry saw over $12 billion in premiums, reflecting the competitive landscape.

Companies with robust distribution networks often enjoy a significant competitive edge. Globe Life leverages diverse channels, such as direct response and agency networks, which shape its market stance. Maintaining and growing these networks is vital for their success. In 2024, Globe Life's agency network contributed substantially to sales, highlighting this importance. They are also investing in digital distribution platforms.

Product innovation is critical for Globe Life's competitiveness. Developing tailored insurance products attracts and retains customers in the competitive market. Globe Life must continuously innovate to meet changing customer demands, like the increased demand for supplemental health insurance, which saw a 15% growth in 2024. Adapting to market trends is key for Globe Life, as demonstrated by the 8% rise in digital insurance policy sales in 2024.

Brand reputation matters significantly

Brand reputation is crucial in the insurance industry, as it fosters trust and customer loyalty. Globe Life's brand image significantly impacts its ability to attract and keep policyholders in a competitive market. A strong reputation can differentiate Globe Life from its competitors, influencing consumer choices. Maintaining a positive brand perception is essential for long-term success.

- In 2024, Globe Life's net income was $766.6 million.

- Customer loyalty is vital, with retention rates directly affecting revenue.

- Positive reviews and ratings boost brand perception.

- Negative publicity can severely damage a brand's image.

Technological advancements drive competition

Technological advancements significantly intensify competitive rivalry within the insurance sector. Digital platforms and data analytics are reshaping the industry, creating new battlegrounds for market share. Globe Life must continuously invest in technology to enhance operational efficiency and improve customer service. Failing to adapt to these technological shifts could result in a loss of competitiveness.

- In 2024, InsurTech investments reached $14.5 billion globally.

- Companies using AI for claims processing can reduce processing times by up to 30%.

- Globe Life's digital initiatives include mobile apps and online portals.

- Customer satisfaction scores are higher for insurers with robust digital offerings.

Competitive rivalry in life insurance is high due to many firms and product similarities. Intense competition influences pricing and profitability, necessitating strategic advantages. Globe Life's success hinges on its ability to differentiate through distribution, product innovation, and brand strength.

| Factor | Impact on Globe Life | 2024 Data |

|---|---|---|

| Competition Level | High; impacts pricing and market share | Industry premiums exceeded $12B. |

| Distribution | Key for market reach; must be robust | Agency network sales were significant. |

| Product Innovation | Needed to meet customer needs | Supplemental health grew by 15%. |

| Brand Reputation | Differentiates; builds trust | Net income was $766.6M. |

SSubstitutes Threaten

Other investments like stocks and bonds are substitutes for life insurance. These can offer higher returns, appealing to investors. In 2024, the S&P 500 returned about 24%, attracting capital. Globe Life needs to highlight life insurance's unique value, emphasizing protection and planning.

Government social security benefits serve as a partial substitute for life insurance, offering a basic financial safety net for survivors. These benefits, while essential, often fall short of covering all financial needs. Globe Life must emphasize the supplemental value of its insurance products to address gaps in government support, highlighting the need for additional coverage. In 2024, the average monthly Social Security benefit for a retired worker was approximately $1,907, underscoring the potential financial limitations.

Employer-sponsored benefits, like retirement plans and health insurance, serve as substitutes for individual life insurance, potentially decreasing demand. These benefits offer financial security and healthcare coverage, impacting the need for standalone policies. Globe Life can focus on individuals needing supplemental coverage beyond their employer's offerings. In 2024, approximately 57% of U.S. workers have access to employer-sponsored retirement plans.

Savings accounts and emergency funds

Savings accounts and emergency funds pose a threat to Globe Life as substitutes, offering immediate financial relief. These funds can cover unexpected expenses, reducing the perceived need for immediate life insurance payouts. To counter this, Globe Life should highlight its policies' long-term value, emphasizing estate planning and financial security benefits. For example, in 2024, the average savings rate in the U.S. hovered around 3.9%. This underscores the importance of educating consumers on life insurance's comprehensive benefits.

- Savings accounts provide an accessible financial buffer.

- Emergency funds offer immediate liquidity.

- Globe Life must differentiate with long-term protection.

- Estate planning is a key benefit of life insurance.

Other insurance products

Other insurance products, like disability or long-term care, can be substitutes for some Globe Life offerings. These alternatives address similar financial risks, potentially impacting demand for Globe Life's specific policies. In 2024, the market for supplemental health insurance, which includes some substitutes, was valued at approximately $40 billion. Globe Life could mitigate this threat by providing a broader range of insurance products. A diverse portfolio helps meet varied customer needs and reduces the impact of substitution.

- Disability insurance offers income replacement if unable to work.

- Long-term care insurance covers expenses for extended care needs.

- Supplemental health insurance covers costs not covered by primary insurance.

- Globe Life's product range can offset substitution risks.

Substitutes like investments and social security impact Globe Life. Employer benefits and savings accounts also compete for consumer funds. Other insurance products, such as disability or long-term care, serve as substitutes too.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Stocks/Bonds | Offer higher returns | S&P 500 return: 24% |

| Social Security | Provides basic safety net | Avg. benefit: $1,907/month |

| Employer Benefits | Offers financial security | 57% U.S. workers have retirement plans |

Entrants Threaten

Entering the insurance industry demands substantial capital. Companies need reserves, marketing budgets, and regulatory compliance funds. These high capital needs act as a significant barrier, preventing many new firms from competing. For example, in 2024, starting a life insurance company required at least $50 million in capital.

Stringent regulatory oversight poses a significant barrier to new entrants in the insurance sector. The insurance industry's complex rules and licensing requirements increase entry costs. Established players like Globe Life benefit from existing compliance infrastructure. In 2024, regulatory compliance costs for insurers averaged $1.2 million annually, according to industry reports. This creates a considerable hurdle for newcomers.

Established companies like Globe Life benefit from strong brand recognition and customer loyalty, making it tough for newcomers. New entrants must invest heavily in marketing and building trust in a crowded insurance market. Globe Life's history provides a substantial edge; in 2024, its brand value was estimated at $3.5 billion. This established presence helps retain customers and fend off new competitors.

Economies of scale are crucial

Economies of scale significantly impact the insurance industry, especially regarding new entrants. Established insurance companies like Globe Life have advantages in underwriting, claims processing, and marketing due to their size. New companies often struggle to match these cost efficiencies, creating a barrier. Globe Life's scale contributes to its competitive edge, making it harder for new firms to compete. For instance, Globe Life's assets totaled approximately $19.7 billion in 2024, reflecting its operational scale.

- Underwriting efficiency is key.

- Claims processing benefits from scale.

- Marketing costs are spread across a large base.

- New entrants face higher operational expenses.

Distribution network challenges

A significant hurdle for new entrants is establishing a robust distribution network to reach customers effectively. This involves building relationships with agents, brokers, and other channels, a process that demands time and resources. Globe Life's well-established distribution network offers a substantial competitive advantage, making it challenging for newcomers to compete. The complexity and cost of replicating this network pose a considerable barrier.

- Globe Life utilizes multiple distribution channels, including exclusive agents, independent agents, and direct-to-consumer methods.

- Building a successful distribution network requires significant investment in training, technology, and marketing.

- New entrants must overcome the existing relationships and market presence of established players like Globe Life.

The threat of new entrants to the insurance sector is moderate due to significant barriers. High capital requirements and strict regulations, like the $1.2M annual compliance costs in 2024, limit new firms.

Established players like Globe Life benefit from brand recognition ($3.5B brand value in 2024) and economies of scale ($19.7B in assets in 2024), making it difficult for new entrants.

Building a distribution network is also a hurdle.

| Barrier | Impact | Example |

|---|---|---|

| Capital Needs | High | $50M to start in 2024 |

| Regulations | High Compliance Costs | $1.2M annually in 2024 |

| Brand/Scale | Competitive Advantage | Globe Life's $3.5B brand in 2024 |

Porter's Five Forces Analysis Data Sources

This analysis leverages Globe Life's financial reports, industry publications, and competitor analyses.