Hulu LLC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hulu LLC Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Customize pressure levels based on new data or evolving market trends.

What You See Is What You Get

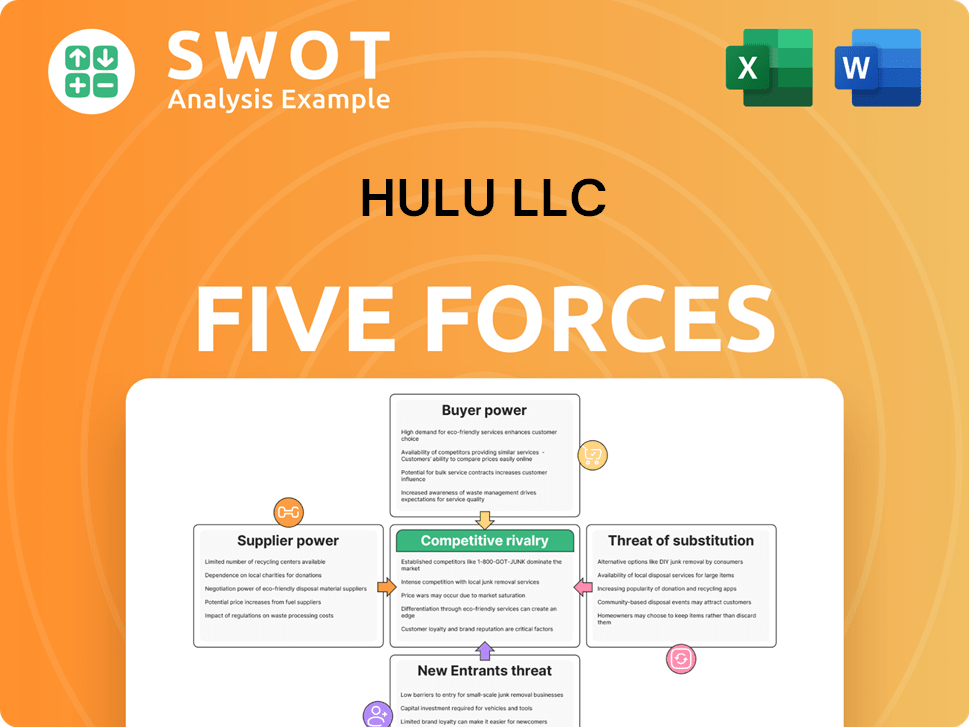

Hulu LLC Porter's Five Forces Analysis

You’re previewing the final version—precisely the same document that will be available to you instantly after buying. This Hulu LLC Porter's Five Forces analysis examines competitive rivalry, bargaining power of buyers and suppliers, threat of new entrants, and threat of substitutes. It delves into the specifics of Hulu's market position, outlining industry forces. The analysis is fully formatted and ready for your use. This is the complete document.

Porter's Five Forces Analysis Template

Hulu LLC's competitive landscape is shaped by powerful forces. Buyer power, fueled by subscription choices, impacts profitability. The threat of substitutes, like Netflix and Disney+, is significant. Intense rivalry amongst streaming services is a key factor. Bargaining power of suppliers (content creators) also influences Hulu. Finally, the threat of new entrants remains a constant challenge.

This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Hulu LLC.

Suppliers Bargaining Power

Content providers hold substantial bargaining power, especially those with exclusive content. They can dictate licensing terms, impacting Hulu's costs. For example, in 2024, major studios charged higher fees. Securing exclusive rights is key for Hulu's competitive edge, but increases its dependence on suppliers. Hulu's content costs were approximately $10 billion in 2023.

Suppliers holding exclusive content rights wield substantial power over Hulu. These rights enable suppliers to dictate terms, increasing Hulu's expenses. For instance, securing exclusive streaming rights for popular shows boosts Hulu's value but demands hefty investments, benefiting the supplier. The capacity to provide unique, in-demand content grants suppliers significant negotiation leverage. In 2024, content acquisition costs for streaming services like Hulu continue to rise, reflecting this power dynamic.

Hulu faces strong supplier power due to the limited number of top-tier original content studios. These studios, which create high-demand series and films, hold significant leverage. Hulu competes with giants like Netflix and Disney+ to secure this content, increasing costs. In 2024, content acquisition costs for streaming services increased by 15-20%, impacting profitability. Investing in original content is vital for Hulu's differentiation, demanding substantial financial investment.

Dependence on Major Networks

Hulu's dependence on major networks for content significantly influences supplier power. Licensing deals with Disney, NBCUniversal, and Warner Bros. Discovery make Hulu reliant on their programming. These suppliers can affect pricing and content availability, impacting Hulu’s offerings. Managing these relationships and negotiating favorable terms are crucial for Hulu.

- In 2024, content licensing costs represented a substantial portion of Hulu's operational expenses, reflecting its reliance on external suppliers.

- Negotiations with suppliers are ongoing, with agreements often lasting for several years.

- The outcome of these negotiations directly impacts Hulu's profitability and its ability to attract and retain subscribers.

- Hulu's ability to secure exclusive content deals can also significantly affect its competitive positioning.

High Switching Costs for Suppliers

Hulu's content suppliers, like major studios and production companies, benefit from high switching costs. These suppliers are locked into existing distribution deals, which is a significant advantage. Switching to a new platform would involve renegotiating contracts and potentially disrupting established revenue streams. This gives content providers considerable leverage when negotiating with Hulu. In 2024, Hulu's content costs were a major part of their expenses.

- Content acquisition costs significantly impact profitability.

- Long-term contracts with major studios strengthen supplier power.

- Negotiating favorable terms is crucial for Hulu's financial health.

- Switching costs are a key factor in maintaining supplier bargaining power.

Hulu faces strong supplier power due to its reliance on content providers. Major studios like Disney and NBCUniversal have significant leverage, impacting costs. In 2024, content licensing represented a large portion of Hulu's expenses.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Content Costs | High | Approx. $10B in 2023; rising 15-20% in 2024 |

| Supplier Power | Strong | Exclusive content providers dictate terms |

| Negotiations | Ongoing | Multi-year agreements impact profitability |

Customers Bargaining Power

Customers wield considerable power due to the abundance of streaming choices available. Platforms like Netflix, Amazon Prime Video, and Disney+ offer viable alternatives, diminishing Hulu's individual influence. In 2024, the streaming market saw over 200 million subscribers across major services, indicating high consumer mobility. This competition necessitates Hulu to provide superior content and pricing to retain its audience. Hulu's 2023 revenue was approximately $10.5 billion, highlighting the stakes in this competitive landscape.

Switching costs for Hulu customers are low, enhancing their bargaining power. Consumers can easily move between streaming services. In 2024, the average monthly subscription cost for streaming services was around $15. This ease of switching makes it crucial for Hulu to maintain customer satisfaction. Hulu must offer compelling content to retain subscribers.

Viewers' price sensitivity significantly shapes their Hulu subscription choices. Many consumers readily switch streaming services to secure the best deal, making price a critical factor. Hulu must maintain a competitive pricing strategy to attract and keep subscribers. In 2024, Hulu's ad-supported plan started at $7.99 per month, showing their effort to cater to price-conscious viewers. Balancing cost and content quality is essential for keeping a strong customer base.

Demand for Personalized Content

The growing demand for personalized content significantly boosts customer power. Viewers now anticipate tailored recommendations and content choices based on their viewing history. Hulu must allocate resources to data analytics and personalization technologies to keep up with these demands. Failing to offer engaging, relevant content can lead to subscriber churn, making customer preferences crucial. In 2024, streaming services saw a 10% increase in churn rates due to content dissatisfaction.

- Subscriber churn rates increased by 10% in 2024 due to content dissatisfaction.

- Data analytics and personalization are essential for retaining subscribers.

- Customer expectations for tailored content are rising.

- Hulu must invest in technologies to meet these demands.

Social Media Influence

Social media significantly boosts customer bargaining power by amplifying their voices. Platforms like X (formerly Twitter) and Facebook enable viewers to share Hulu experiences, directly impacting the service's reputation. User reviews and comments shape perceptions, influencing subscription decisions; positive buzz attracts, while negativity deters. Hulu must actively manage its social media presence to maintain a favorable brand image and promptly address customer issues. In 2024, 68% of U.S. adults used social media, underscoring its influence.

- Social media reviews directly affect customer decisions.

- Positive word-of-mouth is crucial for attracting new subscribers.

- Negative feedback can lead to customer churn.

- Hulu must monitor and respond to social media feedback.

Customers have substantial power due to numerous streaming options. They can easily switch services, which pressures Hulu to offer competitive pricing and compelling content. Price sensitivity is high, with the ad-supported plan starting at $7.99 in 2024.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low, increasing customer power | Avg. monthly sub cost: $15 |

| Price Sensitivity | High, influencing subscription choices | Hulu's ad-supported plan: $7.99/month |

| Content Demand | Personalization crucial | Churn rates increased by 10% |

Rivalry Among Competitors

Hulu encounters fierce competition in the streaming market. Netflix, Amazon Prime Video, and Disney+ are major rivals. These competitors spend billions on original content and aggressive marketing. In 2024, Netflix's content spending was projected to be around $17 billion. Hulu must innovate to stay competitive.

Consumption patterns are rapidly changing, intensifying competition. Streaming services must adapt to new viewer preferences and tech. This includes high-quality streaming and personalization. In 2024, Netflix and Disney+ saw subscriber shifts due to content and pricing. Failing to adapt risks subscriber loss.

Price wars and promotions are standard in streaming, intensifying competition. Hulu uses discounts and bundles to compete. In 2024, streaming services spent billions on content and marketing to lure customers. Hulu needs a smart pricing plan to stay competitive and profitable. Balancing price with content is key for subscriber growth.

Differentiation Through Content

Differentiation through content is vital for Hulu in the competitive streaming market. Hulu's strategy involves producing original series and films, like "The Handmaid's Tale" and "Only Murders in the Building". Securing exclusive licensing agreements for popular content also sets Hulu apart. Content strategy is key to Hulu's ability to compete effectively, especially against rivals like Netflix and Disney+. In 2024, Hulu's subscriber base was around 50 million.

- Original content investment drives subscriber growth.

- Exclusive licensing deals boost viewership.

- Content strategy is crucial for competitive positioning.

- Hulu's subscriber base is a key metric.

Consolidation Trends

The streaming industry's consolidation significantly impacts competitive rivalry. Mergers and acquisitions, like the Warner Bros. Discovery and Paramount Global deals, create formidable competitors. This intensifies pressure on platforms like Hulu to differentiate. Hulu must compete with giants, as Disney+ has a 25% market share. Strategic partnerships and unique content are vital for Hulu's survival.

- Consolidation leads to fewer, bigger players.

- Increased competition for content and subscribers.

- Hulu needs to focus on unique offerings.

- Partnerships can enhance Hulu's competitiveness.

Hulu faces intense competition from streaming giants like Netflix and Disney+. Content spending is massive, with Netflix budgeting around $17 billion in 2024. Price wars and promotions are common, pressuring margins. Hulu needs a strong content and pricing strategy to survive.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Content Spending | High costs | Netflix: $17B |

| Subscriber base | Competitive measure | Hulu: ~50M |

| Market share | Competitive position | Disney+: 25% |

SSubstitutes Threaten

Traditional cable and satellite TV services present a significant threat to Hulu. Many viewers still use traditional TV for live news and sports, such as the NFL. In 2024, traditional pay-TV subscriptions in the US were approximately 63 million. Hulu combats this with Hulu + Live TV, though it faces competition from similar offerings by YouTube TV and others.

Competing streaming platforms, such as Netflix, Amazon Prime Video, Disney+, and HBO Max, pose a significant threat. These services are direct substitutes for Hulu, vying for subscribers with vast content libraries and original shows. In 2024, Netflix and Disney+ led in global streaming subscribers, intensifying competition. Hulu must differentiate via unique content to maintain its market share.

Free ad-supported streaming services (FAST) pose a growing threat to Hulu. Platforms like Tubi and Pluto TV provide content without subscription fees, attracting cost-conscious viewers. These services benefit from significant viewership; for instance, Tubi saw 74 million monthly active users in Q4 2023. Hulu must carefully balance its subscription tiers to remain competitive against these free alternatives.

User-Generated Content

User-generated content (UGC) poses a significant threat to Hulu. Platforms like YouTube and TikTok offer vast libraries of free content, attracting viewers. This content often includes short-form videos, comedy, and niche interests. Hulu must differentiate itself by offering premium, professionally produced content.

- YouTube's ad revenue reached $31.5 billion in 2023.

- TikTok's user base continues to grow, with over 1 billion active users.

- Hulu's subscription numbers are around 48 million.

- Netflix's content budget is $17 billion.

Piracy

Piracy significantly threatens Hulu as a substitute for paid streaming. Illegal downloads and streaming provide a free alternative. This issue is especially pronounced in regions where piracy is common. Hulu combats piracy by offering affordable content and enforcing copyright. Despite efforts, piracy continues to impact the streaming industry.

- In 2024, the global video piracy rate was estimated at 17.7%.

- The Motion Picture Association reported that piracy costs the film and TV industry billions annually.

- Hulu's parent company, Disney, invests heavily in anti-piracy measures.

- Streaming services like Hulu must continually adapt to counter evolving piracy methods.

The threat of substitutes for Hulu includes cable, streaming platforms, and free services like Tubi. Piracy also poses a substantial risk, offering illegal access to content. YouTube’s ad revenue reached $31.5 billion in 2023, showcasing the competition.

| Substitute | Description | 2024 Data/Fact |

|---|---|---|

| Streaming Services | Netflix, Disney+, Amazon Prime Video | Netflix's content budget is $17B |

| Free Streaming | Tubi, Pluto TV | Tubi had 74M MAU in Q4 2023 |

| User-Generated Content | YouTube, TikTok | YouTube's ad revenue was $31.5B (2023) |

Entrants Threaten

The threat from new entrants is moderate due to low startup costs. Launching a streaming service requires less capital than traditional media ventures. This enables new platforms to enter the market with smaller initial investments. For example, smaller services like Crunchyroll have gained traction. Hulu faces the constant need to innovate to fend off new competitors, especially with the rise of niche streaming services, which in 2024, saw a 15% increase in subscriber growth compared to 2023.

Established brands with strong customer loyalty pose a real threat to Hulu. Tech giants such as Apple and Amazon could leverage their resources. They have the financial and marketing power to gain market share. In 2024, Amazon's Prime Video had over 200 million subscribers. Smaller streaming services have difficulties competing with these giants.

Securing content licensing agreements presents a significant hurdle for new entrants in the streaming market. These entrants must acquire the rights to stream popular content, which can be both costly and time-consuming. Hulu, as an established player, benefits from existing relationships with content providers, creating a competitive edge. In 2024, the cost of licensing popular content increased by 10-15% due to heightened competition. New services need compelling content to attract subscribers, but this is increasingly difficult.

Capital Intensity

The video streaming market is capital-intensive, demanding substantial investments for licensing and content. New entrants must spend heavily to compete, deterring those with limited funds. Established players like Hulu invest billions in content, creating a high barrier. For example, Netflix spent over $17 billion on content in 2024.

- Significant Investment: New entrants need substantial capital.

- Content Costs: Licensing and production are major expenses.

- Barrier to Entry: High costs deter smaller companies.

- Industry Spending: Netflix spent over $17B on content in 2024.

Customer Loyalty

Customer loyalty presents a significant threat to new entrants in the streaming market. Established brands like Netflix and Amazon Prime Video benefit from strong customer loyalty, making it difficult for newcomers to gain traction. Hulu's subscriber satisfaction is relatively high, but it still faces competition from platforms with vast user bases. New entrants must offer exceptional value to overcome this hurdle.

- Netflix has a subscriber base of over 260 million as of early 2024.

- Amazon Prime Video has a large user base due to its integration with Amazon Prime.

- Hulu's subscriber satisfaction rates, while decent, are still under pressure from larger competitors.

- New entrants need compelling content and competitive pricing.

The threat of new entrants for Hulu is moderate due to substantial investment needs. Securing content is costly, increasing the barrier for new services. Netflix spent over $17B on content in 2024, emphasizing the capital-intensive nature of the market. Established brands like Netflix and Amazon also pose a significant threat.

| Factor | Impact | Details |

|---|---|---|

| Investment | High | Netflix spent over $17B on content in 2024 |

| Content Costs | Significant | Licensing and production are major expenses. |

| Market Dynamics | Competitive | Established brands have large user bases. |

Porter's Five Forces Analysis Data Sources

Hulu's Porter's Five Forces draws on industry reports, financial statements, and market research data. Competitor analysis is based on public filings and press releases.