Hulu LLC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hulu LLC Bundle

What is included in the product

Tailored analysis for Hulu’s product portfolio. Focuses on strategic investment and divestment decisions.

Clean and optimized layout for sharing or printing, providing Hulu with an easy-to-understand overview.

What You See Is What You Get

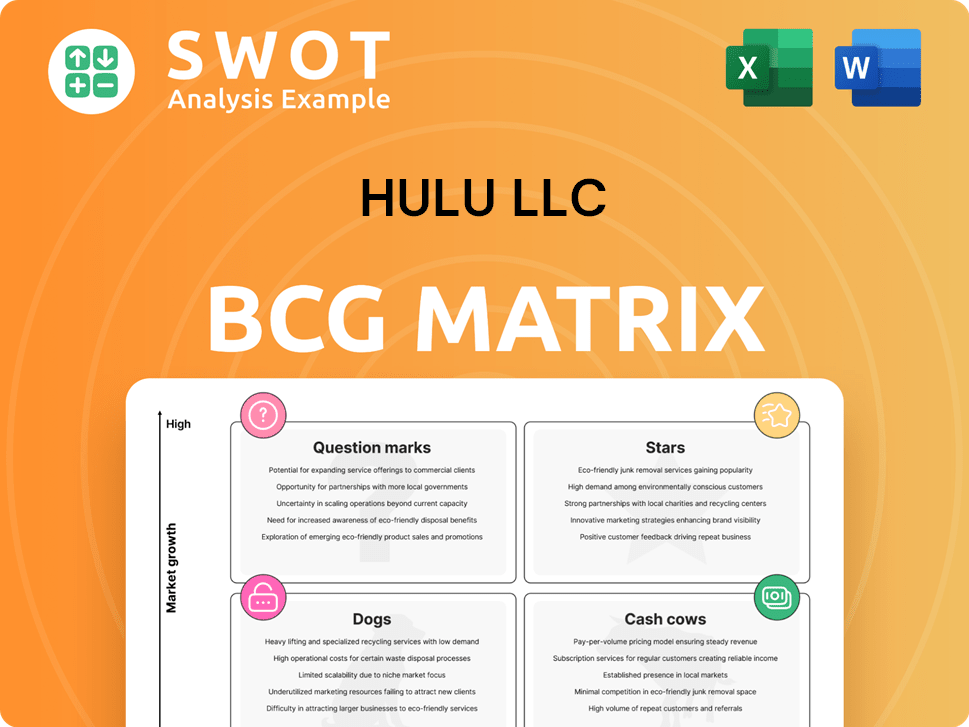

Hulu LLC BCG Matrix

This is the complete BCG Matrix document you'll receive after buying. It's the same version, professionally crafted for strategy and ready for your analysis.

BCG Matrix Template

Hulu's streaming services compete fiercely in the market, with some offerings clearly leading the pack. Its original programming generates significant revenue, akin to "Stars" in the BCG Matrix. However, some older content might be "Dogs," requiring careful resource allocation decisions. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Hulu's original content, such as 'The Handmaid's Tale', is a 'Star' in its BCG Matrix. In 2024, these series drove subscriber growth, with Hulu reaching 50 million subscribers. The critical acclaim and awards won by these shows enhance Hulu's brand. Investment in originals, which totaled $3.5 billion in 2023, is crucial for maintaining its market position.

The Disney Bundle, featuring Hulu, Disney+, and ESPN+, is a strong value for consumers, boosting subscriber growth and retention. This bundle caters to diverse audiences, from families to sports fans. In Q4 2023, Disney+ had 111.3 million subscribers and Hulu had 49.7 million, showing the bundle's appeal. The integration leverages each service's strengths, boosting Hulu's market reach.

Hulu's ad-supported tier is a cash cow, drawing in budget-conscious viewers. This boosts advertising revenue, vital for profitability. Around 60% of Hulu subscribers chose this plan in 2024, and it's expected to hit 65% by 2025. This approach sets Hulu apart.

Live TV Offering

Hulu + Live TV is a "Star" in Hulu's BCG matrix, offering live channels. It attracts cord-cutters wanting a cable-like experience. Although growth has slowed, it still brings in a lot of revenue. This offering is a key differentiator for Hulu. In 2024, Hulu + Live TV had around 4.6 million subscribers.

- Live TV offers over 75 channels.

- It's a strong revenue generator.

- Subscriber growth has moderated.

- It provides a complete entertainment option.

Extensive Content Library

Hulu's extensive content library, a key aspect of its BCG Matrix positioning, features current TV episodes, movies, and originals. This extensive selection aims to capture a broad audience, boosting engagement and subscriber retention. Partnerships with major networks enrich Hulu's content, setting it apart. The depth of its offerings is a significant subscriber draw.

- In 2024, Hulu's subscriber base reached approximately 50 million.

- Hulu's original programming has increased by 20% in 2024.

- The average user spends 5 hours per week.

- Hulu's content library includes over 80,000 TV episodes and movies.

Hulu's "Stars" include original content and Hulu + Live TV. These are high-growth, high-market-share offerings. Investment in originals, like the $3.5 billion in 2023, is crucial. The Disney Bundle further boosts reach.

| Feature | Details |

|---|---|

| Originals Growth | 20% increase in 2024 |

| Live TV Subs | Approx. 4.6M in 2024 |

| Hulu Subscribers | Reached 50M in 2024 |

Cash Cows

Hulu's subscription video on demand (SVOD) brings in steady revenue from monthly fees. In Q1 2025, Hulu's SVOD revenue reached $3.2 billion, showing a consistent income source. This revenue stream is powered by a large subscriber base and varied plan options. Hulu's SVOD revenue is a dependable financial asset.

Hulu is a cash cow due to its strong market position. It holds an 11% share in the U.S. SVOD market. This translates to a large subscriber base, ensuring consistent revenue. Hulu’s brand recognition fosters customer trust and loyalty. Its established presence supports sustained profitability.

Hulu's partnerships with Disney, NBCUniversal, and Warner Bros. Discovery are a major strength. These deals give Hulu access to popular content, boosting its subscriber base. These alliances ensure a steady flow of popular shows and movies. This is key to Hulu's competitive edge. In 2024, Hulu had over 50 million subscribers.

Subscriber Base Stability

Hulu's subscriber base has shown resilience. In 2024, it had a substantial number of subscribers. This stability offers a predictable revenue stream. It forms a strong base for further growth.

- Subscriber numbers are consistently high.

- This indicates a loyal customer base.

- It supports long-term financial planning.

- The platform can invest in new content.

Bundling Options

Hulu's bundling options are key to its financial strategy. These bundles, like the Disney Bundle and the Disney+, Hulu, Max bundle, boost revenue and draw in more subscribers. They offer consumers a strong value proposition, increasing subscriber numbers and decreasing the rate at which people cancel their subscriptions. Bundling makes Hulu more attractive and improves its financial results; in 2024, the Disney Bundle had over 50 million subscribers. This bundling approach enables access to multiple streaming services at a reduced cost.

- Disney Bundle's popularity drives subscriber growth.

- Bundling options increase revenue.

- Bundles help retain subscribers.

- Offers a cost-effective way to access multiple services.

Hulu is a cash cow due to its steady revenue, strong market position, and resilient subscriber base. The SVOD market share in the U.S. is 11%. Its strategic content partnerships with Disney and others are a major strength. In 2024, Hulu had over 50 million subscribers, which provides a predictable revenue stream.

| Aspect | Details |

|---|---|

| Market Share (US SVOD) | 11% |

| Subscribers (2024) | Over 50 million |

| Q1 2025 SVOD Revenue | $3.2 billion |

Dogs

Hulu's "Dogs" status in the BCG matrix stems from its limited international presence. Available mainly in the U.S., Hulu misses out on global subscriber growth. In 2024, Netflix and Amazon Prime Video boast massive international user bases. Hulu's revenue in 2024 was $11.7 billion, indicating unrealized potential.

Hulu's subscriber growth has moderated, a sign of market saturation. Subscribers rose from 49.7 million in early 2024 to 53.6 million by early 2025. This slower pace reflects increased competition in streaming. Innovation is crucial for Hulu to maintain its market position.

Hulu heavily depends on licensed content from external sources, creating content licensing risks. In 2024, Hulu's content licensing costs were a significant portion of its operational expenses. These costs impact profitability, with a need for original content to lessen reliance. Losing key titles if licensing fails is a constant threat.

Competition in the Streaming Industry

The streaming industry is fiercely competitive, with Hulu battling for viewers and subscriptions. Hulu faces giants like Netflix and Amazon Prime Video and newer services like Disney+ and Apple TV+. This competition forces Hulu to innovate and stand out. In 2024, Netflix had about 260 million subscribers globally, while Hulu had around 50 million.

- Netflix's global subscriber base dwarfs Hulu's.

- Amazon Prime Video's integration with Amazon's ecosystem provides a competitive advantage.

- Disney+ and Apple TV+ are investing heavily in original content.

- Hulu must differentiate itself through content and pricing strategies.

Linear TV Downtrend

The linear TV downtrend presents a significant hurdle for Hulu + Live TV. Viewers are increasingly choosing on-demand streaming, challenging the service's live TV component. This shift could affect Hulu's long-term success. Adapting with unique content is crucial for staying competitive, emphasizing streaming strengths.

- Linear TV viewership decreased, with a 30% drop in the last five years, impacting live TV services.

- Hulu + Live TV faces competition from on-demand platforms like Netflix and Disney+.

- Hulu's strategy must prioritize its core streaming strengths, as linear TV declines.

- Subscription models and content offerings are key to navigating the shift.

Hulu's "Dogs" face challenges due to limited international reach and high licensing costs. Subscriber growth has slowed despite its popularity in the U.S. This position suggests a need for strategic adjustments, like increasing global presence and expanding original content. In 2024, Hulu's share of the streaming market was smaller compared to giants like Netflix.

| Aspect | Details |

|---|---|

| Market Share | Hulu: ~10%; Netflix: ~33% in 2024 |

| Subscriber Growth | Moderate, slower than competitors in 2024-2025 |

| Revenue | $11.7 Billion in 2024 |

Question Marks

International expansion offers Hulu a chance to grow subscribers and revenue. Hulu could reach a wider audience by entering new markets, competing globally. Challenges include licensing, competition, and localization costs. Successful expansion could greatly enhance Hulu's growth potential. In 2024, Netflix's international revenue was over $18 billion, showing the potential.

The Disney+, Hulu, and Max bundle presents a strong "Star" in the BCG Matrix. This offering combines diverse content, potentially boosting subscriber numbers and decreasing cancellations. Currently, Disney+ has around 150 million subscribers, while Max boasts about 97.5 million. This bundling strategy is expected to attract users subscribed to only one or two services, increasing overall engagement.

Hulu's investment in original content is a "Question Mark" in its BCG Matrix, requiring strategic decisions. Hulu's originals, like "The Handmaid's Tale," attract subscribers. In 2024, Hulu planned to increase original content spending. This boosts appeal and competitiveness in the streaming market. High-quality originals differentiate Hulu.

Interactive Content and T-commerce

Interactive content and t-commerce represent a bold strategy for Hulu. Implementing interactivity can boost user engagement and unlock new revenue streams. This includes adding interactive layers to existing content and integrating elements into unscripted shows. T-commerce, allowing direct purchases via TV or app, offers significant potential. The global t-commerce market was valued at $20.6 billion in 2023.

- User engagement can increase with interactive features.

- T-commerce unlocks new revenue streams.

- The t-commerce market was worth $20.6 billion in 2023.

- Younger audiences are attracted by interactive programming.

Consolidation with Disney+

Consolidation with Disney+ could streamline the user experience, potentially attracting a wider subscriber base. Combining content libraries may reduce operational costs, although brand identity and content integration pose challenges. In 2024, Disney+ and Hulu's combined subscriber base reached approximately 150 million globally. The integration aims to leverage Hulu's more mature content for an older demographic. However, the operational cost savings have yet to be fully realized.

- Streamlining the User Experience: Combining content.

- Wider Subscriber Base: Potential for growth.

- Cost Reduction: Efficiency gains.

- Brand Identity and Integration: Key challenges.

Hulu's original content investments are "Question Marks," requiring careful strategy. Spending increased in 2024 to boost appeal. This strategy aims to differentiate Hulu in the competitive streaming market. High quality originals are key.

| Aspect | Details | Impact |

|---|---|---|

| Investment | Increased in 2024. | Higher production costs. |

| Content | Original series like "The Handmaid's Tale." | Attracts subscribers. |

| Market | Streaming competition. | Differentiation is key. |

BCG Matrix Data Sources

The Hulu BCG Matrix utilizes financial statements, market analysis, and industry research for strategic evaluation. Data from subscriber reports and competitor data is incorporated as well.